Every registered business will have to file their sales and service tax return at the government portal.

The first taxable period begins from the date the registered person should have registered and the following month ends. The subsequent taxable period shall be a period of two months ending on the last day of any month based on the calendar year.

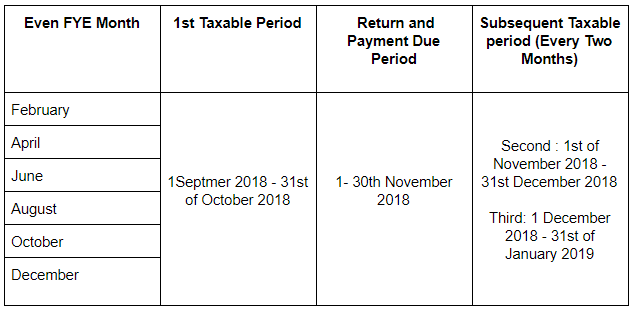

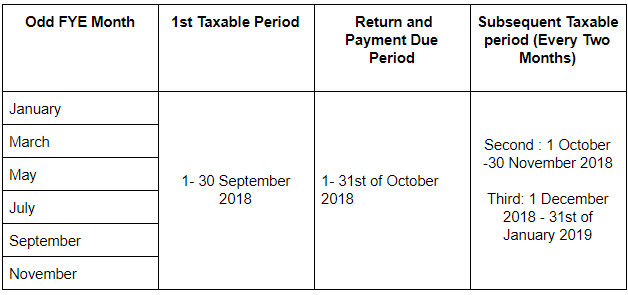

Do take note that there are two different taxable periods according to your FYE month; they can be odd FYE month or even FYE month.

A) ODD FYE Month= First Taxable Period = 1 month

- 1st Taxable Period = 1st to 30th September 2018 (One month)

- 2nd taxable Period = 1st of October 2018 to 30th November (Two months)

- 2rd Taxable Period= 1st of December 2018 -31 of January 2019 (Two months)

- EVEN FYE Months – 1st – First Taxable Period = 2 month

1st Taxable Period = 1st September to 31st October 2018 (Two months)

2nd Taxable Period = 1st November to 31st December 2018 (Two months) and so on.