What is Form 944?

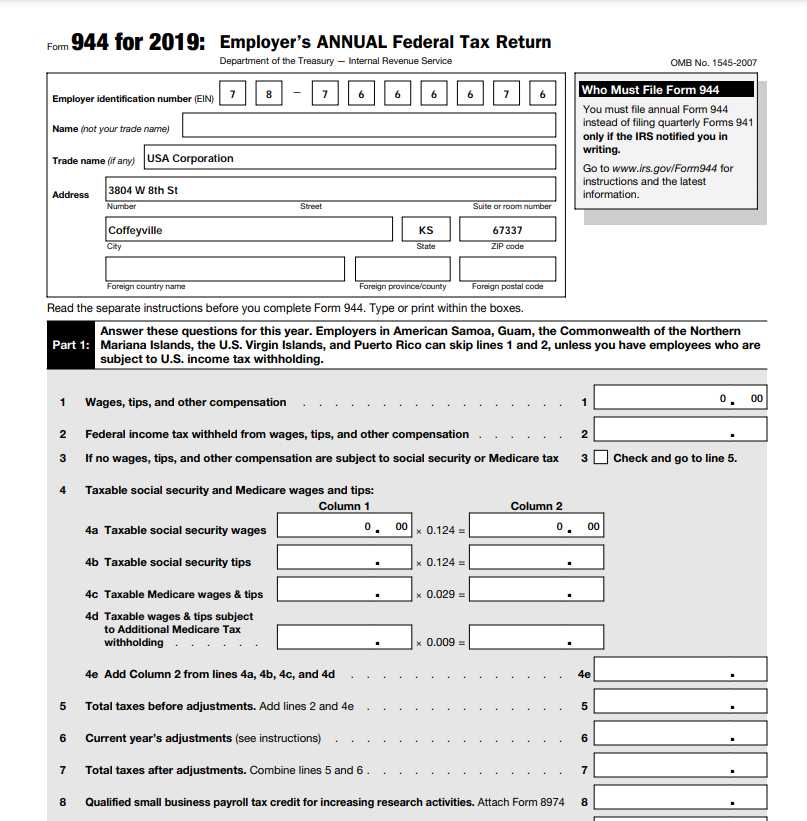

Form 944, Employer’s Annual Federal Tax Return, is a form that eligible small businesses file annually to report federal income tax and FICA tax (Social Security and Medicare taxes) on employee wages.

Small business owners also use IRS Form 944 to calculate and report their employer Social Security and Medicare tax liability. The IRS designed the form especially for small businesses with fewer employees and a smaller tax liability than other companies.

Who needs to file Form 944?

Not every business owner can use Form 944 to report wages and taxes. In fact, only a specific group of small businesses can.

The IRS tells you whether you need to file a 944 form. Typically, if your annual liability for Social Security, Medicare, and federal income taxes is $1,000 or less for the year, the IRS notifies you to file Form 944. Usually, this comes in the form of a written notice.

What is the Form 944 due date?

Form 944 is due by January 31 each year. If January 31 falls on a weekend, then it’s due the following business day.

How to Download Form 944 Using Deskera People?

Using Deskera People you can Download federal form 944 for employer with the , following steps

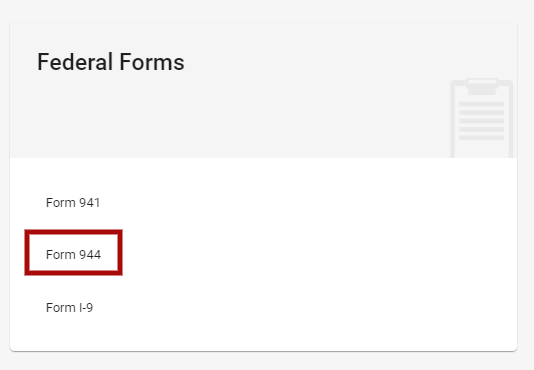

1. Go to the Report Tab>> under Federal Forms Section>> click on form 944,

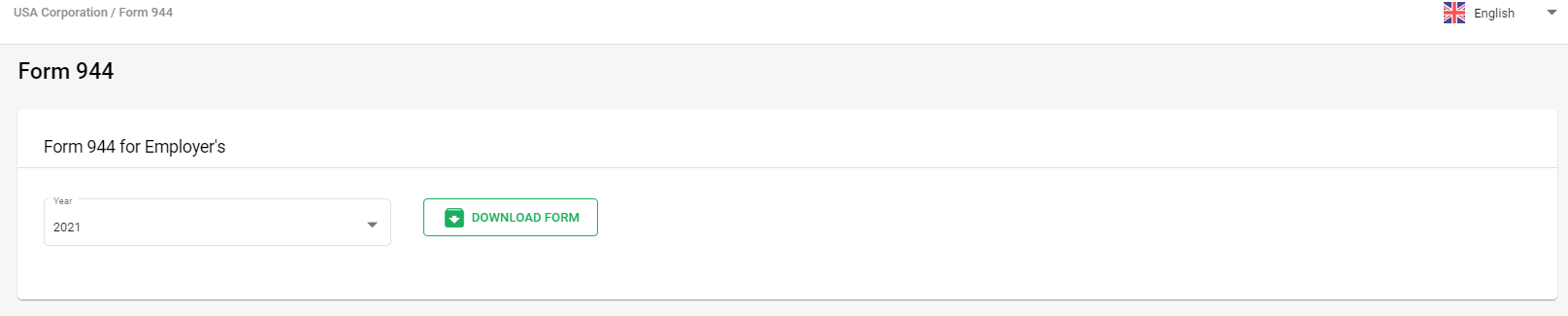

2. A below screen will appear,

- Year - Select the year from drop down list

- Click on Download form button and a below form 944 will be downloaded for further submission to IRS