Once you have learned how to set up your account, next, you need to generate the VAT Report for tax return purposes.

In Deskera Books, you can generate the VAT Report with just a few clicks.

Read more below.

How can I generate the VAT Report?

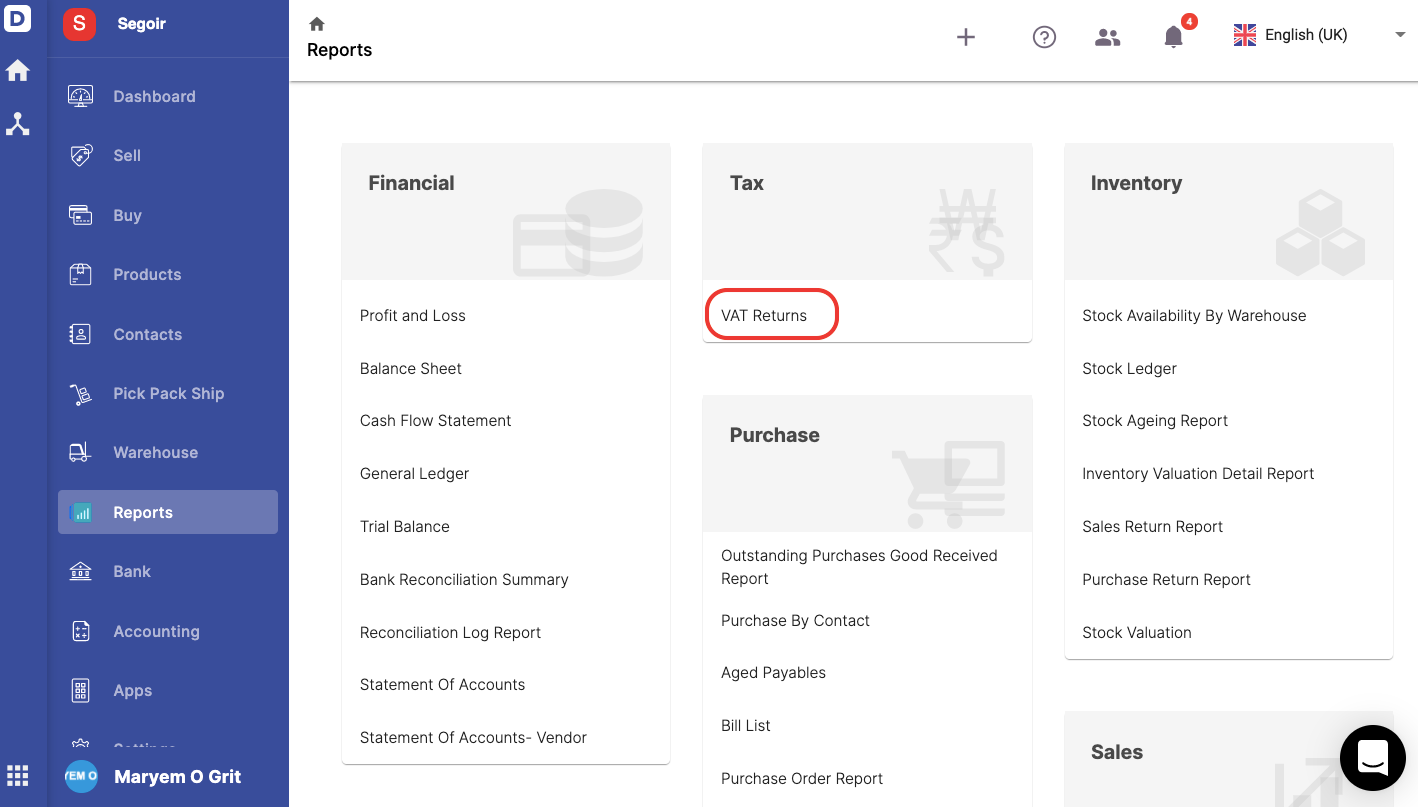

- In your Deskera Books' main dashboard, click on the Reports Module.

2. Click on the VAT Returns.

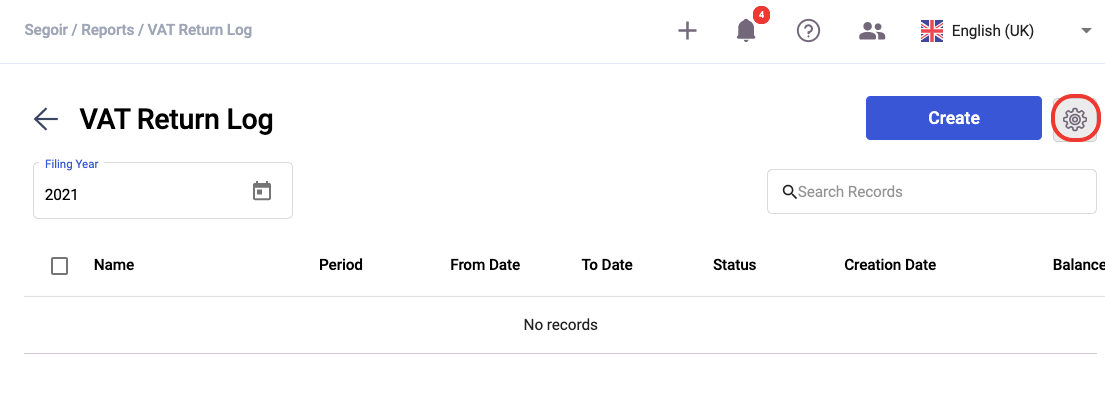

3. In the VAT Returns window, click on the setting icon to configure the VAT return report.

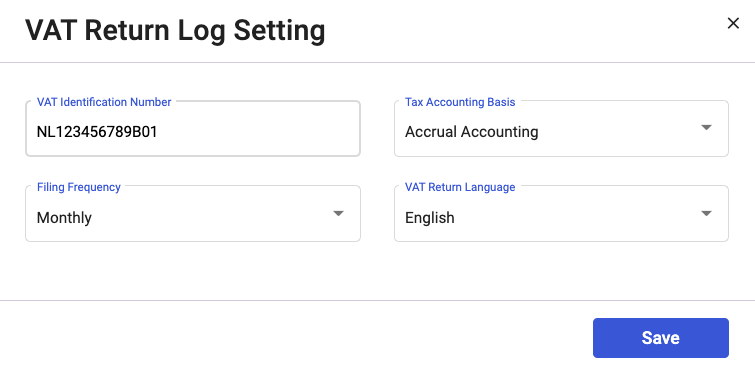

4. A pop-up will appear. You will need to input the following fields:

- VAT Identification Number - This field will be auto-populated as per the value saved in the company setting

- Tax Accounting Basis - By default, the system will populate accrual accounting

- Filing frequency - Choose the filing frequency; Monthly, Quarterly or Yearly

- VAT Return Language - Indicate the VAT Return report language here. Choose from English, French or Dutch

5. Click on the Save button.

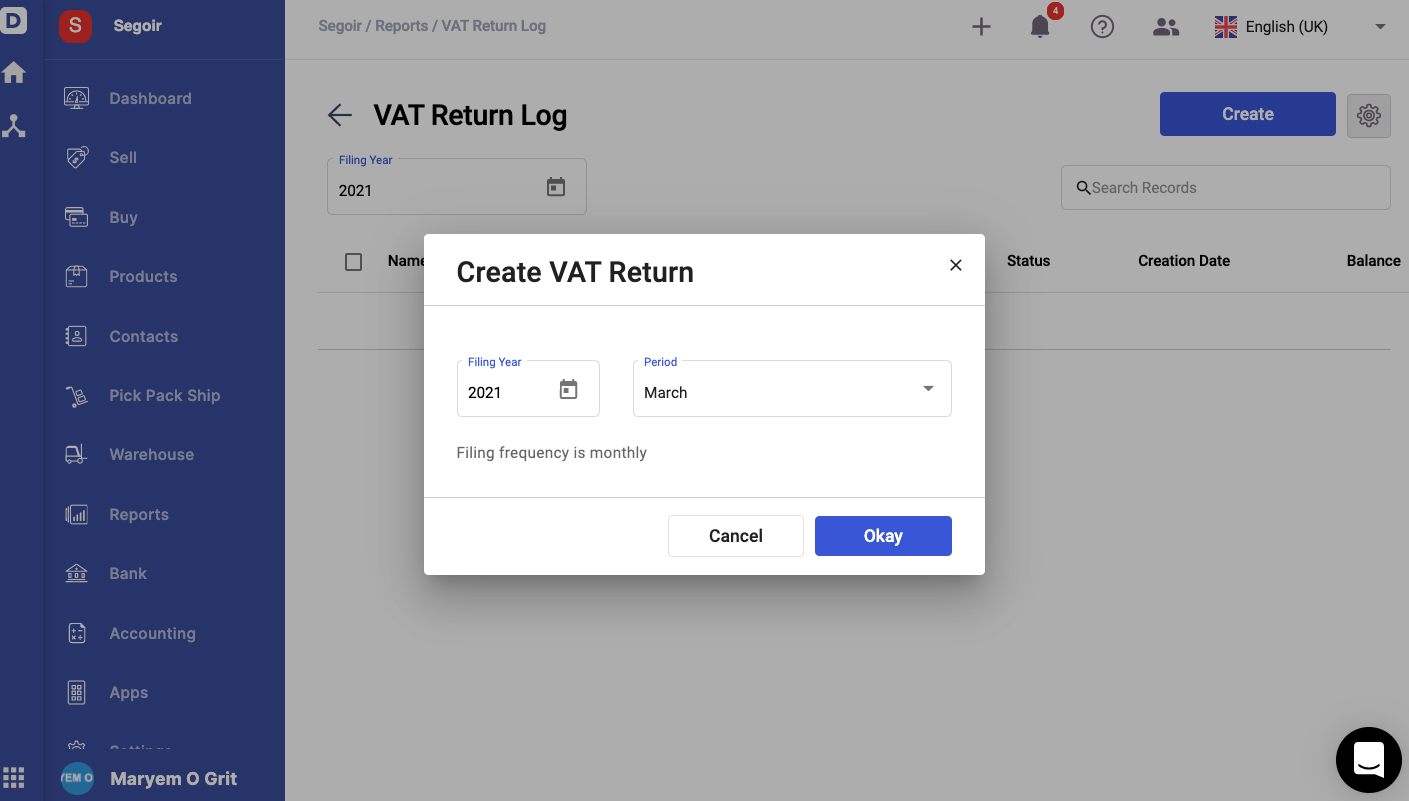

6. Once you have set-up the report's setting, click on the create button to generate the VAT Return report.

7. Chose the filing year and period. Select Okay.

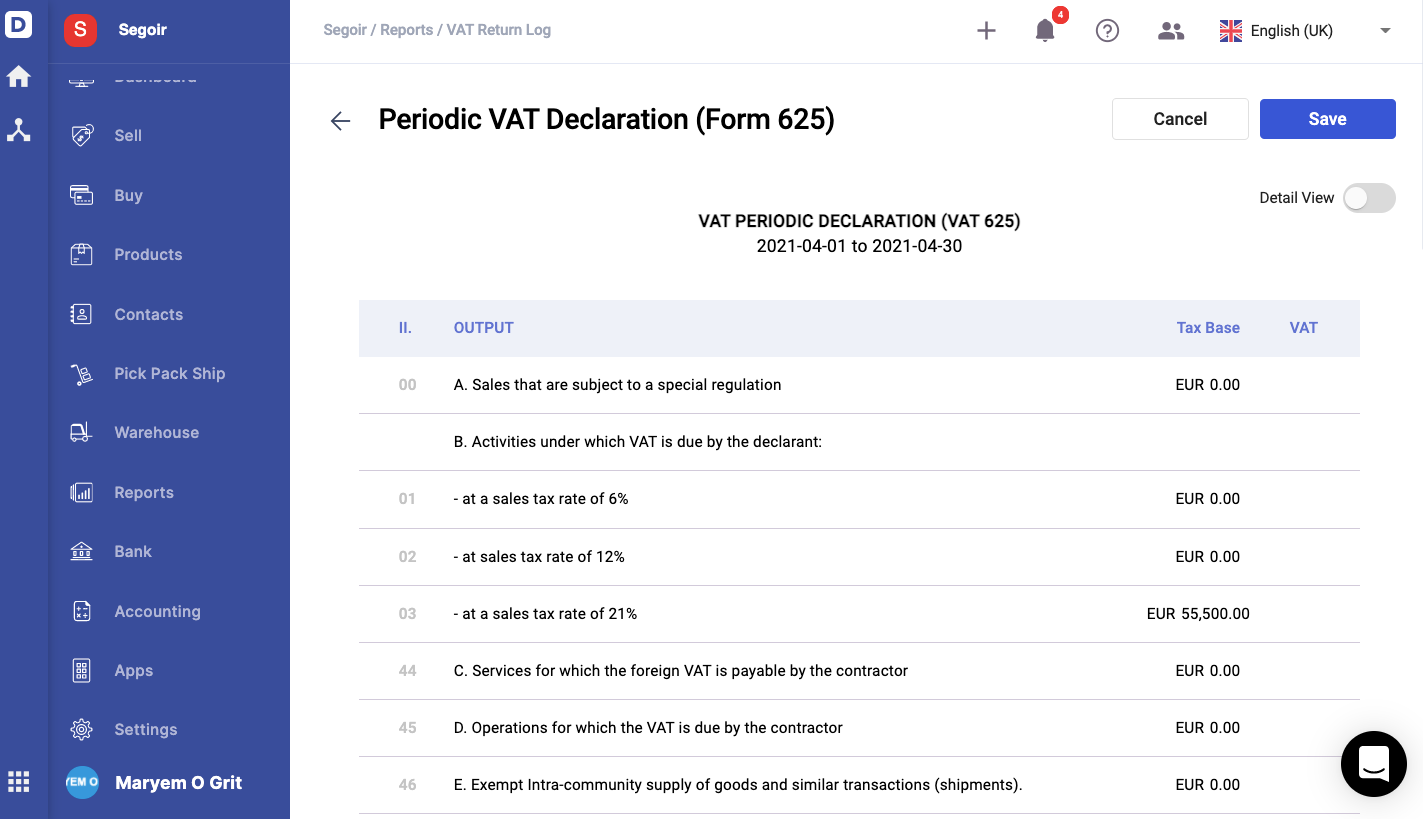

8. The periodic VAT declaration (Form 625) will be populated on the screen, as per the image above.

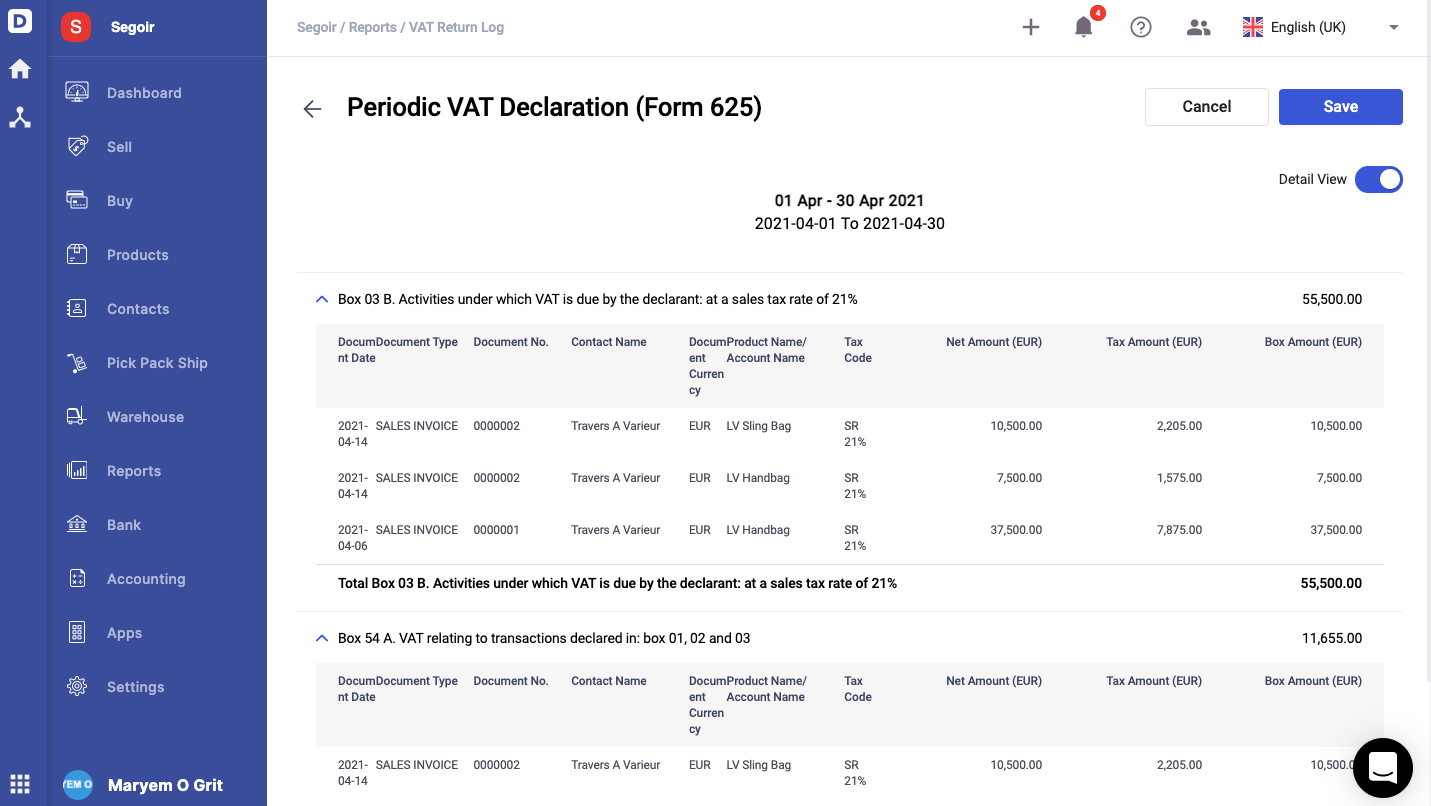

9. Click on the Detail View button.

10. You should be able to view the transactions for each box. Then, click on the Save button after verifying all the information.

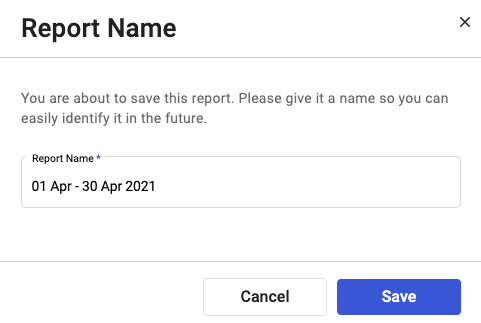

11. Next, enter the report name.

12. Click on the Save button.

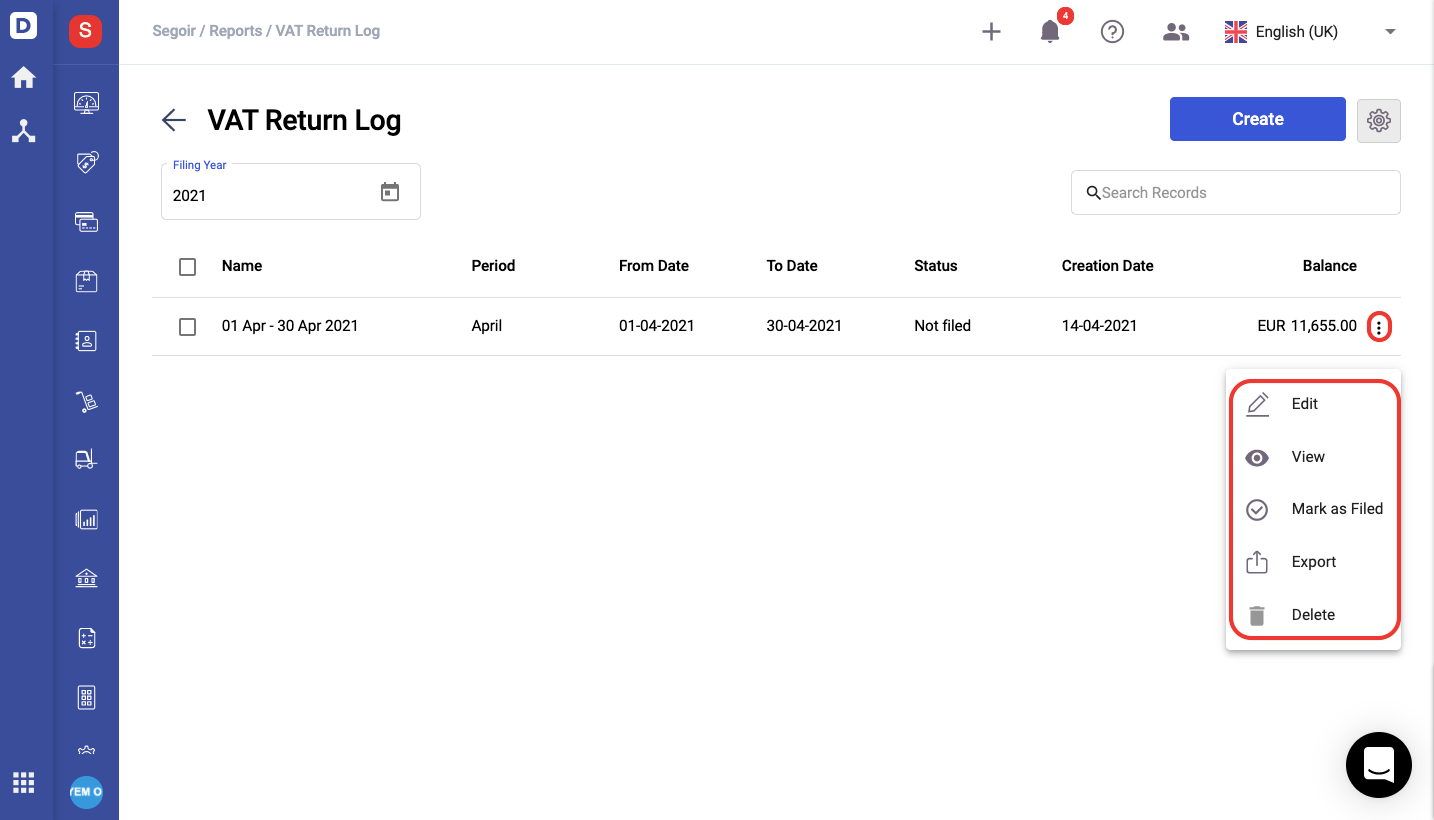

How can I edit, delete and export the VAT Return report?

- Go to the VAT Return log screen.

- Click on the three dots to perform the following actions:

- Edit - To amend the amount in the report before filing

- View - To have an overview of the entire report

- Mark as Filed - Mark the report as filed once you have filed your return

- Export - Download the report in xls format

- Delete - To remove the report from the system