In the previous article, you have seen what is IT declaration and how the employees can do their investments under Deskera People

Now let us see with an example how Income Tax is calculated post ITR submission using Deskera People.

As an admin, you can calculate employee’s taxes accurately after the IT declarations have been submitted by the employee to comply with the government regulations using Deskera People.

In Deskera People Income tax is calculated as per the below Income Tax Slabs,

- The tax slabs must be applied to the Taxable income of the employee.

- The IT Declaration must be mapped to the following tables to calculate the TDS.

Below 60:

| Income Tax Slab | Individuals Below The Age Of 60 Years |

| Up to 2,50,000 | Nil |

| 2,50,001 to 5,00,000 | 5% |

| 5,00,001 to 10,00,000 | 12,500 + 20% of total income exceeding 5,00,000 |

| Above 10,00,000 | 1,12,500 + 30% of total income exceeding 10,00,000 |

Age 60 - 80

| Income Tax Slab | Senior Citizens (Aged 60 Years But Less Than 80 Years) |

| Up to 3,00,000 | Nil |

| 3,00,001 to 5,00,000 | 5% |

| 5,00,001 to 10,00,000 | 10,000 + 20% of total income exceeding 5,00,000 |

| Above 10,00,000 | 1,10,000 + 30% of total income exceeding 10,00,000 |

Above 80

| Income Tax Slab | Very Senior Citizens (Aged 80 Years And Above) |

| Up to 5,00,000 | Nil |

| 5,00,001 to 10,00,000 | 20% |

| Above 10,00,000 | 1,00,000 + 30% of total income exceeding 10,00,000 |

Calculation Example

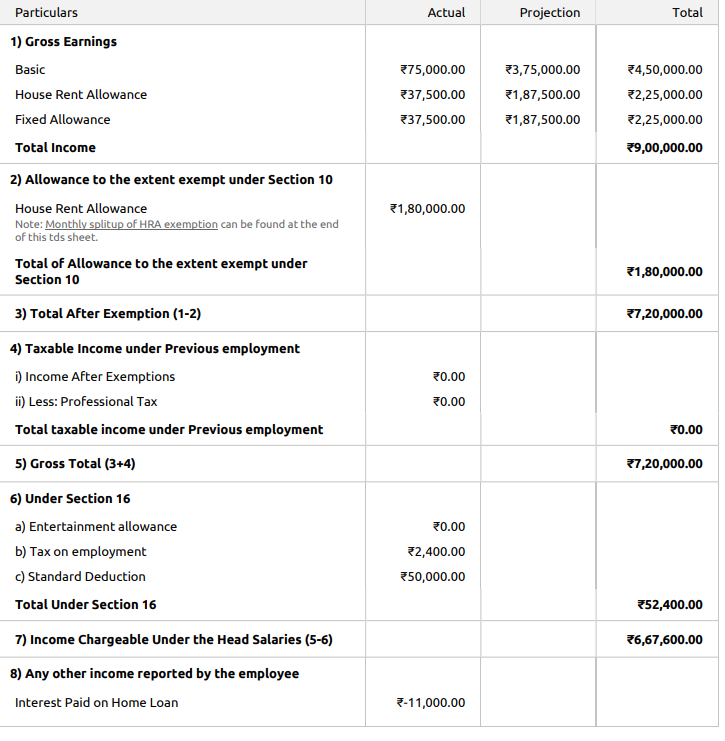

(A)Determine the Gross Salary ( Basic + HRA + Fixed Allowances+ Other earning components ) for the year. ( (CTC for a month * 12) or (CTC for a year))

CTC = 900000 # (A) = 900000

# Allowance to the extent exempt under Section 10 ( Rent Paid + Rs 27000 declared in ITR)

- Exemption of 180000

# Total After Exemption (1-2) = 7,20,000.00

# Taxable Income under previous employment = 0

# Gross Total (3+4) = 7,20,000.00

# Determine the Professional Tax paid for a year ( Professional Tax for a month * 12) + Standard Deduction of 50,000

# Income Chargeable Under the Head Salaries (5-6) = 6,67,600.00

# Any other income reported by the employee ( Taken from ITR)

- Interest Paid on Home Loan = -11,000 ( Positive value becomes negative)

- Income from other sources = 900.00

- Let Out Property =1,32,200.00

- Interest Earned from Savings Deposit = 10

- Interest Earned from Fixed Deposit = 10

* Total Income From Other Sources = ₹1,22,120.00

- Note: A maximum of ₹2,00,000.00 is allowed as exemption for housing loan interests on Self Occupied House Property and Let Out Property.

- Gross Total Income (7+8) =7,89,720.00

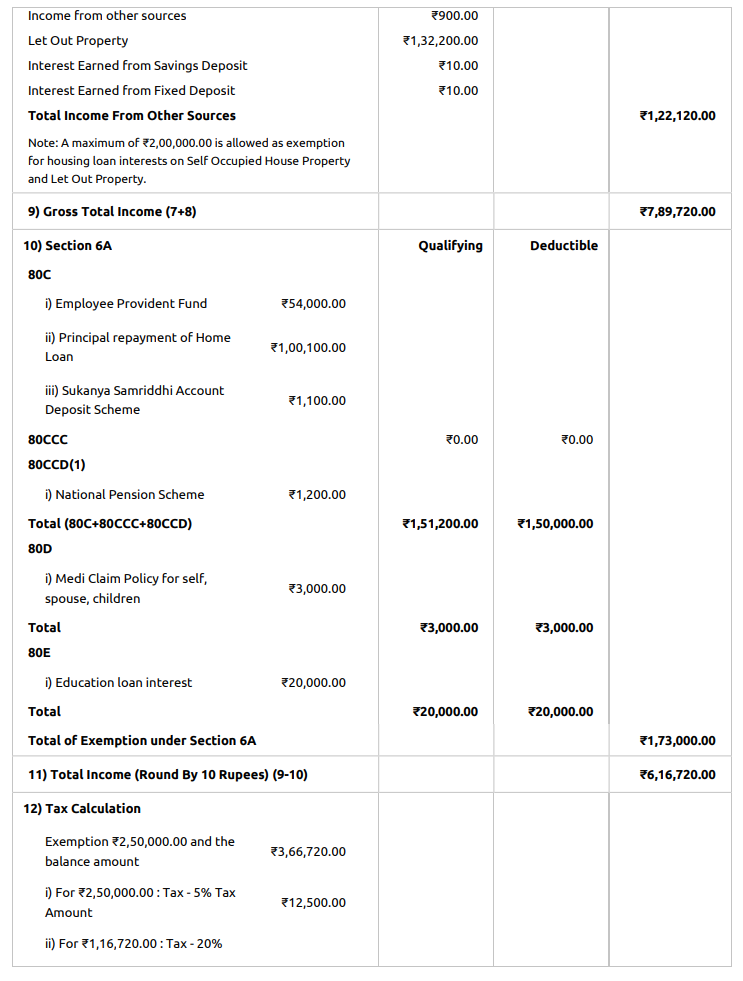

# Section 6A

80C

i) Employee Provident Fund ₹54,000.00

ii) Principal repayment of Home Loan ₹1,00,100.00

iii) Sukanya Samriddhi Account Deposit Scheme ₹1,100.00

80CCD(1)

i) National Pension Scheme ₹1,200.00

Total (80C+80CCC+80CCD) = ₹1,51,200.00

But only a maximum of ₹1,50,000.00 is deductible for 80C+80CCC+80CCD ( Limit for 80C Investments)

80D

i) Medi Claim Policy for self, spouse, children ₹3,000.00

The maximum limit for investments under this section is ₹1,00,000.

80E

i) Education loan interest ₹20,000.00

Total of Exemption under Section 6A = 1,73,000.00

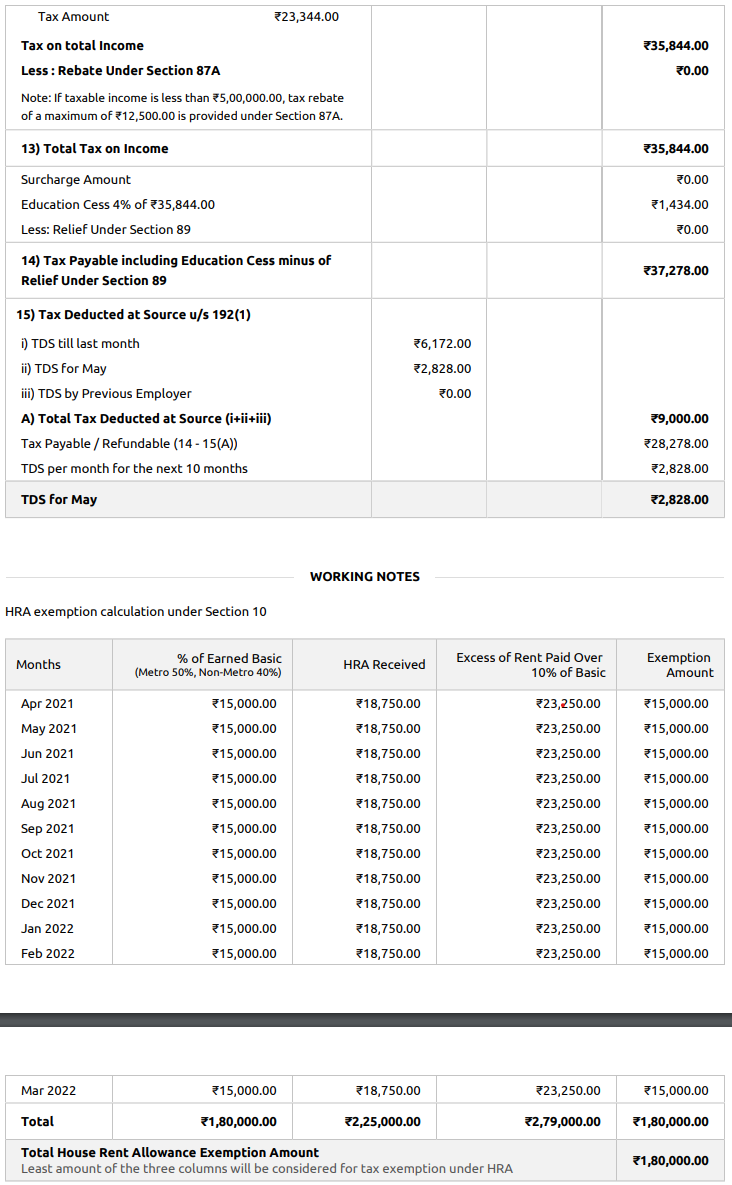

11) Total Income (Round By 10 Rupees) (9-10) = 6,16,720.00

(11) Income tax for the month is ( I/12)

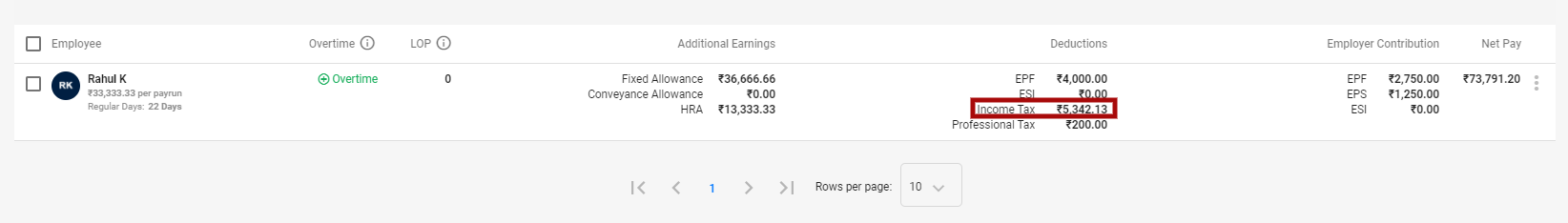

To calculate the taxable income, Deskera People has implemented the auto calculation of Income Tax and taxable income while processing the payrun.