Every country has its own sales and purchases tax. To stay compliant with your country's regulations, you have to ensure that you apply the correct tax when trading locally or globally.

With Deskera Books+, you have the option to customize a new tax rate based on your country tax regulation.

Follow the steps mentioned below to create a new tax rate in the system:

- Login to your Books+ account.

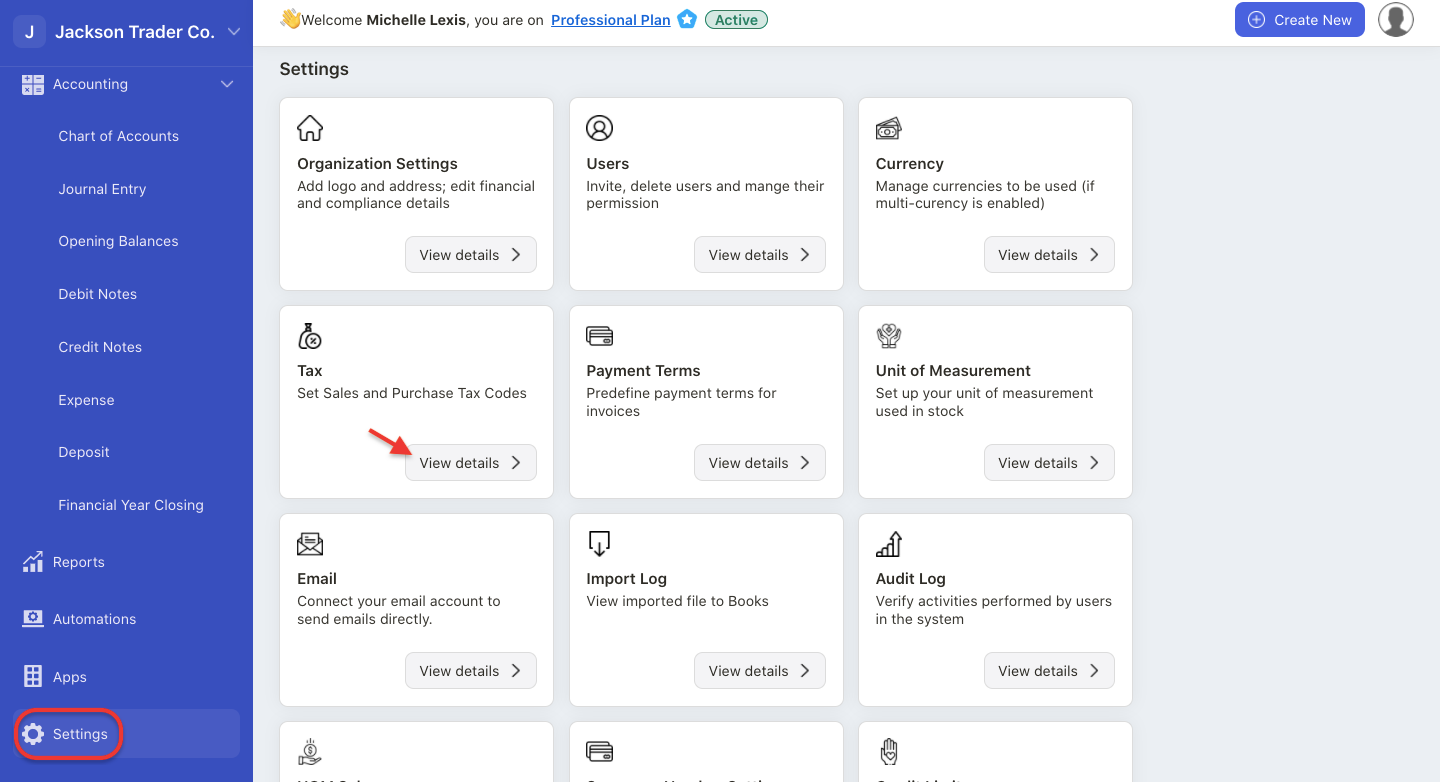

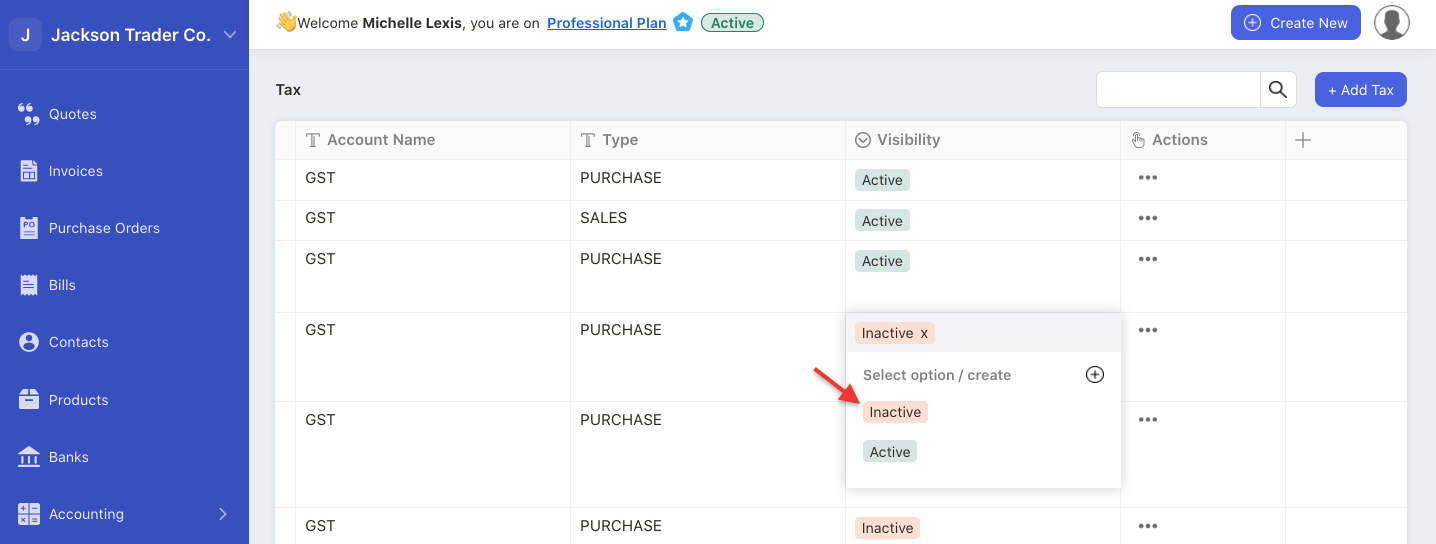

2. Click Settings > Select Tax.

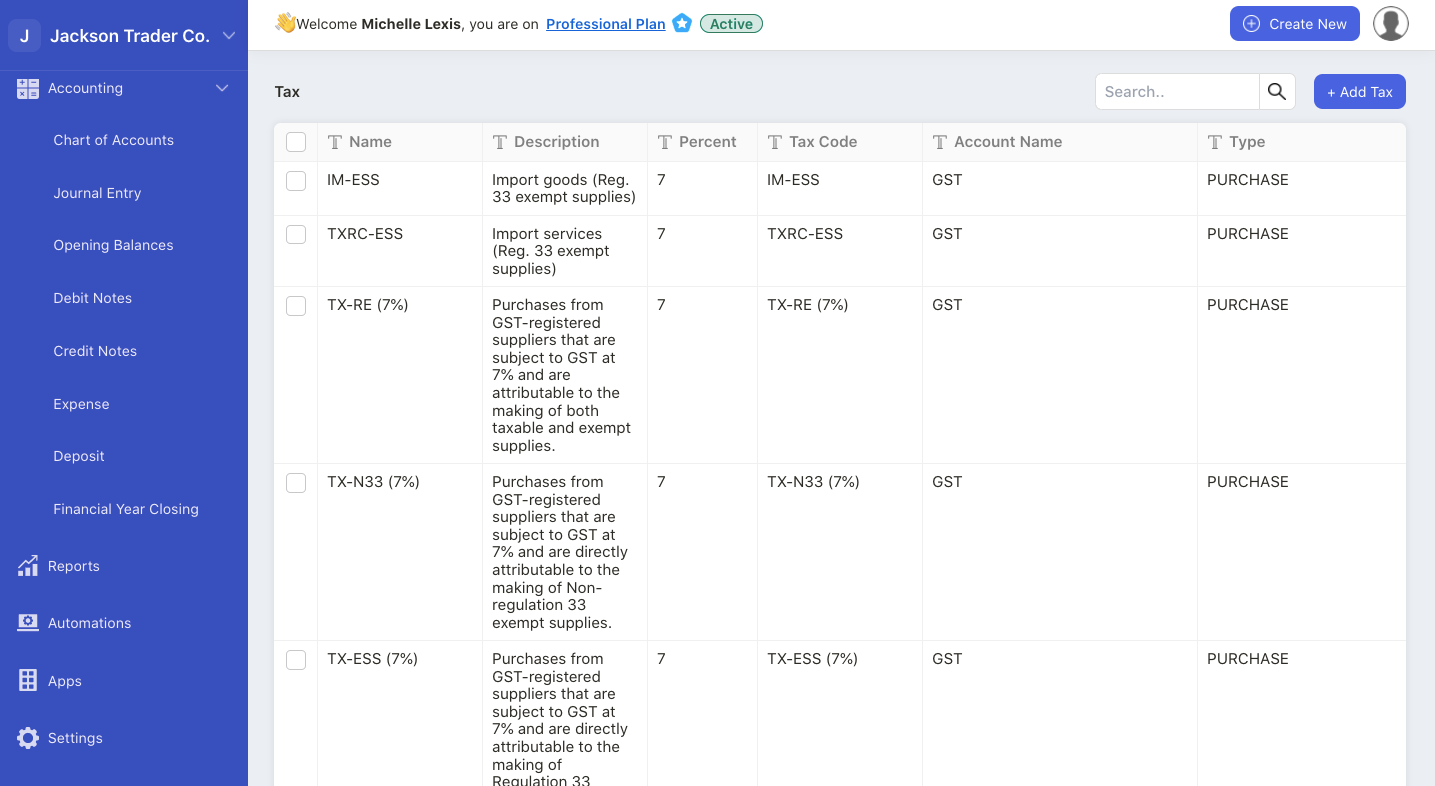

3. On this page, you should be able to view the default tax rate as per your organization country.

4. If the default tax rate is not available, you can always create a new tax rate on this page.

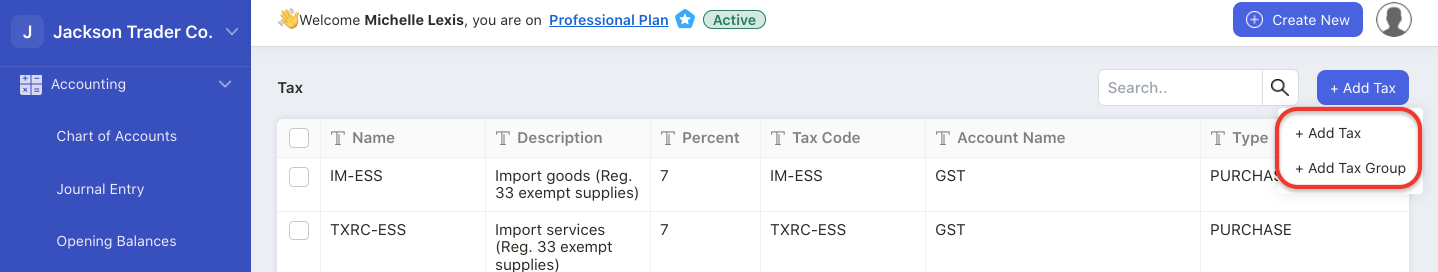

5. Click on the “+ Add Tax” button. Here you can choose to create:

- add new tax- this is an individual tax

- add new tax group- this is a combination of individual tax rate

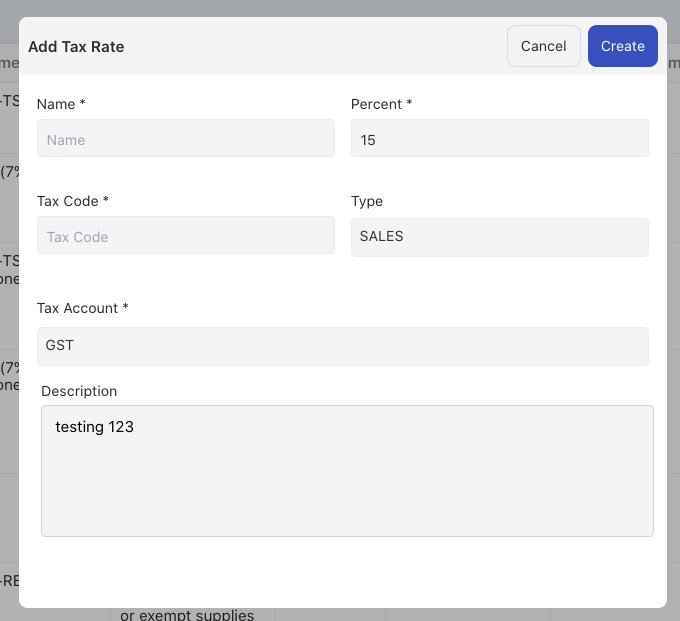

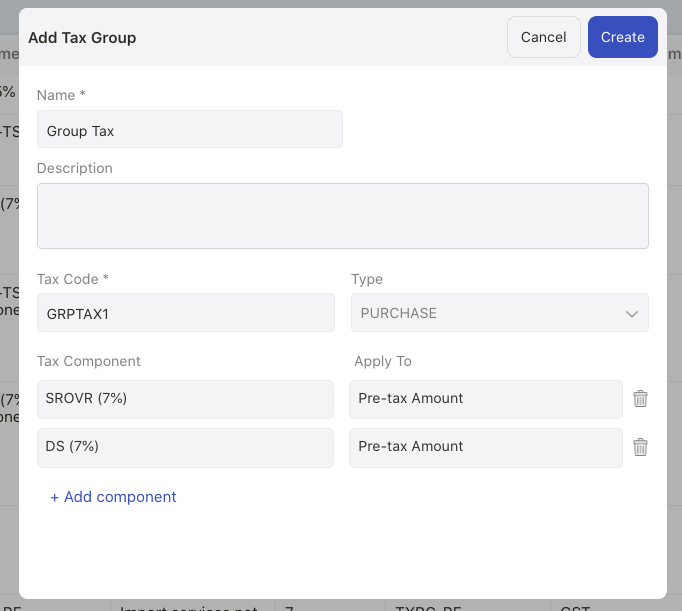

6. A pop-up menu will appear. Fill in the fields below:

- name - the name of the tax rate

- tax code - enter the tax code. this should be unique and cannot have duplicated tax code in the system

- percent - the tax rate percentage

- type - choose whether the tax rate applies for purchases, sales, or both accounts

- tax account - choose the tax account affected

- description - enter a short description for the tax created

- tax group - choose the component from the drop-down menu. you can choose whether the tax rate apply if pretax amount or after tax amount

7. Click on the create button.

8. Once you have created the new tax rate, you can apply this tax rate to your sales and purchase documents.

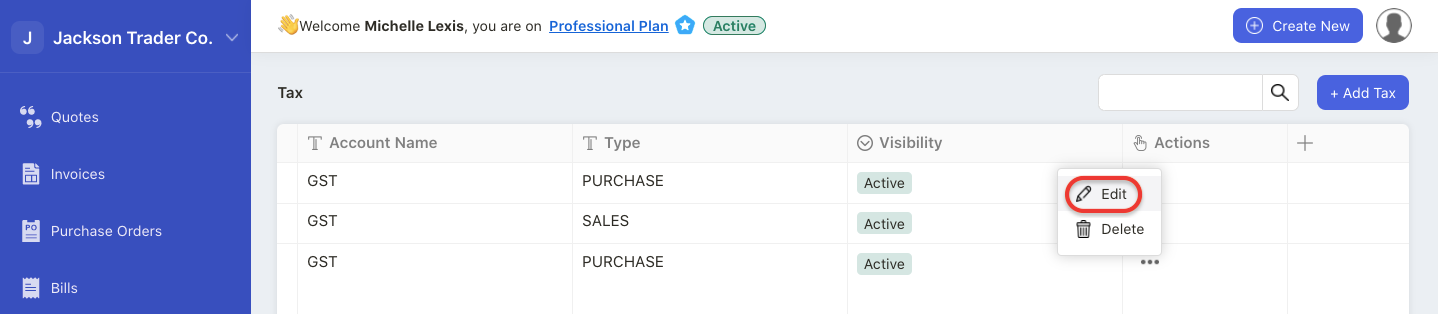

How can I edit the tax rate?

Click on the edit button under the actions column.

Select the edit button.

Updated information will appear in newly created documents only, not the documents created prior to the changes.

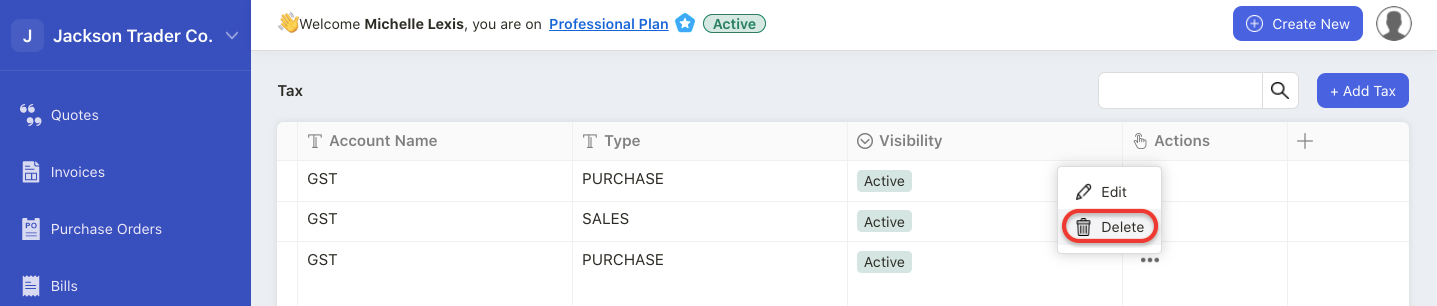

How can I delete the tax rate?

Click on the delete button under the actions column.

Select the edit button.

You cannot delete the default tax rate in the system. You can only delete the newly created tax rate.

Note: You cannot delete the tax rate if you have used this in the documents.

How can I mark the tax rate as inactive?

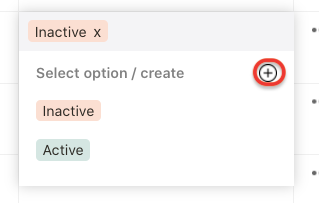

Click on active button on the visibility column.

Select the inactive button in the pop-up menu to mark the tax-rate as inactive.

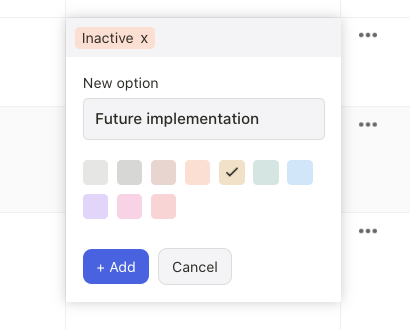

You can create a new status label by clicking on the "+" icon.

Choose the right color for the new status added and click on the add button.

Once you have marked the tax rate as inactive, then you won’t be able to view this tax rate in the drop-down menu in all modules.