A 1099-MISC tax form is used for reporting taxable payments from your business to a variety of payees. You must report payments you make to miscellaneous types of payees during the year, and you must give these reports to the payee and send them to the IRS.

Who Uses Form 1099-MISC?

If you are in a trade or business, you must use 1099-MISC forms to report the amount you have paid to others during the year. The IRS considers “trade or business” to include:

- Operating for gain or profit

- A non-profit organization, including 501(c)3 and (d) organizations

- A trust of a qualified employer pension or profit-sharing plan

- A non-exempt farmers’ cooperative

- A widely held fixed investment trust

What is Form 1099-MISC used for?

You use your IRS Form 1099-MISC to help figure out how much income you received during the year and what kind of income it was. You’ll report that income in different places on your tax return, depending on the type of income.

If you need help estimating how interest income on a Form 1099-MISC could affect your tax bill.

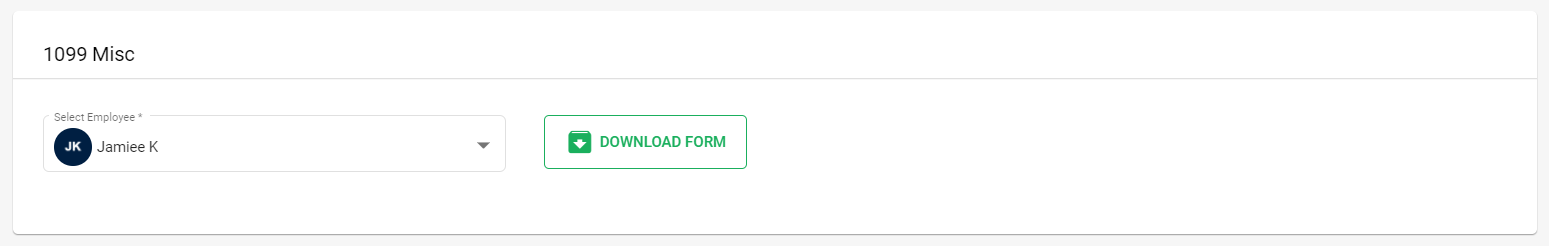

Downloading 1099- misc forms using Deskera People

Using Deskera People you can Download the 1099- misc form, following the below steps,

1. Go to the Report Tab>> under Employee withholding section>> click on forms 1099- misc form >> Select the name from the dropdown list>> Click on the download the button for downloading these forms.

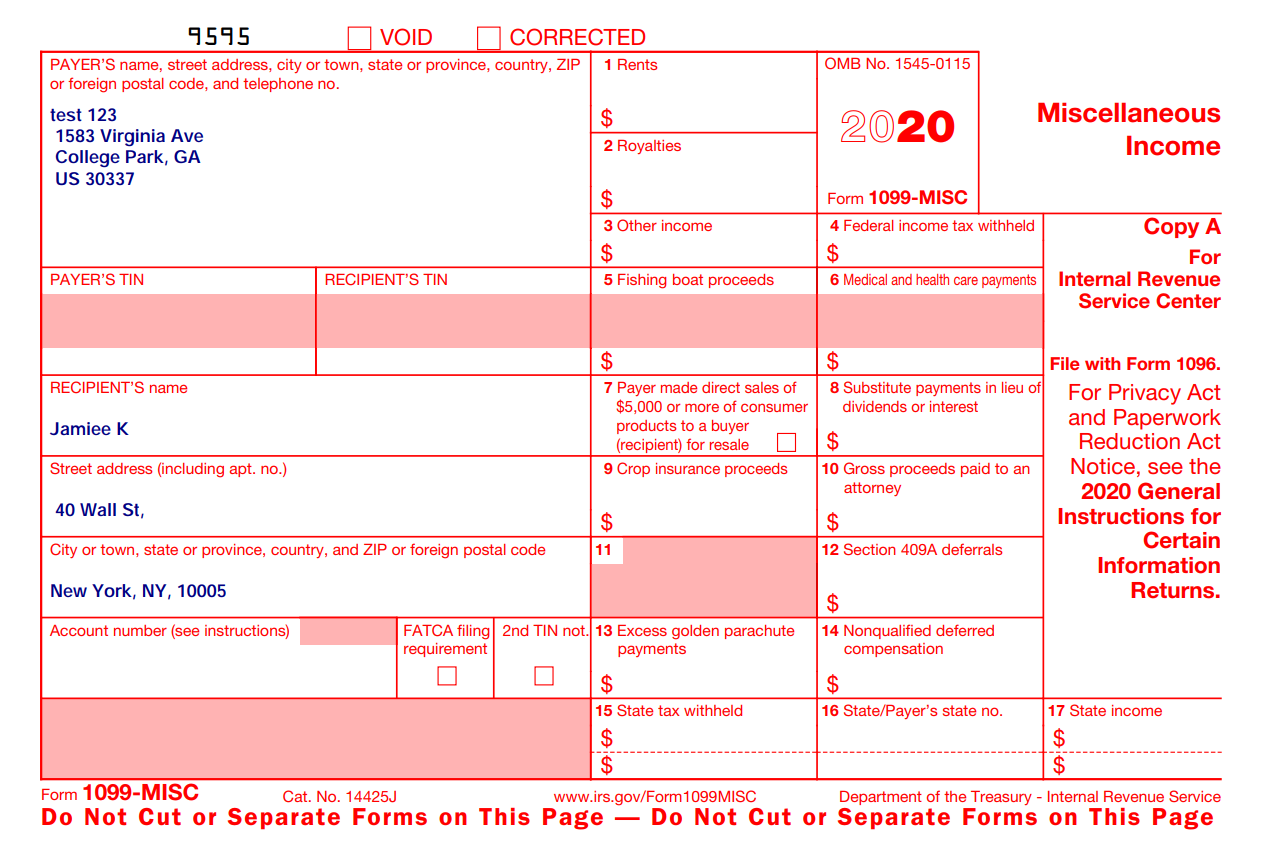

2. Once you have downloaded the 1099-misc form below details will be auto-populated in the form as entered in the system,

Congratulations: You have successfully learned how to Download employee withholding forms 1099-misc using Deskera People