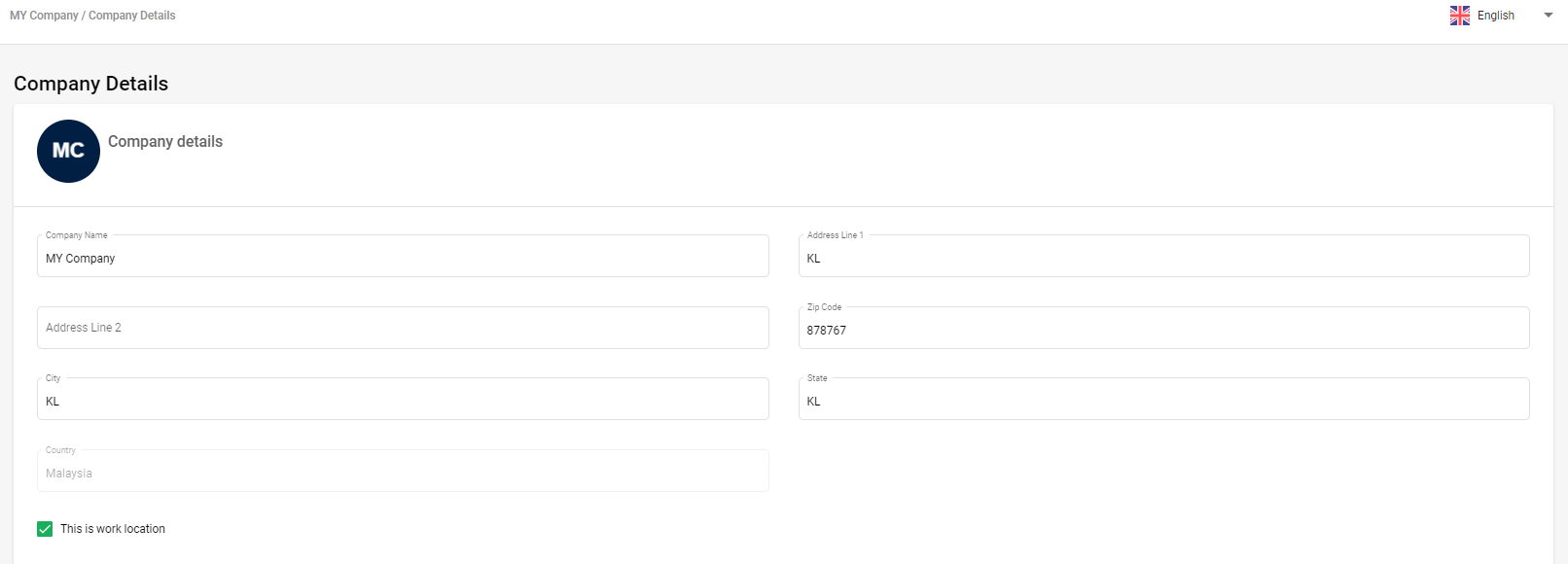

Company Details

From the settings module, select company Settings, a screen will appear with company information.

In this screen, you can set up the following information:

- Company name (To be used in payslip and statutory reports)

- Company Address - Zip code, City , State (To be used in payslip and statutory reports)

Once the required information is filled click on the update button to save the details in the system.

Incase, at any point of time if you want to make any changes, you can always edit the company details.

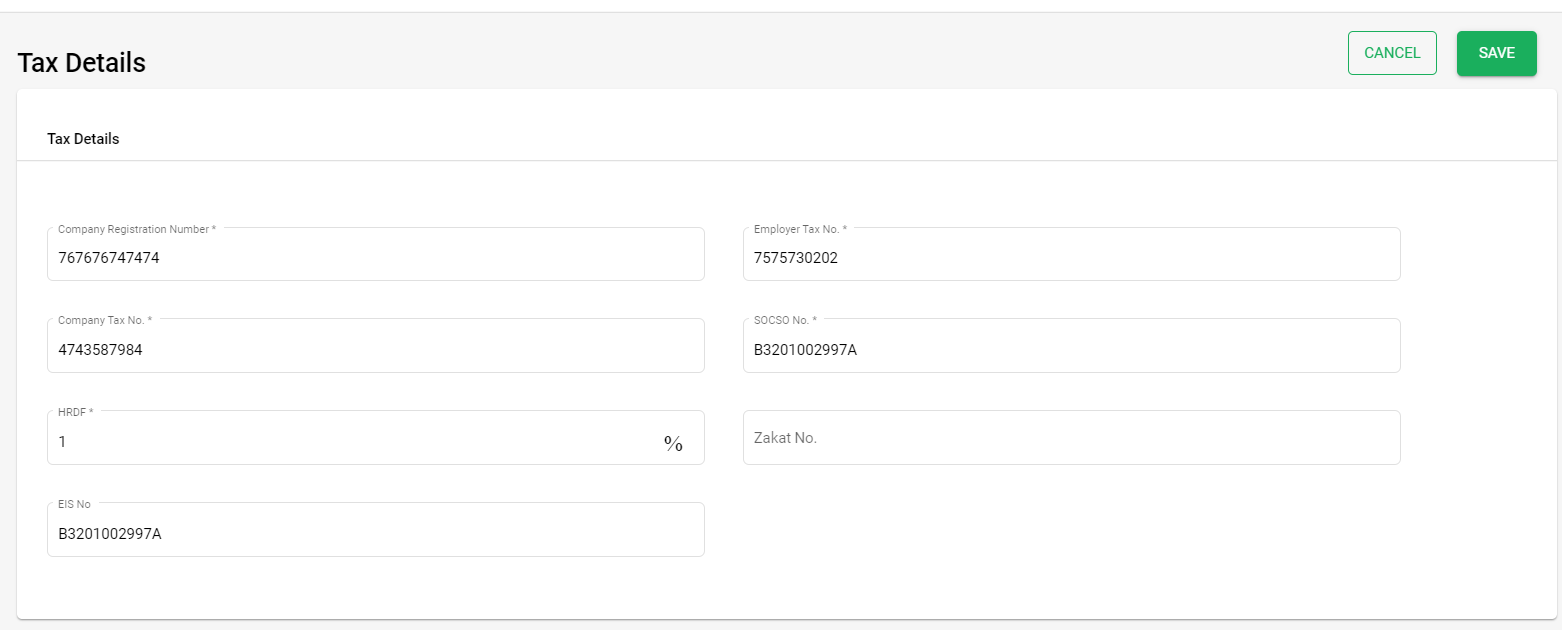

Tax Details

Company Tax information (the numbers can be obtained from each statutory body upon the employer registration, this information is needed for monthly statutory file/report generation):

Using Deskera People, you can set up all your tax details under Settings module>> Tax Details

In this screen, you can set up the following tax information:

- Company Registration Number: (To be used in payslip and statutory reports)

- C Number: Company tax number

- E Number: Employer tax number

- SOCSO Number: Social Security Organisation is an organisation that protects Malaysian employees in accordance with the Employees' Social Security Act 1969. A monthly contribution must be made by both employer and employees according to the percentage stipulated by the government.

- Zakat Number: A form of tithe; mandatory payment by Muslims only in Malaysia. The purpose is to assist the less fortunate, as all of the collected payments will be distributed to different channels and handed to those who need it most.

- EIS Number - Enter EIS number required in SIP form

You can always, edit the tax details at any time needed.

Congratulations! You have successfully learned How to fill in company information and tax details using Deskera HRIS.