Organisations, investors, and individuals need to file various taxes in Indonesia.In Indonesia, the tax obligations may include individual income tax, corporate income tax, value-added tax, withholding taxes, international tax agreements, luxury-goods sales tax, tax concessions, customs & excise, and land & building tax.

In his article you will see the business update with regard to VAT of exports in Indonesia. The Minister of Finance has entitled a new regulation on types of Taxable Services and Limitations on Activities for which exports are to VAT, in order to widen the scope of taxable services of exports in consideration to Value-Added Tax (Pajak Pertambahan Nilai – PPN), Tax Provision under PPN includes, whenever any exports take place is payable,Tax invoices created by the taxable businesses for the exports, reporting exports and all manufacturing services of exports through periodic PPN returns are mandatory

Using Deskera Books you can file following two VAT reports

- PPN Masukan (VAT In)

- PPN Keluaran (VAT Out)

Any VAT registered business, has to submit VAT In & Out report to the Onlinepajak of Indonesia by each month to declare sale of goods and services to the customers and Purchases from VAT registered or Unregistered businesses, the VAT collected and VAT has to be filed for the relevant accounting period.

Let us see how PPN Masukan (VAT In) and PPN Keluaran (VAT Out) Reports can be filed using Deskera Books

Click on the Reports on the side bar menu, under the Tax section you will see two reports PPN Masukan (VAT In) and PPN Keluaran (VAT Out).

Let us learn more about these reports one by one.

1. PPN Masukan (VAT In) Reports

Click on the PPN Masukan (VAT In) under the Tax section. Below window will appear and you can view the detailed report,

- You can view the Total DPP Amount, Total PPM Amount,, PPBN Amount,Tax creditable amount if applicable. The amount reflected is based on Purchase invoices you have created in the Buy Tab.

- From and To date: You can select from and to date to view the report date wise.

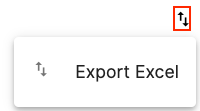

- Export Report: Click on the upward and downward arrow, where you can export the VAT IN report in Excel format.

2. PPN Keluaran (VAT Out)

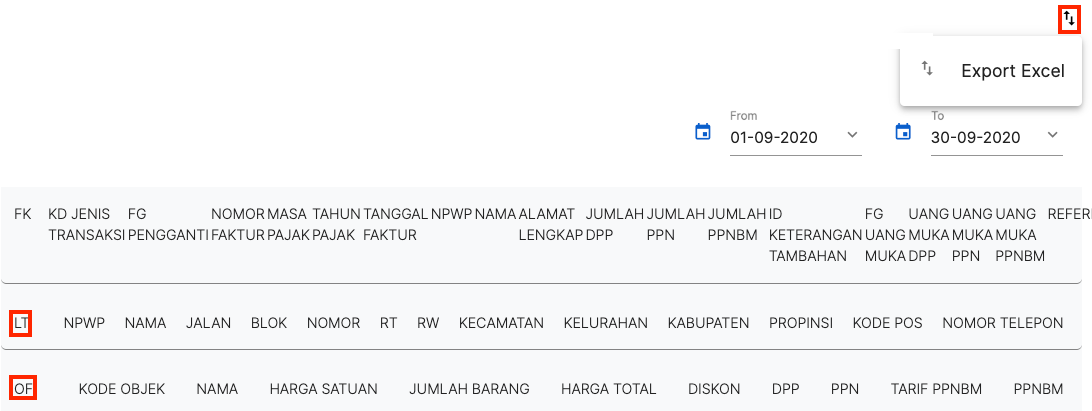

Click on the PPN Keluaran (VAT Out) under the Tax section. Below window will appear and you can view the detailed report,

This report is divided into two sections LT and OF

- Under LT section all Tax registration related details of your company will be displayed like NPWP number, Address, Customer Name and other details as filled in while creating a new customer sales order.

Under OF Section details related to Product will be displayed like product name, total quantity, price per unit, Total Price of the product, Discount, amount before tax, VAT amount. The amount reflected is based on selling invoices you have created in the sell Tab.

From and To date: You can select from and to date to view the report date wise.

Export Report: Click on the upward and downward arrow, where you can export the VAT OUT report in Excel format.