This section will guide you on how to set up the new payroll components, that can either be earnings or deductions.

With Deskera People+, you have pre-defined earning payroll components set and you can also add earning and deduction components of your own.

Where to view pre-defined Payroll Components in Deskera People+?

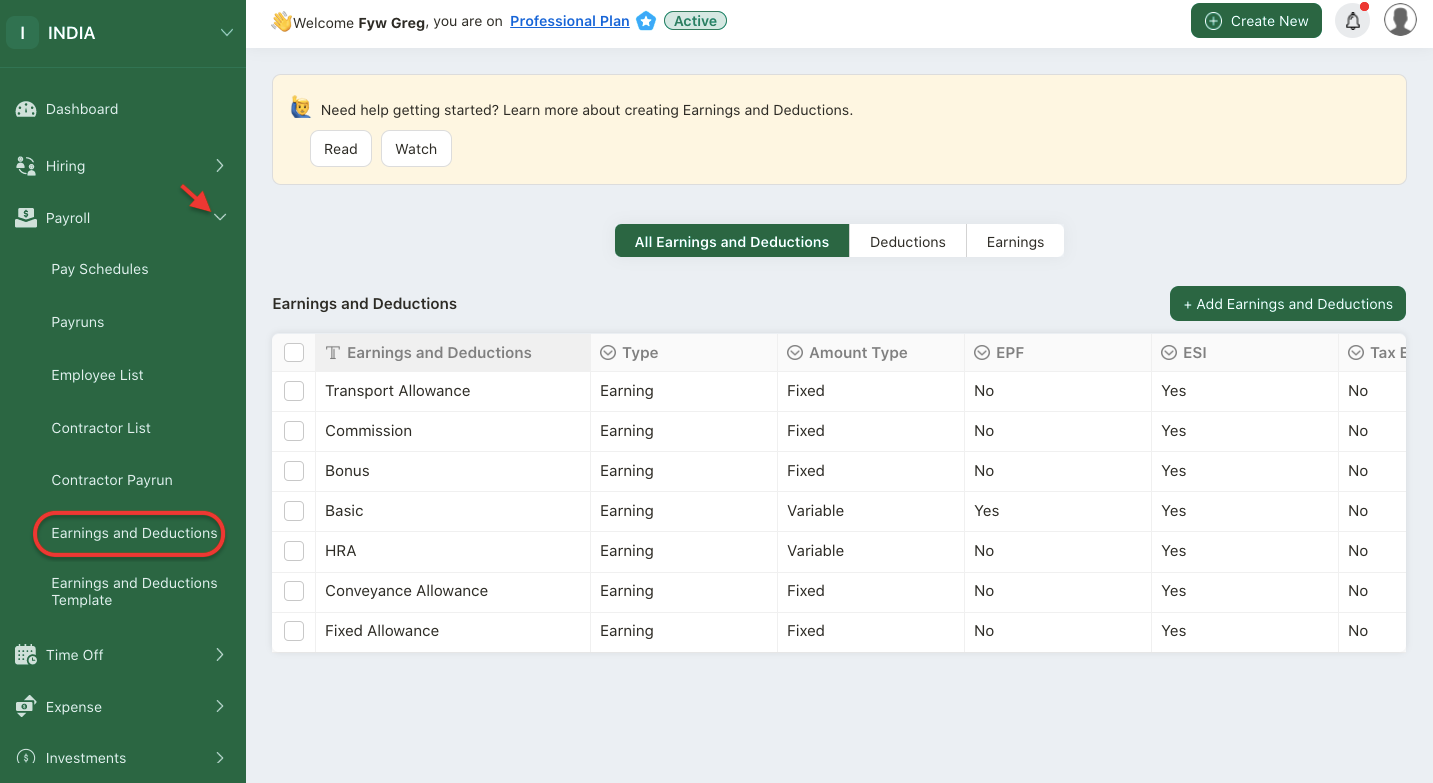

- Login to your Deskera People + Account.

2. After you have logged into your account, you can view Deskera People+ Dashboard. Click on Payroll module on the sidebar menu. Under this, select the Earnings and Deductions Module.

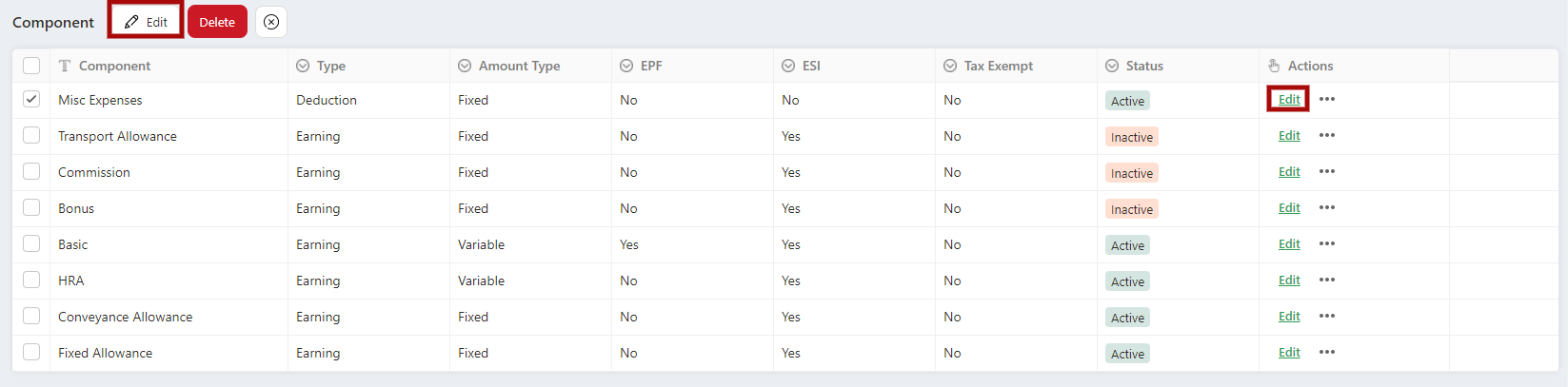

3. A screen will appear where you can view all the pre-defined Earning Components set in the system.

- These components(Transport Allowance, Commission, Bonus, Basic, HRA, Conveyance Allowance, Fixed Allowance) will be set by default to all the employees.

- As these components are pre-defined, under the status column for default component, Basic, HRA, Conveyance Allowance and Fixed Allowance the status will remain Active and cannot make these components as inactive.

- However, the default component, such as, Transport Allowance, Commission, Bonus, status can be either changed to Active/Inactive.

How to add Earning Components?

Payroll earning component means an additional income from the employees gross pay salary.

With Deskera People+ you can add the payroll earning components for employees at any time, before processing the payroll.

Follow the simple few steps to do so:

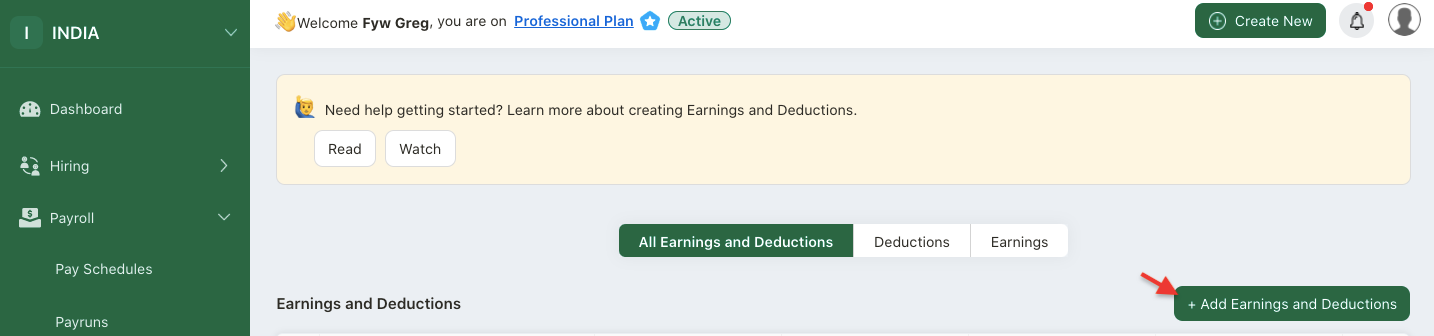

- Click on the + Add Component button , to add a new earning component in the system.

- After clicking on the +Add component button below window will pop up where you need to fill in the required information for creating the a new component.

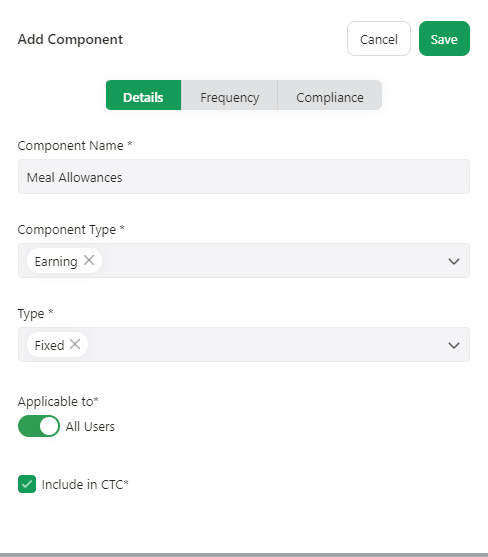

3. Under Details Tab, fill in the fields in the pop-up box:

- Component Name: Add the earning component name

- Component Type: Select the component type Earnings from the drop-down menu.

- Type: Select the component type if, Fixed or Variable

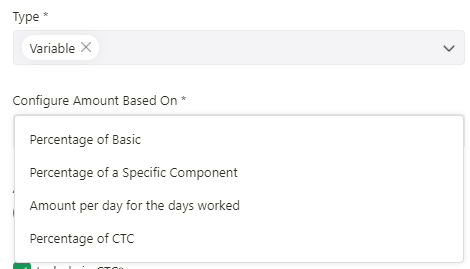

- If you select the component type as variable, you need to fill in additional "Configure Amount Based On" field as per image below. Select the option from the drop down menu.

- Applicable to: Under this, the Admin User has an option to select if this new component is applicable to all users or any particular user only.

- Include in CTC: Tick/untick on the checkbox if the added earning component is inside CTC limit.

4. Click on the Frequency Tab. Fill in the fields in this tab;

- Select the Frequency option if the component has to be used during Every Payrun/Monthly/Quarterly/Yearly/Custom Date.

- If Frequency is selected as Monthly/ Quarterly you need to fill in below additional information,

a) Month - Select the months from drop down list

b) When - Select the options (start of month / end of month)

- If frequency is selected as Yearly you need to fill in additional below details,

c) When - Select the options (start of month / end of month)

d) If frequency is selected as Custom date you need to fill in additional below details;

- Custom date - Select the date from the calendar

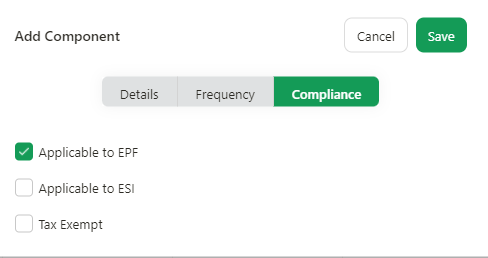

5. Next, click on the compliance tab. Enable the checkboxes here, if applicable;

- Under this tab, you can tick or untick the earning component if applicable to EPF or ESI or Tax Exempt. This will add the earning component amount in EPF and ESI calculation.

How to add deduction components?

Similarly, you can also add payroll deduction component in the system which means that is taken from an employee's pay.

Follow the simple steps mentioned below,

- Click on the + Add Component button , to add a new deduction component in the system.

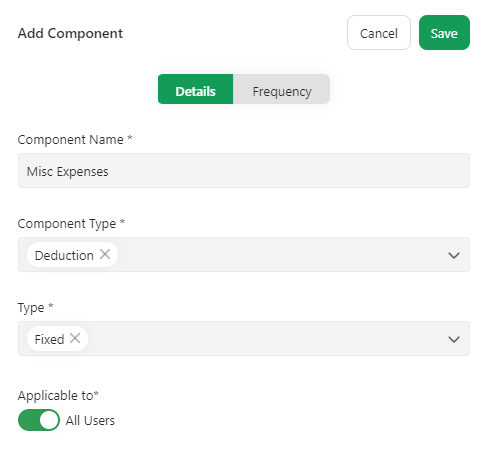

- After clicking on the +Add component button below window will pop up where you need to fill in the required information for creating the a new component

3. Under Details Tab, fill in the fields below;

- Component Name: Add deduction component name

- Component Type: Select the component type as Deduction

- Type: Select the component type if, Fixed or Variable

- Applicable to: Under this, the Admin User has an option to select if this new component is applicable to all users or any particular user only.

4. Under Frequency Tab, you need set the component frequency same as earning components.

5. After you have filled in the details for earning and deduction components, click on the save button, and the added components will be visible on the main component dashboard.

How to edit and delete Earning and Deduction components?

Now let us see how can you edit, delete the components in the system.

Edit Component details

- Select the Components from the list, you wish to make the changes. Then by clicking on the Edit button available on top left or under Actions Column, the component details editable screen will appear and you can make the required changes. Save it to get the changes reflected further in the system.

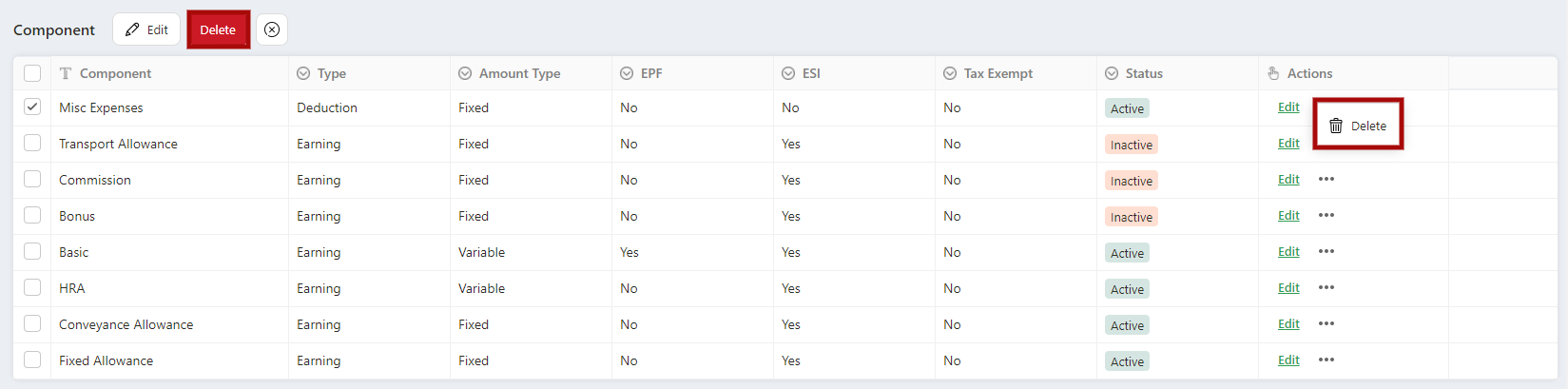

Delete Component Details

If you wish to remove the components from the system, select the component, click on the Delete icon located on the left side of the screen or by clicking on the three horizontal dots, you can delete the selected component from the system.