This section will guide you to set up the new payroll earnings and, deductions components for India.

With Deskera People, you have pre-defined earning payroll components set and you can also add earning and deduction components of your own.

Lets get to know more about the payroll components in detail,

Pre-defined Payroll Components in Deskera People

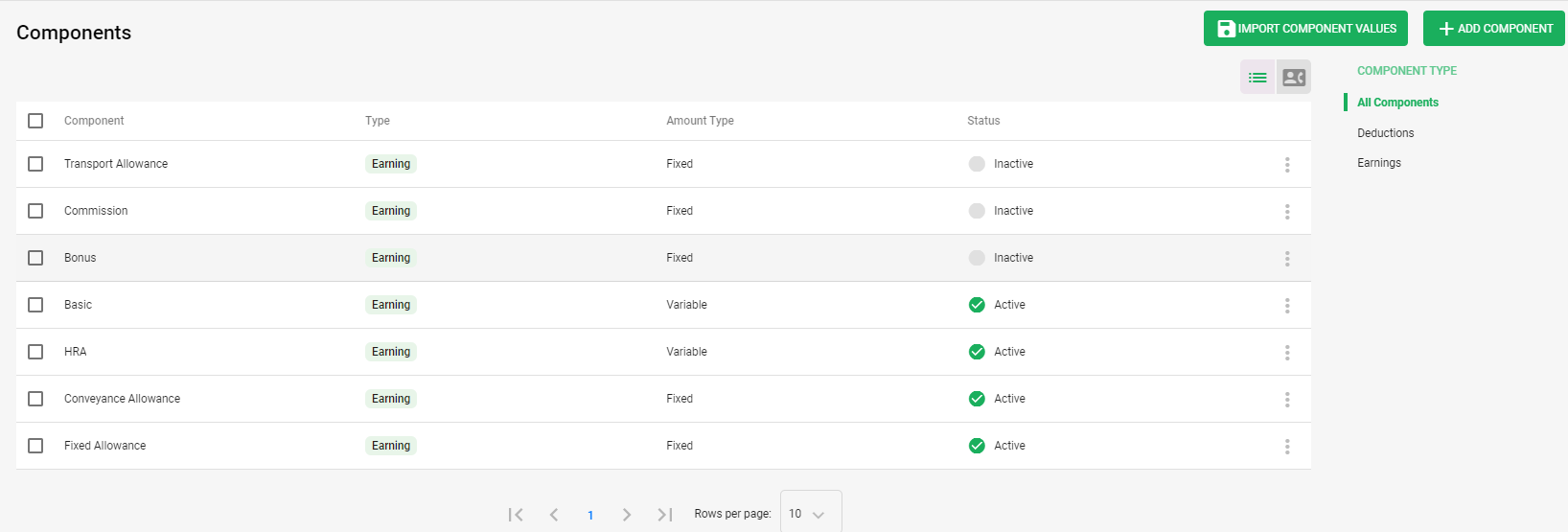

On the main side-bar menu click on the Components Module. A screen will appear where you can already see the pre-defined India payroll Earning Components set in the system.

- These components(Transport Allowance, Commission, Bonus, Basic, HRA, Conveyance Allowance, Fixed Allowance) will be set by default to all the employees.

- As these components are pre-defined, under the status column for default component, Basic, HRA, Conveyance Allowance and Fixed Allowance the status will remain Active and cannot make these components as inactive.

- However, the default component, such as, Transport Allowance, Commission, Bonus, status can be either changed to Active/Inactive.

Edit/Delete Pre-defined component

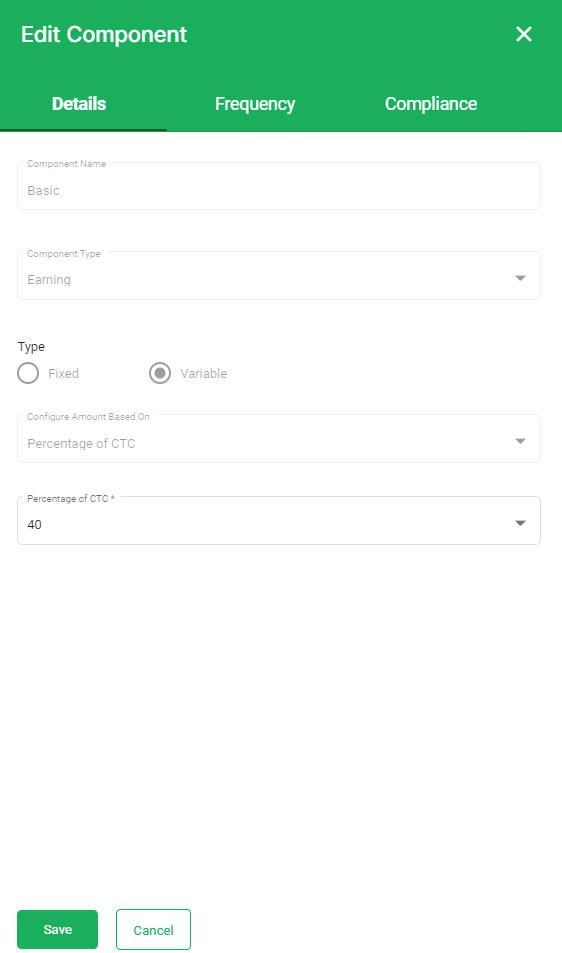

To edit the pre-defined components, select any of these components, then click on the Edit option and and window will pop up where you can make the below changes,

- Under Details Tab, you can edit, only the Percentage of CTC

- Under Frequency Tab you can change the frequency applicable

- And, under the compliance you can tick or untick the earning component if applicable to EPF or ESI or both or is a Tax Exempt component.

Lastly click on the save button to make this changes visible in the system

Unfortunately, you cannot delete the pre-defined earning components from the system.

How to add earning components in Deskera People?

Payroll earning component means an additional income from the employees gross pay salary.

With Deskera People you can add the payroll earning component for India employees at any time, before processing the payroll.

Follow the simple few steps to do so,

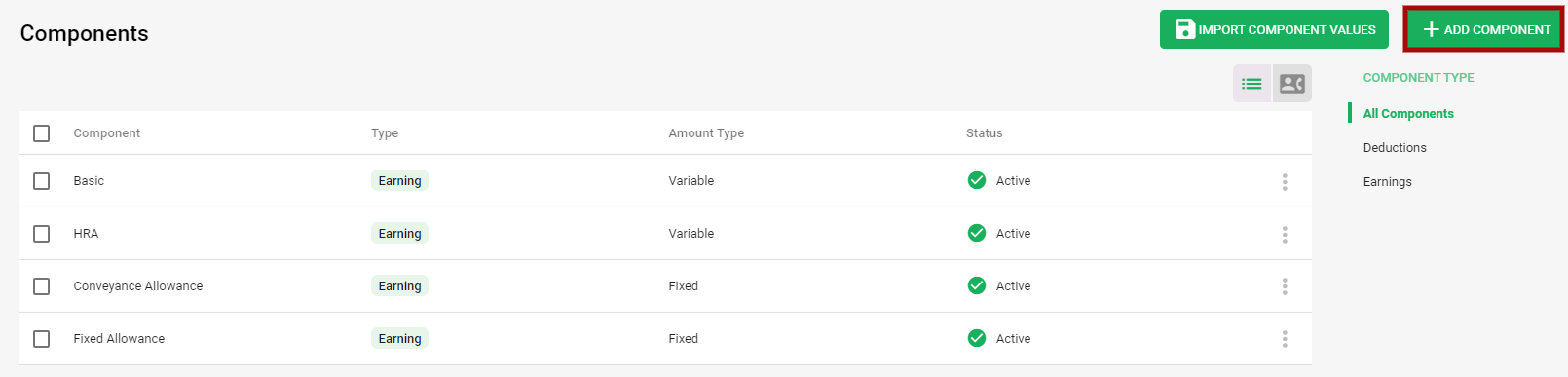

- Click on Component Module, below screen will appear,

2. To add a new earning component, click on +Add Component button and a window will pop up where you need to fill in the following information,

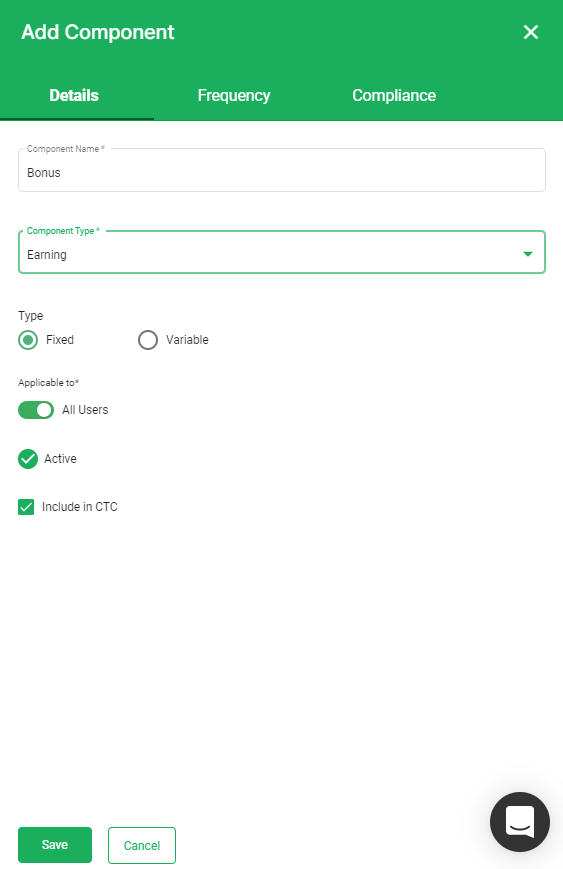

3. Under Details Tab Section:

- Component Name: Add the component name

- Component Type: Select the component type Earnings from the drop-down menu.

- Type - Select the component type if, Fixed or Variable

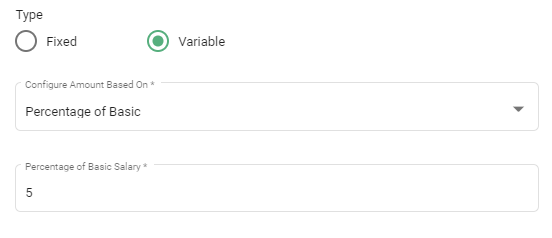

- Incase you select the component type as variable you need to fill in additional fields as mentioned below,

a). Configure Amount Based On - Select the option from the drop down menu.

b). Percentage of Basic Salary - Enter the percentage applicable for the component on basic pay.

- Applicable to: Under this, the Admin User has an option to select if this new component is applicable to all users or any particular user only.

- Active: Tick if the component is active or inactive

- Include in CTC - Tick/untick on the checkbox if the added earning component is inside CTC limit

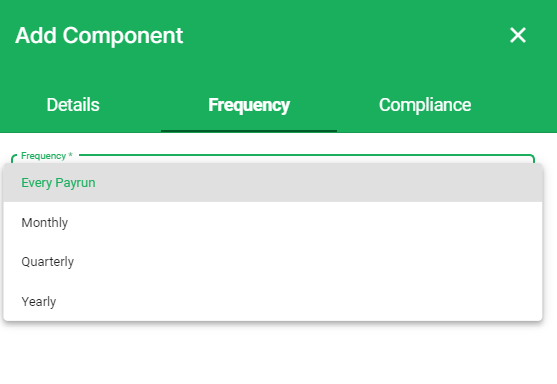

4. Under Frequency Tab,

- Select the Frequency option if the component has to be used during Every Payrun/Monthly/Quarterly/Yearly.

- If Frequency is selected as Monthly/ Quarterly you need to fill in below additional information,

a). Months - Select the months from drop down list

b). When - Select the options (start of month / end of month)

- If frequency is selected as Yearly you need to fill in additional below details,

C). When - Select the options (start of month / end of month)

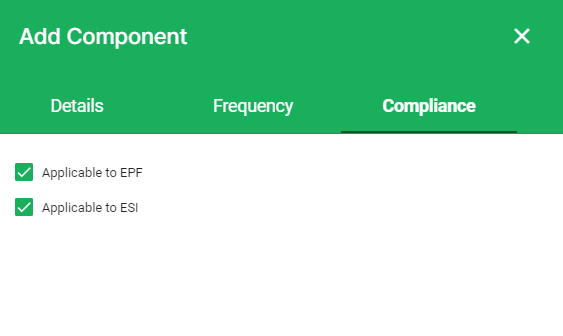

5. Under Compliance Details,

Here, you can tick or untick the earning component if applicable to EPF or ESI or both. This will add the earning component amount in EPF and ESI calculation.

How to add deduction components in Deskera People?

Similarly, you can also add Payroll deduction component in the system which means that is taken from an employee's pay.

Follow the simple steps mentioned below,

- Click on the Component Module>> a screen will appear

- Click on + Add new component button>> a window will pop up where you need to fill in the following information

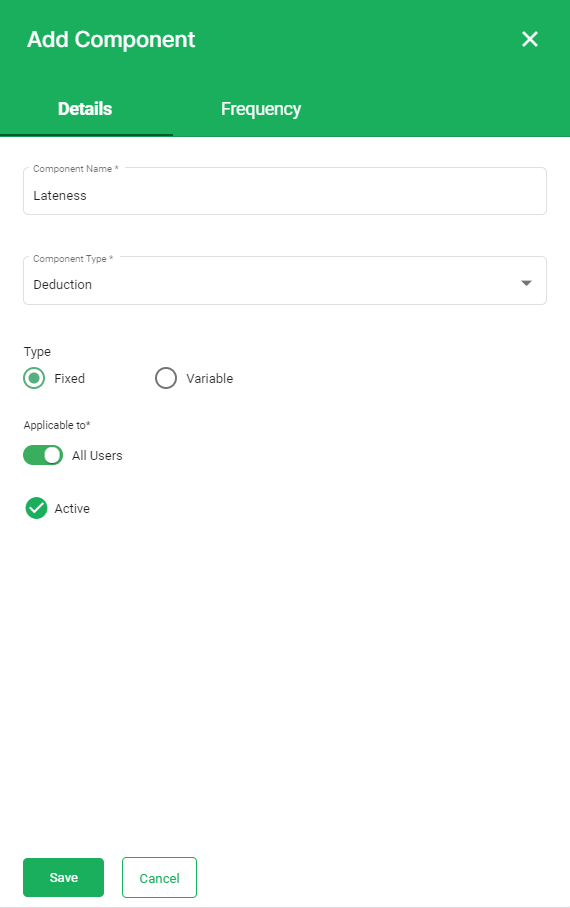

3. Under Details Tab

- Component Name - Add deduction component name

- Component Type - Select the component type as Deduction

- Type - Select the component type if, Fixed or Variable

- Applicable to: Under this, the Admin User has an option to select if this new component is applicable to all users or any particular user only.

- Active: Tick if the component is active or inactive

4. Under Frequency Tab, you need set the component frequency same as earning components.

After you have filled in the details for earning and deduction components, click on the save button, and the components will be visible on the main component dashboard.

Edit/Delete earning and Deduction components,

As seen above the edit component option for pre-defined components, in the same way you need to edit the payroll components for newly added earning and deduction components.

For newly added earning and deduction components, you also have an option to delete it entirely from the system, else if you want to keep these components in the system and use them later, then under the status column, you can make the component as inactive by simply clicking in Active checkbox.

Import Component

Now you also have an option to bulk import the component by clicking on the Import Component Values via excel sheet and map them accordingly in the system.

Congratulations! You have successfully learned how to add a new component to the Deskera People.