Financial reports are your Profit and Loss Statement, Balance Sheet and Cash Flow Report.

To generate these financial reports, follow the steps mentioned below:

- Login to your Deskera Books+ account

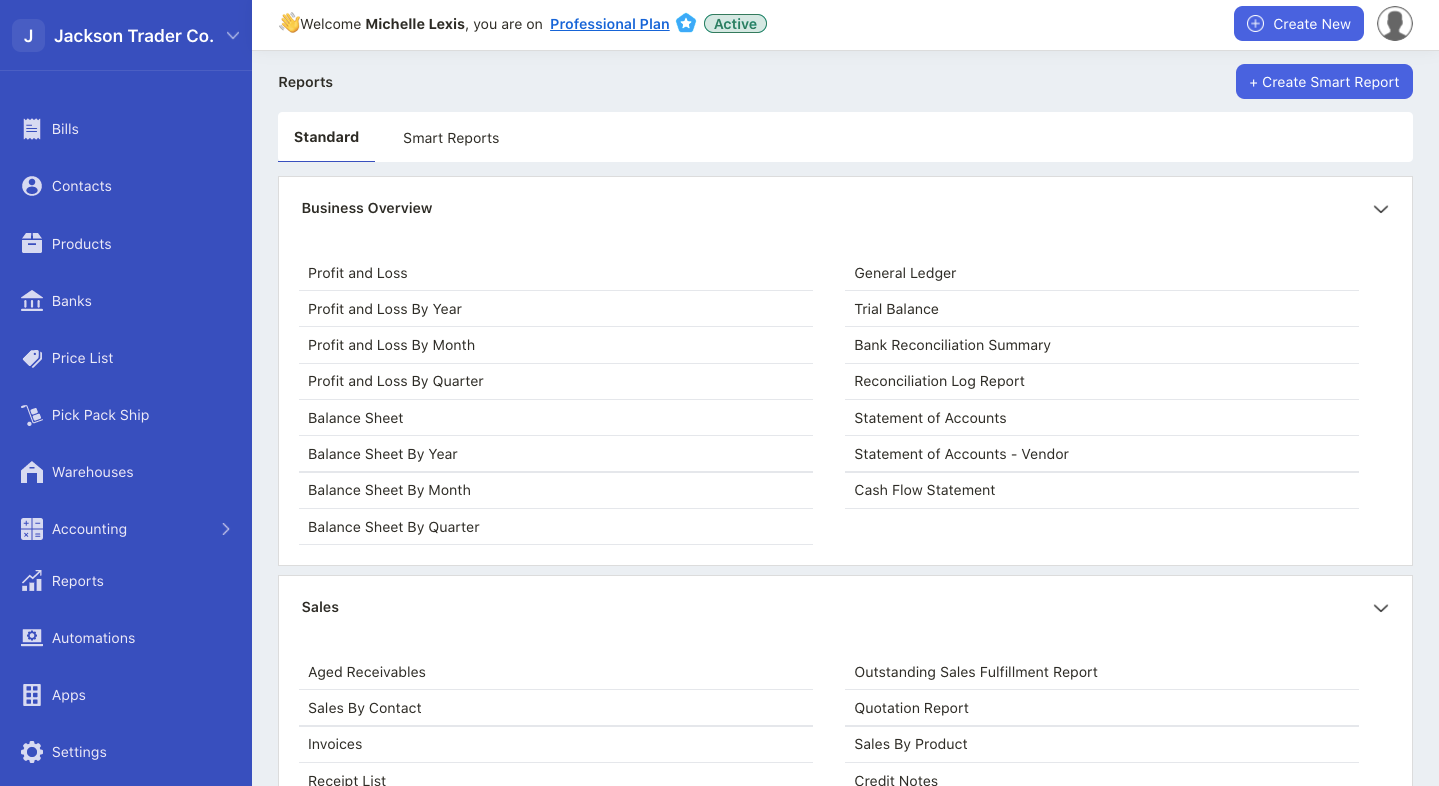

- Click on Reports on the sidebar menu.

3. Under the financial section, select the reports that you wish to generate from the system.

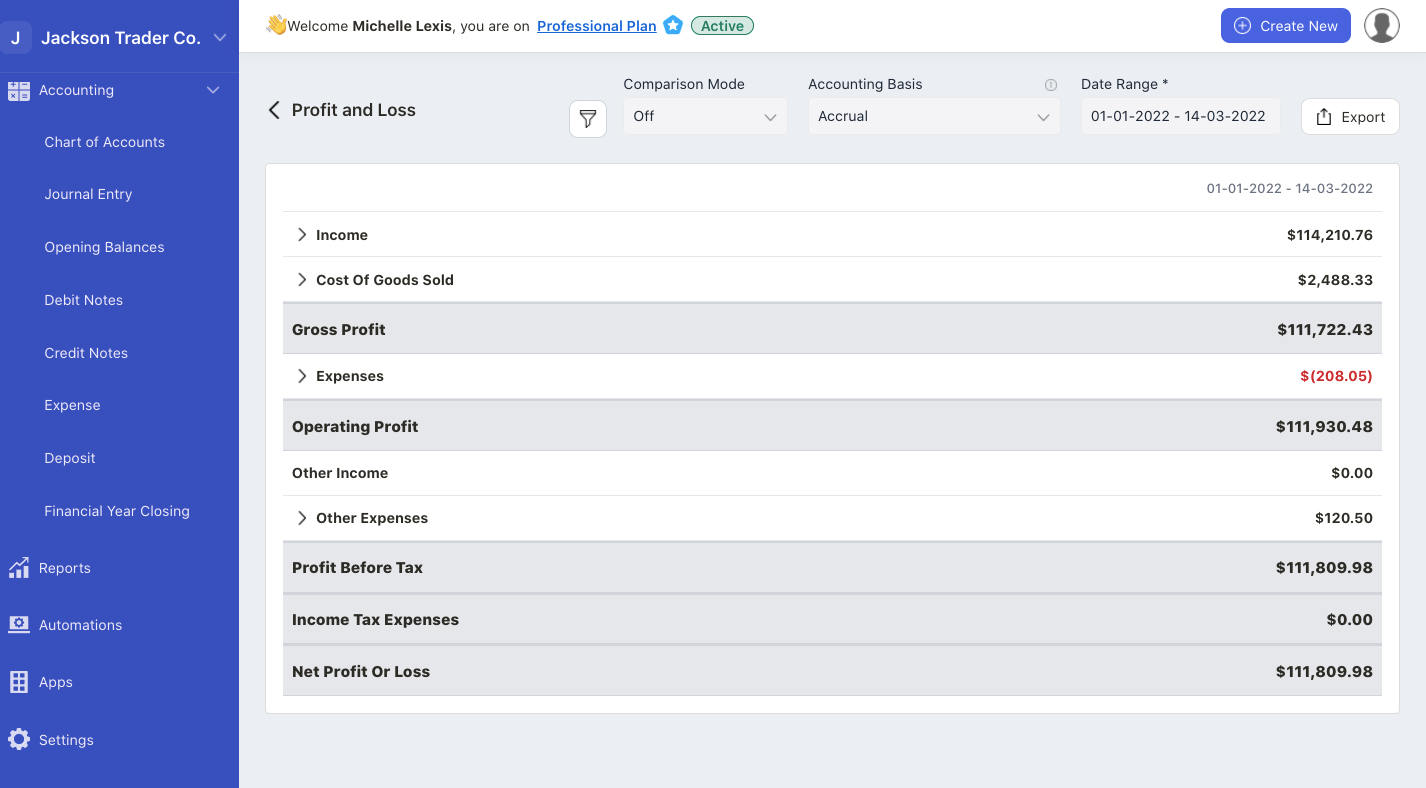

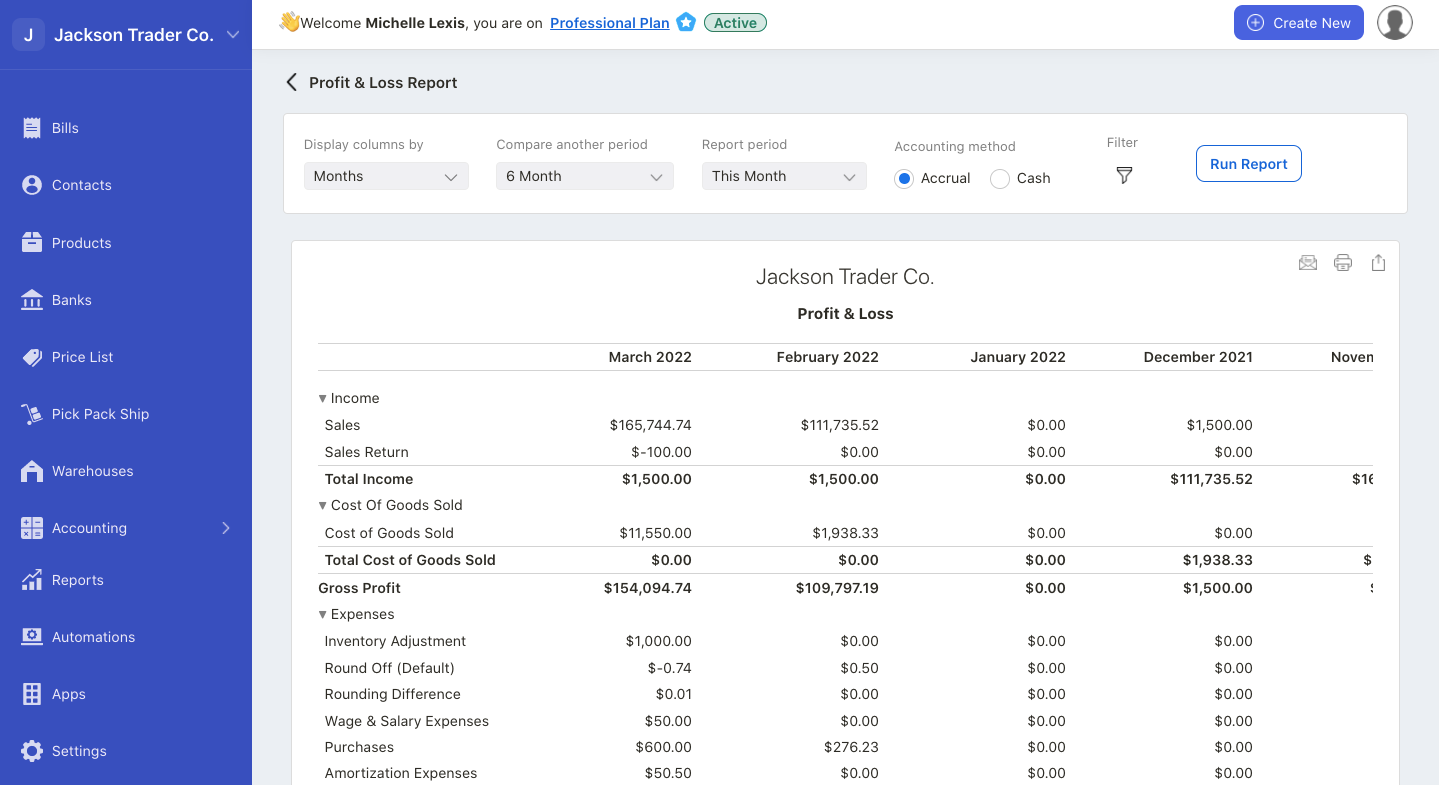

A) profit and loss statement

A Profit and Loss statement is a financial statement summarizing your company’s revenues, expenses incurred, and profits and losses during a specified period.

On this page, you can perform a few actions:

- choose whether to generate the P/L using accrual or cash basis.

- compare the Profit and Loss Report for different time range; yearly, quarterly, monthly or daily basis

- view the report with different columns such as days, weeks, contacts, months, quarters, years, or products

- select the reporting period

Finally, click on the run report.

The system will generate the Profit and Loss Report as per your configuration.

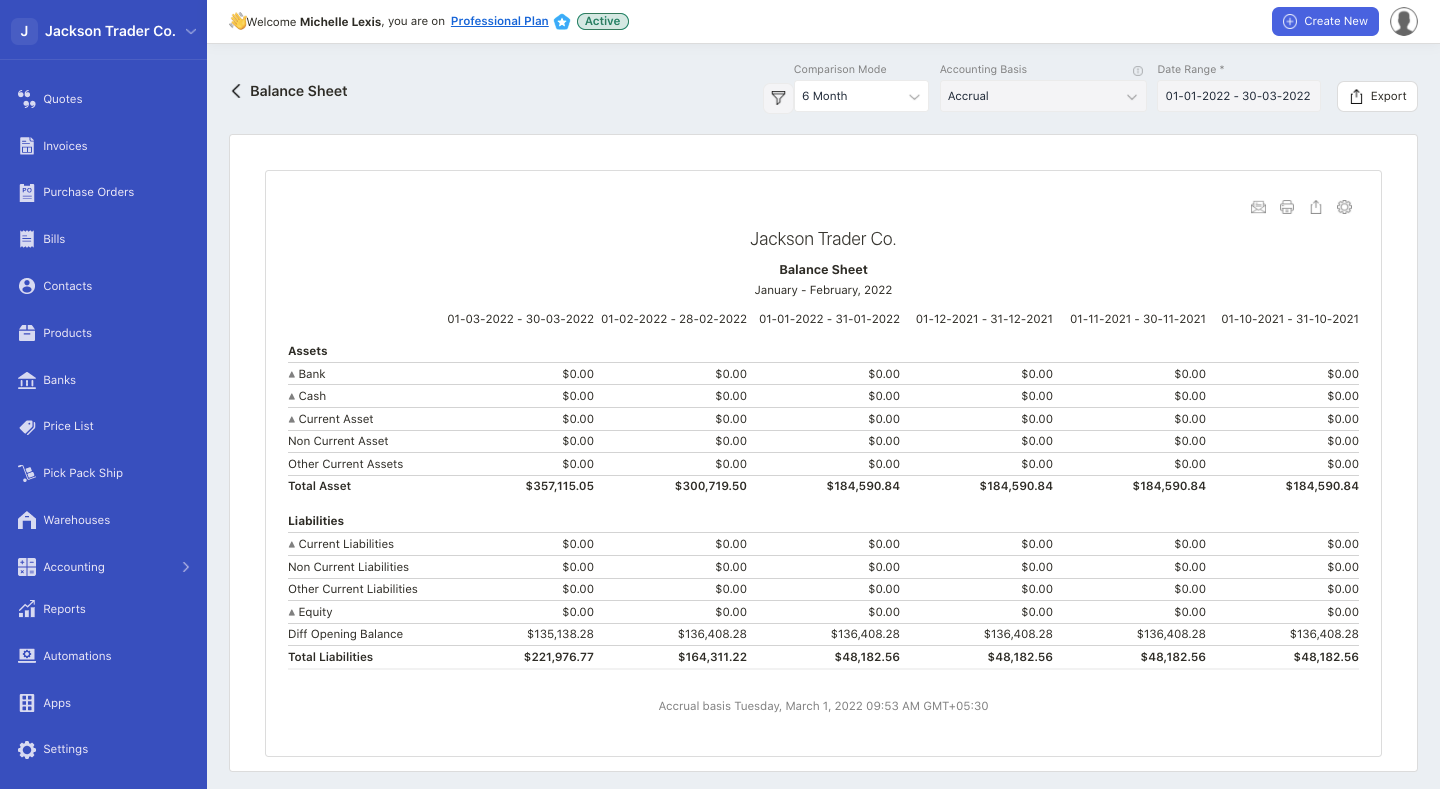

B) Balance sheet

The balance sheet is a statement that records entity assets, liabilities, and equity at the end of the accounting period.

Examining the balance sheet gives the accountants, investors, or business owners insights into the company's net worth and financial position.

Select the comparison mode for months, yearly, quarterly, or daily basis. Filter the report using custom fields, if required.

And, you can choose whether to generate the balance sheet using accrual or cash basis.

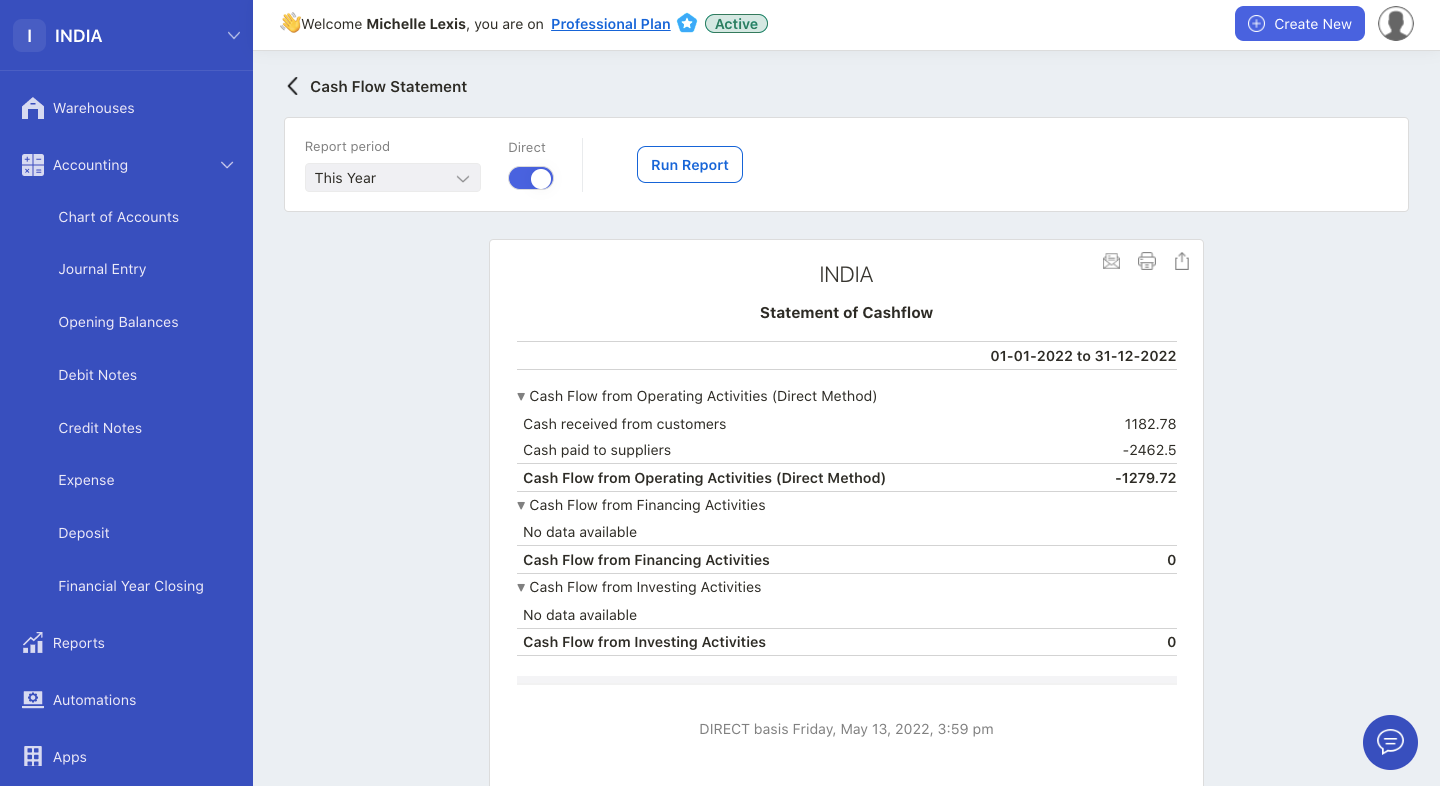

C) Cash flow statement

The cash flow statement is a company’s financial statement indicating the inflow and outflow of cash and cash equivalents of the organization.

The objective of the cash flow statement is to assess how well a company manages its cash position and measure how quickly a company generates cash to repay its debt obligations.

It also gives a rough gauge of how a company finances its business activities.

You can choose to view the cash flow report either using the direct method or the indirect method. Filter the report using custom fields, if required.

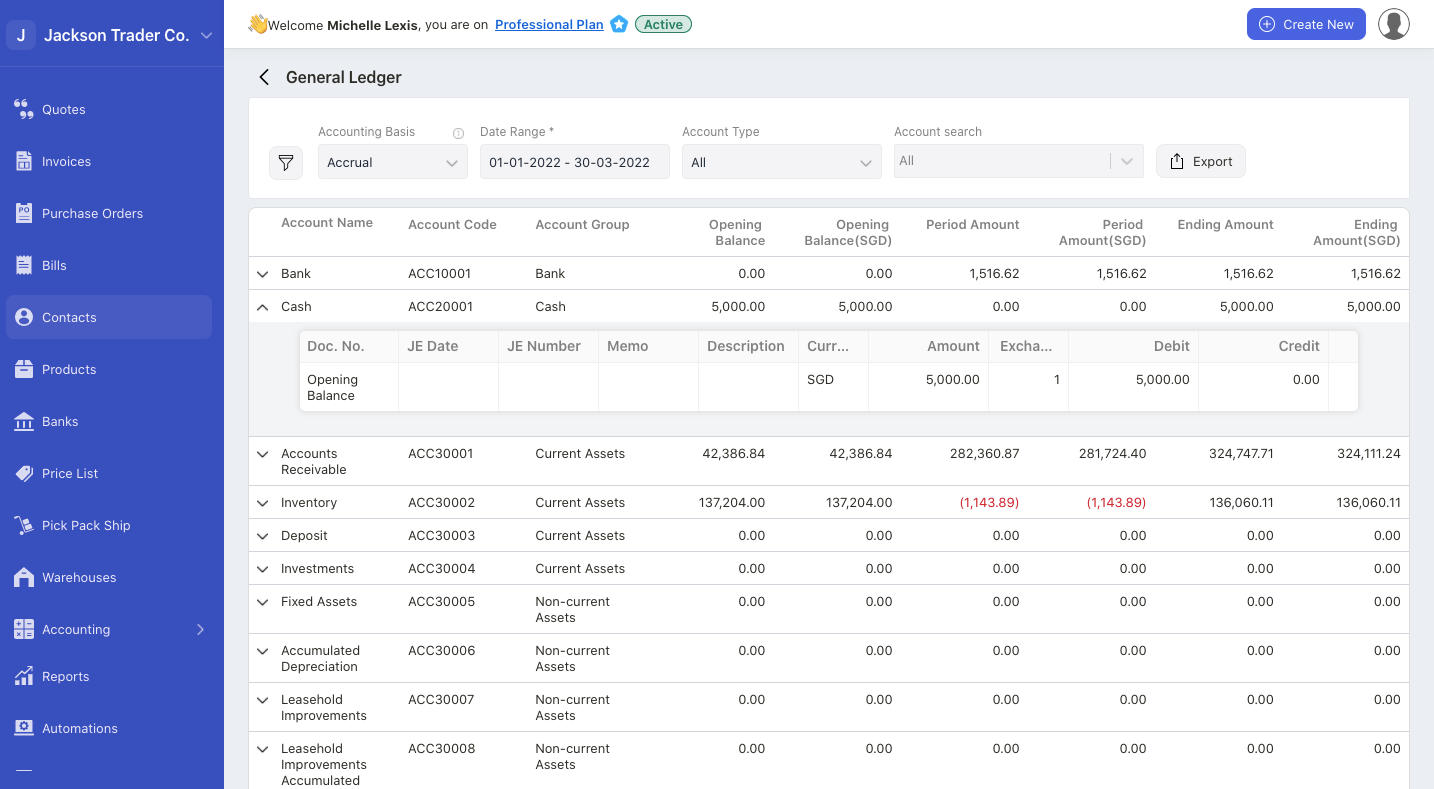

How to generate the general ledger report?

General Ledger acts as a master record for your company's financial transactions. A ledger typically consists of assets, Liabilities, Owner's Equity, Revenue, and Expenses.

It follows a double-entry system, whereby each transaction will have debit and credit journal entries posted.

Within each account, details from your sub-ledgers provide more in-depth information on the business transactions.

To view the General Ledger Report:

- Go to Reports via the sidebar menu.

- Select General Ledger Report.

- Click on the drop-down arrow to view each individual record for each account.

- This filter enable you to search for the relevant accounts and amounts in the cash flow statement. By applying the custom field, the accounts or amounts you are searching for will be auto-populated by on the fields indicated.

- Prior to that, you need to ensure that the custom fields are enabled for Accounts in the Custom Field Master when creating a new custom field in the system.

- Export the General Ledger report by clicking the export button.

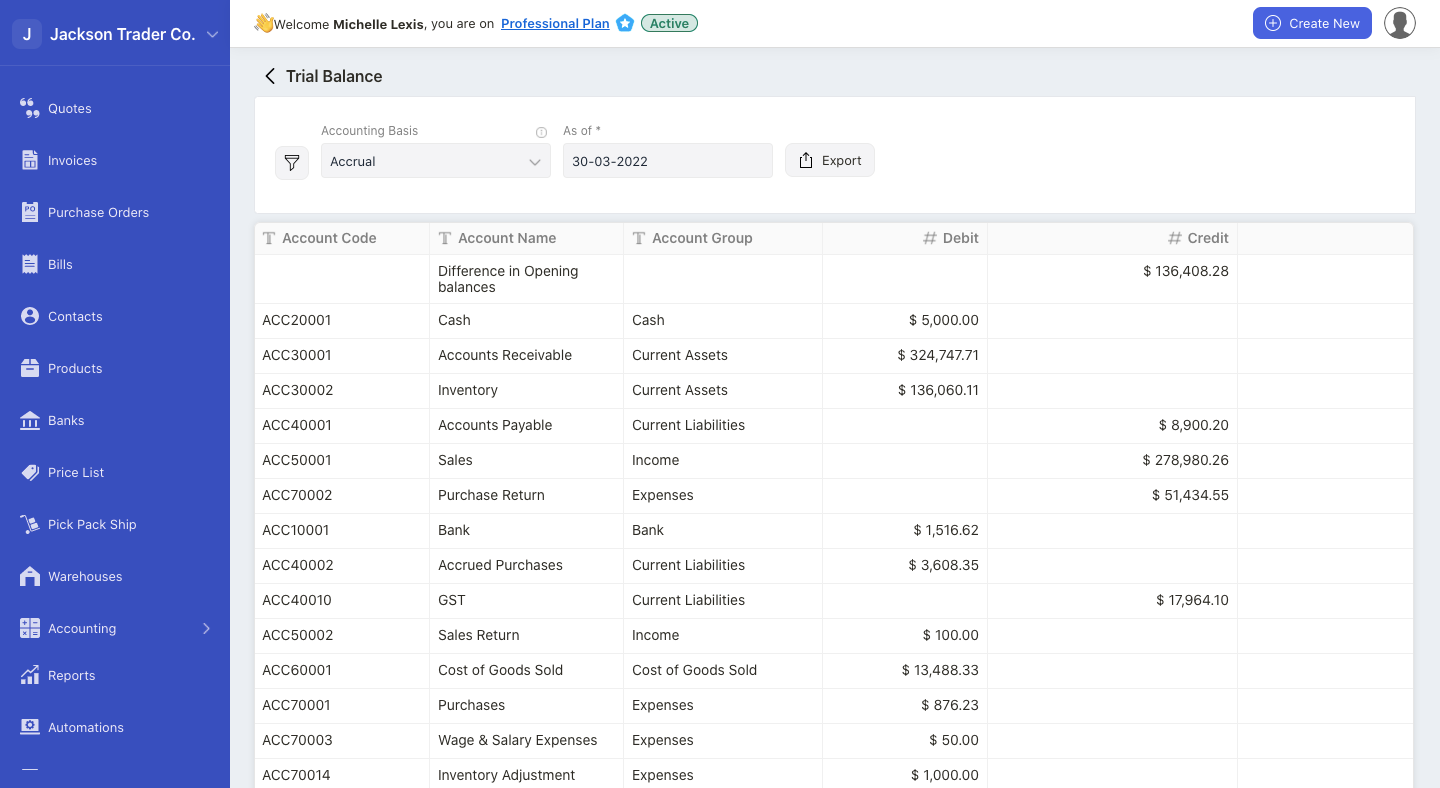

How to generate the trial balance report?

To check if the ending figures of your General Ledger are balanced, you should use a Trial Balance. Based on the double-entry accounting system, each transaction should have total debits equal to credits.

A Trial Balance serves an essential function by allowing businesses to spot discrepancies if the total of debit balances is not the same as the total of credit balances.

To generate a trial balance report:

- Go to Reports via the sidebar menu.

- Select Trial Balance.

- You can filter the report based on custom fields.

- Choose either to view the trial balance report using accrual or cash basis.

- Choose the trial balance as of date.

- Click on the export button to download this report in xls format.