India, one of the fastest-growing economies globally offers vast business opportunities for businesses to kick-start their business operations here. India is ranked as the 5th largest economy by GDP globally, with annual growth rates of 6% to 7%, with more than a billion population.

To start a business in India, you must understand the requirements and rules of starting a business.

Aside from equipping yourself with tax knowledge, you will need the right software to help you generate business transactions with the correct tax rates.

You can now use Deskera Books+ as your ultimate accounting software to record business documents and automate your work.

Follow the steps below:

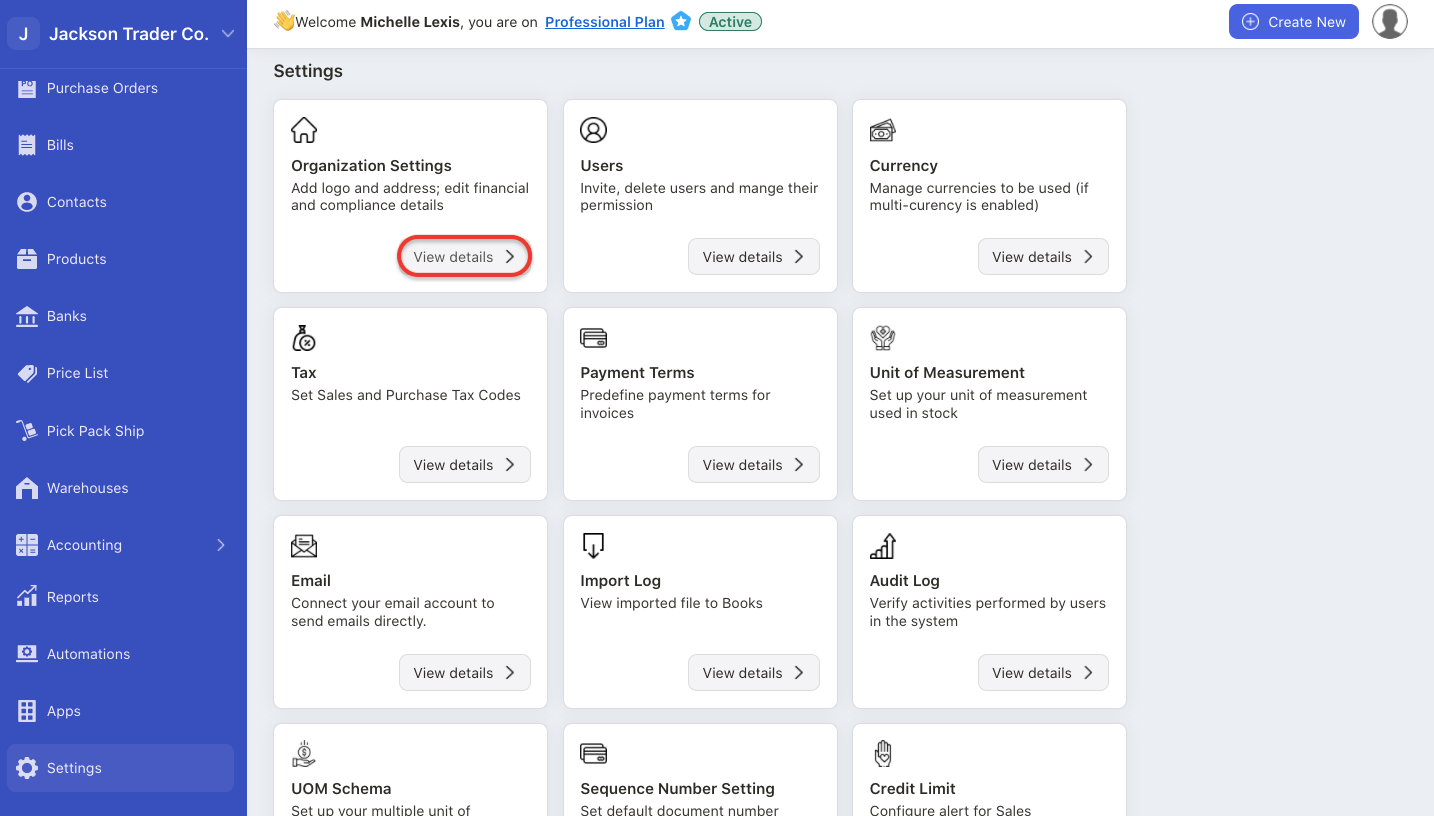

- Login to your Books+ account

- Go to Setting via the sidebar menu.

- Click on the organization profile.

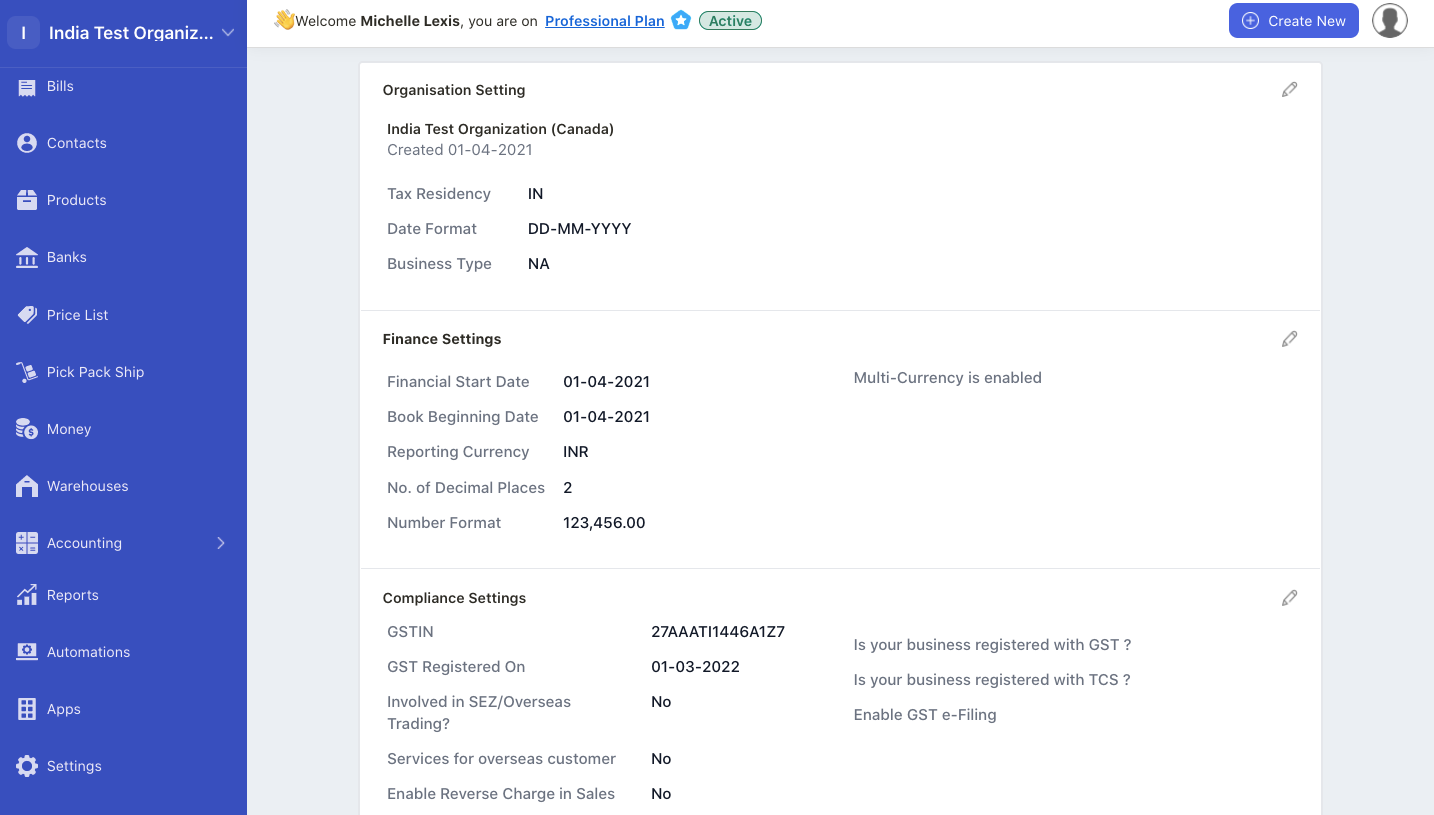

4. You can view five sections on this page. Fill in the fields;

Organization setting

- tax residency; choose your organization's tax residency

- date format; choose the date format that you wish to view in your organization

- business type; choose from sole proprietorship, partnership, LLP, S Corporation, LLC, Corporation, non-profit organization, or charitable organization

Finance setting

- financial start date; enter your accounting financial start date. You cannot edit this field after you have saved it

- book beginning date; enter the date you start using Deskera Books+. You cannot edit this field after saving it

- reporting currency; this will be your organization base currency

- no of decimal places; enter the number of decimal places to appear in your organization. Choose 2, 3 or 4 decimal places

- number format; select the number format that you wish to be reflected in your organization

Compliance setting

- GST-registered; enable the GST registered toggle if your business is registered for GST. If not, disable this toggle

- GSTIN number; if your business is GST-registered, enter the GSTIN number. A GSTIN number is a 15 digits alpa-numerics given to your business for GST purposes

- GST register date; enter the date you register for GST

- Checkboxes; enter the checkboxes if your business is involve in Special Economic Zone (SEZ), supply digital services for overseas customers, and is registered for composition scheme

- TCS registered; enable the toggle if your business is registered for Tax Collections at Source (TCS)

- TAN number; This is a 10 digit alpha-numeric number issued by the income-tax department

- Interest rate; enter the interest rate involved

- GST eFiling; enable the toggle for GST eFiling. Then, enter your username and click on the connect button to connect to your GST account

Address setting

- billing address; enter your organization billing address

- shipping address; enter your organization shipping address. Click on the add another address to add multiple addresses

Categories setting

- track classes; enable the toggle if you wish to track classes. You can choose to apply one class to entire transactions or one class to each row in transaction

- track locations; enable the toggle if you wish to track locations. Label the location by business, department, division, location, property, store, or territory

5. After you have completed all the fields above, click on the save button.

6. Your company information will be reflected on this page and you can always view them whenever you want.