Harmonized System of Nomenclature (HSN) is used for the classification of tracked goods systematically. HSN is a 6 digit code developed by the World Customs Organization (WCO), which is accepted worldwide.

The purpose of implementing the HSN Code/SAC in GST is to make GST more systematic in India and make it globally accepted.

On the other hand, Service Accounting Code (SAC) is used to classify services systematically. This code is provided for recognition, measurement, and taxation purposes. All these services start with a number 99, making it easy to differentiate between HSN and SAC.

How does HSN/SAC work on the Deskera Mobile App?

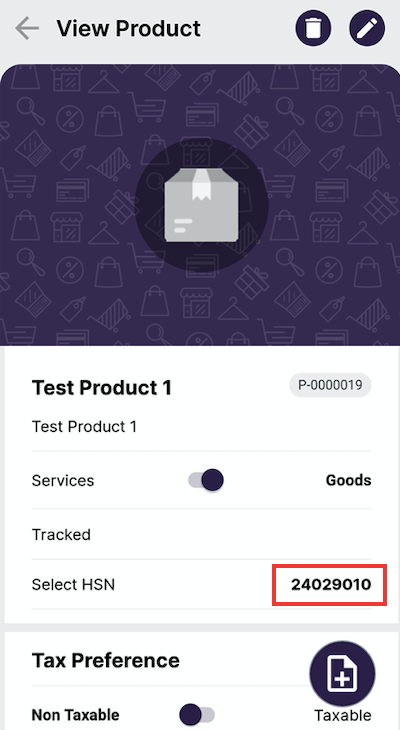

When users are creating a product, they are required to fill in the HSN/SAC of particular products.

Click on the "Products" icon under the Business Module on the main dashboard menu.

A pop-up will appear where you need to create a new product by clicking on the "+" icon.

When you categorize the product type as Goods, tagged it as tracked inventory. For tracked products, you need to fill in the HSN code. Alternatively, for non-tracked goods, you can indicate the SAC code.

Indicate the respective HSN/SAC code on the search box. The products will be auto-populated instantly.

Congratulations! You have successfully learned how HSN/SAC works on Deskera Mobile App.