If you are a registered taxable person in Malaysia, you are required to prepare and file the SST-02 Report. To view this report, go to the Report tab on the sidebar menu and select the SST-02 Report under the Tax section.

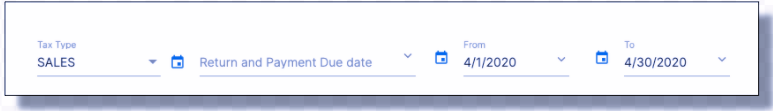

Deskera Books users can filter the report based on the tax type, return and payment due date, and the date range. The report will be generated based on your filter.

Part A

Under the Part-A of SST-02 Report, you will have to fill in the details such as your:

- SST Registration Numbers

- Name of Registered Manufacturer/Registered Person

- Taxable Period

- Taxable Period Due Date

However, this part is not covered in Deskera Books.

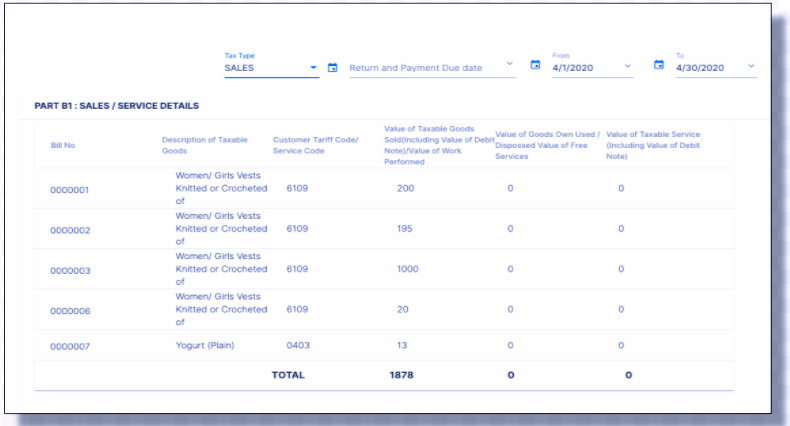

Part B1

Under section B1, you’ll come across the invoice document number, tariff code of the products, the value of taxable goods sold, the value of goods for own use, and the value of taxable services. The amount in each column is auto-populated based on the invoices you have created in the Sell tab.

Part B2

The line item on Part B2 is auto-populated based on the business activities you have performed on Deskera Books. Below are the explanations of each line item in the SST-02 Report:

- Line 11 - The total value of tax payable as per tax rate: The information here is auto-populated based on the information declared on Part B1.

- Line 12 - Total value of Tax Payable: The value of tax payable in Malaysian currency (RM).

- Line 13 - Amount of Tax Deducted from Credit Note/ Contra Tax: The amount of tax deducted from credit note or contra tax in Malaysian currency (RM).

- Line 14 - Total Tax Payable Before Penalty Imposed: The total amount of tax payable before penalty (Line 12 - Line 13).

- Line 15 - Penalty Rate/ Penalty Amount: This is generated by the government portal based on the number of days delayed in submitting the returns and payment.

- Line 16 - Total of Tax Payable Inclusive Penalty: This is generated by the government portal (Line 14 + Line 15).

Part D: Sales/ Services Exempted From Tax

- Line 18: Sales of Taxable Goods Exempted From tax under Sales Tax (Goods Exempted From Sales Tax) Order 2018: The total value of sales tax exempted from tax in the Export/Special Area/ Designated Area and local sales exempted under Schedule A, B, and C.

Part E: Purchase Under Schedule C, Sales Tax (Person Exempted From Payment of Sales Tax) Order 2018

- Line 19 - Item 1 and Item 2 (Purchase / Importation of Raw Material Exempted from Sales Tax): The amount of purchase and importation of raw material exempted from sales tax in Malaysian currency (RM).

- Line 20 - Item 3 and Item 4 (Purchase/ Importation of Raw Material on behalf Registered Manufacturer Exempted from Sales Tax): The amount of purchase and importation on behalf of registered manufacturer exempted from sales tax in Malaysian currency (RM).

- Line 21 - Item 5: The value of work performed exempted from the sales tax in Malaysian currency (RM).

Part F

Under Section F, fill in the details as stated below:

- Date of Declaration

- Name of Declarant

- Identity Card/ Passport Number

- Designation of Declarant

- Telephone Number

Once you have generated the SST-02 Report, you will have to file the report manually by posting it to the Customs Processing Center (CPC) or submit the report via MySST Portal. Do note that the SST-02 Report should be furnished even though there is no tax to be paid (NIL Return).