An employee and employer can select to contribute EPF at a higher rate than the minimum rates specified(9% or 11%). However an approval is required fromKWSP before increasing these contributions.

How to apply to KWSP for increased EPF contributions?

- Increased EPF contributions for an Employer:

If an employer wants to contribute a higher percentage, he will need to fill in Form KWSP 17 (MAJ) and further submit it to KWSP. After submitting this form the employer is eligible to contribute at the new rare going forward.

- Increased EPF contributions for an Employee:

Incase and employee wants to opt to contribute at a higher rate than his current statutory rate, he may do so by submitting a notice of election first by using Form KWSP 17A (AHL).

How to increase the contribution rate in Deskera People?

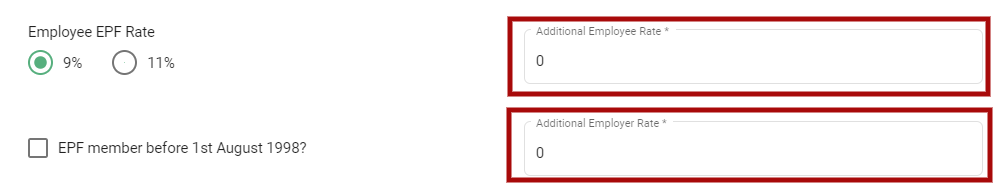

Go to Employees List>Employees>>Select Employee>Compliance Details and set the Additional Rate for employee and/or employer.

So for example, consider if the employee’s current contribution rate is 9% and you want to increase it to 11% you should add 2% as Additional Rate on the Employee EPF Rate.

How to revert back to the statutory contribution rates?

To revert back to the minimum EPF statutory rates, the employer /or employee must submit a cancellation notice using Form KWSP 18 (MAJ) and/or Form KWSP 18A (AHL) respectively. Once KWSP has received and processed this notification, the rate of contribution will be reverted back to the previous statutory rate.