Composition Scheme

It is a hassle-free compliance scheme for small taxpayers. In the Composition Scheme, a registered taxable person whose aggregate turnover does not exceed one crore and 75 lakhs for the special category states can pay tax at a lesser rate. The tax rates applicable under this scheme are 1% (CGST-0.5% and SGST-0.5%) of turnover in the case of manufacturers and traders,5% in the case of restaurants serving alcohol and 6% (3% CGST and 3% SGST) in case of other providers. This figure cannot be collected from the clients. Ice-cream, pan masala, and tobacco manufacturers cannot opt for composition scheme.

Also, businesses engaged in inter supply of goods cannot opt for this scheme. The primary purpose of the composition scheme is to simplify the tax procedures for small taxpayers; they are not required to keep lengthy records. Under Composition Scheme, a taxpayer should remit tax as a percentage of his turnover in a State for that particular year without the benefit of ITC.

Who are all eligible for the Composition Scheme?

As per last year's report, the limit for the turnover has been increased to 1.5 crores from 1 crore and remains the same for the unique category states, i.e., 75 lakhs. These businesses can only deal with intrastate supplies (suppliers and places of supply should be within the same state).

Advantages of Composition Scheme

- The business has to file quarterly returns, which are better than filing 3 to 4 returns per month for regular GST.

- The businesses that come under this scheme have to bear a lower tax rate.

- In place of tax invoice, businesses are required to submit the Bill of Supply, which is convenient since there are not many details required.

Disadvantages of Composition Scheme

- Businesses cannot engage in interstate supplies.

- The person/business is not permitted to collect GST.

- The person/business is not entitled to Input Credits under GST.

- The law provides for additional conditions to be prescribed.

Penal Provisions

In case it is found that the scheme is ineligible, the differential tax along with Penalty equal to the tax will be applied.

How does this apply to Deskere users?

When Deskera users are creating their organization in the Deskera Books software, you will come across this section:

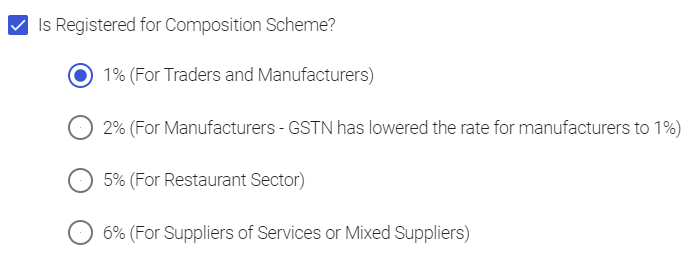

Users are allowed to tick more than one checkboxes, for any fields that apply to them. Once they tick the checkbox that they are registered for Composition Scheme, they will have to select the category of their businesses:

- 1% - For Traders and Manufacturers

- 2% - For Manufacturers: GSTIN has lowered the rate for manufacturers to 1%

- 5% - For Restaurant Sector

- 6% - For Suppliers of Services or Mixed Suppliers)