As we already know, the product classifications and place of supply will affect the GST computation. Hence, it's crucial to indicate your products' right tax rate based on the tax rate mentioned in the article for the specific products and the ship-to address.

Let's go through the steps below to view how the GST is computed on Deskera Mobile App.

1. Tap on the 'Product' Icon.

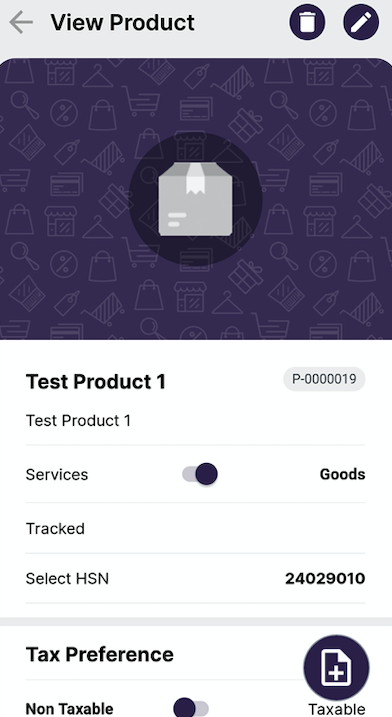

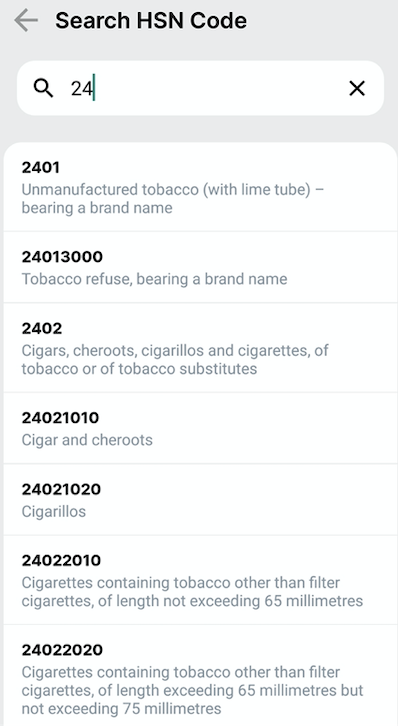

2. Create a new product as per usual. For India, you will need to indicate the HSN/SAC code for the product.

3. The sales tax and purchase tax will be auto-populated.

4. Next, tap on the 'Save' button.

5. Next, tap on the invoice icon.

6. On the invoice page, tab on the 'Create New Button.'

7. Fill in the Contact based on your contact record. The address of the Contact is essential for the computation of GST.

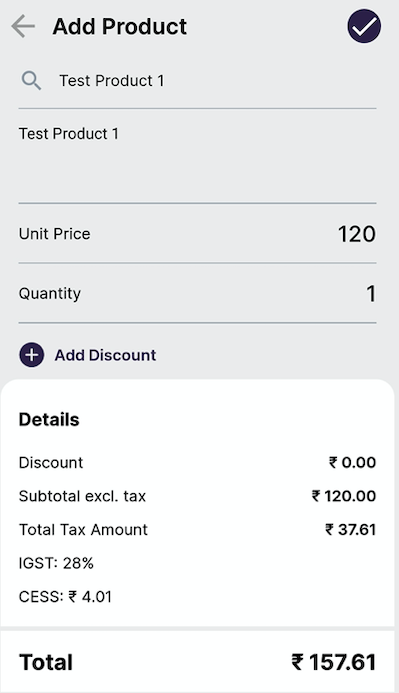

8. Select the products to be sold to your customers or scan the barcodes using the Mobile App application.

9. Make necessary adjustments to the quantity of the products. Add a discount for the products, if any.

10. Finally, you can see that the Tax is computed automatically in the system. Click on the 'Save' button to create the Invoice.

Do note that the calculation for Tax will differ depending on the place of supply. If the transactions occur within the same state, it will attract CGST and SGST. On the other hand, if the supplier and supply are from different states, it will attract IGST.

If you the products you're selling attract Cess, it will be auto-populated in the system.

Products that attract Cess are motor cars, coal, solid fuels, aerated waters, pan masala, motor vehicle design to transport people, and tobacco products. Compensation cess applies to interstate sales, intrastate-sales, and import.