For employees who have a NPWP or who do not have an NPWP, they will be subject to different deductions of Income Tax (PPh) Article 21.

Let us see below on how to calculate PPh 21 without NPWP for employees before depositing taxes in the state treasury.

What is NPWP and Its Role in Calculating PPh 21 without NPWP

Directorate General of Taxes (DGT) Taxpayer Identification Number (NPWP) is a number given by the DGT to each Taxpayer as a means of tax administration, which is used as an identity in exercising tax rights and obligations.

The role of NPWP in calculating PPh Article 21

NPWP influences the calculation of PPh 21 employees.

Of course, employees who do not have a NPWP will still be liable to pay income tax as long as they receive their salary or income.

In tax laws and regulations, individual taxpayers who have an NPWP and do not have an NPWP will be subject to different income tax obligations.

The withholding rates for Income Tax Article 21 for income recipients who do not have an NPWP are:

- For recipients of income withheld from Article 21 PPh who do not have an NPWP, they will be subject to withholding Income Tax Article 21 at a rate that is 20% higher than the rate set for Taxpayers who have an NPWP.

- (2) The amount of Article 21 PPh that must be withheld as referred to in paragraph (1) is 120% of the total PPh Article 21 which should be deducted if the person concerned has a TIN

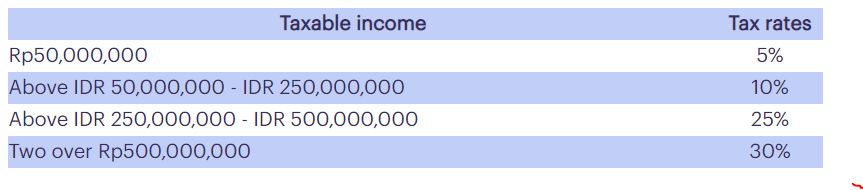

How Much is the Income Tax Rate for Employees Who Have NPWP?

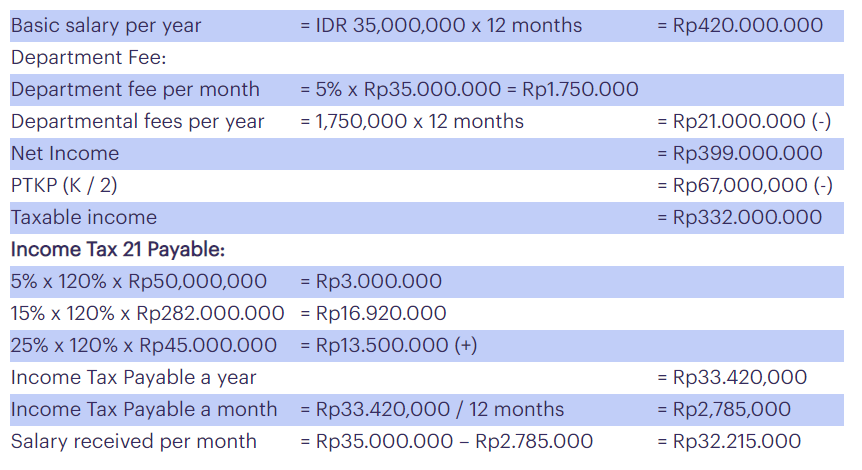

Example of calculating PPh for 21 employees who have a NPWP

Pak Kelik is an employee at PT AAA with a gross monthly income of IDR 35,000,000 . Pak Kelik is married with 2 children and has a NPWP.

So, the calculation of PPh 21 Pak Kelik is:

Example of calculating PPh 21 without NPWP for employees

Pak Kelik is married and has 2 children, works as an employee at PT BBB with a gross monthly income of IDR 35,000,000 and does not have a NPWP.

So, the calculation of PPh 21 Pak Kelik is:

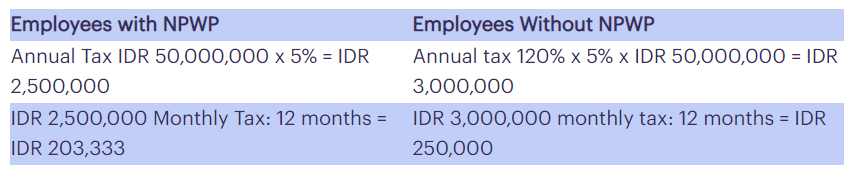

Example of Comparison of PPh 21 without NPWP and PPh 21 with NPWP

The following is a simple comparison of calculating PPh 21 Employees with NPWP and those without NPWP, with an illustration of IDR 50,000,000 Taxable Income:

How to calculate PPH21 with and without NPWP number using Deskera People?

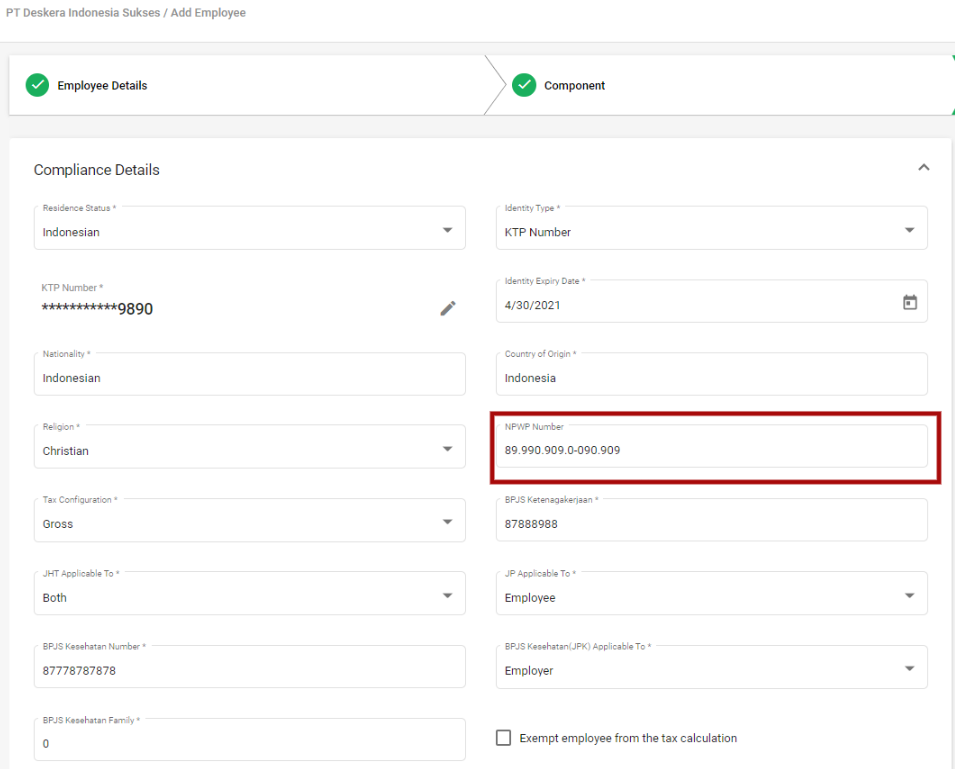

Go to Employee List>>Add/Edit Employees>>Compliance Details>>NPWP field

Deskera People will auto calculate PPH21 as per the employee holding / not holding NPWP number.