There are two reports that you can generate for Canada Compliance in Deskera Books.

They are Sales Tax Report and Tax Report by Tax Code.

Read more below to generate these reports using Deskera Books.

How to generate the Sales Tax Report?

- Login to your Deskera account.

- Click on the Switch To button at the bottom left >> Select Deskera Books.

- The system will direct to Deskera Books' Main Dashboard.

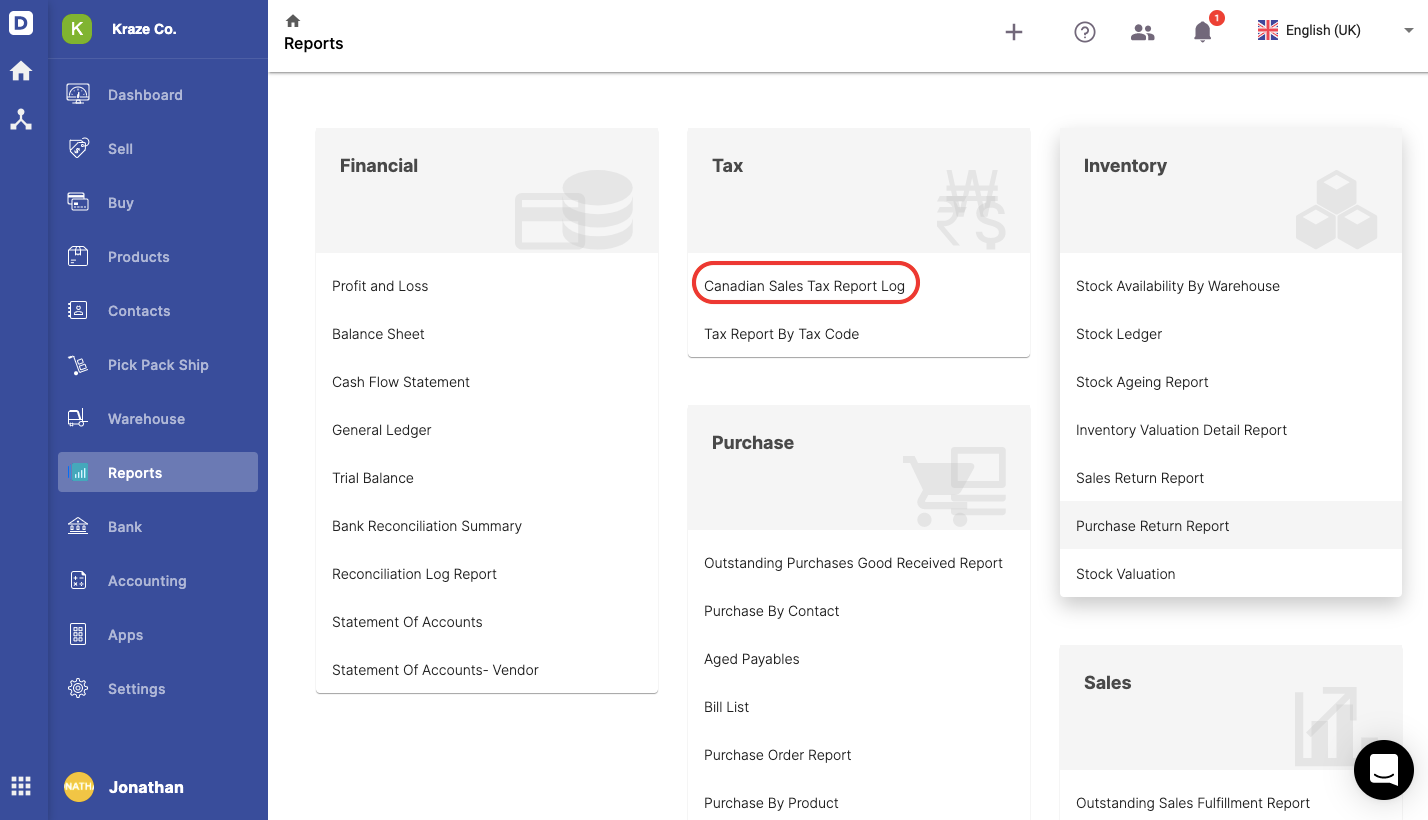

4. Go to Report via the sidebar menu.

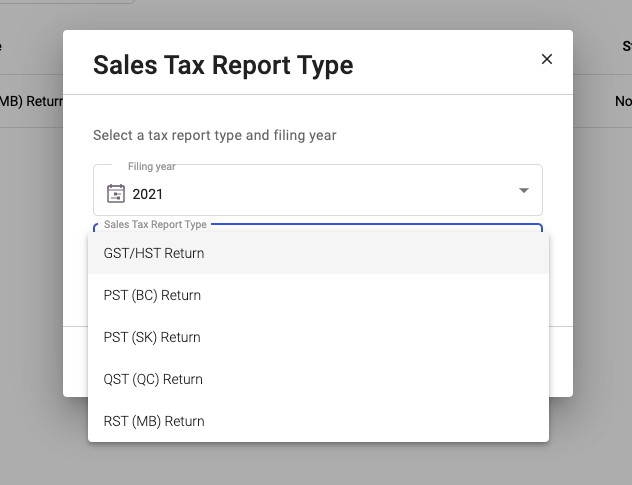

5. Click on the Canadian Sales Tax Report Log.

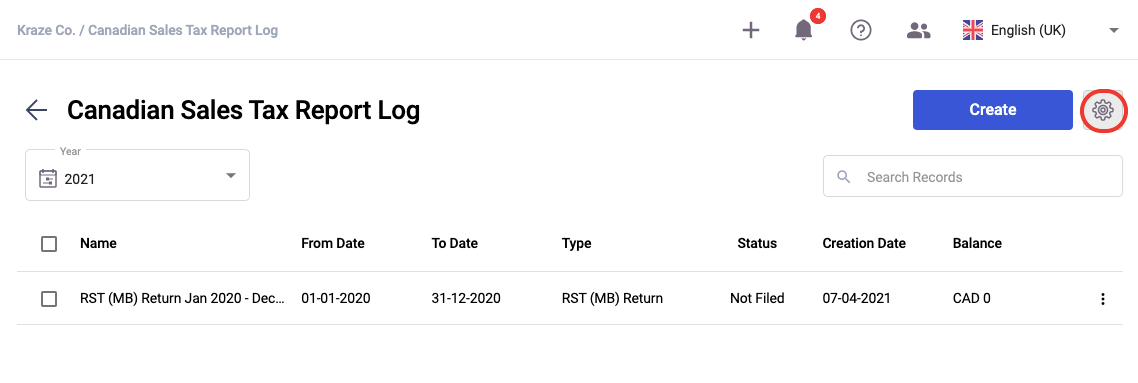

6. On the Canadian Sales Tax Report page, select the setting icon.

6. On the Canadian Sales Tax Report page, select the setting icon.

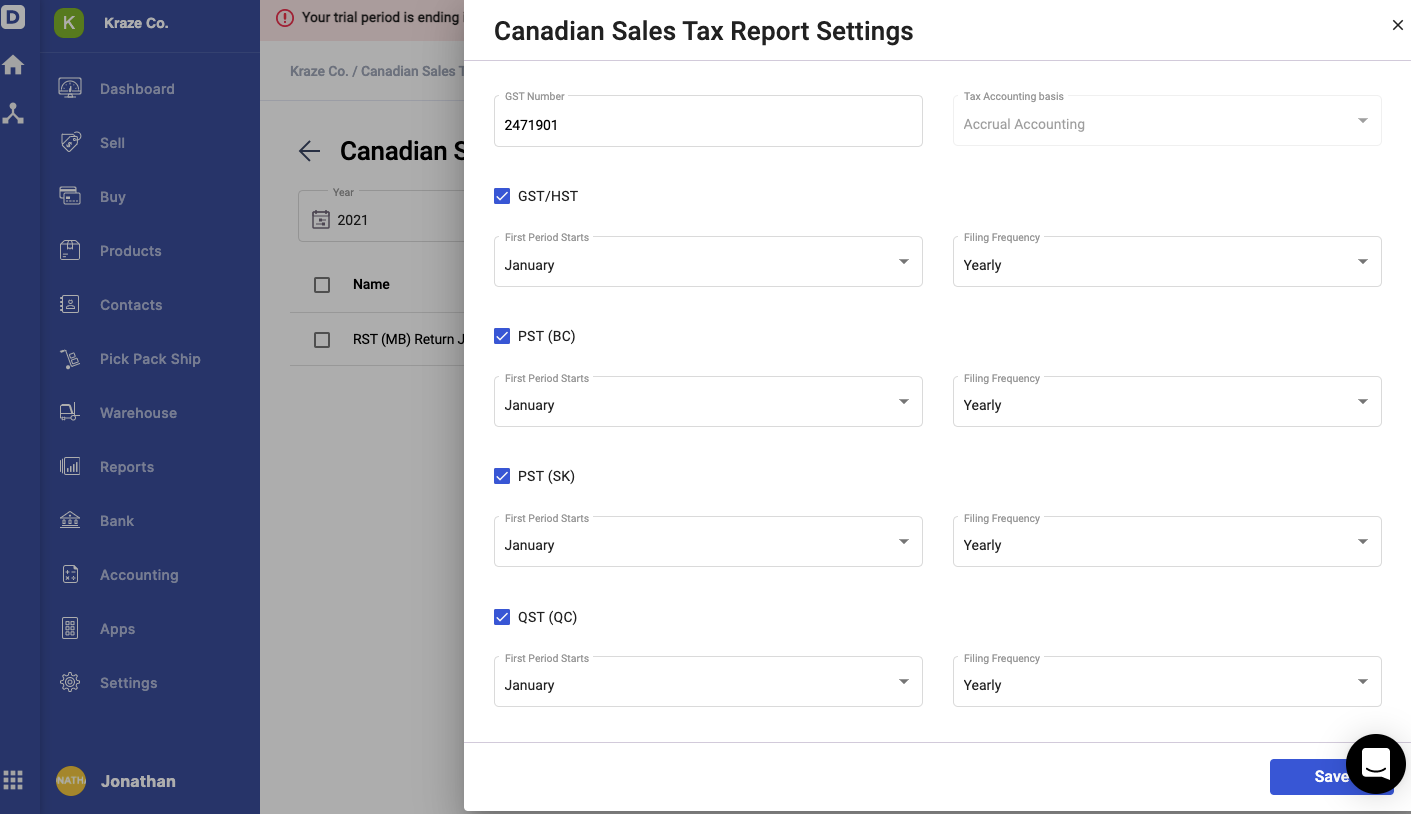

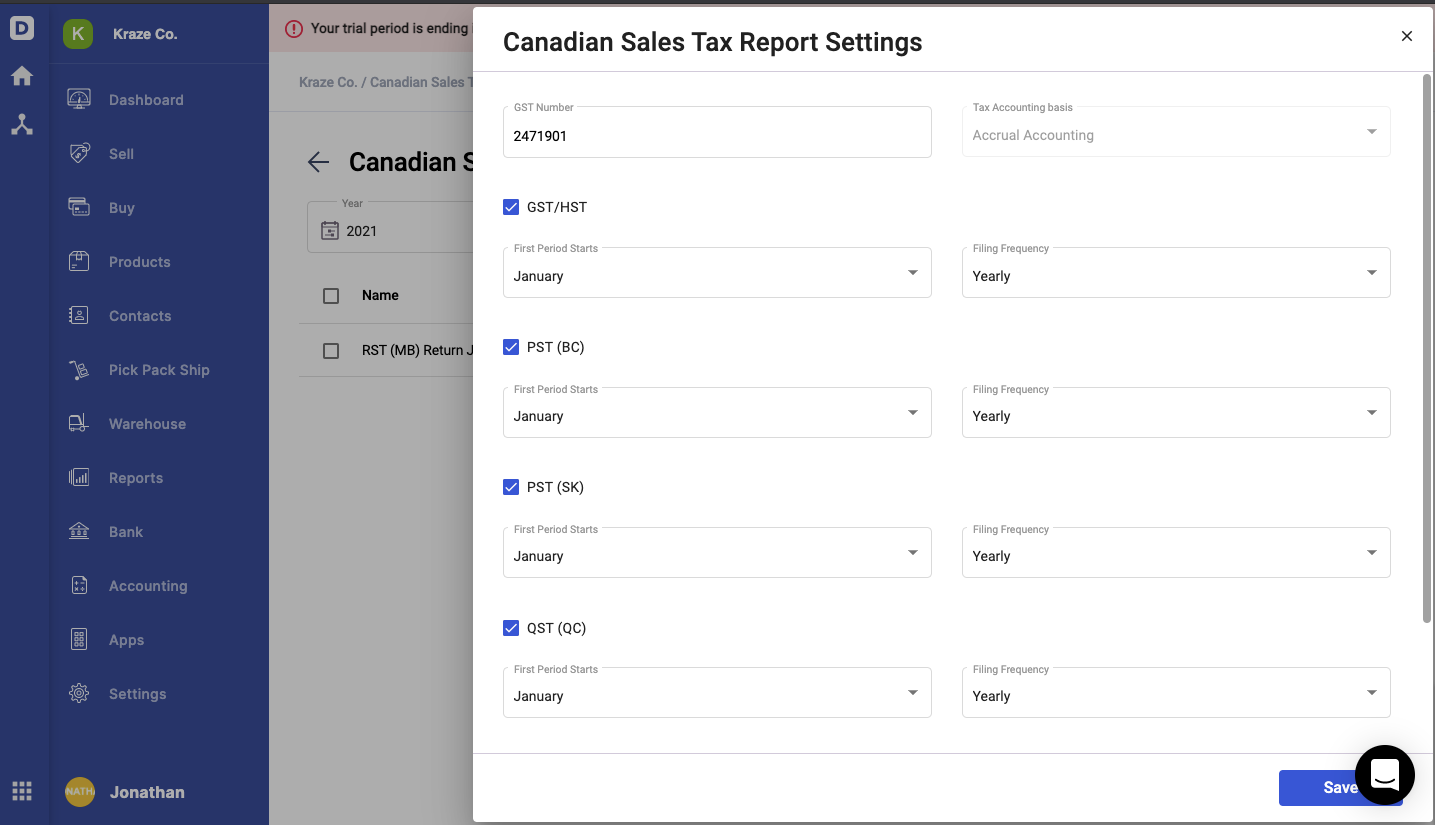

7. This action will open a slider on the right-hand side screen.

8. Under the settings, you can view the GST Number populated from your setting tab, and the tax accounting basis is locked at accrual accounting as the default mode.

9. There are five types of reports that you generate here. Enable the sales tax report that you want to generate:

- GST/HST Return

- PST (BC) Return

- PST (SK) Return

- QST (QC) Return

- RST (MB)

10. Indicate the First Period Stats and filing frequency (12 months, January to December) for each report (Monthly, Quarterly, Half-Yearly, Yearly).

11. Click Save.

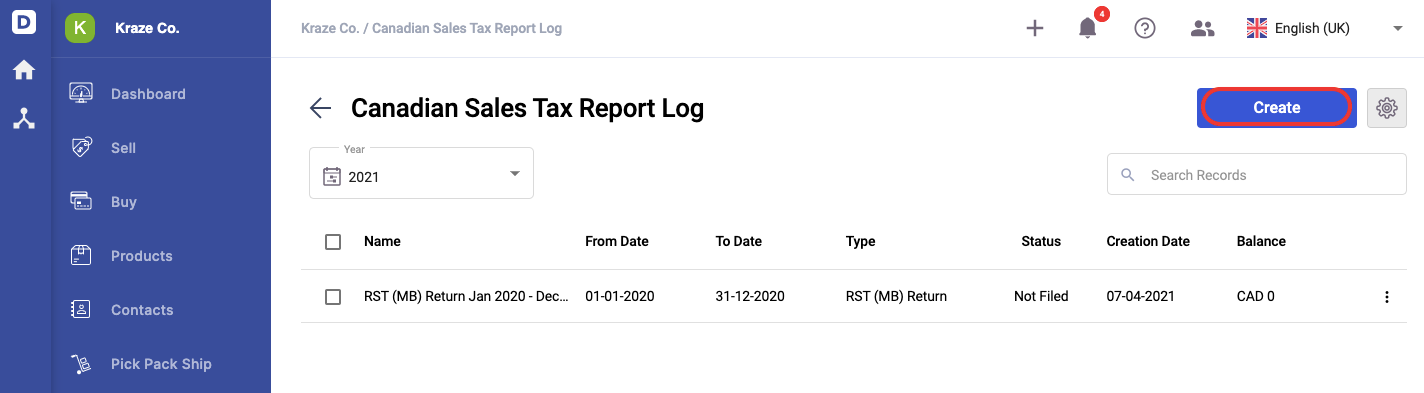

12. Whenever you need to generate the report, click on the create button.

13. A pop-up will appear. Select the filing year and choose the respective report type via the drop-down menu.

14. Click on the Next button.

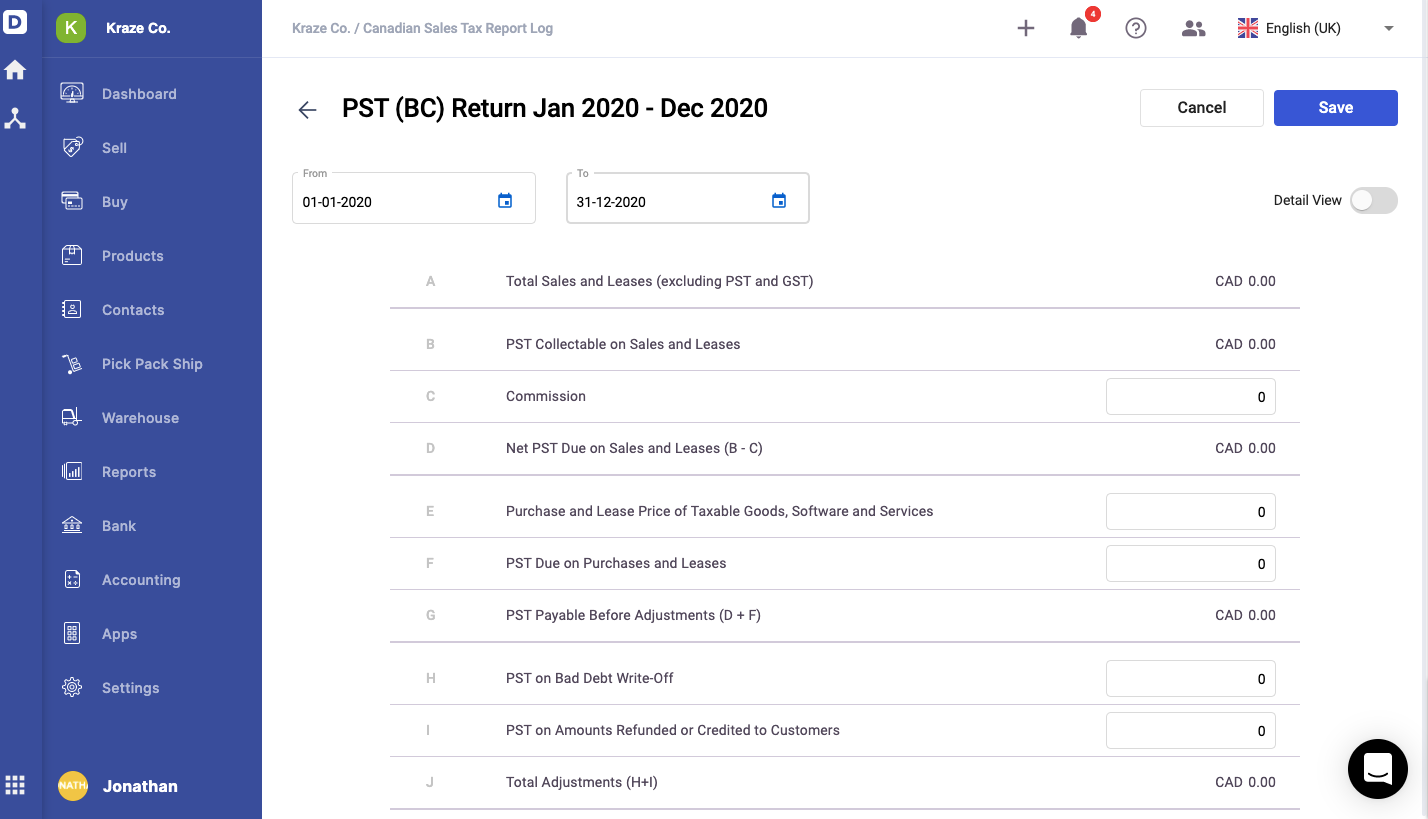

15. The system will direct you to the respective report that you have chosen.

16. Enable the detail view toggle to view each transaction tagged under each field in the report.

17. Click on the Save button.

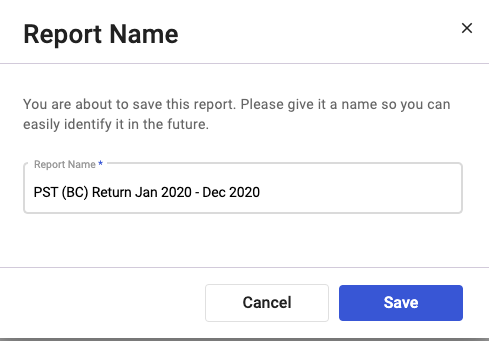

18. Enter the name of the report.

19. Click on the Save button.

How can I edit and delete the sales tax report?

Follow the steps below:

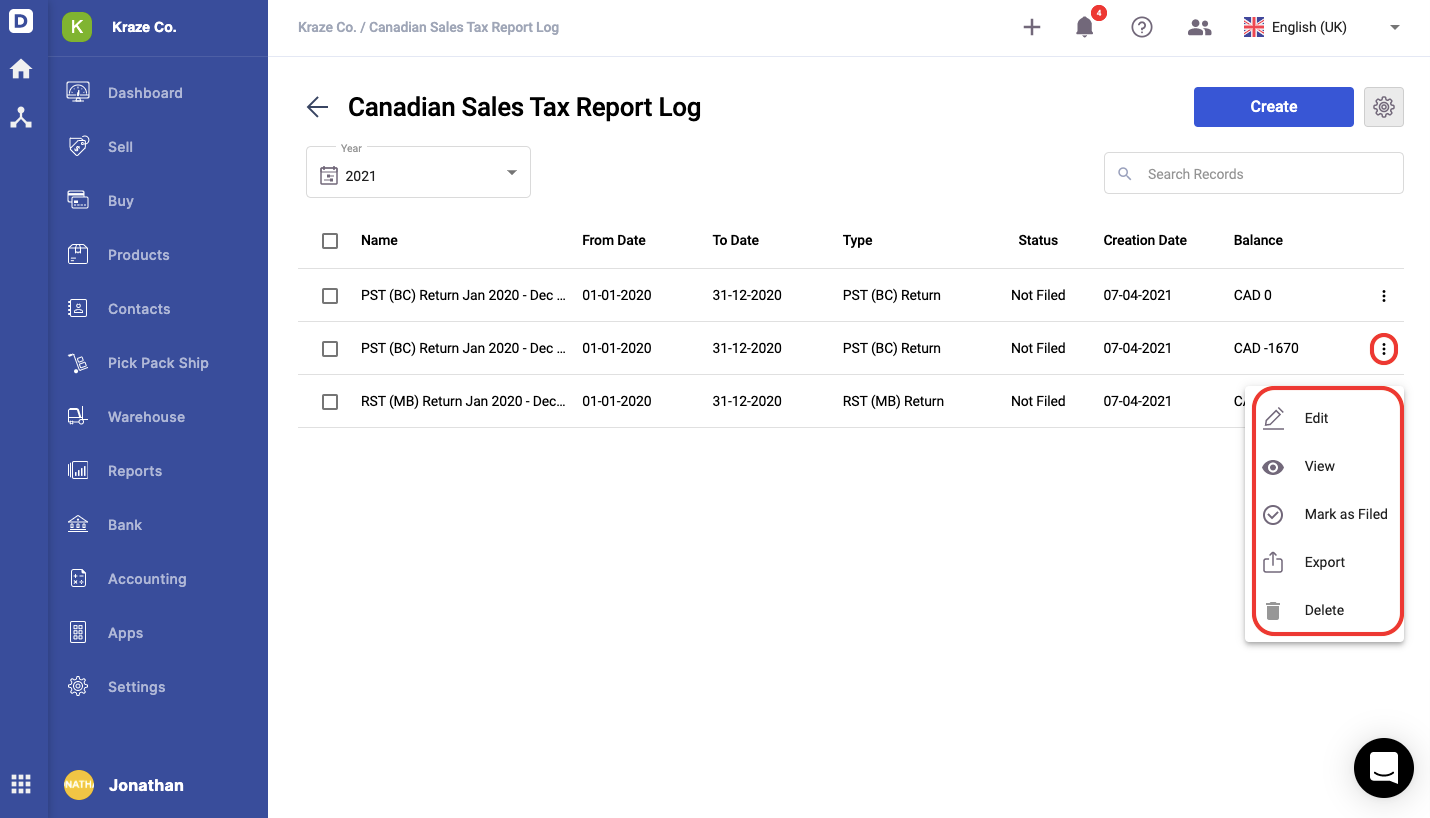

- Click on the three dots of the respective sales tax report.

- You can perform the following actions:

- Edit - Edit the details in the report. This option is only available if the file is not filed yet.

- View - You can view the report

- Mark as Filed - If you have filed the sales tax report to the government, you can mark it as filed here. You can always revert the process here.

- Export - You can export the report in .xls format

- Delete - You can only delete the report that is yet to be filed

How to generate the Tax Report by Tax Code?

- Login to your Deskera account.

- Click on the Switch To button at the bottom left >> Select Deskera Books.

- The system will direct to Deskera Books' Main Dashboard.

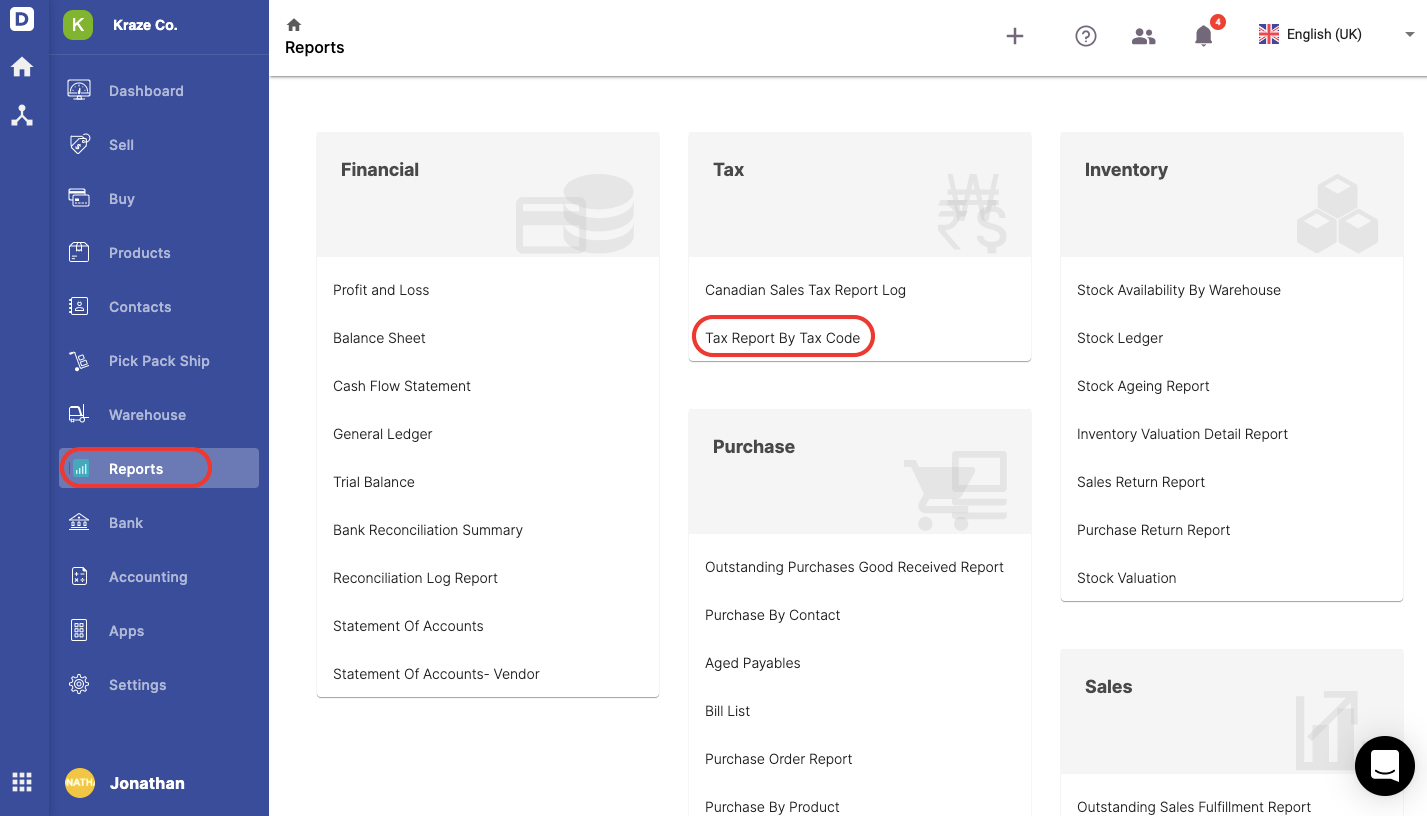

4. Click on the Reports button via the sidebar menu.

5. Next, select the Tax Report By Tax Code.

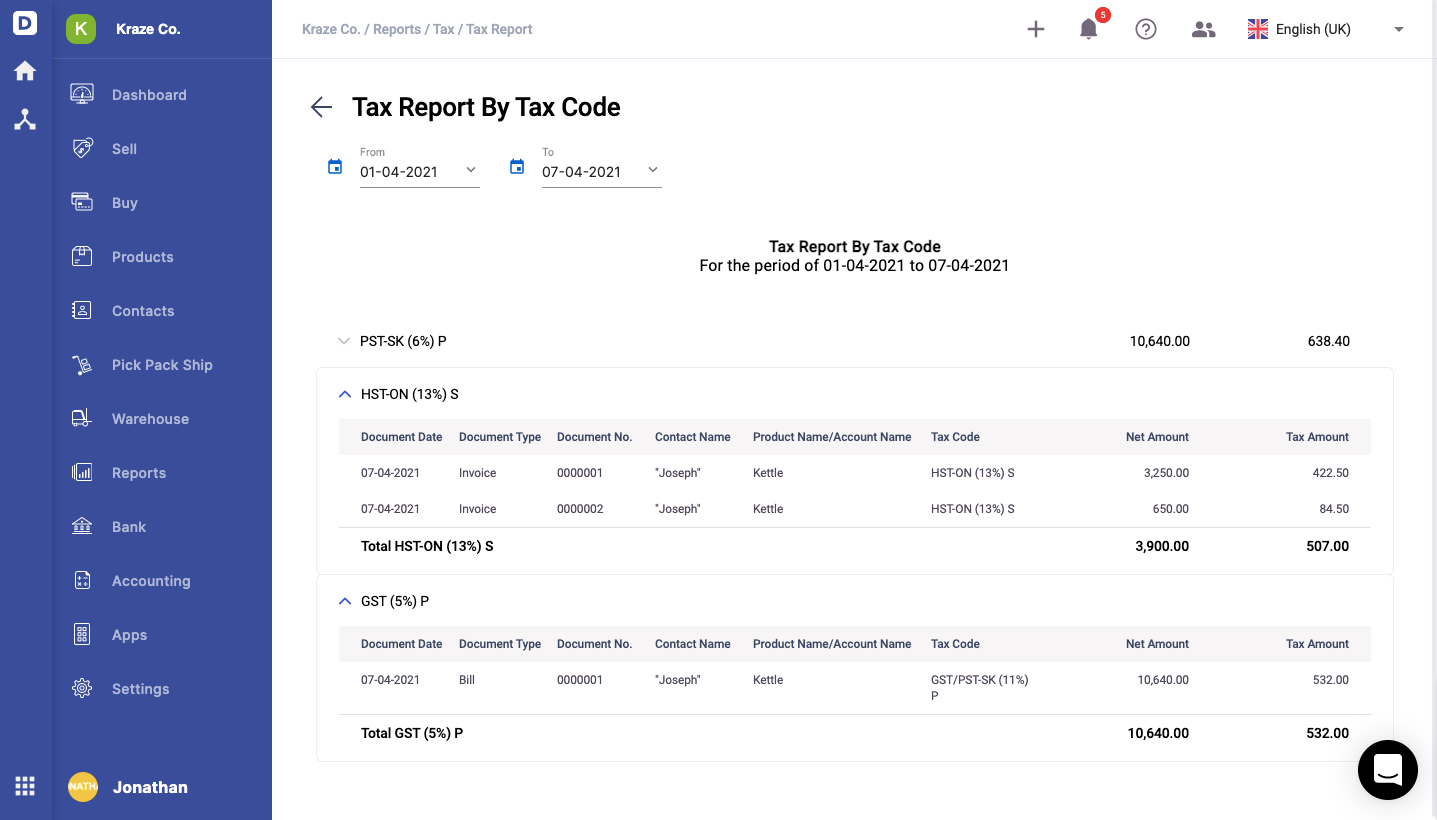

6. On the tax report by tax code screen, you can view all the tax codes applied to all the system's transactions.