In this article, we will explain each section in GSTR-1 Report in detail. If you are unable to find there report, click here to download it onto your desktop.

Once you have downloaded the GSTR-1 Report, you will have to fill in the 13 sections in it.

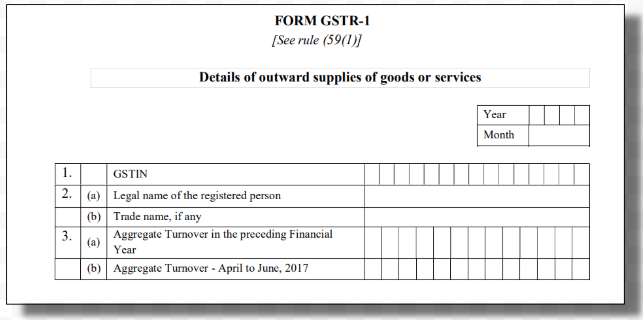

Section 1, 2 and 3

For the first three sections, fill in the fields as shown:

1. GSTIN: 15-digits PAN Number (Click here to find out more about GSTIN)

2A: Legal name of the registered person

2B: Trade name

3A: Aggregate turnover in the preceding Financial Year: The value here represents the sum of sales and supplies you made in, e.g., 2018 to 2019 minus Tax.

3B: Aggregate turnover - April to June (Year): The total value of sales and supplies made from the start of the fiscal year until the GST rollout.

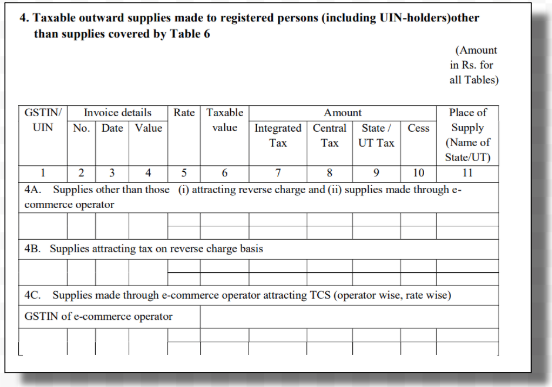

Section 4

Section 4 covers the taxable outward supplies made to the registered person, including UIN-holders, other than supplies covered in Table 6.

4A: Includes all sales and account receivable transactions, for both intrastate and interstate supply except any transactions through e-commerce and on any reverse charge applied.

4B: For all B2B sales that apply the reverse charge.

4C: Supplies made through the e-commerce channel oh which Tax collected at source (TDS) is applicable.

The transactions that occur in Section 4A and 4B are classified by GSTIN of the customer and type of GST rate.

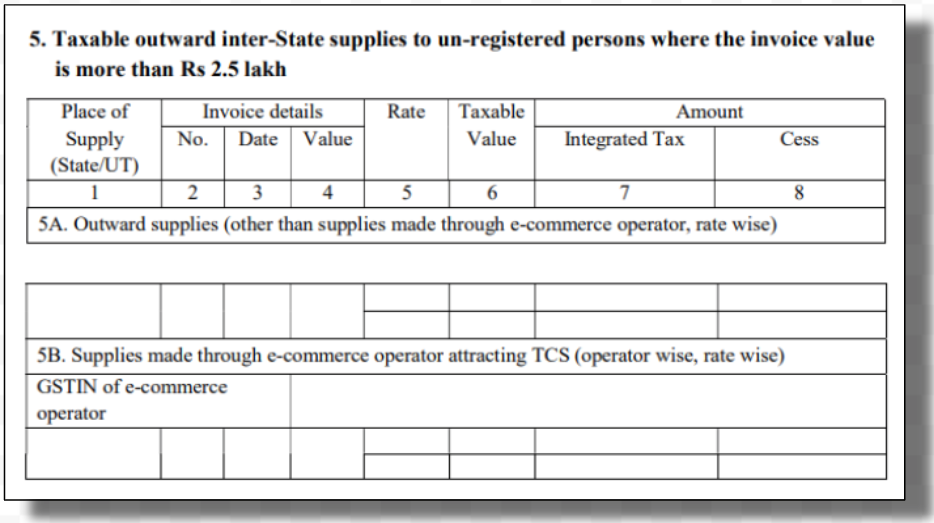

Section 5

Section 5 contains the following sub-sections:

5A: Includes all the inter-state sales and account receivable (AR) transactions completed with un-registered consumers except e-commerce transactions.

5B: Includes all inter-state transactions completed with unregistered consumers via e-commerce, which Tax Collected at Source (TDS) is applicable.

Section 5A transactions are grouped based on the place of supply of th customer and the type of GST rate.

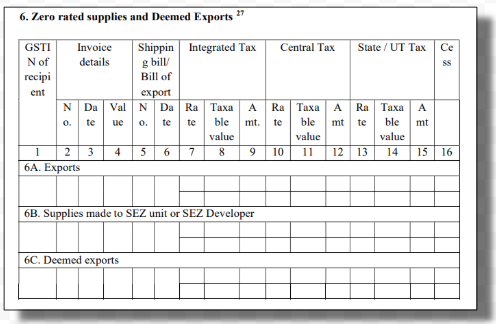

Section 6

Section 6 covers the information of zero-rated supplies, deemed exports, and sales to the Special Economic Zone (SEZ). The transactions that occur here will involve IGST.

6A: Provide details of the invoices, shipping bills, and details of any taxes included.

6B: Transactions of invoices and shipping bills made to SEZ or the SEZ developers.

6C: Invoice and shipping information of all deemed export transactions.

The transactions in Section 6A, 6B, and 6C are categorized based on customer's GSTIN and type of GST rate.

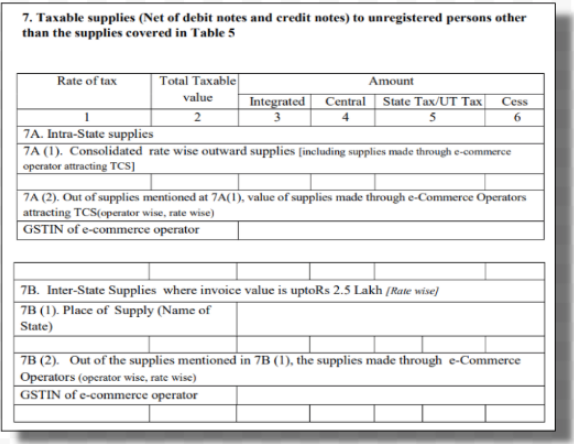

Section 7

Section 7 in GSTR-1 Report involves taxable supplies, both net of debit notes and credit notes to un-registered persons other than supplies covered in Table 5 plus rate-wise details about the sals and account receivable transactions for the month specified in the processing options.

7A: Inclusive of all the sales and accounts receivable, including those transactions and supplies through e-commerce.

7B: Any interstate-transactions whereby invoice amount is higher than INR 2,50,000.

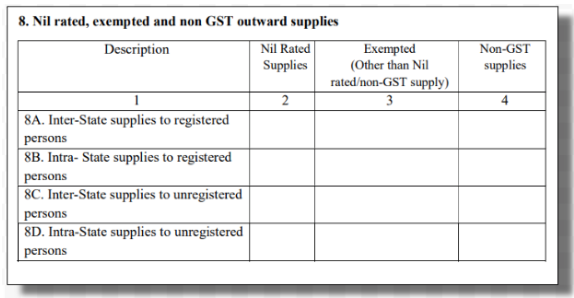

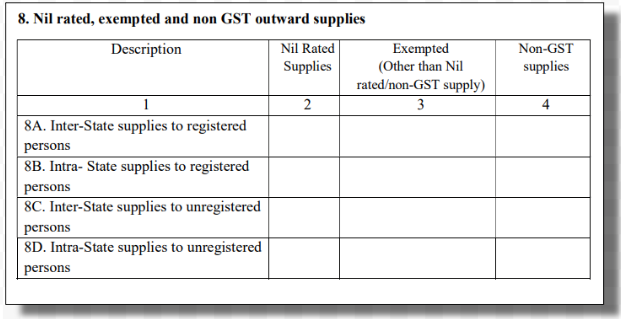

Section 8

Fill in the subsection in Section 8:

8A: Include inter-state supply transactions completed with a GST registered entity.

8B: Include intra-state supply transactions completed with a GST registered entity.

8C: Include inter-state supply transactions completed with un-registered bodies.

8D: Include Intra-state transactions completed with un-registered organizations.

Section 9

Section 9 enables you to make changes or make any amendments to the transaction records that you have file during the previous tax periods.

9A: Any incorrect information about the invoices or shipping bills that are reported in the earlier tax period.

9B: The original information about debit notes, credit notes, and refund vouchers completed in the previous tax period.

9C: Debit notes, credit notes, and refund vouchers issued in the current tax period for the past transactions during the last tax period.

All the subsections in Section 9 are grouped based on the GST rate type.

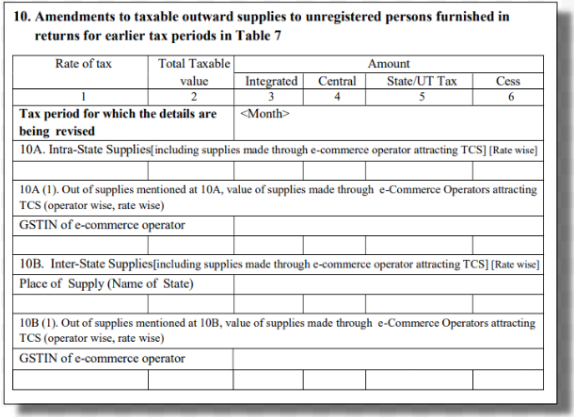

Section 10

Section 10 involves the amendments to taxable outward supplies to unregistered persons furnished in returns for the earlier tax period in Table 7.

10A: Any changes or modifications made to the intra-state sales.

10B: Any changes or modifications made to inter-state transactions.

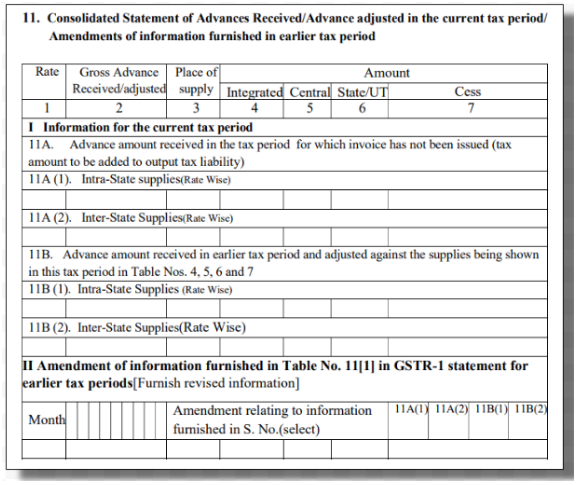

Section 11

Section 11 covers the consolidated statement of advances received or adjusted in the current tax period, plus amendments from the earlier tax periods.

11A: Applies for both interstate and intrastate transactions, any advances you received during the current tax period, which are yet to be invoiced.

11B: Advances received in the earlier tax period and adjusted against the supplies being made in this tax period under Table 4, 5,6, and 7.

11C: Any amendments made to the information under subsection 11A of the earlier tax return.

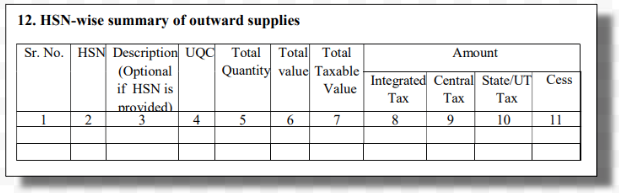

Section 12

Under Section 12, you'll have to fill in the HSN summary of the items sold by you, including the total quantity sold, taxable value under each tax heading, and unit quantity codes, for both exports or imports.

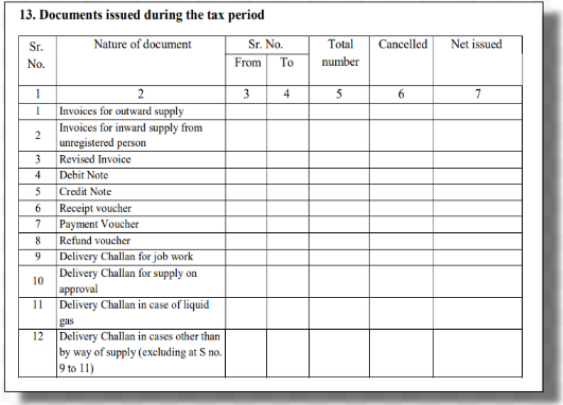

Section 13

Fields to fill in under Section 13:

- Invoices for outward supply

- Invoices for inward supply from unregistered person

- Revised Invoice

- Debit Note

- Credit Note

- Receipt Voucher

- Payment Voucher

- Refund Voucher

- Delivery Challan for job work

- Delivery Challan for supply on approval

- Delivery Challan in case of liquid gas

- Delivery Challan in cases other than by way of supply (excluding at S no.9 - 11)

Fill in the declaration of truth as a confirmation that the above information is accurate. Make sure to get an authorized signature from your company along with the name stamp at the right end of the page.