Reverse Charge Mechanism (RCM) under VAT eliminates the responsibility for the businesses outside the UAE to register for VAT in UAE. The reverse charge mechanism under VAT is mainly used for transactions from cross the border.

In a typical business, the supplier supplies goods to the customers and collects VAT from the customers,which is later paid to the Federal Tax Authority (FTA).

Under the reverse charge mechanism (RCM), the supplier does not charge VAT to the customer, the buyer or end customer pays the tax directly to the government authority.

If the supplier is from outside the country and does not have a business in the UAE, the VAT is not implemented on the businesses who are not in the UAE.

Hence, recipients who are residents of the UAE and receiving goods from the supplier who is not in the UAE are made to pay VAT on a reverse charge basis.

List of scenarios where reverse charge is applicable

- Import of goods/services from other GCC and non-GCC countries. The supplier of these goods/services must be located in another country and they may or may not have a business in the UAE.

- Purchase of goods from a designated zone

- Supply of gold and diamonds

- Purchase of gold and diamonds for resale or further production/manufacture

- Supply of hydrocarbons for resale by a registered supplier to a registered recipient in the UAE

- Supply of crude/refined oil by a registered supplier to a registered recipient in the UAE

- Supply of processed/unprocessed natural gas by a registered supplier to a registered recipient in the UAE

- Production and distribution of any form of energy supplied by a registered supplier to a registered recipient in the UAE

How to apply RCM on Deskera Books?

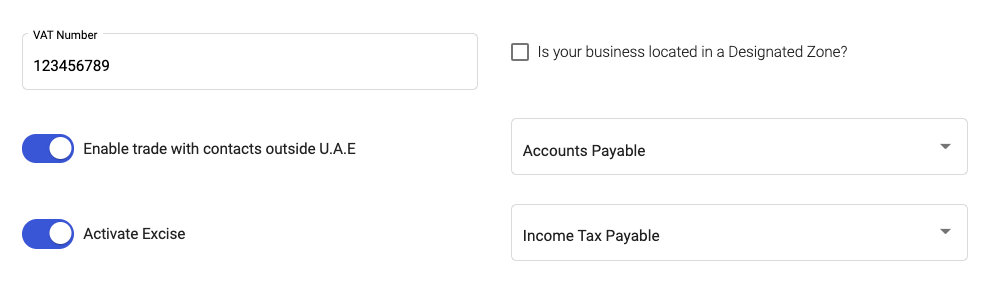

- Click on setting on the left side bar menu.

- Select company option and under VAT details you have an option to enable RCM in the system by ticking on the checkbox “Enable trade with contacts outside U.A.E"

- This option will help you to do your business with other GCC/Non-GCC countries and also for reverse charge handling.

- When a user activates this option then a checkbox in purchase transaction(Bills) for the contact registered only with the tax treatment type selected as Non VAT Registered-Designated Zone, Non GCC, GCC Non VAT Register & GCC VAT Registered selected.

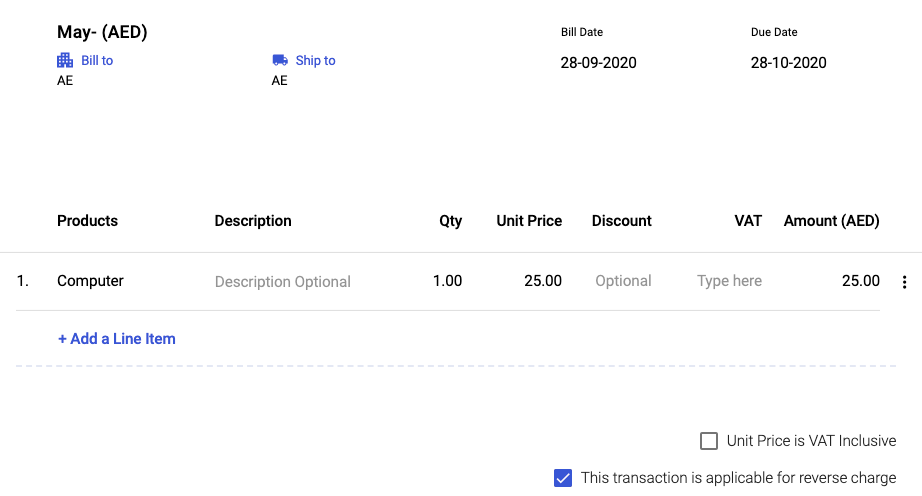

- Tick on the checkbox “This transaction is applicable for reverse charge”.

6. Similarly creating a bill, when you select the contact which is registered under Non VAT Registered and VAT Registered-Designated Zone then the Tax column will be freezed and Tax will not be applicable.There will not be any RCM checkbox available.

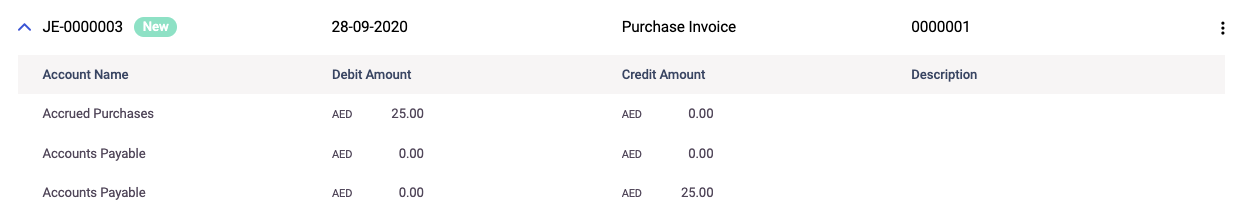

7. The separate JE for this transaction will be passed with RCM calculation.

8. While creating the sales transactions when you select the contact registered under Tax Treatment type as VAT Registered, Non VAT Registered, VAT Registered - Designated Zone and Non VAT Registered - Designated Zone then calculate tax is calculated as per normal procedure.

9. When you select the contact registers under Tax treatment type as Non-GCC, GCC VAT Registered & GCC Non-VAT Registered then only Zero rated tax will be applicable because this will be treated as an Export transaction.