What is Form 1099-NEC?

he 1099-NEC is the new form to report nonemployee compensation—that is, pay from independent contractor jobs (also sometimes referred to as self-employment income). Examples of this include freelance work or driving for DoorDash or Uber.

Nonemployee compensation – what does that mean?

Nonemployee compensation is paid to independent contractors who aren’t employees. If that distinction doesn’t ring a bell, be sure to review the difference between employee and independent contractor work statuses.

From a tax standpoint, here’s the difference:

- Employees: Employers will take out various payroll taxes (such as federal and state taxes) from your paycheck. That withholding gives employees an automatic way to pay taxes as they go. At tax time, you receive a Form W-2 from your employer.

- Independent contractors: Your check won’t have any payroll taxes withheld. That means paying as you go falls on your to-do list. At tax time, you’ll receive Form(s) 1099-NEC to show the total amounts you were paid for the year.

Who Uses Form 1099-NEC?

All businesses must file a Form 1099-NEC form for nonemployee compensation if all four of these conditions are met:

- It is made to someone who is not your employee.

- It is made for services in the course of your trade or business.

- It was made to an individual, partnership, estate, or corporation.

- The payments made to the payee were at least $600 or more for the year.

What to Do If You Don't Receive Form 1099-NEC

Form 1099-NEC must be filed with the IRS and given to nonemployees by January 31 after the reporting year. If you're a nonemployee and haven't received your form by then, contact the company directly to request it. You will need it for your personal tax return, so it's important to get it promptly

When is the Form 1099-NEC deadline?

Not only do employers have to keep the new 1099-NEC on their radars, but they also need to mark their calendars for a new nonemployee compensation due date.

Starting in 2021, send copies of Form 1099-NEC to workers you paid nonemployee compensation to during the year by January 31 or the next business day (if it falls on a weekend).

Also file Copy A with the IRS by January 31 each year.

How to generate form 1099-NEC Using Deskera People?

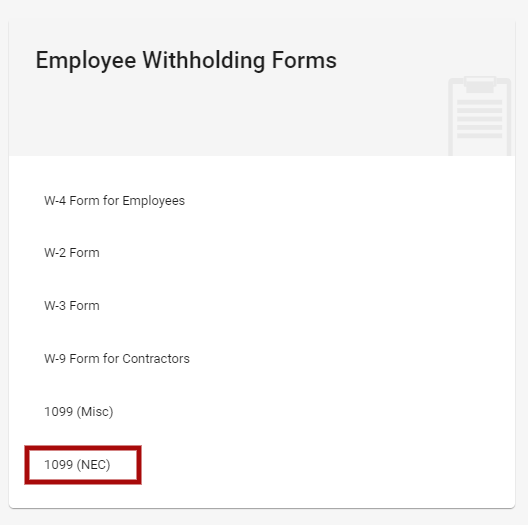

Go to reports>>under Employee withholding Forms>>click on 1099(NEC),

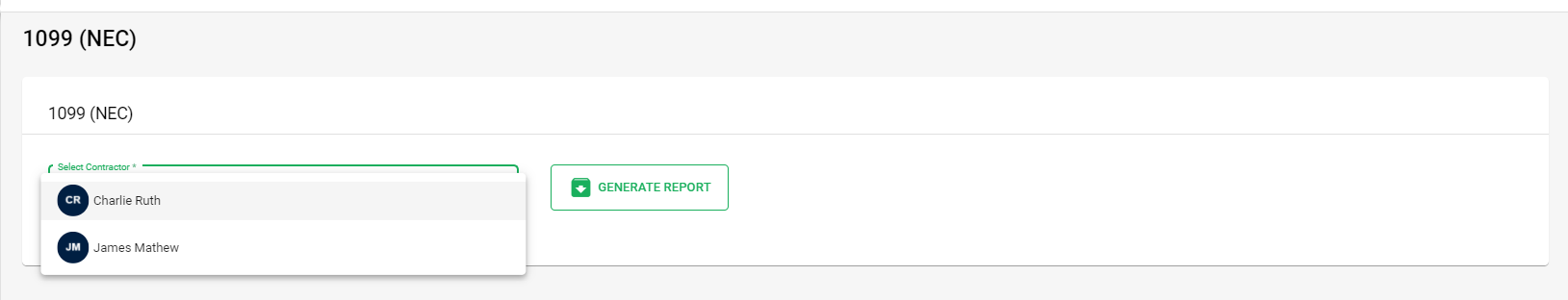

2. A below screen will appear,

- Select the contractor from the drop down list to download their 1099(NEC) form.

- To Generate the form for the selected contractor, click on Generate Report Button.

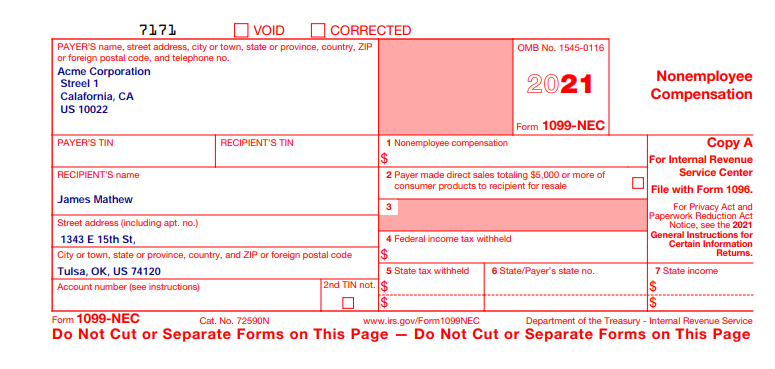

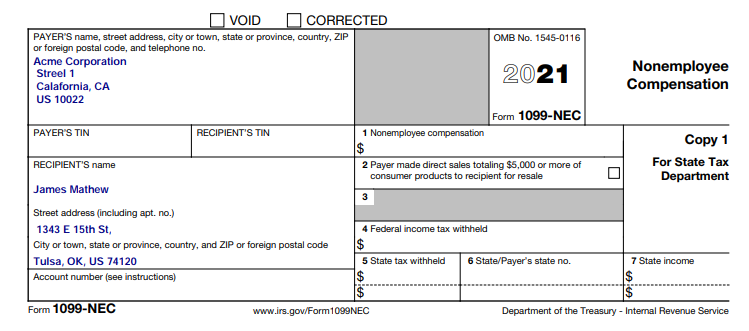

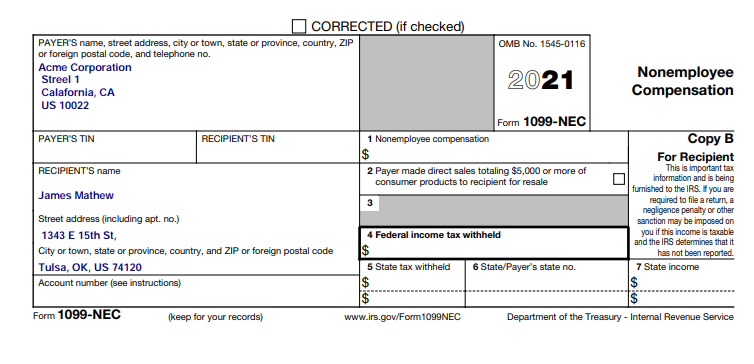

1099(NEC) form downloaded from Deskera People

After this 1099-NEC form is downloaded it can further be uploaded on IRS by January 31 every year.