Deskera Releases Learn what is new and improved in the latest updates on Deskera People.

Date of Release: September 17, 2021 Indonesia Payroll Compliance - Bank Transfer Report Malaysia Payroll Compliance - C.P. 8D txt file (Yearly) Language translation support for Indonesia Export Employee Based on Filter

Date of Release: September 7, 2021

Malaysia Payroll Compliance - EA Forms (Yearly) 2. Malaysia Payroll - EPF(Borang A) TXT File - New Specifications

3. Employee Export for IN, SG, MY & Non-compliance countries

4. Overtime Correction: Singapore Compliance

5. Tax-Exempt Payroll Component

6. ESI and PF Exemption: India Compliance

7. Frequency of Components in the Employee Profile - Applicable for All counties.

8. PPH21 Tax on THR Component for Indonesia and PPH21 Tax on BONUS Component for Indonesia

9. Decimal Format changes in Payroll Summary Report, Payroll Liability Report & Employee Export

Date of Release: August 19, 2021

Indonesia Payroll Compliance - Export Employee File Indonesia Payroll Compliance - How to add the employee details using Deskera People?

Using Deskera People, you can add Indonesia employee’s details for creatingtheir profile required to run the payroll. Following are the below steps to add employees in the system 1. Click on the Employees option located on the left side of the main dashboard, 2. Then, click on the ’+Add Employ…

2. Indonesia Payroll Compliance - Monthly eSPT Masa

Indonesia Payroll: How to generate a Monthly eSPT Masa CSV file using Deskera People?

Monthly eSPT Masa is a document used to report taxes collected from thetaxpayer’s economic income and reported at each tax period (every month) Monthly eSPT Masa CSV file is a eSPT Period PPh 21 contains a list ofwithholding income tax 21 for permanent employees and pension recipients or old…

3. Indonesia Payroll Compliance - Yearly eSPT Masa

Indonesia Payroll: How to generate a Yearly eSPT Masa CSV file using Deskera People?

Your employer is responsible for the calculation of any taxes that need to bewithheld from your salary, monthly payment of these taxes to the taxauthorities, and provision of annual numbers to the employee. Each employee is required to report their annual tax income every March of thenext year…

4. Employee Missing Information/Profile Completeness

How to add the employee details using Deskera People?

The employee details are filled partially during the initial onboarding process.The additional details can be configured by the employee or the admin later. Using Deskera People, you can add employee’s information for creating theirprofile required to run the payroll. Following are the below st…

5. Display Overtime Details in the Payroll Summary Report

what-are-the-different-types-of-payroll-reports-available-in-deskera-people

In Deskera People there are two types of payroll reports available, 1. Payroll Summary Report 2. Payroll Liability Report Let us see more about these reports in detail, Payroll Summary Report The Payroll Summary Report is a report for reviewing all payroll information forpaid employees base…

6. Email Notification Eleave - Leave Application

7. Revert Payrun and Delete Payrun- SG,US,CA,AUS,ID,IND and Display the Overtime Details on the Payslip

What are the different stages for processing the Payroll using Deskera People?

After all the payroll details are added in Deskera People and when you click onProcess Payroll button you need to go through the different payrun stages beforeprocessing the final payrun Below listed are the payrun stages, 1. Select Employee 2. Ready for processing 3. Payroll processed Let …

Date of Release: August 2, 2021

People Integration with Books and Books Integration: Impact in Books How to integrate People with Books?

Deskera People has recently launched a feature where, an admin can record theprocessed payroll in Deskera Books as a Journal Entry which will accommodate allthe expenses and liabilities of the company is recorded in the accounts. Let us understand more in detail, how to do people integration wi…

2. Attendance : clock in and clock, Attendance: Employee Report and Attendance : Admin Report

How do clock-in/clock-out work and view employee attendance report in Deskera E-Leave?

To clock in is to record your time of arrival at work, usually by punching atime clock; to begin work. To clock out is to record your time of departure fromwork; to end work. Deskera People has recently released a feature, where employees can clock in /clock out and will also be able to see th…

3. Company Setting: Date Format

Where can I update my company’s information, Work Week, and CPF details in Deskera People?

In every organization, there comes a time when the organization decides to makechanges to the company’s details like the company address as some companiesshift to a new business location due to the end of office leasing or for someother reasons. Using Deskera People, the admin of the system can…

4. Indonesia Payroll Compliance - End of year (Finalization) calculation

5. Indonesia Payroll Compliance - PPH21 calculation for resign employees

Date of Release: July 9, 2021

Payroll Compliance: Payroll Liability Report Please refer the below care articlehttps://www.deskera.com/care/what-are-the-different-types-of-payroll-reports-available-in-deskera-people/

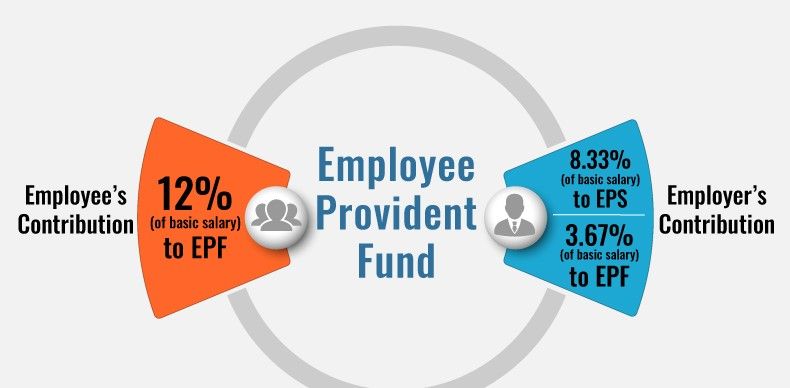

2. India Compliance: Impact of EPF Payroll and Impact of HRA Payroll

India Payroll : What is IT declaration and how employees do their investment declarations using Deskera People?

At the beginning of the financial year, an investment declaration has to bemade. Here the employer will ask you to declare the tax-savings investments forthe year. It will deduct the tax accordingly from your monthly salary. It isessential as it can lead to a higher in-hand salary. What is inc…

3. India Compliance: Earning components outside of CTC Payroll

India Payroll : How to add payroll components using Deskera People?

This section will guide you to set up the new payroll earnings and, deductionscomponents for India. With Deskera People, you have pre-defined earning payroll components set and youcan also add earning and deduction components of your own. Lets get to know more about the payroll components in d…

4. Eligibility Criteria for Employees to be present in a payroll

What are the eligibility criteria in Deskera People for Employees to be present in a payroll?

Eligibility Criteria for Employees to be present in a payrollBefore you Run the Payroll, make sure you understand the different criteria’sfor employees to be present on a specific payrun. 1. For employees who’s information is not complete In the Employee Profile tab, in the payrun screen sta…

Date of Release: June 18, 2021

India Compliance - Show All Employees in IT Declaration Employee List and Notification - IT Declaration and Send emails only when the IT declaration is unlocked and Lock/Unlock IT declaration India Payroll : What is IT declaration and how employees do their investment declarations using Deskera People?

At the beginning of the financial year, an investment declaration has to bemade. Here the employer will ask you to declare the tax-savings investments forthe year. It will deduct the tax accordingly from your monthly salary. It isessential as it can lead to a higher in-hand salary. What is inc…

2. India Compliance - Tax Details - ESI Rates - ESI Rates should be not editable and get it from backend

India Payroll : What is Employee State Insurance (ESI)? How it is calculated in Deskera People?

What Is Employees State Insurance (ESI)?Under the Employees State Insurance Act, 1948, ESI is governed and is aself-financed social security scheme designed to protect employees. Employees ofan eligible organization are protected against financial distress arising out ofsickness, disablement, …

India Payroll : What is IT declaration and how employees do their investment declarations using Deskera People?

At the beginning of the financial year, an investment declaration has to bemade. Here the employer will ask you to declare the tax-savings investments forthe year. It will deduct the tax accordingly from your monthly salary. It isessential as it can lead to a higher in-hand salary. What is inc…

India Payroll : How to add payroll components using Deskera People?

This section will guide you to set up the new payroll earnings and, deductionscomponents for India. With Deskera People, you have pre-defined earning payroll components set and youcan also add earning and deduction components of your own. Lets get to know more about the payroll components in d…

Date of Release: June 7, 2021 India Compliance: Employee Profile Please refer below article link,

India Payroll: How to add employee’s and their compliance details in Deskera People?

In the previous article you have seen how to add company details and company taxdetails for India payroll compliance. Now let us see how to add employees andtheir compliance details using Deskera People. Following are the below steps to add employees in the system 1. Click on the Employees op…

2. India Compliance: Add Component/Default Component Please refer below article link,

India Payroll : How to add payroll components using Deskera People?

This section will guide you to set up the new payroll earnings and, deductionscomponents for India. With Deskera People, you have pre-defined earning payroll components set and youcan also add earning and deduction components of your own. Lets get to know more about the payroll components in d…

3. India Compliance: ESI Please refer below article link,

India Payroll : What is Employee State Insurance (ESI)? How it is calculated in Deskera People?

What Is Employees State Insurance (ESI)?Under the Employees State Insurance Act, 1948, ESI is governed and is aself-financed social security scheme designed to protect employees. Employees ofan eligible organization are protected against financial distress arising out ofsickness, disablement, …

4. India Compliance: Provident Fund

Please refer below article link,

India Payroll : What is Employee Provident Fund(EPF) and Employee Pension Scheme(EPS)? How it is calculated in Deskera People?

What is Employee Provident Fund(EPF) and Employee Pension Scheme(EPS) in India?In order to help individuals save money for their future, the Government ofIndia has launched various investment and saving schemes. Two popular schemesare the Employees’ Provident Fund (EPF) scheme and the Employees…

Please refer below article link,

India Payroll : What is Professional Tax(PT)? How it is calculated in Deskera People?

PT or a Professional tax is a direct tax that applies to all individuals whoearns income from employment, practicing their trading or professions such asdoctors, lawyers, teacher, CA, etc. The PT is deducted from the individual’s monthly salary and is deposited to thestate government. Professi…

6. India Compliance : IT Declaration/Employee Investments/Tax Submission List View

Please refer below article link,

India Payroll : What is IT declaration and how employees do their investment declarations using Deskera People?

At the beginning of the financial year, an investment declaration has to bemade. Here the employer will ask you to declare the tax-savings investments forthe year. It will deduct the tax accordingly from your monthly salary. It isessential as it can lead to a higher in-hand salary. What is inc…

7. India Compliance: Income Tax Calculation Post ITR

As an admin, you can calculate employee’s taxes accurately after the IT declarations have been submitted by the employee to comply with the government regulations using Deskera People.

Please refer below article link,

India Payroll : How is income tax calculated post ITR using Deskera People?

In the previous article, you have seen what is IT declaration and how theemployees can do their investments under Deskera People Now let us see with an example how Income Tax is calculated post ITR submissionusing Deskera People. As an admin, you can calculate employee’s taxes accurately after…

8. India Compliance - Import Changes / India Tax - Payslip changes

Please refer below article link,

India Payroll: How to add employee’s and their compliance details in Deskera People?

In the previous article you have seen how to add company details and company taxdetails for India payroll compliance. Now let us see how to add employees andtheir compliance details using Deskera People. Following are the below steps to add employees in the system 1. Click on the Employees op…

9. Indonesia Payroll Compliance - Tax allowance for Gross up methods

Please refer below article link,

Indonesia Payroll - What are the methods to calculate PPH21? How it is applicable in Deskera People?

Methods to Calculate PPH 21?In general, there are 3 methods that can be used to calculate PPh 21, namely the Net, Gross, and Gross Up methods. Before calculating, it is better to look atthe PPh 21 tariff layer imposed on taxpayers. * Taxpayers with an annual income of up to IDR 50,000,000 are…

10. Indonesia Payroll Compliance - Calculating Income Tax Article 21 Employees previously employed in current year

Please refer below article link,

Indonesia Payroll - How is PPH21 calculated in Deskera People?

The definition of PPh 21 is a tax on income in the form of salaries, wages,honoraria, allowances and other payments in whatever name and in any form inconnection with work or position, services and activities carried out byindividuals who are domestic tax subjects or referred to as taxpayers. …

Date of Release: May 11, 2021

Salary Advance Payment Deskera People has recently rolled out a salary advance feature where you can do an advance payment to your employee.

Please refer below article link,

How to process Advance Payment for your employees using Deskera People?

Sometimes, an employee might hit a financial rough patch. Something unexpectedmight happen, such as a medical emergency, that requires more money than theemployee has saved up. If this happens, the employee might ask you for a salary advance to help themmake ends meet. A salary advance is ess…

2. Malaysia Payroll Compliance - Borang A (EPF) CSV File

Now with Deskera People you can download the KWSP Borang A CSV file.

Please refer below article link,

How to generate KWSP Borang A Form/TXT/CSV file using Deskera People?

In the previous articles you have read what is EPF?[https://www.deskera.com/care/malaysia-payroll-epf/#epf-contribution-payment] Now let us see how can you generate KWSP Borang A form for submitting themonthly EPF to the KWSP [https://www.kwsp.gov.my/en/ilogin/login-employer…

3. Malaysia Payroll Compliance EPF calculation updated as below,

EPF until January 2021 is calculated at 7% , and with effect from February 2021 to January 2022 EPF will be calculated at 9%.

4. Set Effective Date for Salary

Please refer below article link,

How to add the employee details using Deskera People?

The employee details are filled partially during the initial onboarding process.The additional details can be configured by the employee or the admin later. Using Deskera People, you can add employee’s information for creating theirprofile required to run the payroll. Following are the below st…

Integrate E-Leave with Payroll (Phase 1 and Phase 2) Please refer below article link

How to Integrate E-Leave with Payroll Using Deskera People?

E-leave integration with payroll makes everything easier. Instead of enteringinformation in two separate systems, you can enter it once and be done. Thissimplifies payroll for your HR staff. In turn, they can complete payroll soonerand with fewer errors. Deskera People has recently rolled ou…

2. US Payroll - Default Payroll Components

Please refer below article link

How to add the employee/contractor details for US using Deskera People?

The employee details are filled partially during the initial onboarding processthe employee and admin can add the details later. Using Deskera People, you can add employee’s information and Contractorinformation for creating their profile required during the pay run. Following are the below st…

Date of Release: April 5, 2021 Indonesia Payroll Compliance - Import Employee File Please refer below article link

Indonesia Payroll Compliance - How to add the employee details using Deskera People?

Using Deskera People, you can add Indonesia employee’s details for creatingtheir profile required to run the payroll. Following are the below steps to add employees in the system 1. Click on the Employees option located on the left side of the main dashboard, 2. Then, click on the ’+Add Employ…

2. Indonesia Payroll Compliance - 2021 changes - UMR Province/State

Please refer below article link

Indonesia Payroll - How to fill in company information and tax details in Deskera People?

In Indonesia, payroll management involves adhering to various steps and deadlinesubmissions to ensure that calculations comply with government regulations. Do you wish to handle your payroll calculations, payments and filingsaccurately?then you are at the right place. Deskera People has recent…

3. Indonesia Payroll Compliance - Payroll Summary Report

Please refer below article link

How Do I Generate Payroll Summary Report Using Deskera People?

The Payroll Summary Report is a report for reviewing all payroll information forpaid employees based on a date range. With Deskera People, you can now generate the payroll summary report easily andget a summary of employee payroll activity with date range, or see paycomponents for a specific …

4. Indonesia Payroll Compliance - JPK calculation as per UMR

For JPK calculation, if Basic pay is less than the UMR amount then JPK for employee and employer will be calculated on the UMR amount.Deskera People will auto calculate the JPK amount for this scenario.

Eg - If Amars Basic pay is 2,500,000.00 and he is working in state/Province DKI Jakarta with a UMR(Min Wage) amount of 4,416,186.00. In this scenario, his Basic pay is less than the UMR(Min Wage) amount.

So, the JPK will be calculated as,

1% *4,416,186.00 = 44,161.86 (EMP) 4 % 4,416,186.00 = 176,647.44 (COMP) 5. Singapore Compliance: Updates to CPF Employer E-Submission

Please refer below article link

Singapore Payroll Compliance: How to Generate CPF E-Submission TXT File in Deskera People?

In the previous article you have seen what is CPF and how to add a CPF account?.Now let us see how to generate CPF E-Submission file to IRAS using DeskeraPeople. Follow the below steps to generate CPF txt file: 1. Go to the Report Tab >> A window will appear>>Under CPF section>>click on C…

6. US Payroll - Form 1099 NEC

Please refer below article link

USA Payroll Compliance: What is form 1099-NEC and how to generate a 1099-NEC form using Deskera People?

What is Form 1099-NEC?he 1099-NEC is the new form to report nonemployee compensation—that is, pay fromindependent contractor jobs (also sometimes referred to as self-employmentincome). Examples of this include freelance work or driving for DoorDash orUber. Nonemployee compensation – what does…

Date of Release: March 19, 2021 SDL implementation for Foreign employee - Singapore Please refer below article link

How to add the employee details using Deskera People?

The employee details are filled partially during the initial onboarding process.The additional details can be configured by the employee or the admin later. Using Deskera People, you can add employee’s information for creating theirprofile required to run the payroll. Following are the below st…

2. Set Period Based Payroll Components

Please refer below article link

How to add a component using Deskera People?

Before you can begin to [https://www.patriotsoftware.com/blog/payroll/run-payroll/]run the payroll, youneed to collect some vital information from your employees, and if you feel anyinformation is missing while processing the payroll you can add it to thesystem. Hence using the Deskera Payroll…

3. Pro-ration of salary based on the joining date of the employee in the first month and Pro-ration of salary based on the joining date

This will auto calculate the pro-ration salary based on DOJ.

For example, if employee is joining on 15th march while processing the march payroll the salary will be calculated on pro-ration basis.

4. Include Tax exempt for SG and other country where it is missing

Please refer below article link

How to add the employee details using Deskera People?

The employee details are filled partially during the initial onboarding process.The additional details can be configured by the employee or the admin later. Using Deskera People, you can add employee’s information for creating theirprofile required to run the payroll. Following are the below st…

3. Indonesia Payroll Compliance - BPJS (JP, JHT and JPK) calculation if Borne by employer

If BPJS (JP, JHT, and JPK) is borne by the company entirely then BPJS will be calculated on the total contribution of the employee and the company both. Deskera People will auto calculate JP, JHT and JPK if borne by the employer.

Eg - If JP is borne entirely by the company then 1 %(EMP) + 2% (COMP) = 3% will be calculated on the basic salary, the same calculation will be made if JHT and JPK borne by the company.

Date of Release: March 3, 2021 Import employees for Australia Payroll Compliance Please refer below article link

Australia Payroll Compliance: How to add employee details using Deskera People?

Using Deskera People, you can add Australia employee’s details for creatingtheir profile required to run the payroll. Following are the below steps to add employees in the system 1. Click on the Employees option located on the left side of the main dashboard, 2. Then, click on the ’+Add Employ…

2. Malaysia Payroll Compliance -MY Payroll Summary Report

Please refer below article link,

How Do I Generate Payroll Summary Report Using Deskera People?

The Payroll Summary Report is a report for reviewing all payroll information forpaid employees based on a date range. With Deskera People, you can now generate the payroll summary report easily andget a summary of employee payroll activity with date range, or see paycomponents for a specific …

Date of Release: February 18, 2021

Indonesia Payroll Compliance - Pension Cost and occupational Cost Please refer below article link,

Indonesia Payroll - How is PPH21 calculated in Deskera People?

The definition of PPh 21 is a tax on income in the form of salaries, wages,honoraria, allowances and other payments in whatever name and in any form inconnection with work or position, services and activities carried out byindividuals who are domestic tax subjects or referred to as taxpayers. …

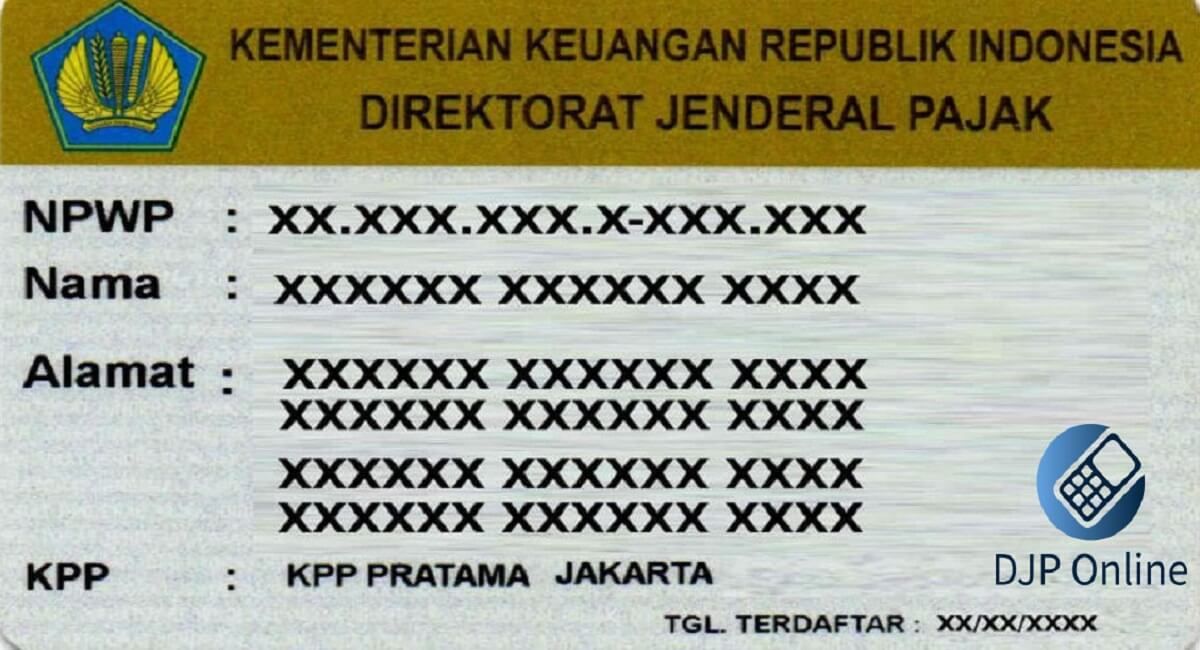

2. Indonesia Payroll Compliance - PPH21 calculation with and without NPWP number

Please refer below article link,

Indonesia Payroll Compliance - How to Calculate PPH 21 with and without NPWP number using Deskera People?

For employees who have a NPWP or who do not have an NPWP, they will be subjectto different deductions of Income Tax (PPh) Article 21. Let us see below on how to calculate PPh 21 without NPWP for employees before depositing taxes in the state treasury. What is NPWP and Its Role in Calculating …

3. Indonesia Payroll Compliance - Methods to Calculate PPH21

Please refer below article link,

Indonesia Payroll - What are the methods to calculate PPH21? How it is applicable in Deskera People?

Methods to Calculate PPH 21?In general, there are 3 methods that can be used to calculate PPh 21, namely the Net, Gross, and Gross Up methods. Before calculating, it is better to look atthe PPh 21 tariff layer imposed on taxpayers. * Taxpayers with an annual income of up to IDR 50,000,000 are…

4. Indonesia Payroll Compliance - PPH21 Calculation

Please refer below article link,

Indonesia Payroll - How is PPH21 calculated in Deskera People?

The definition of PPh 21 is a tax on income in the form of salaries, wages,honoraria, allowances and other payments in whatever name and in any form inconnection with work or position, services and activities carried out byindividuals who are domestic tax subjects or referred to as taxpayers. …

. Indonesia Payroll Compliance - PTKP Status and Calculation

Please refer below article link,

Indonesia Payroll : What is PTKP? How it is applicable in Deskera People?

Speaking of tax reporting, some of the taxpayers(WP) may have heard the termnon-taxable income (PTKP). PTKP cannot be ruled out because it affects the calculation of Income Tax (PPh)of each individual WP. Every salary or wage received by an employee / employee,there will always be a component…

6. Indonesia Compliance - Social Security (BPJS Ketenagakerjaan) rates and calculation

Please refer below article link,

Indonesia Payroll : What is BPJS Ketenagakerjaan (JHT/JP), and how is it applicable in Deskera People?

The Employment Social Security Administration or BPJS Ketenagakerjaan[https://www.talenta.co/solusi/perhitungan-bpjs-ketenagakerjaan/?utm_source=blog&utm_medium=hyperlink&utm_campaign=BPJSTK_AutoLinker] is a substitute for PT Jamsostek (Persero). Its job is to provide socialsecurity protection …

7. Import Employees for UK Payroll Compliance

Please refer below article link,

UK Payroll: How to get started with UK payroll compliance in Deskera People?

Many small companies still do manage their payroll manually, this istime-consuming and prone to error. So, the best solution for most SMEs is toautomate the process using specifically designed payroll software for smallbusiness. If you are a small business owner in UK and looking for a Payroll…

8. US - Form - W2 - W3 - W4 2021

Date of Release: February 11, 2021

Malaysia Payroll Compliance - Borang A (EPF) Txt file Please refer below article link

How to generate KWSP Borang A Form/TXT File using Deskera People?

In the previous articles you have read what is EPF?[/care/malaysia-payroll-epf/#epf-contribution-payment] Now let us see how can you generate KWSP Borang A form for submitting themonthly EPF to the KWSP [https://www.kwsp.gov.my/en/ilogin/login-employer]. With the below simple steps you can do…

2. Malaysia Payroll Compliance - EIS Txt file

Malaysia Payroll Compliance - How to Generate SIP(EIS) Form/TXT File in Deskera People?

In the previous article you have seen what is EIS?[/care/malaysia-payroll-what-is-eis-aaplicable-deskera-people/] Now let us see how can you generate SIP Form for submitting the monthly SIP tothe Perkeso [https://assist.perkeso.gov.my/employer/login]. With Deskera People , you can generate SI…

3. Malaysia Payroll Compliance - CP39 Txt file

Please refer below article link

How to generate CP39 form /TXT file using Deskera People?

In the previous article you have already seen what is PCB[/care/malaysia-payroll-mtc-pcb/]?. Now let us see how can you generate CP39 form for submitting the monthly PCB tothe LHDN. With the below simple steps you can download the CP39 form/txt file usingDeskera People. 1. Go to Reports Mod…

4. Import employees for Canada payroll compliance

Please refer below article link

Canada Payroll: How to add employee compliance details in Deskera People?

In the previous article you have seen how to add company details and company taxdetails. Now let us see how to add employees compliance details using DeskeraPeople. 1. After entering the Employee Details and Components, click on the Next button which will take you to the next screen of Com…

5. Import employees for India payroll compliance

Please refer below article link

India Payroll: How to add employee compliance details in Deskera People?

In the previous article you have seen how to add company details and company taxdetails for India payroll compliance. Now let us see how to add employeescompliance details using Deskera People. 1. After entering the Employee Details and Components, click on the Next button which will take …

6. Integrate Work week setting in the leave application

Please refer below article link

How to Integrate Work Week and Hours using Deskera eLeave?

A work week is a fixed, regularly-recurring period of 168 hours. In other words,a workweek is seven consecutive 24-hour periods. Once a workweek ends, a newworkweek begins. Let’s say your employees come to office from Monday to Friday, and they don’twork at all on Saturday and Sunday. so here,…

Date of Release: February 4, 2021

India Payroll Compliance - Employee Details Please refer below article link,

India Payroll: How to add employee compliance details in Deskera People?

In the previous article you have seen how to add company details and company taxdetails for India payroll compliance. Now let us see how to add employeescompliance details using Deskera People. 1. After entering the Employee Details and Components, click on the Next button which will take …

2. India Payroll Compliance - Tax and Company Details

India Payroll - How to get started with India payroll compliance in Deskera People?

For businesses in India, managing payroll is a challenging task because of thevarious statutory compliances. Many Small businesses in India manage their payroll tasks through spreadsheets,which seem easy to work with. However, this means that every time a new budgetannouncement is made or a sa…

3. Indonesia Payroll Compliance - Add BPJS check box on component level

Please refer below article link,

Indonesia Payroll- What is BPJS? How to set BPJS statutory settings contribution in Deskera People?

All Indonesian residents, including expats who have been residing in the countryfor more than6 months , have the right to obtain BPJS Kesehatan (HealthcareBPJS). This BPJS type is independently processed by individuals in Indonesia. However, if you are a part of a company—for both local or fore…

4. Malaysia Payroll Compliance - CP38 and PCB Calculation

5. Malaysia Payroll Compliance - Borang 8A Txt file

Please refer below article link

How to generate SOCSO Borang 8A Form/TXT File in Deskera People?

In the Previous article you have read about what is SOCSO?[/care/malaysia-payroll-socso-applicable-deskera-people/] Now let us see how can you generate SOCSO Borang 8A Form for submitting themonthly SOCSO to the Perkeso [https://assist.perkeso.gov.my/employer/login] With Deskera People , yo…

6. Malaysia Payroll Compliance - EIS Report 7. Canada Payroll Compliance - Pension Plan and Employment Insurance

Please refer below article link

Canada Payroll: How to add employee compliance details in Deskera People?

In the previous article you have seen how to add company details and company taxdetails. Now let us see how to add employees compliance details using DeskeraPeople. 1. After entering the Employee Details and Components, click on the Next button which will take you to the next screen of Com…

8. UK Payroll Compliance - Employee Details and Company Profile

Please refer below article link

UK Payroll: How to get started with UK payroll compliance in Deskera People?

Many small companies still do manage their payroll manually, this istime-consuming and prone to error. So, the best solution for most SMEs is toautomate the process using specifically designed payroll software for smallbusiness. If you are a small business owner in UK and looking for a Payroll…

Date of Release: January 28, 2021 Indonesia Payroll Compliance - Employment Details Please refer below article link,

Indonesia Payroll Compliance - How to add the employee details using Deskera People?

Using Deskera People, you can add Indonesia employee’s details for creatingtheir profile required to run the payroll. Following are the below steps to add employees in the system 1. Click on the Employees option located on the left side of the main dashboard, 2. Then, click on the ’+Add Employ…

Indonesia Payroll Compliance - Add Component

Please refer below article link,

Indonesia Payroll: How to add and assign Payroll Component using in People?

This section will guide you to set up the new payroll earnings and, deductionscomponents. Payroll components other than basic salary will increase or decrease employeeTake Home Pay. Earning Components:Payroll earning component means an additional income from the employees grosspay salary, wh…

Indonesia Payroll Compliance - Statutory Details (Company and Tax Details)

Please refer below article link,

Indonesia Payroll - How to fill in company information and tax details in Deskera People?

In Indonesia, payroll management involves adhering to various steps and deadlinesubmissions to ensure that calculations comply with government regulations. Do you wish to handle your payroll calculations, payments and filingsaccurately?then you are at the right place. Deskera People has recent…

Indonesia Payroll Compliance - Add BPJS Account

Please refer below article link,

Indonesia Payroll- How to add, edit, and delete BPJS account in Deskera People?

In the previous article you have read in details what is BPJS[/care/indonesia-tax-what-is-bpjs-set-statutory-setting-bpjs-deskera-people/] now let us see how to add, edit and delete an BPJS account using Deskera People. Add BPJS accountAs an admin user, you have an option to add a BPJS account…

4. Canada Compliance - Tax and Company Details

Please refer below article link,

Canada Payroll: How to get started with Canada payroll compliance in Deskera People?

There is no question that payroll is one of the most important aspects for allbusinesses that needs to be managed effectively. If you are a small business owner in Canada and looking for a Payroll Softwareto automate your payroll processed then you are a right place. Deskera People has recentl…

5. Malaysia Payroll Compliance - Borang A (Monthly EPF Report) KWSP .

Please refer below article link,

How to generate KWSP Borang A Form/TXT File using Deskera People?

In the previous articles you have read what is EPF?[/care/malaysia-payroll-epf/#epf-contribution-payment] Now let us see how can you generate KWSP Borang A form for submitting themonthly EPF to the KWSP [https://www.kwsp.gov.my/en/ilogin/login-employer]. With the below simple steps you can do…

6. Malaysia Payroll Compliance - Borang 8A (Monthly SOCSO Report) Perkeso .

Please refer below article link,

How to generate SOCSO Borang 8A Form/TXT File in Deskera People?

In the Previous article you have read about what is SOCSO?[/care/malaysia-payroll-socso-applicable-deskera-people/] Now let us see how can you generate SOCSO Borang 8A Form for submitting themonthly SOCSO to the Perkeso [https://assist.perkeso.gov.my/employer/login] With Deskera People , yo…

Please refer below article link,

How to determine Benefit-In-Kind and Value of Living Accommodation in Deskera People?

What is Benefit-In-Kind (BIK)?BIK are benefits not convertible into money, even though they have monetaryvalue. The phrase not convertible into money means that when the benefit isprovided to the employee, that benefit cannot be sold, assigned or exchanged forcash either because of the employm…

8. Malaysia Payroll Compliance - Normal, Iskander Knowledge Worker , Returning Expert Program

Please refer below article link,

Malaysia Payroll Compliance - How to add the employee details using Deskera People?

Using Deskera People, you can add Malaysia employee’s details for creating theirprofile required to run the payroll. Following are the below steps to add employees in the system 1. Click on the Employees option located on the left side of the main dashboard, 2. Then, click on the ’+Add Employe…

9. US Compliance - Payslip

Date of Release: January 20, 2021 Malaysia Payroll Compliance - 2021 Changes Malaysia Payroll Compliance - Bulk import employee compliance details Please refer below article link,

Malaysia Payroll Compliance - How to add the employee details using Deskera People?

Using Deskera People, you can add Malaysia employee’s details for creating theirprofile required to run the payroll. Following are the below steps to add employees in the system 1. Click on the Employees option located on the left side of the main dashboard, 2. Then, click on the ’+Add Employe…

3. Malaysia Payroll Compliance - Exempt employee from tax calculation

Malaysia Payroll: How is MTD/PCB calculated in Deskera People?

If you have just started using Deskera People (Malaysia), you would want to makesure that the Monthly Tax Deduction (or Potongan Cukai Bulanan) for youremployees is accurate. Follow the below simple steps: 1. Under Employees Module, select Employee List. A screen will appear 2. Then, under E…

Please refer below article link,

How to increase EPF Contributions for an Employee and Employer in Deskera People?

An employee and employer can select to contribute EPF at a higher rate than theminimum rates specified(9% or 11%). However an approval is required fromKWSPbefore increasing these contributions. How to apply to KWSP for increased EPF contributions?- Increased EPF contributions for an Employer:…

. Malaysia Payroll Compliance - CP39 Report (PCB)

Please refer below article link,

How to generate CP39 form /TXT file using Deskera People?

In the previous article you have already seen what is PCB[/care/malaysia-payroll-mtc-pcb/]?. Now let us see how can you generate CP39 form for submitting the monthly PCB tothe LHDN. With the below simple steps you can download the CP39 form/txt file usingDeskera People. 1. Go to Reports Mod…

6. Payroll Summary report format changes for US

Please refer below article link,

How Do I Generate Payroll Summary Report Using Deskera People?

The Payroll Summary Report is a report for reviewing all payroll information forpaid employees based on a date range. With Deskera People, you can now generate the payroll summary report easily andget a summary of employee payroll activity with date range, or see paycomponents for a specific …

7. Australia Compliance - Payroll Tax

Please refer below article link,

Australia Payroll Compliance: What are tax rates in Australia?

Payroll tax is a state or territory tax. It’s calculated on the total wages youpay each month. The state or territory that your employees are located incollects the tax. The payroll tax rates and thresholds vary between states and territories. Thepayroll tax is mandatory for each state only af…

8. Australia Compliance: STSL

Please refer below article link,

Australia Payroll Compliance: What is Study Training and Support Loans(STSL), and how it is implemented in Deskera People?

What is Study Training and Support Loans(STSL)?The government provides financial assistance (in the form of loans) like STSL topeople undertaking higher education, trade apprenticeships and other trainingprograms. Information on the different type of loans that fall into the STSL category can…

9. Australia Compliance: Payroll Tax Report and Include Pre tax deduction calculation for Australia payroll tax report

Please refer below article link,

Australia Payroll Compliance: How to view payroll tax report in Deskera People?

In the previous article you have read different tax thresholds in Australia fordifferent states. Now let us see, how to view and record the payroll tax in Deskera People whichwill display the accurate rates based on the conditions for the particularstates. With Deskera People As an admin you …

Date of Release: January 12, 2021

Malaysia Payroll Compliance - 11% EPF Contribution With Deskera People, now you can auto-calculate your EPF at 11%.

Please refer below article link,

Malaysia Payroll: How is MTD/PCB calculated in Deskera People?

If you have just started using Deskera People (Malaysia), you would want to makesure that the Monthly Tax Deduction (or Potongan Cukai Bulanan) for youremployees is accurate. Follow the below simple steps: 1. Under Employees Module, select Employee List. A screen will appear 2. Then, under E…

Please refer below article link,

Malaysia Payroll: How is MTD/PCB calculated in Deskera People?

If you have just started using Deskera People (Malaysia), you would want to makesure that the Monthly Tax Deduction (or Potongan Cukai Bulanan) for youremployees is accurate. Follow the below simple steps: 1. Under Employees Module, select Employee List. A screen will appear 2. Then, under E…

3. US Compliance - Federal Income Tax 2020-2021

Date of Release: January 7, 2021

Malaysia Payroll Compliance - HRDF Calculation To learn more, please refer below article,

Malaysia Payroll: What is HRDF? How it is applicable in Deskera People?

What is the HRDF Levy?The HRDF levy is a mandatory levy payment collected by the Human ResourcesDevelopment Fund (PSMB). It is imposed on employers from certain industries. The main purpose of HRDF levy is to enable employee training and skillsupgrading of the Malaysian workforce. Who is eli…

Malaysia Payroll Compliance - EIS Calculation

To learn more, please refer below article,

Malaysia Payroll: What is EIS? How it is applicable in Deskera People?

The Employment Insurance System Act 2017 was introduced and came into force on 1 January 2018. CoverageAll employers in the private sector are required to pay monthly contributions onbehalf of each employee. (Government employees, domestic workers and theself-employed are exempt) An employee…

Malaysia Payroll Compliance - SOCSO Calculation

To learn more, please refer below article,

Malaysia Payroll: What is SOCSO and how is it applicable in Deskera People?

SOCSO (Social Security Organization), also known as PERKESO (PertubuhanKeselamatan Sosial), is a Malaysian government agency that was established toprovide social security protections to employees under the Employees’ SocialSecurity Act, 1969. Coverage of the Workers Social Security Act 1969E…

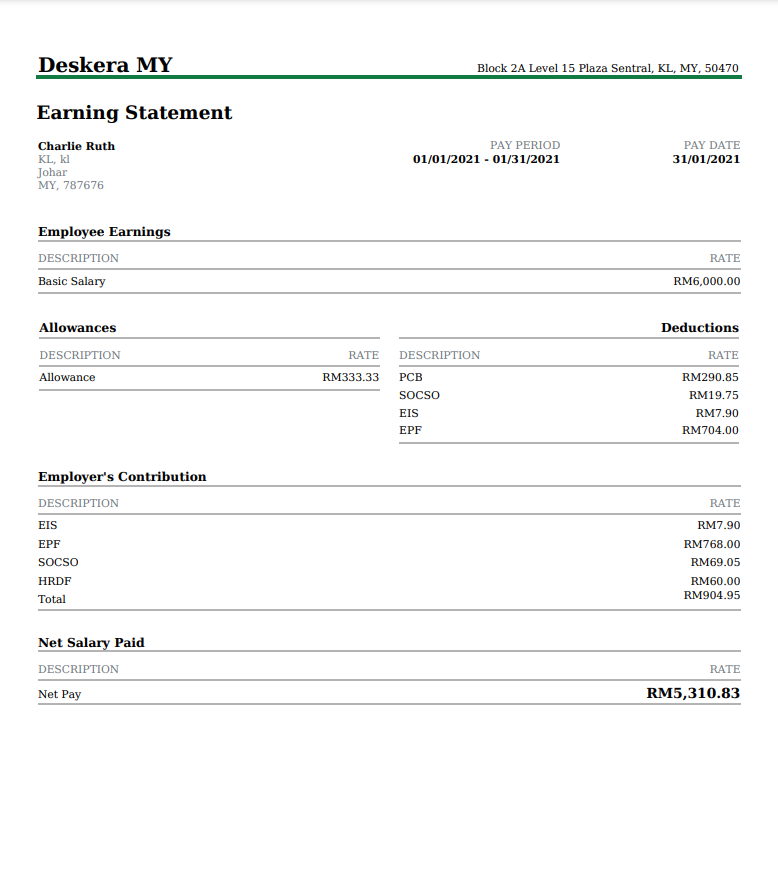

4. Malaysia Payroll Compliance - Payslip

5. HRDF - Component level changes in earning component

To learn more, please refer below article,

Malaysia Payroll: How to add and assign Payroll Component using Deskera People

This section will guide you to set up the new payroll earnings and, deductionscomponents. Earning Components:Payroll earning component means an additional income from the employees grosspay salary. With Deskera People you can add the payroll earning component for your employeesat any time, b…

6. Australia Compliance - Superannuation

To learn more, please refer below article,

Australia Payroll Compliance: What is Superannuation, and how it is applicable in Deskera People?

What is Superannuation?Superannuation is one way Australians can save money for their retirement. Your employer should pay 9.5% of your salary into a super fund, through theSuperannuation Guarantee (SG). There is a maximum cap the employer needs to payper quarter is $5,423.55 You can also top…

7. Australia Compliance - PayG Withholding Amount

To learn more, please refer below article,

Australia Payroll Compliance: What is PayG withholding and how it is applicable in Deskera People?

What Is PAYG Withholding?Most Australian workers pay income tax, calculated as a percentage of the incomethat they earn. The ATO only confirms the total amount of tax owed by a workerafter the worker files their tax return at the end of the financial year. The purpose of PAYG withholding is to…

Date of Release: December 16, 2020

Contractor Payment: Capture Hourly/Fixed Amount , Contractor Payment: Capture Bank Details of the Contractor To learn more, please refer below article,

How to add the employee/contractor details for US using Deskera People?

The employee details are filled partially during the initial onboarding processthe employee and admin can add the details later. Using Deskera People, you can add employee’s information and Contractorinformation for creating their profile required during the pay run. Following are the below st…

To learn more, please refer below article,

USA Payroll: How to Process Contractors Payrun Using Deskera People

In the previous article you have read how to add a contractor.[/care/add-employee-contractor-details-usa-deskera-hris/] Now let us see how toprocess the Payrun for contractors separately using Deskera People with thebelow simple steps. 1. Under Payrun Module>>Click on Contractor Payrun>> a wi…

3. Bi-Weekly Payrun - With Deskera People, now you can pay your employees every other week on a specific day of the week.

To learn more, please refer below article,

How to add a new payrun using Deskera People?

Using Deskera People, while processing the pay run, if you have missed addingPayrun for the employees there is an option to add a pay run. Below are the steps, 1. Click on the Payrun icon on the left side of the main dashboard where you canview the payrun dashboard details. 2. To add a new pa…

4. Malaysia Payroll Compliance - Employee Details

To learn more, please refer below article,

Malaysia Payroll Compliance - How to add the employee details using Deskera People?

Using Deskera People, you can add Malaysia employee’s details for creating theirprofile required to run the payroll. Following are the below steps to add employees in the system 1. Click on the Employees option located on the left side of the main dashboard, 2. Then, click on the ’+Add Employe…

5. Malaysia Payroll Compliance - Add Components

To learn more, please refer below article,

Malaysia Payroll: How to add and assign Payroll Component using Deskera People

This section will guide you to set up the new payroll earnings and, deductionscomponents. Earning Components:Payroll earning component means an additional income from the employees grosspay salary. With Deskera People you can add the payroll earning component for your employeesat any time, b…

6. Malaysia Payroll Compliance - Statutory Details (Company and Tax Details)

To learn more, please refer below article,

How to fill in company information and tax details using Deskera HRIS?

Company DetailsFrom the settings module, select company Settings, a screen will appear withcompany information. Add company DetailsIn this screen, you can set up the following information: * Company name (To be used in payslip and statutory reports) * Company Address - Zip code, City , State…

7. Malaysia Payroll Compliance - EPF Account Details and EPF Calculation

To learn more, please refer below article,

Malaysia Payroll: What is EPF?

OverviewThe Employees’ Provident Fund (known by its acronym EPF, or KWSP in Malay) is aMalaysian government agency that manages a compulsory savings plan andretirement planning for private and non-pensionable public sector employees. The EPF functions through monthly contributions from employe…

Malaysia Payroll: How to add, edit, and delete EPF account Using Deskera People?

In the previous article you have read in details what is EPF[/care/malaysia-payroll-epf/] now let us see how to add, edit and delete an EPFaccount using Deskera People. Add EPF accountAs an admin, you have an option to add a EPF account for your company byfollowing the simple few steps. 1. …

8. Malaysia Payroll Compliance - PCB/MTD Calculation

To learn more, please refer below article,

Malaysia Payroll: What is PCB (MTD)?

MTD stands for Monthly Tax Deduction, also known as Potongan Cukai Bulanan(PCB). Hence, you may realize that MTD and PCB can be used interchangeably. MTD/PCB is a series of monthly deductions that go towards your tax payment inrelation to your employment income. These monthly deductions are re…

Malaysia Payroll: How is MTD/PCB calculated in Deskera People?

If you have just started using Deskera People (Malaysia), you would want to makesure that the Monthly Tax Deduction (or Potongan Cukai Bulanan) for youremployees is accurate. Follow the below simple steps: 1. Under Employees Module, select Employee List. A screen will appear 2. Then, under E…

Date of Release: Nov 4, 2020

Terminating an Employee, Manage/Edit Termination and Default Checklist - View Checklist: Employee, Admin To learn more, please refer below article,

View, edit, delete, terminate employees from Deskera People

In the previous article, you have learned how to add employee details manuallyin the system using Deskera People. Now let us see how can you view, edit,delete and terminate the created employees. How to View employees? 1. Using the Deskera People, you can view the employees by clicking on the …

2. IR8S E-Submission

To learn more, please refer below article,

How to download IR8S Form using Deskera People?

If you are an employer who has made excess CPF contributions to your employees’wages, and/or claimed or will be claiming a full refund on the excess of thecontributions you paid, you will be required to complete IR8S[https://www.iras.gov.sg/irashome/uploadedFiles/IRASHome/Businesses/Explanatory%20Notes%20on%20Form%20IR8S.pdf…

To learn more, please refer below article,

How to download Appendix 8A and Appendix 8B Forms using Deskera People?

All employers in Singapore are legally needed under S68( 2) of the Income TaxAct to prepare Form IR8A, along with Appendix 8A, Appendix 8B where applicablefor all Singapore-based employees. This must be done by 1 March annually andemployers will be accountable for submitting these forms to the In…

To learn more, please refer below article,

How to download Appendix 8A and Appendix 8B Forms using Deskera People?

All employers in Singapore are legally needed under S68( 2) of the Income TaxAct to prepare Form IR8A, along with Appendix 8A, Appendix 8B where applicablefor all Singapore-based employees. This must be done by 1 March annually andemployers will be accountable for submitting these forms to the In…

5. GIRO File Format for HSBC & Citibank GIRO File Format To learn more, please refer below article,

How do I set up a Bank Account to make payments using GIRO in Deskera People?

What is GIRO?General Interbank Recurring Order (GIRO) is a convenient, paperless and cashlesspayment method which enables you to make hassle-free payments to billingorganisations (BO) through your bank account. GIRO is an automated electronic payment service where the amount will beautomatica…

6. Leave entitlement implementation when Creation of New Leave, Leave Entitlement for New user if on boarded into system and Leave Entitlement for all eligible users once we make default leave (for Singapore) active

To learn more, please refer below article,

How to Implement Leave Entitlement for employees while creating a new Leave in Deskera People?

An employee is entitled to a range of leave benefits, whether he/she ispermanent or casual employee. Below mentioned are few leave type an employee is entitled to,- Annual Leave- Sick Leave- Earned Leave- Medical Leave- Maternity Leave- Casual Leave, etc. Deskera People has rolled out a …

7. US Tax Details - Hide State Tax Section for Non-Texas State

To learn more, please refer below article,

Where can I update/add my company’s information and Tax details for the US on Deskera People?

In case you need to make any changes in company details, like the companyaddress as shifting the company to the new business location you can do so byusing Deskera People As an admin of the system can amend or change the company’s details by followingthe below steps. 1. First and foremost, go …

Date of Release: October 06, 2020

Payroll Summary Report- With Deskera People, you can now generate the payroll summary report easily and get a summary of employee payroll activity with date range, or see pay components for a specific period or individual employees.To learn more, please refer below article,

How Do I Generate Payroll Summary Report Using Deskera HRIS?

The Payroll Summary Report is a report for reviewing all payroll information forpaid employees based on a date range. With Deskera HRIS, you can now generate the payroll summary report easily andget a summary of employee payroll activity with date range, or see paycomponents for a specific pe…

2. Adding Multiple Bnak accounts - Now you can add multiple bank account for GIRO like OCBC, CIMB, OCBC Velocity, UOB and can generate the file in GIRO Format.

To learn more, please refer below article,

How do I set up a Bank Account to make payment using GIRO in Deskera HRIS?

What is GIRO?General Interbank Recurring Order (GIRO) is a convenient, paperless and cashlesspayment method which enables you to make hassle-free payments to billingorganisations (BO) through your bank account. GIRO is an automated electronic payment service where the amount will beautomatica…

Date of Release: Sept 25, 2020

IR8S Form Edit and download Please refer the below article,

How to download IR8S Form using Deskera People?

If you are an employer who has made excess CPF contributions to your employees’wages, and/or claimed or will be claiming a full refund on the excess of thecontributions you paid, you will be required to complete IR8S[https://www.iras.gov.sg/irashome/uploadedFiles/IRASHome/Businesses/Explanatory%20Notes%20on%20Form%20IR8S.pdf…

2. Hourly Wages capture at employee profile

Please refer the below article,

How to add the employee details using Deskera People?

The employee details are filled partially during the initial onboarding process.The additional details can be configured by the employee or the admin later. Using Deskera People, you can add employee’s information for creating theirprofile required to run the payroll. Following are the below st…

3. Hourly Wages and OT in the Stages of Pay Run

Please refer the below article,

How to add a new payrun using Deskera People?

Using Deskera People, while processing the pay run, if you have missed addingPayrun for the employees there is an option to add a pay run. Below are the steps, 1. Click on the Payrun icon on the left side of the main dashboard where you canview the payrun dashboard details. 2. To add a new pa…

4. Work Week and Default Hours

Please refer the below article,

How to Create Work Week and Hours using Deskera People?

A work week is a fixed, regularly-recurring period of 168 hours. In other words,a workweek is seven consecutive 24-hour periods. Once a workweek ends, a newworkweek begins. Let’s say your employees come to office from Monday to Friday, and they don’twork at all on Saturday and Sunday. so here,…

5. New Performance - Self Assessment, New Performance - Completing an Assigned Review, New Performance - Assigned Review Grid and New Performance - Appraisal Cycle Settings

Please refer the below article,

How do I create a Performance Appraisal Cycle schedule using Deskera HRIS?

Performance Management Cycle is more than the quarterly performance interview orthe annual performance review. All members of an organization will go throughthe cycle, which begins with setting goals at the beginning of the year,monitoring progress along the way, and completing the year with a …

Please refer the below article,

How do I create a new type of leave in Deskera eLeave?

As the admin of the system, you will need to create different types of leaves toclassify the reasons why the employee uses their leaves into groups. This typeof leave needs to be created before the onboarding process of your staff so thatthey are aware of what they are entitled to once they join…

Date of Release: Sept 15, 2020 Now with Deskera People you can make the payment via GIRO account To learn more, please refer below article,

How do I set up a Bank Account to make payments using GIRO in Deskera People?

What is GIRO?General Interbank Recurring Order (GIRO) is a convenient, paperless and cashlesspayment method which enables you to make hassle-free payments to billingorganisations (BO) through your bank account. GIRO is an automated electronic payment service where the amount will beautomatica…

How do I process payroll using GIRO in Deskera People?

In the previous article you have read, how to set up a bank account for makingpayments via, GIRO. Now lets is see how to make payment for your employees with GIRO in DeskeraPeople. After entering all transactions into the system for the pay period, you can nowstart to process the payroll via …

Date of Release: Aug 14, 2020 New feature released: US Compliance for Texas with the same flow as Singapore compliance with few changes as mentioned below,

Adding the employees once the onboarding is completed. To learn more, please refer below articles,

How to add the employee/contractor details for US using Deskera People?

The employee details are filled partially during the initial onboarding processthe employee and admin can add the details later. Using Deskera People, you can add employee’s information and Contractorinformation for creating their profile required during the pay run. Following are the below st…

2. Set up/Update company's information and Tax details for the US on Deskera People

To learn more, please refer below articles,

Where can I update/add my company’s information and Tax details for the US on Deskera People?

In case you need to make any changes in company details, like the companyaddress as shifting the company to the new business location you can do so byusing Deskera People As an admin of the system can amend or change the company’s details by followingthe below steps. 1. First and foremost, go …

3. Download the withholding form W-4

To learn more, please refer below articles,

How to Download employee withholding forms W-4 and W-9 using Deskera People?

What is the W-4 form for employees?When you get a new job, your employer will ask you to complete is IRS Form W-4:Employee’s Withholding Certificate. The way you fill out this form determineshow much tax your employer will withhold from your paycheck. Your employer sendsthe money it withholds f…

4. Download the withholding form W-9

To learn more, please refer below articles,

How to Download withholding W-9 form for contractors in Deskera People?

What is the W-9 form for contractors?Businesses use IRS Form W-9, Request for Taxpayer Identification Number andCertification, to get information from vendors they hire as independentcontractors (also called freelancers). The form is filled out by independent contractors who provide services t…

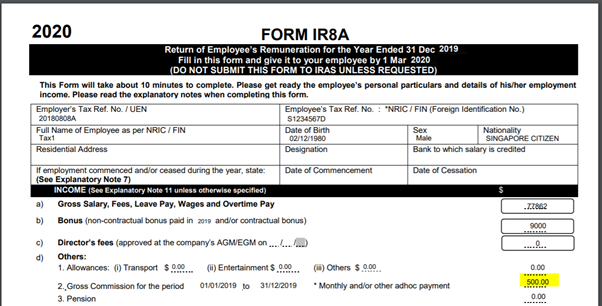

5. Download IR8A Form using Deskera People?

To learn more, please refer below articles,

How to download IR8A Form using Deskera People?

What is IR8A?Form IR8A in Singapore is a mandatory document that contains information onemployees’ earnings. Depending on various working conditions of your employeesyou might need to prepare Appendix 8A, Appendix 8B, and Form IR8S as well. Theyare issued by the employer and relate to employees…

6. Generate IRAS E-Submission file using Deskera People?

To learn more, please refer below articles,

How to Generate IRAS E-submission file using Deskera People?

If you are resident in Singapore, you can e-File your completed tax form from 1Mar to 18 Apr every year. If you paper file, please submit your completed taxform by 15 Apr of each year. You can e-File via myTax Portal [https://mytax.iras.gov.sg/ESVWeb/default.aspx] with your SingPass or IRAS Un…

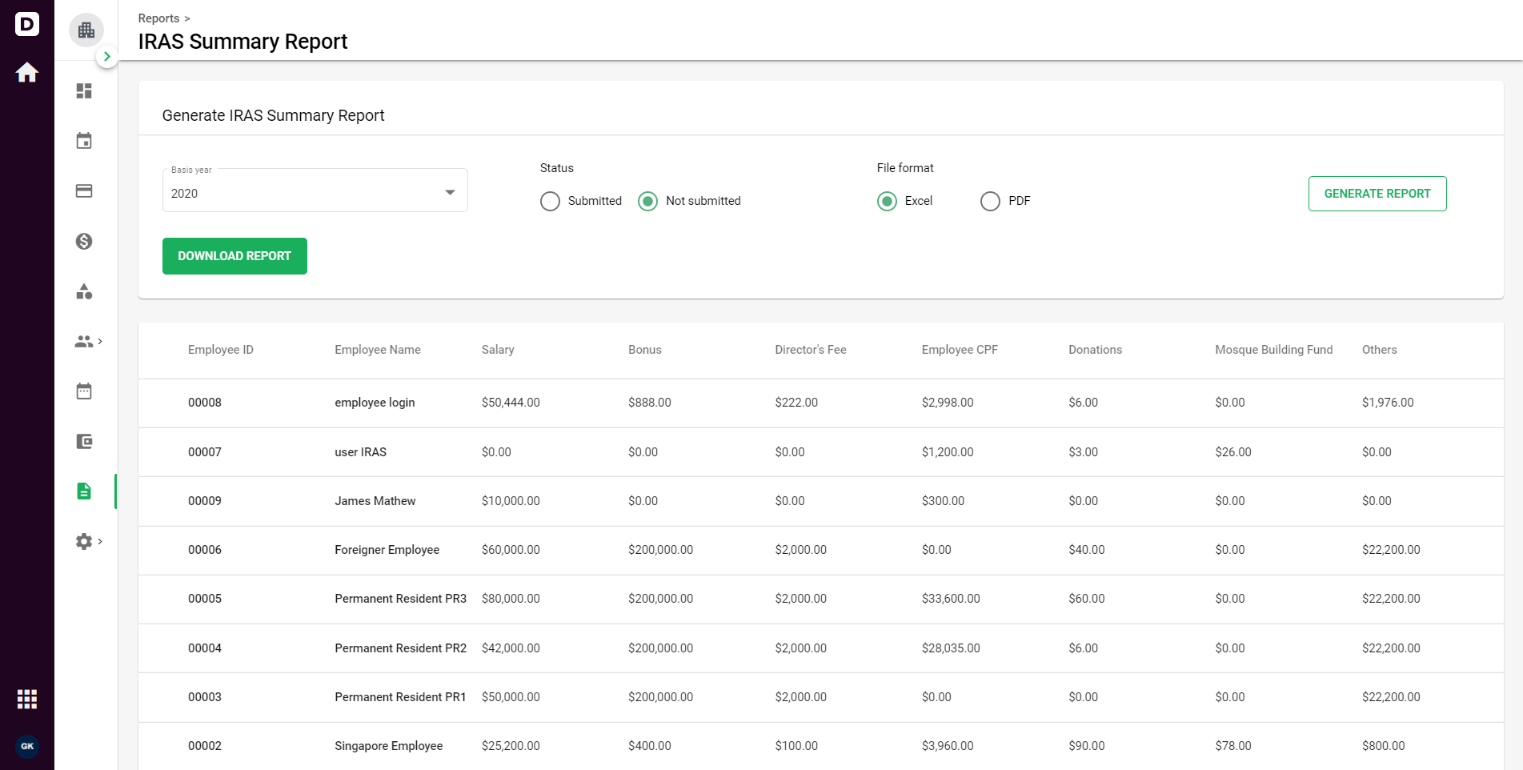

7. Generate IRAS Summary report using Deskera People? To learn more, please refer below articles,

How to generate IRAS Summary report using Deskera People?

As an admin after you file the tax returns to IRAS for your employees for thatparticular year, using Deskera People you can so so by generating the detailedIRAS report. Following are the below steps to generate the IRAS report 1. Go to the Report tab on the sidebar menu>>A window will appear>>u…

8. Record the Loss of pay details while going through the different payrun Stages

To learn more, please refer below articles,

What are the different stages for processing the Payroll using Deskera People?

After all the payroll details are added in Deskera People and when you click onProcess Payroll button you need to go through the different payrun stages beforeprocessing the final payrun Below listed are the payrun stages, 1. Select Employee 2. Ready for processing 3. Payroll processed Let …

Date of Release: July 3, 2020 New feature released:

1. We have officially launched Deskera People system also known as Human Resources Management System (HRMS) on production. You can sign-up for 30 days free trial . Follow the steps as mentioned here to sign-up for Deskera People account and follow through the sign-up procedure.

Here are some of the features we have you covered on Deskera People:

A) Onboard all your employees on Deskera People and update your employees' profiles. Check on the supporting guide below to learn how to onboard your employees:

Adding your employees' details on Deskera People To learn more, please refer below article,

How to add the employee details using Deskera People?

The employee details are filled partially during the initial onboarding process.The additional details can be configured by the employee or the admin later. Using Deskera People, you can add employee’s information for creating theirprofile required to run the payroll. Following are the below st…

2. View, edit, delete, and terminate employee from Deskera People

To learn more, please refer below article,

View, edit, delete, terminate employees from Deskera People

In the previous article, you have learned how to add employee details manuallyin the system using Deskera People. Now let us see how can you view, edit,delete and terminate the created employees. How to View employees? 1. Using the Deskera People, you can view the employees by clicking on the …

3. Set-up the company's information and CPF details on Deskera People.

To learn more, please refer below article,

Where can I update my company’s information, Work Week, and CPF details in Deskera People?

In every organization, there comes a time when the organization decides to makechanges to the company’s details like the company address as some companiesshift to a new business location due to the end of office leasing or for someother reasons. Using Deskera People, the admin of the system can…

4. Learn about the payroll processes, adding new pay-run, and new ad-hoc payroll on Deskera People.

To learn more, please refer below articles,

What are the different stages for processing the Payroll using Deskera People?

After all the payroll details are added in Deskera People and when you click onProcess Payroll button you need to go through the different payrun stages beforeprocessing the final payrun Below listed are the payrun stages, 1. Select Employee 2. Ready for processing 3. Payroll processed Let …

How to add a new payrun using Deskera People?

Using Deskera People, while processing the pay run, if you have missed addingPayrun for the employees there is an option to add a pay run. Below are the steps, 1. Click on the Payrun icon on the left side of the main dashboard where you canview the payrun dashboard details. 2. To add a new pa…

How to add a new ad-hoc payroll using Deskera People.

What is Ad hoc payroll? Ad-hoc Payroll is used to run the payroll for situations whereby there is a needto run a separate payroll due to certain circumstances. For instance: aresignation/dismissal of an employee or a missing payout for the employee(s). Using Deskera People you have an option to…

5. Arranging the pay schedule on Deskera People and also learn to edit and delete the pay schedule as well.

To learn more, please refer below articles,

How to add a Pay Schedule using Deskera People

Pay Schedules are used to set up pay runs. The pay schedule’s settings are usedfor each pay run to calculate what to pay employees. There is no limit to the number of pay schedules. You can create and configurefor any combination of pay frequencies. You can have multiple Monthly, Weekly &Twice…

View, Edit, delete a Pay Schedule using Deskera People

Once you have created a new pay schedule you have an option to view them in 2different views, and can also edit and delete them. How to view Pay Schedules? 1. Click on the Pay Schedules located on the left-hand side of the maindashboard, where you can view the list of created pay schedules in …

6. Add new components on Deskera People

To learn more, please refer below articles,

How to add a component using Deskera People?

Before you can begin to [https://www.patriotsoftware.com/blog/payroll/run-payroll/]run the payroll, youneed to collect some vital information from your employees, and if you feel anyinformation is missing while processing the payroll you can add it to thesystem. Hence using the Deskera Payroll…

8. On Deskera People, the employees can also submit their expense claims. The admin will review all the expense claims submission before approval.