The businesses registered under UAE VAT are required to file online VAT returns. The VAT returns are required to be filed on a quarterly basis and a few types of businesses may be requested to file on a monthly basis.

The VAT return form 201 is at a summary level or a consolidated level. In which the registered person has to furnish the consolidated details of total supplies - both purchase and sales, output VAT collected on supplies, eligible input VAT paid on purchases, input VAT recovered and the total tax due.

The date of submission

The VAT returns need to be submitted within 28 days following the end of the VAT return period. Here, the date on which returns are submitted will be captured.

Tax Period

Tax Period is the return period to which the Tax Return relates. For example, for January to March'18, it will be Jan-Mar'18.

Where can Deskera users retrieve the VAT Return 201 Report?

To file the VAT Return 201 Report using Deskera Books, select the Report button on the sidebar menu.

Under VAT Reports Section, click on VAT Return 201 Report.

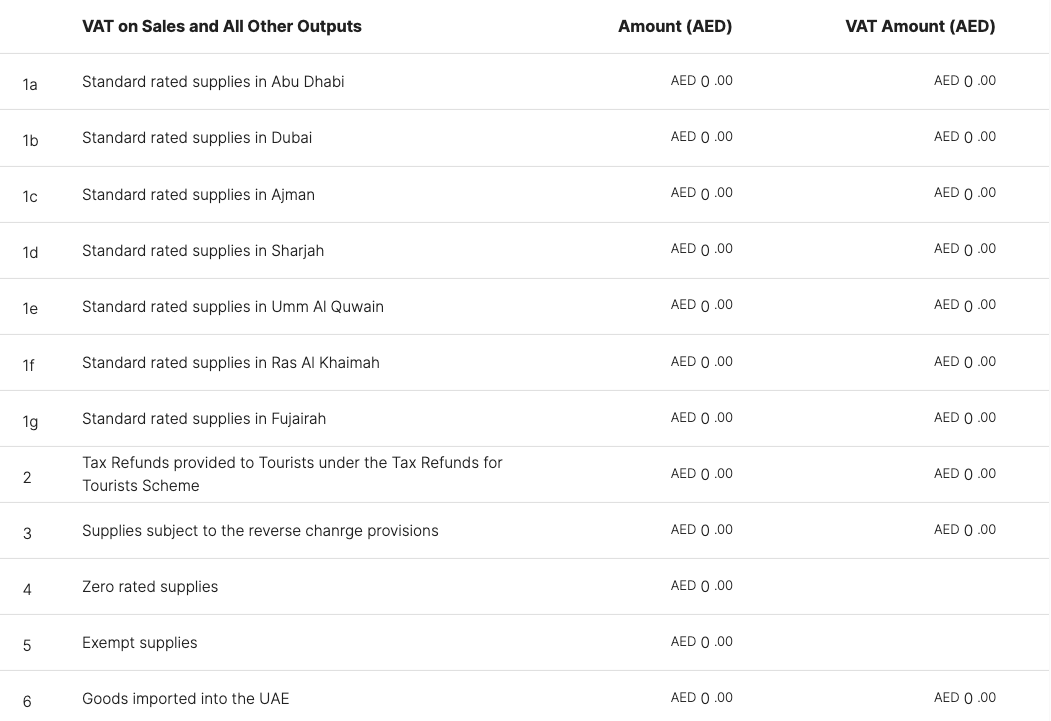

Below report sections will appear;

Standard rated supplies which determines your output VAT liability.

In the above box, the taxpayer is required to declare the net value of standard supplies and applicable output VAT. Standard rated supplies are those supplies which are subject to VAT at 5%. Here, net value refers to the value of the supplies excluding the VAT charged to the customer.

The VAT on sales and other outputs section contains above mentioned 8 boxes in which the sales and output VAT details will be furnished to complete the TAX Return filing.

As shown in the images above, against each box, you need to capture the details in the following columns:

- Amount (AED): It mentions the amount in AED relating to sales and other outputs less VAT.

- VAT Amount (AED): It mentions the output VAT amount levied on your sales.

Report Generation

You can also generate the report based on the date range you prefer by using the date filter at the top right of the screen.

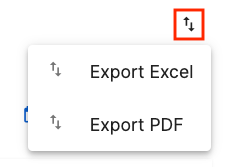

Export Report

You also have an option to export the file in excel format by clicking on the Export button on the left side corner of the screen.

Deskera users can file their VAT Return 201 Report via Federal Tax Authority (FTA) portal using the report generated from our system.