In the previous article you have read what is form W-2.

What Is a W-3 Form?

Employers need to file Form W-3 each year to report employee wages and tax withholdings to the Social Security Administration. While an employee W-2 form shows that information for just one employee, the W-3 form combines the numbers for all of your employees in one place.

What’s the difference between Form W-2 and Form W-3?

The difference between Form W-2 and Form W-3 is the person(s) who complete the forms. Employees are required to complete Form W-2 while employers are responsible for completing Form W-3.

Employers must file both W-2 and W-3 forms with the Social Security Administration by January 31st of every year.

Who must file Form W-3?

Any employer required to file Form W-2 must also file Form W-3. Be sure to use the correct version. For example, use the 2020 version for reporting 2020 taxes, even though you may be working on the form in 2021.

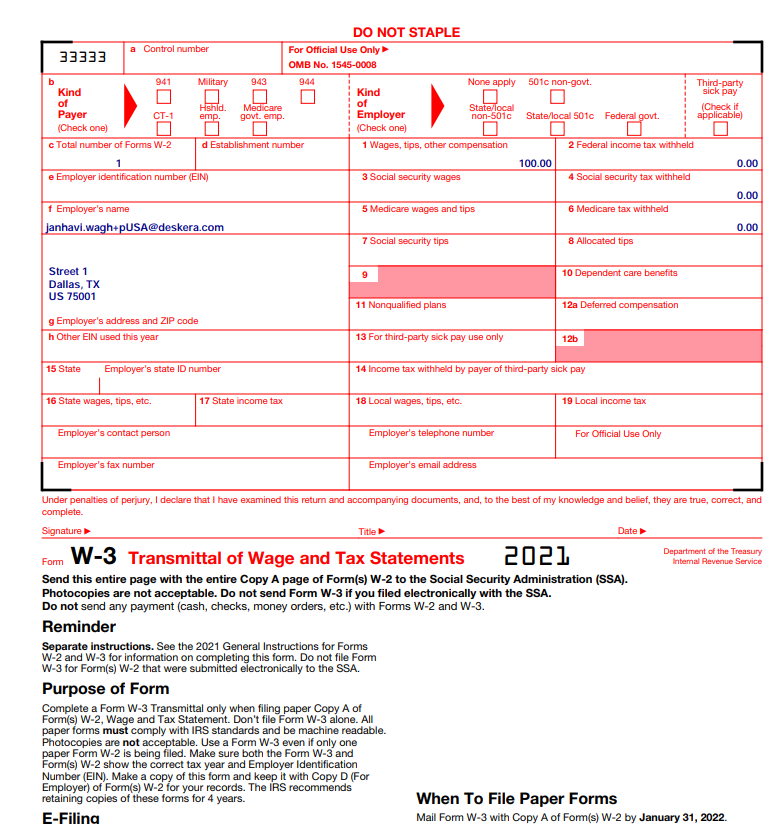

What’s included in a W-3 form?

The W-3 form essentially totals up all of the W-2 data that employers submit in an overview document. The form summarizes employer name, EIN (employer identification number), address, contact information, and other details.

The W-3 then provides a total of all the business’ employee information that includes:

- Wages, tips, and other compensation

- Allocated tips

- Wages and tips subject to social security tax

- Wages and tips subject to Medicare taxes

- Federal income tax withheld

- State income tax withheld

- Social security tax withheld

- Medicare tax withheld

- Dependent care benefits

- Deferred compensation

- Nonqualified plans

Businesses need to only file the form with the SSA, along with the corresponding W-2 forms. No payment is sent when filing the W-3.

When a W-3 Form Must Be Filed

The deadline for giving W-2 forms to employees and sending W-2 and W-3 forms to the Social Security Administration is the same date: January 31 of the year following the tax year

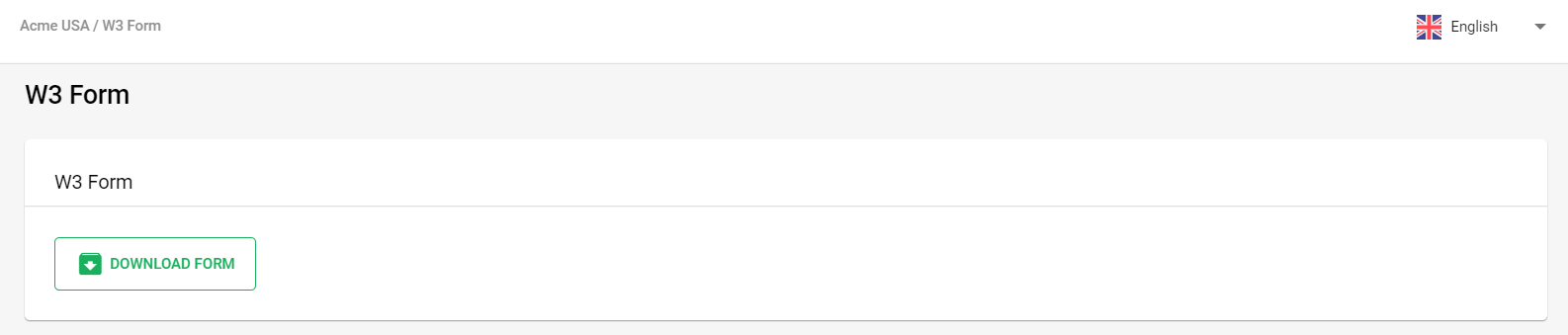

Downloading W-3 forms in Deskera People

Using Deskera People you can Download the W-3 form, following the below steps,

1. Go to the Report Tab a window under Employee withholding forms section, click on W-3 Form>> Click on the Download button for downloading this form.

2. After you download the form, below details marked in Blue will be auto-populated in the form as per the details mentioned in the system and further can be submitted to IRS.