Indonesian income tax is collected mainly through a system of withholding taxes. Where a certain item of income is subject to withholding tax, the payer is usually held responsible for withholding or collection of the tax. These withholding taxes are commonly referred to using the relevant article of the Income Tax (Pajak Penghasilan/PPh) Law.

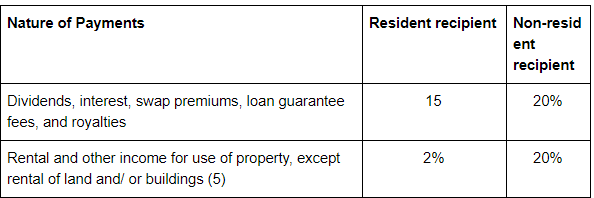

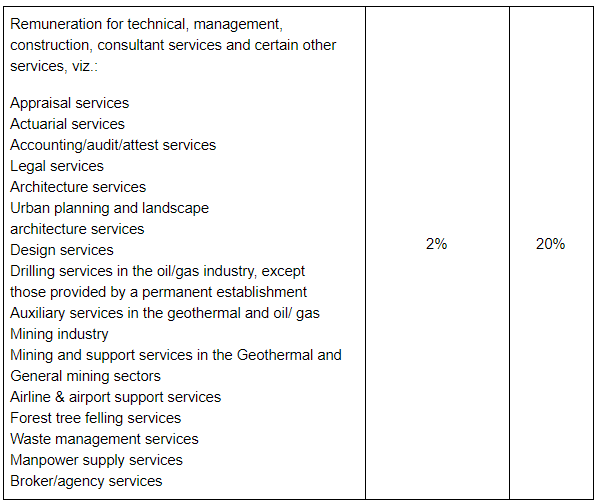

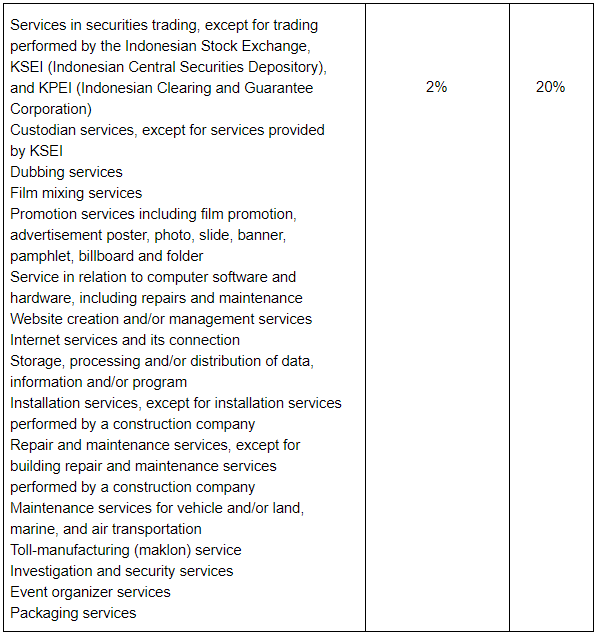

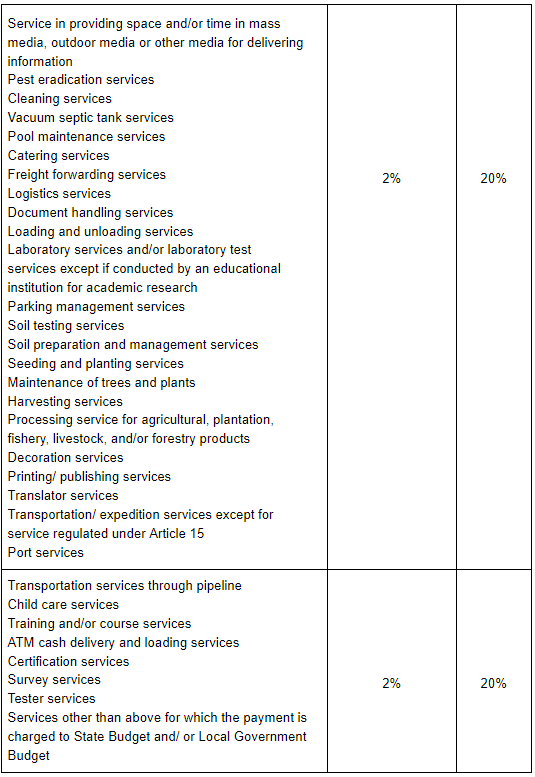

Following are the Withhold tax rates for Indonesia Resident & Non-resident recipients as per Article 23 (PPH23).

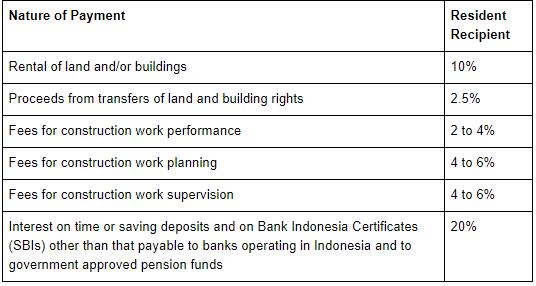

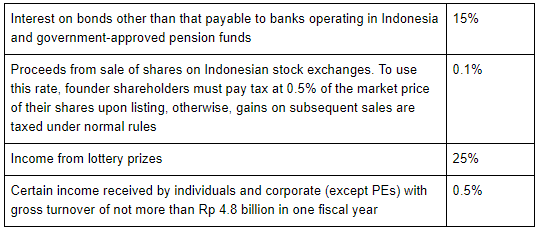

Following WHT rates for Indonesia country for Resident taxpayers.

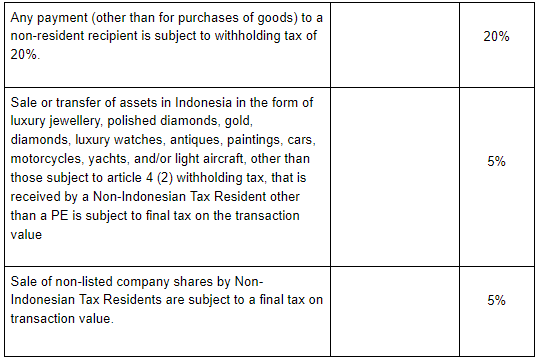

Foreign companies, organisations and appointed individuals are required to withhold final tax from the following gross payments to resident taxpayers and PEs:

Using Deskera Books these accounts for WHT are implemented and all Journal Entry transactions will go to these particular accounts.