PT or a Professional tax is a direct tax that applies to all individuals who earns income from employment, practicing their trading or professions such as doctors, lawyers, teacher, CA, etc.

The PT is deducted from the individual's monthly salary and is deposited to the state government. Professionals also pay it directly to the government.

The professional tax are calculated for certain states and are under different brackets.

- The professional tax will be calculated on the Gross Earnings ( Basic Pay + Additional Earnings)

Profession Tax Rates in Key States of India

| State | Income per Month | Tax Rate/Tax Amount (p.m.) |

| Andhra Pradesh | Less than Rs. 15,000 | Nil |

| Rs. 15,000 to less than Rs. 20,000 | Rs. 150 | |

| Rs. 20,000 and above | Rs. 200 | |

| Gujarat | Up to Rs. 5999 | Nil |

| Rs. 6000 to Rs. 8999 | Rs. 80 | |

| Rs. 9000 to Rs. 11999 | Rs. 150 | |

| Rs 12000 and above | Rs. 200 | |

| Karnataka | Up to Rs. 15,000 | Nil |

| Rs. 15,001 onwards | Rs. 200 | |

| Kerala (Half yearly income slabs and half yearly tax payment) | Up to Rs.11,999 | Nil |

| Rs.12,000 to Rs.17,999 | Rs.120 | |

| Rs.18,000 to Rs. 29,999 | Rs.180 | |

| Rs.30,000 to Rs. 44,999 | Rs.300 | |

| Rs.45,000 to Rs. 59,999 | Rs.450 | |

| Rs.60,000 to Rs. 74,999 | Rs.600 | |

| Rs.75,000 to Rs. 99,999 | Rs.750 | |

| Rs.1,00,000 to Rs. 1,24,999 | Rs.1000 | |

| Rs.1,25,000 onwards | Rs.1250 | |

| Maharashtra | Up to Rs. 7,500 | Nil (for male) |

| Up to Rs. 10,000 | Nil (for female) | |

| From Rs. 7,500 to Rs. 10,000 | Rs. 175 (for male) | |

| Rs. 10,000 onwards | Rs. 200 for 11 months + Rs. 300 for 12th month | |

| Telangana | Up to Rs. 15,000 | Nil |

| Rs.15,001 to Rs.20,000 | Rs. 150 | |

| Rs.20,001 onwards | Rs.200 | |

| Up to 5 years (For professionals such as legal practitioners, CA, architects, etc.) | Nil | |

| Over 5 years (For professionals such as legal practitioners, CA, architects, etc.) | Rs. 2,500 (per annum) | |

| West Bengal | Up to 10,000 | Nil |

| 10,001 to 15,000 | Rs. 110 | |

| 15,001 to 25,000 | Rs. 130 | |

| 25,001 to 40,000 | Rs. 150 | |

| 40,001 and above | Rs. 200 |

How is Professional Tax calculated in Deskera People?

With Deskera People, with the below mentioned simple steps you can easily calculate the PT for your employees.

- Under Employees Module>>Select Employee List, a screen will appear

- Then select the Employee and edit the profile/click on +Add Employee button to create a new employee profile

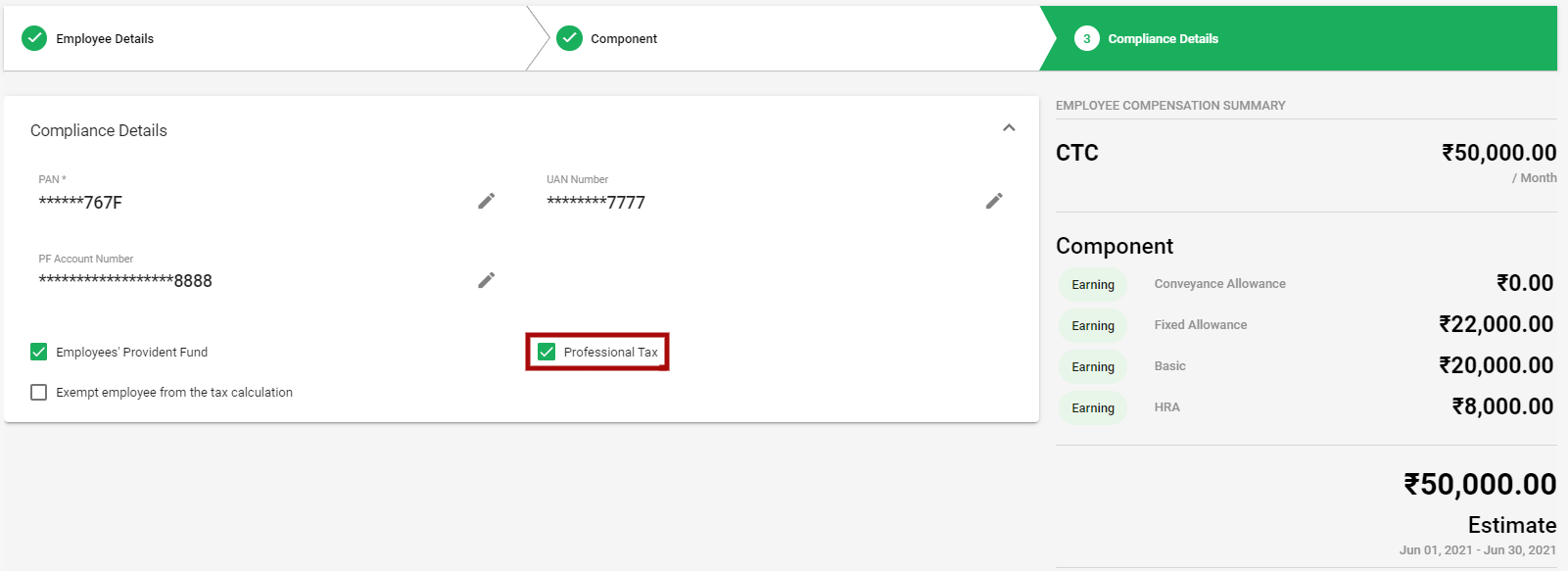

- Next, a screen will appear, go to Compliance Details tab,

4. You can see a Professional Tax checkbox where you can tick the check box and the PT will be applicability for the employee.

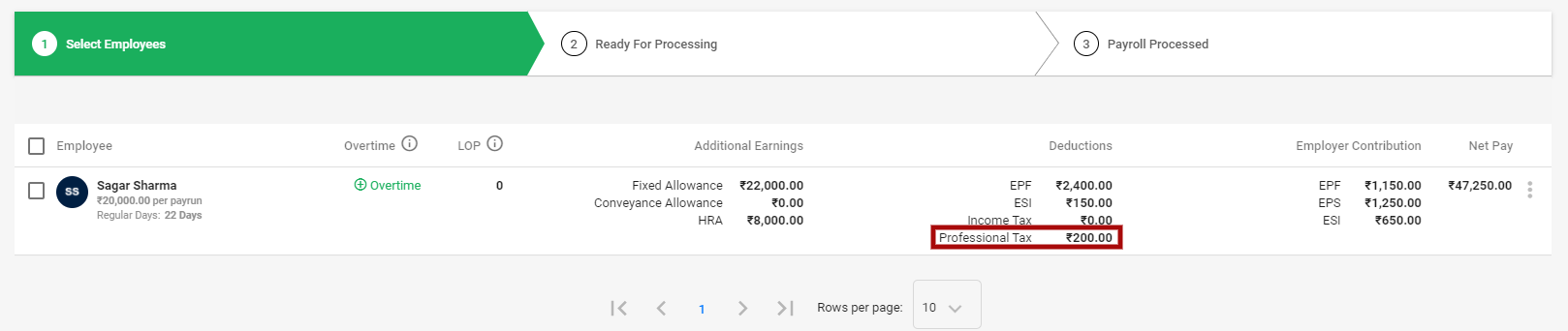

5. Based on the above mentioned state wise PT rates, these calculation will be auto-calculate in the system, once the payrun is processed. You can view this amount under Employee Deduction Column.