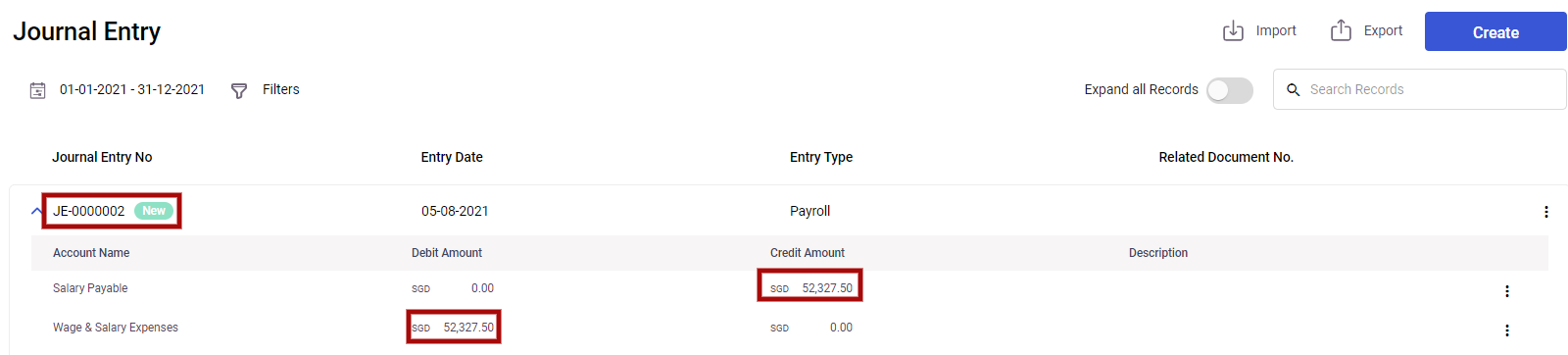

Deskera People has recently launched a feature where, an admin can record the processed payroll in Deskera Books as a Journal Entry which will accommodate all the expenses and liabilities of the company is recorded in the accounts.

Let us understand more in detail, how to do people integration with books.

How to enable People integration with Books?

Firstly an admin needs to have Deskera Books access to see the integration module in Deskera People.

- Go to Books by clicking on switch to menu >> Create a company in books>> go to Accounting Module >> Click on Journal Entry.

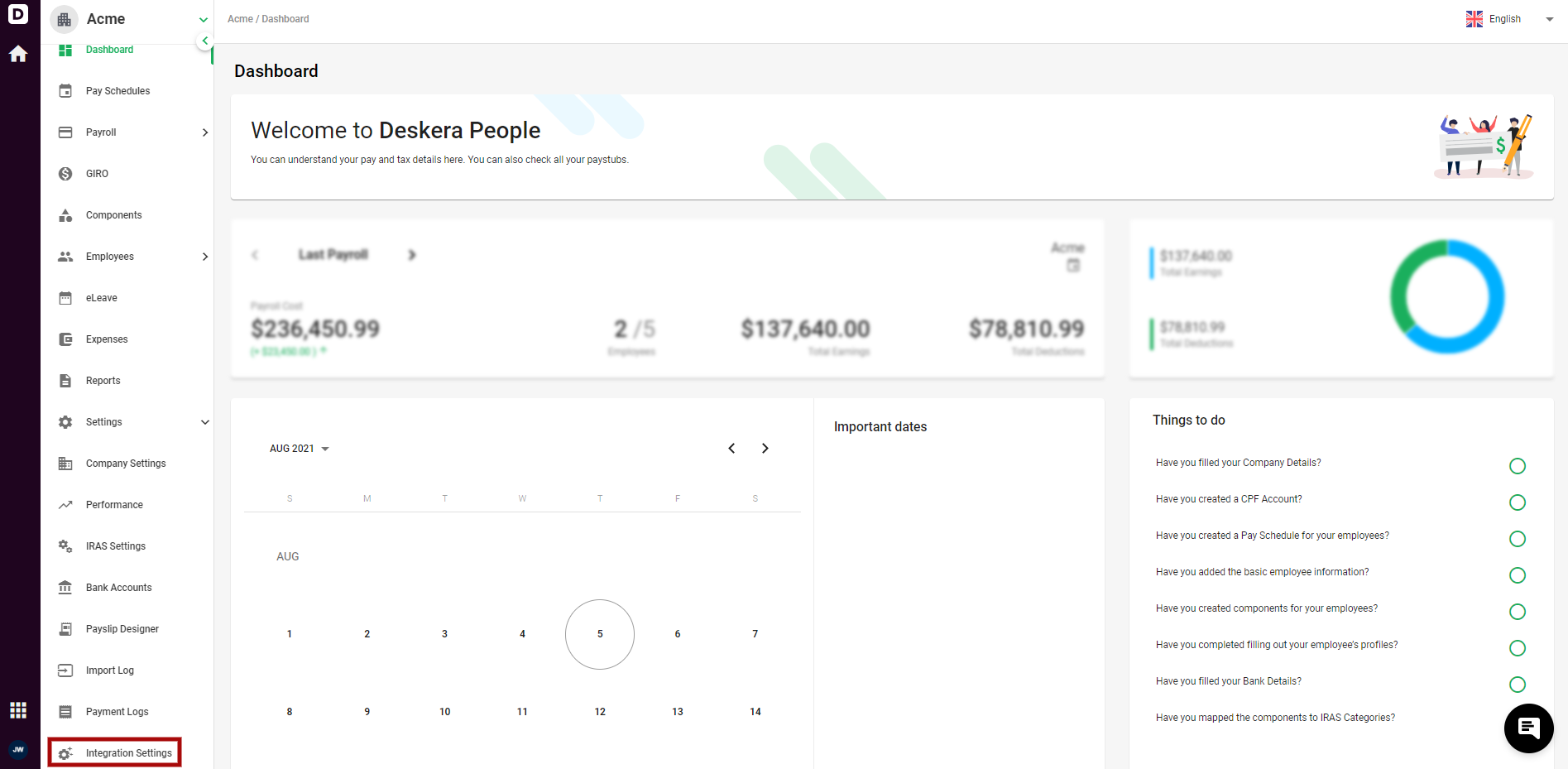

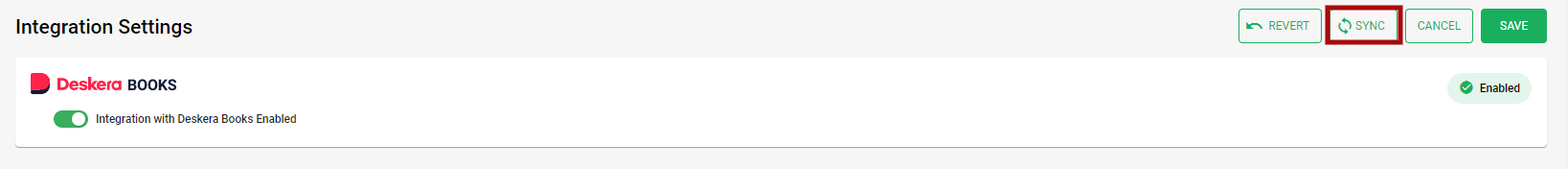

- Then again go to Deskera People, and under settings, you can see the Integration Settings module

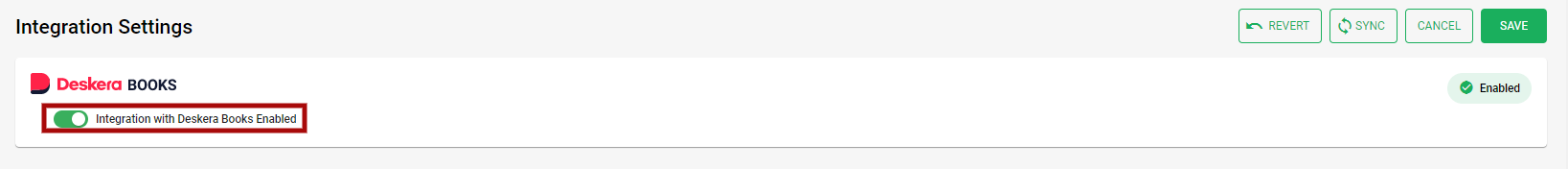

3. After you click on Integration Settings, a screen will appear, where in you can enable Deskera Books, by clicking on the toggle button Integration with Deskera Books Enabled.

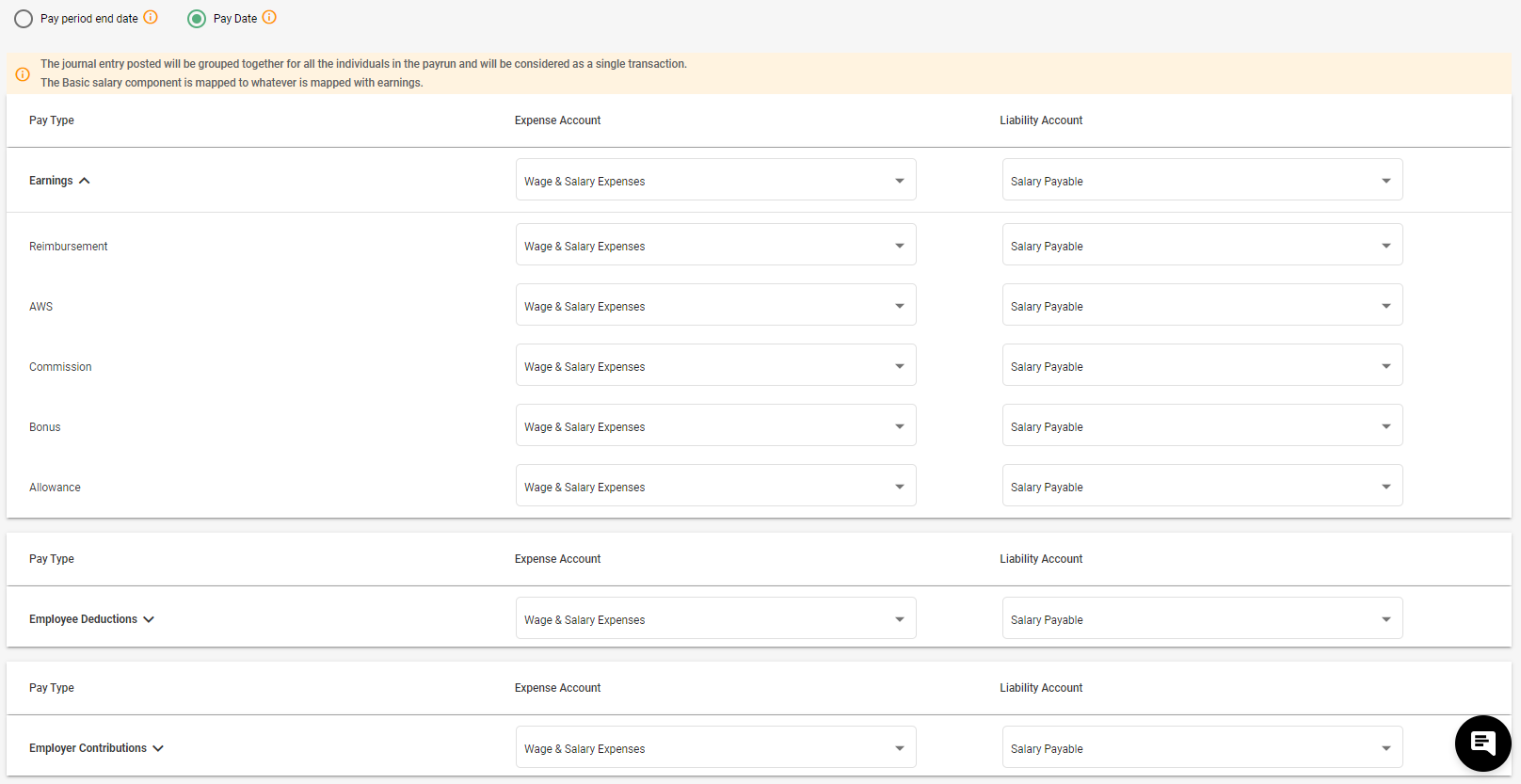

3. Next, once the Integration with Deskera Books is enabled, you will be able to view below fields, here all the salaries will be combined as one and will be displayed in Books.

- You can select the dates as, 1).Pay period end date - The date at which the pay period ends or, 2). Pay Date - The date at which the employee gets paid from a specific pay run.

- Earnings - All the components will be categorized as Earnings, will be displayed one below the other along with the option of choosing the expense and liability account via the drop down

- Employee Deductions - All the components will be categorized as Statutory Deductions, will be displayed one below the other along with the option of choosing the expense and liability account via the drop down.

- Employee Contributions - All the components will be categorized as Statutory Contributions, will be displayed one below the other along with the option of choosing the expense and liability account via the drop down.

- Column Expense Account - The expense account present in Books will be displayed for the user via drop-down for selection. By default it will be Wage & Salary Expenses.

- Column Liability Account - The liability account present in Books will be displayed for the user via drop-down for selection. By default it will be Salary Payable.

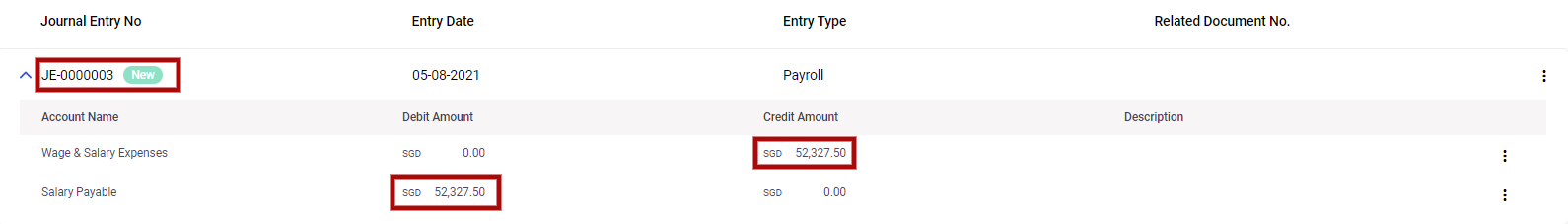

5. After, the changes are made and verified, click on the Save Button and successfully the integration with Books will be saved and Payroll JE entry will be posted.

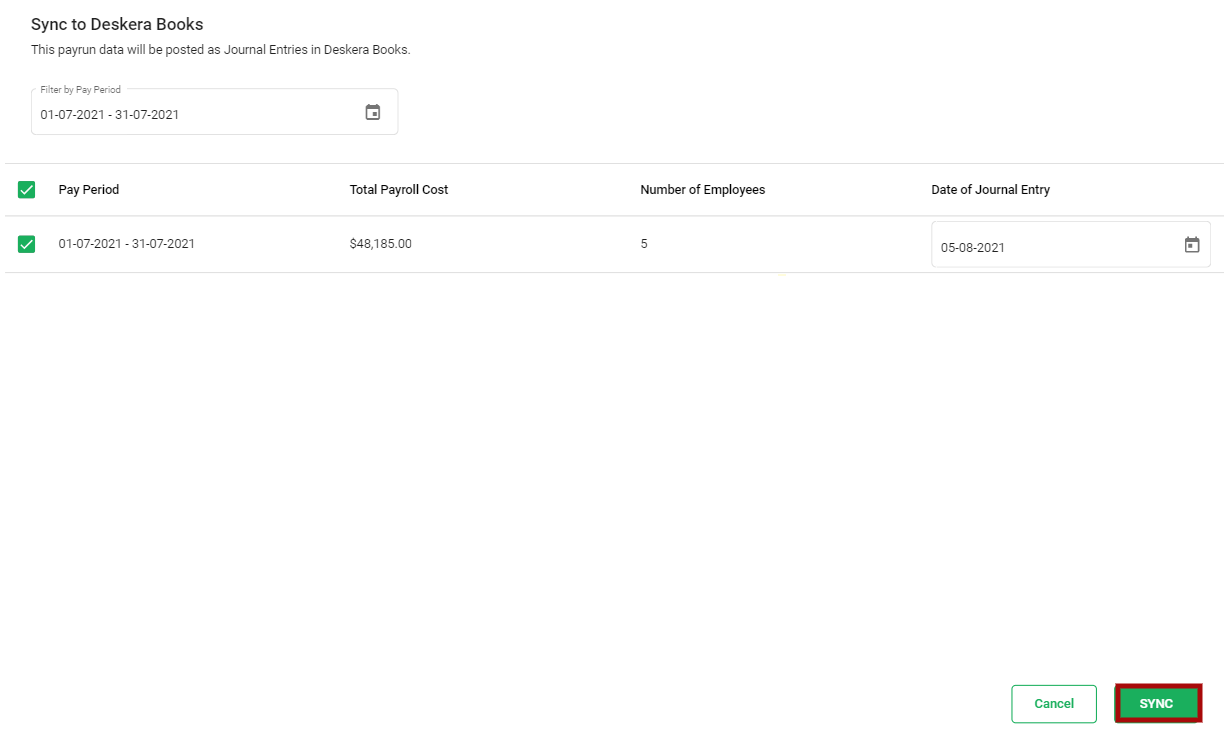

How to Sync previous payroll to Deskera Books?

You can now also sync your previous payroll details to Deskera Books, in case you have processed the payroll before enabling the integration.

- From the Integration Settings page, click on the SYNC button,

2. A below screen will appear with the details of previous payroll processed before integration.

- You can filter by Pay period date

- Pay Period - The pay period of the pay run

- Total Payroll Cost - The total payroll cost of the payrun

- Number of employees - The number of employees in the payru

- Date of the Journal Entry - The date at which the Journal Entry will be pushed to Books . By default, it will be the current date

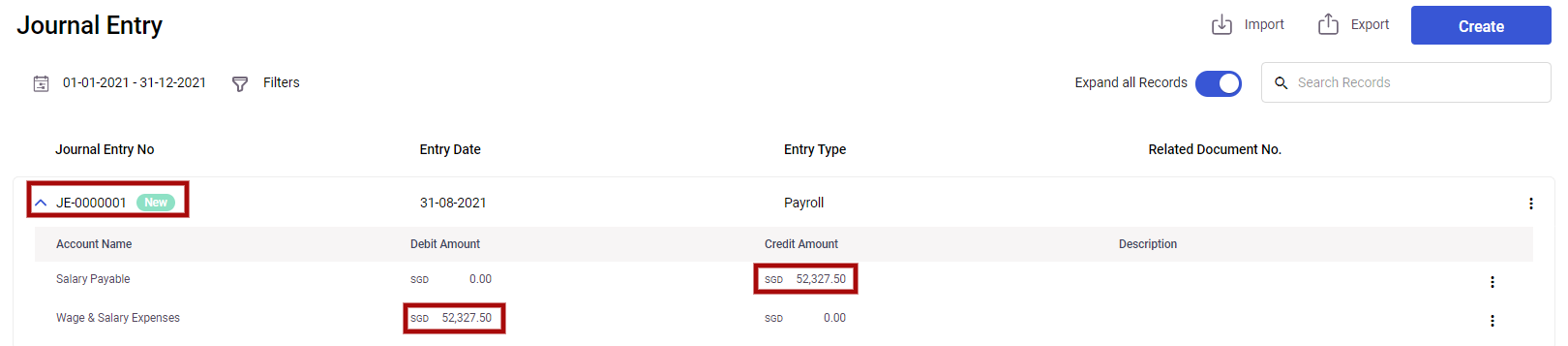

3. Next, click on the SYNC button, and the the JE will be successfully posted in Deskera Books.

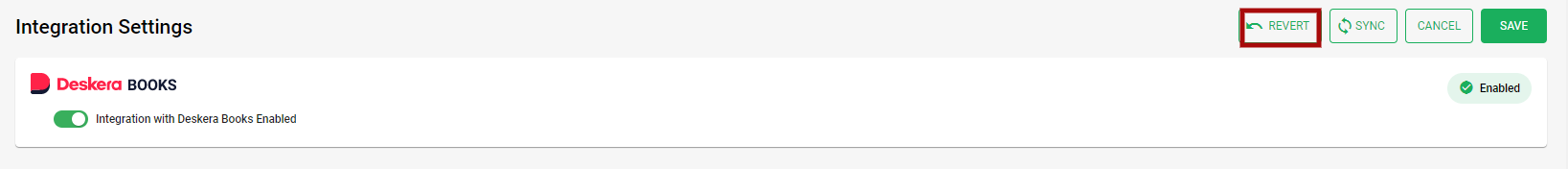

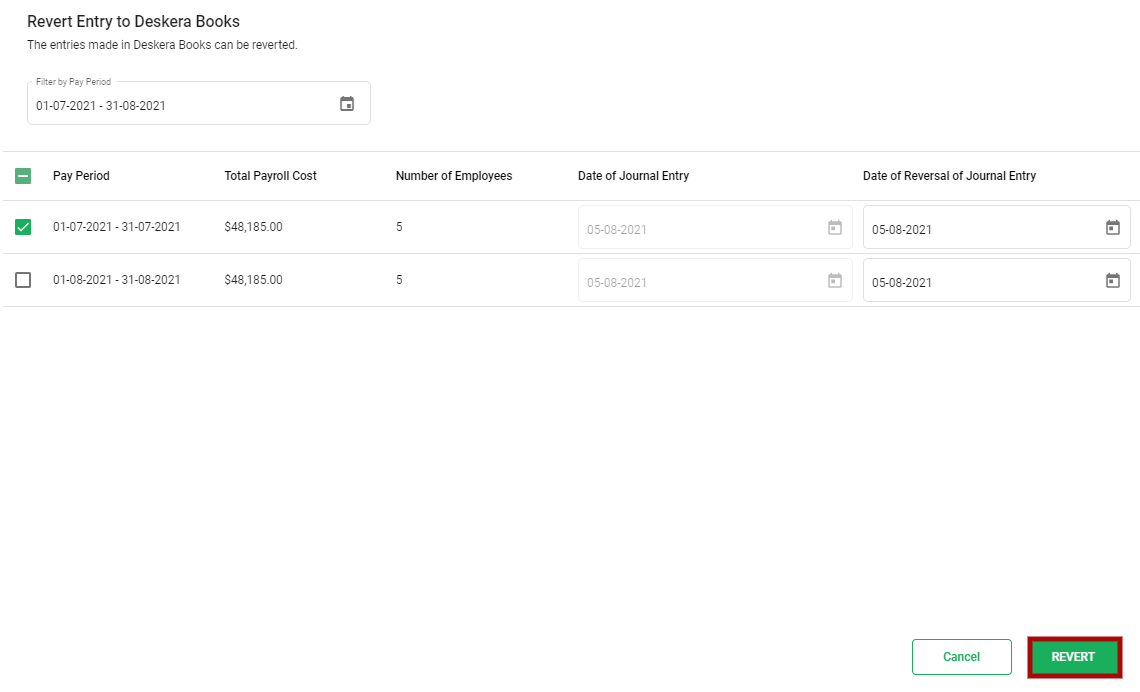

How to Revert Journal Entry

If incase you need to revert the journal entries made in the Deskera Books, you can do so following the below steps,

- From the Integration Settings page, click on the REVERT button,

2. A below screen will appear with the details of the entries already made in Deskera Books.

- You can filter by Pay period date

- You can filter by Pay period date

- Pay Period - The pay period of the pay run

- Total Payroll Cost - The total payroll cost of the payrun

- Number of employees - The number of employees in the payru

- Date of the Journal Entry - The date at which the Journal Entry will be pushed to Books . By default, it will be the current date

- Date of Reversal of Journal Entry - Date on which the journal entry was reverted.

3. Next, click on the REVERT button, and the the JE will be successfully reverted in Deskera Books.

Note : Following the same process you can do it for Contractors employees as well.