In the previous article you have seen how to add company details and company tax details. Now let us see how to add employees compliance details using Deskera People.

- After entering the Employee Details and Components, click on the Next button which will take you to the next screen of Compliance Details.

Fill in the following details,

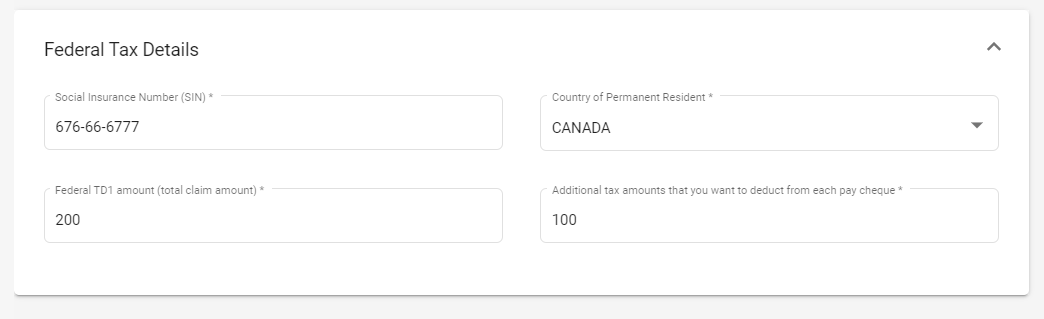

2. Under Federal Tax Details

- Social Insurance Number (SIN) - Enter your 9-Digit Social Insurance Number. A Social Insurance Number (SIN) is a form of identification that every individual residing / working in Canada must have in order to access government benefits, file income taxes and, most importantly, get paid.

- Country of Permanent Resident - Select Country of Resident from drop down list

- Federal TD1 amount(Total claim amount) - Enter your TD1 federal amount.

TD1, Personal Tax amount is used to determine the amount of tax to be deducted from an individual's employment income or other income, such as pension income. - Additional tax amount - Enter if any additional tax amounts needs to be deducted from your each pay check.

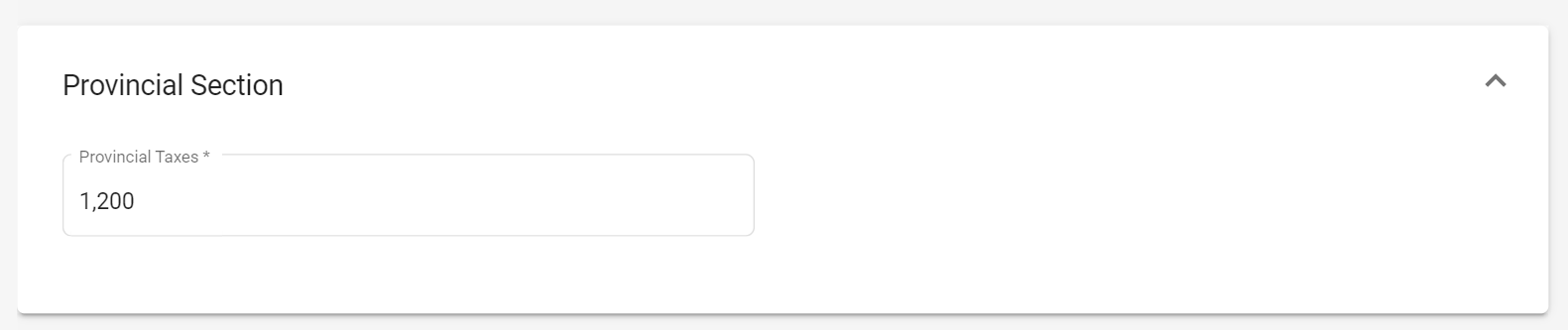

3. Under Provincial Tax

Although federal tax rates are the same across Canada, each province has its own provincial or territorial rate. For example, in Alberta, the provincial income tax rate is 10% on the first $131, 220 of income, while BC's provincial income tax rate is 5.06% on the first $40, 707.

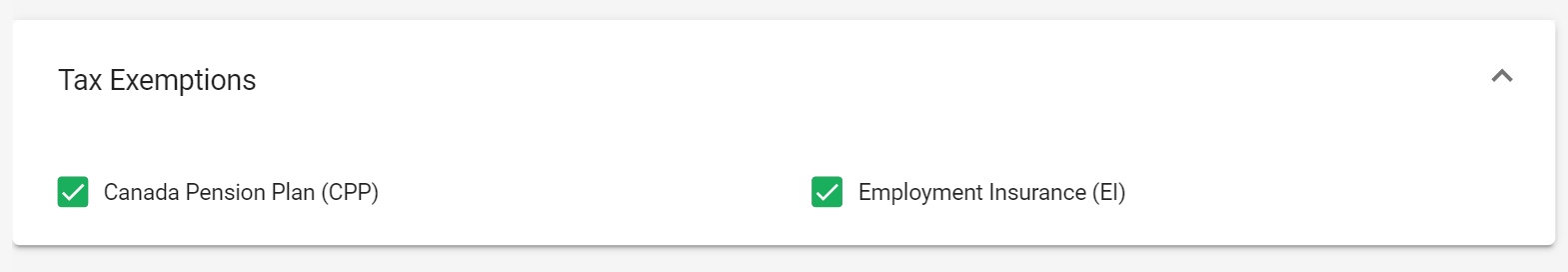

4. Under Tax Exemptions

- Canada Pension Plan - Tick if you want to exempt your tax from CPP

The Canada Pension Plan (CPP) retirement pension is a monthly, taxable benefit that replaces part of your income when you retire. If you qualify, you'll receive the CPP retirement pension for the rest of your life.

The average monthly amount is $614.21. Your situation will determine how much you'll receive up to the maximum. You can get an estimate of your monthly CPP retirement pension payments by logging into your My Service Canada Account.

- Employment Insurance (EI) - Tick if you want to exempt your tax from EI

The Employment Insurance (EI) program provides temporary income support to unemployed workers while they look for employment or to upgrade their skills. The EI program also provides special benefits to workers who take time off work due to specific life events:

- illness

- pregnancy

- caring for a newborn or newly adopted child

- a critically ill or injured person

- or a family member who is seriously ill with a significant risk of death

After all these compliance details are filed in, click on the save button to calculate the federal income tax.

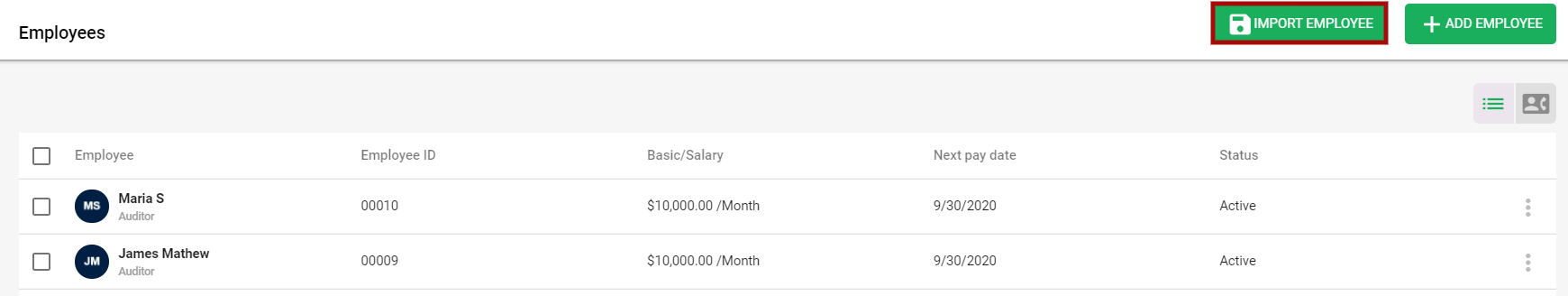

Import Employees with compliance Details

Now you have an option to Bulk Import Employees for Canada along with their compliance details.

You can do this by simply downloading the excel spreadsheet, fill in the details and upload this file. With this import function it will help you save your time.