A tariff code is a code tagged to every product that is involved in global trading. It’s a product specific code as stated in the Harmonized System (HS).

The tariff codes are mandatory when classifying goods and services in Malaysia. These tariff codes are required when generating the sales tax return and service tax return to the government.

Follow the steps below to indicate a product's tariff code in Books Plus:

- Login to your Books Plus account.

- Click on Product via the sidebar menu.

- Select "+ New Product" button. You can refer to this guide to create a new product in the system.

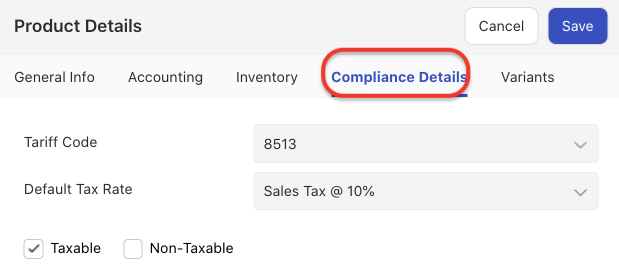

4. Next, navigate to compliance details tab.

5. On this tab, enter your product tariff code. Choose the correct tariff code from the drop-down menu.

6. Enter the default tax rate for this product. The default rate will be reflected in your invoice/bill documents.

7. If the product is taxable, select the taxable checkbox.

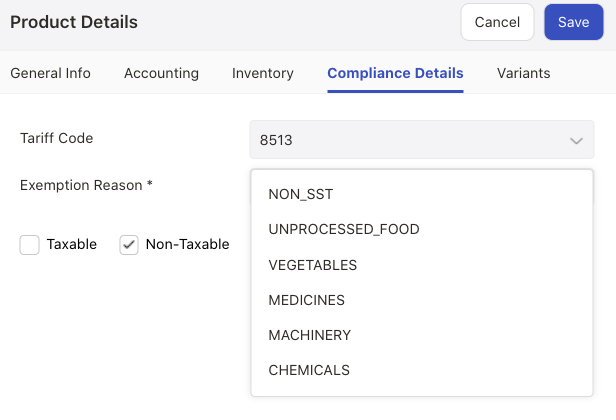

8. If the product is not-taxable, choose the non-taxable checkbox.

9. Choose the exemption reason such as non-SST, unprocessed food, vegetables, medicines, machinery or chemicals.

10. Click on the save button.

How can I view the tax code in my sales invoice?

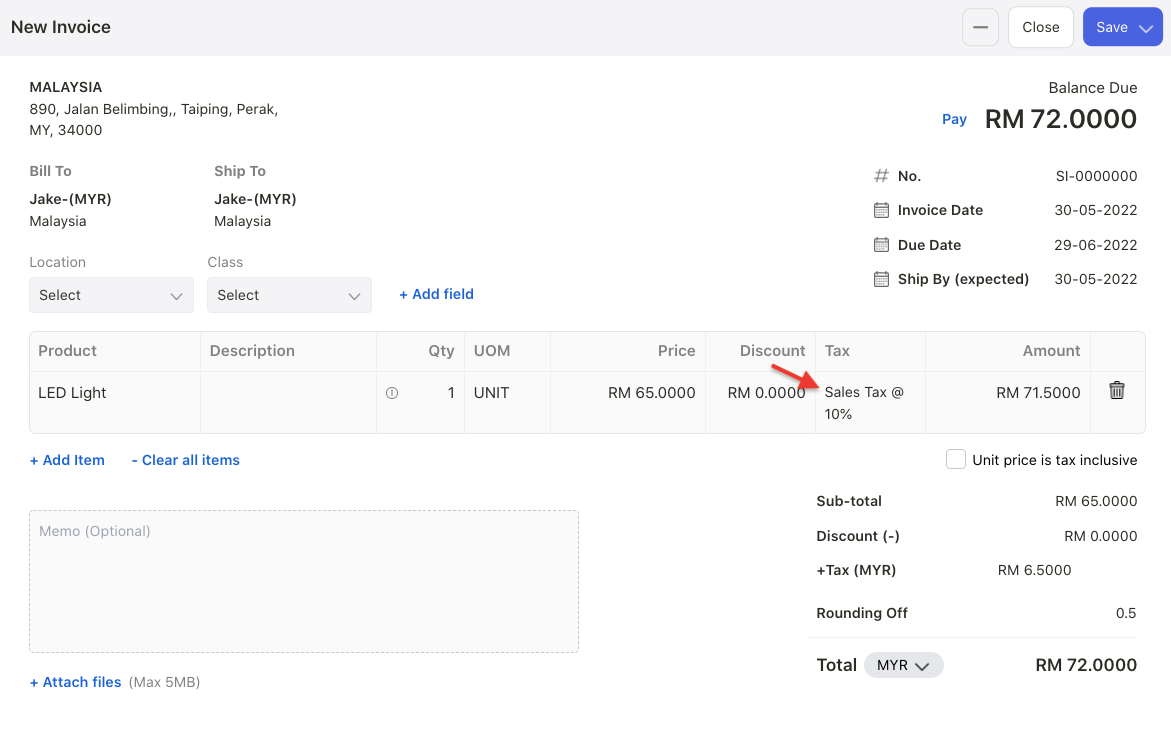

- Go to the Invoice Module after you have created all the products in the system.

- Create a new invoice document. You can refer to this guide to create a new sales invoice in the system.

- The invoice canvas screen will appear.

- Under the line item, choose the product that you have created in the Product Module.

5. The tax rate will be auto-populated as per your tax configuration in Product Module.

6. Verify the information in the invoice document and save the document.

7. The same flow applies to bill document.