In the previous article you have seen how to view default tax and set up custom tax in the system.

Let is now take a look at, how these Tax rates are applicable in different modules on Deskera Books

As a user you can calculate Tax Rates while creating business transactions in the Buy and sell module, Product setup.users can also select default tax accounts in Journal entry and in contact set up.

Let us see in detail how these taxes are applicable the system/

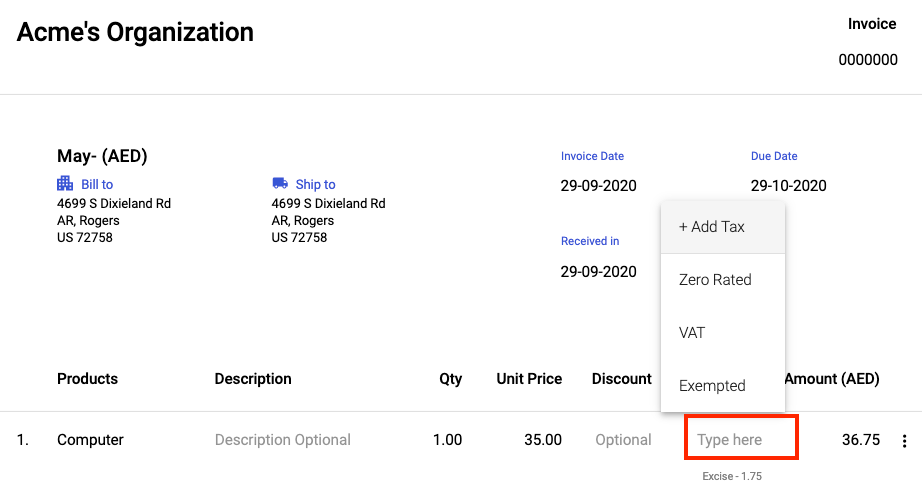

1. The Quotes and Invoice

While creating a Sales invoice and Quotes you can select the tax from the dropdown menu where only sales taxes are present in these tax options.

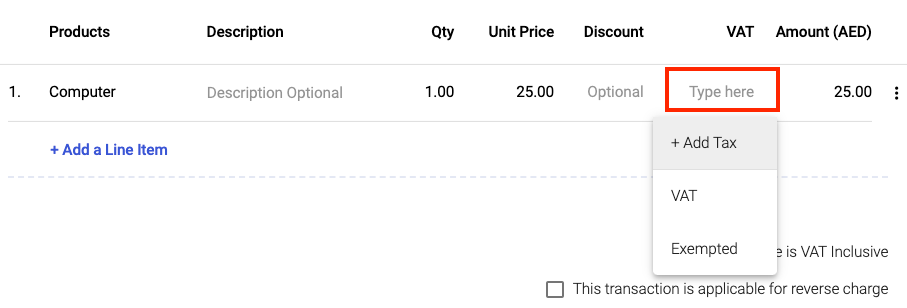

2. The Orders and Bills

While creating a Bill or Order when you select the tax from the dropdown menu only purchase taxes are present in these tax options

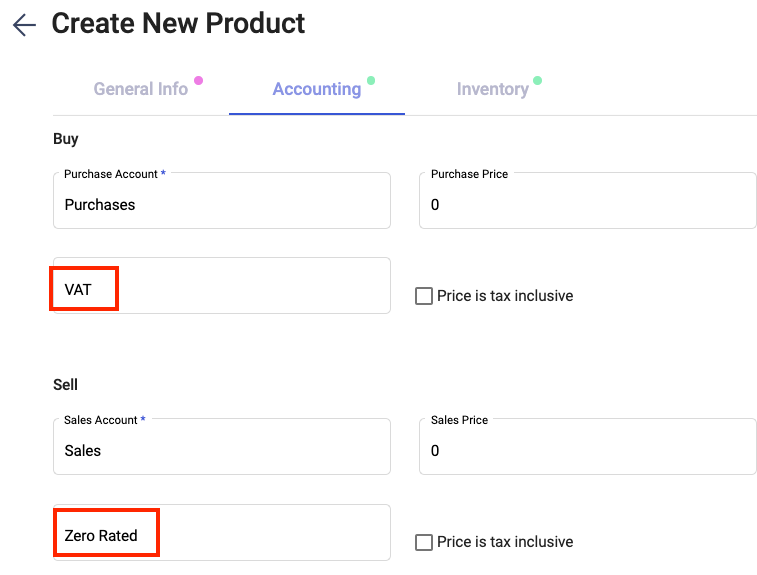

3. The Product Module

While creating a product in the sale section only sale type taxes will be shown and in the Buy section only Purchase type taxes are shown.

These tax codes will automatically be populated when you select the product in sales and purchase transactions.

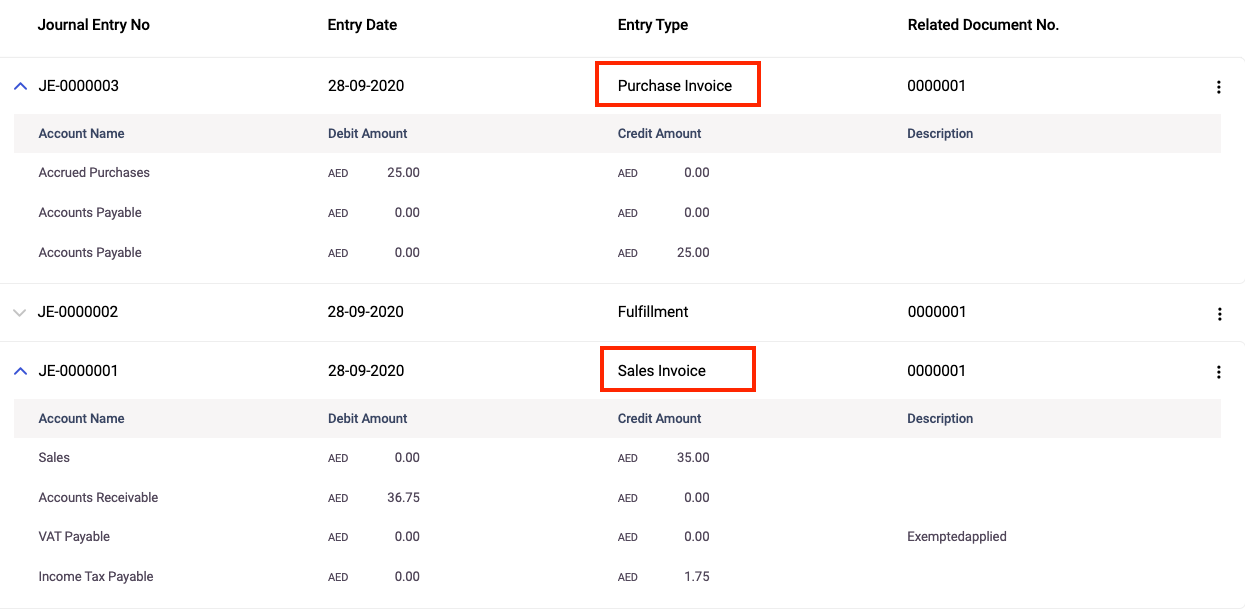

4. Journal Entry

A separate Journal entry will be passed for each Invoice and Bill created with Tax rates applied.

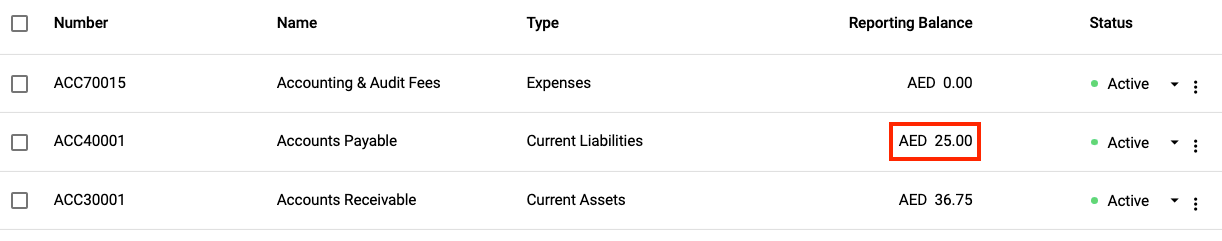

5. Charts of Accounts

You will also be able to view a separate account maintained for VAT Payable under COA which is the total amount being changed on purchase and sales.

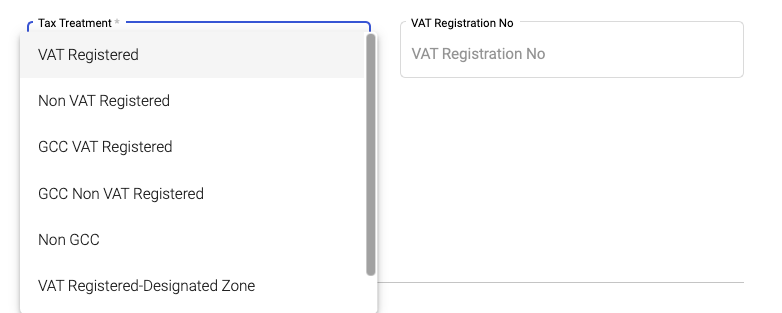

6. Contacts setup for VAT

You can also set up VAT while creating a new contact with the following fields in the contact master.

You need to select the Tax Treatment applicable for the contact from the drop down menu and depending on this you need to fill in the 15 digit VAT registration number.

The details for these fields are as follows:

- When the user selects VAT Registered, GCC VAT Registered, VAT Registered -Designated Zone then the VAT Registration No field will appear where mandatory you need to fill in 15 digit VAT no

- When the user selects Non VAT Registered, GCC Non VAT Registered, Non GCC & Non VAT Registered - Designated Zone then the VAT Registration No files will not appear.

These tax treatments will automatically be populated when you select the contact in sales and purchase documents.