What is W-2 form?

A W-2 form is a wage and tax statement. It's a form that must be completed by employers on behalf of their employees. So if you employ anyone, this is something you have to do every year, for every employee.

Who needs these forms?

According to the IRS, there are clear and specific conditions that apply to W-2 forms, as follows:

- They apply to employers engaged in trade or business.

- They must be filed for employees who receive $600 or more from you in a year, including non-cash payments.

- You must complete the form even if the employee is related to you.

- You don't need to complete W-2 forms for independent contractors (use form 1099 instead).

- They apply to employees for whom income, social security or Medicare tax was withheld.

- They also apply when income tax would have been withheld if an exemption didn't apply.

What are the deadlines for filing W-2 form?

- 1 January and 31 December – the start and end of the tax year.

- 31 January – the deadline for submitting an employee's W-2 form for the previous tax year.

- 28/29 February – the deadline for paper filing of employer's Copy A of form W-2.

- 31 March – the deadline for online filing of employer's Copy A of form W-2.

Downloading W-2 forms using Deskera People

Using Deskera People you can Download the W-2 form, following the below steps,

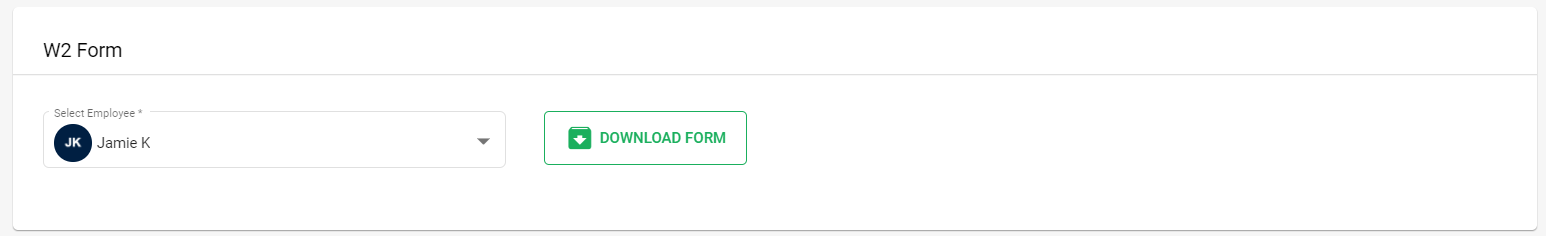

1. Go to the Report Tab a window under Employee withholding forms section, click on W-2 Form>> Select the employee name from the drop down list>> Click on the Download button for downloading these forms.

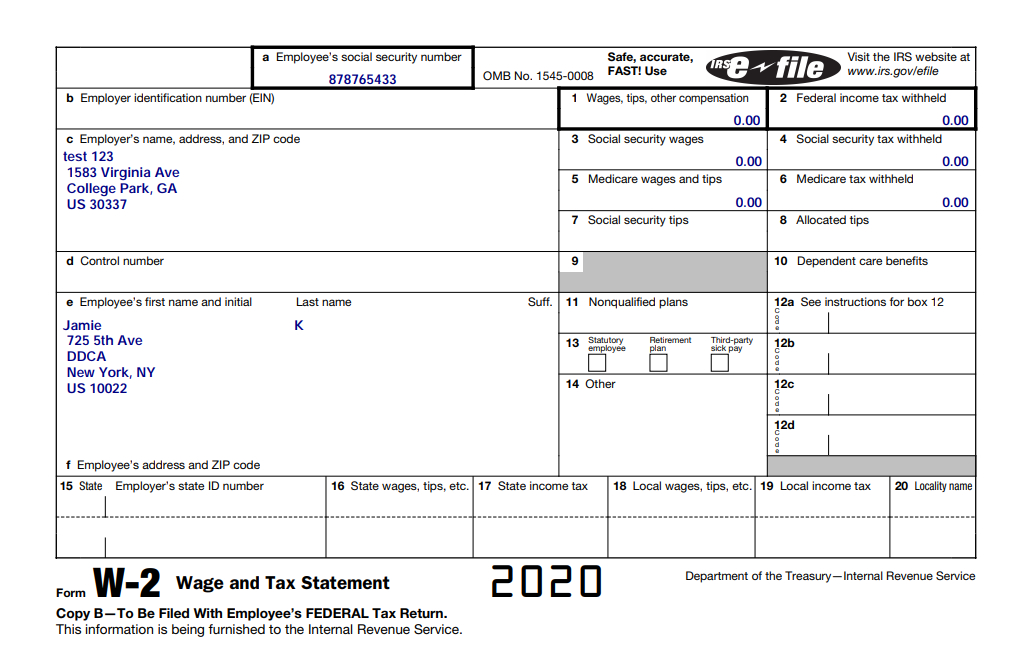

2. After you download the form, below details marked in Blue will be auto-populated in the form as per the details mentioned in the system and further can be submitted to IRS.

Congratulations: You have successfully learned how to Download employee withholding forms W-2 using Deskera People