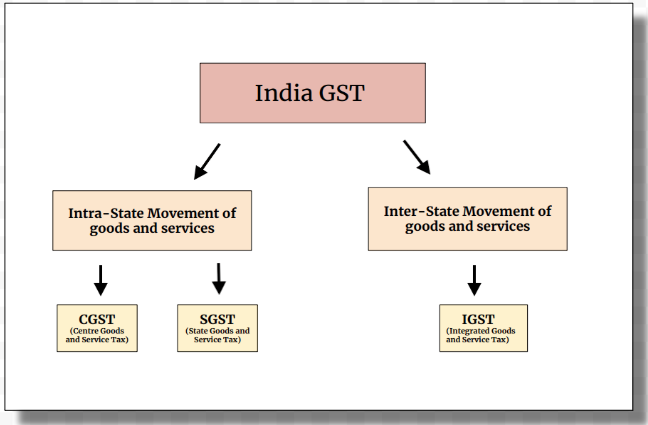

As we know that the GST is a destination-based tax, so the computation of GST will be different depending on the place of supply. There are three components in GST that are crucial for the computation of GST and they are IGST, CGST, and SGST.

For any intra-state transaction, it will attract SGST and CGST tax rate whereas any interstate transaction businesses will attract the IGST tax rate.

What is the Intra-State Supply (CGST+SGST)?

Intra-State Supply refers to the supply of goods and services where the location of the supplier and the place of supply of goods and services are in the same place or the same Union territory. Hence, both the supplier and the recipient of goods are in the same state.

However, in the scenario where the supply is not considered as intra-state supply and it includes:

- The supply of goods or services by an SEZ developer

- Goods that are imported into the territory of India

- The supplier made for the foreign tourist leaving India

The following tax is applicable in the case of Intra-State Supply are CGST and SGST. If a seller is selling their products in the Intra-state region, they are required to collect CGST and SGST from the buyers. Once they have collected the GST, the portion collected under the CGST rate will be deposited back to the Central Government whereas the SGST rate will be deposited to the State Government.

For Example:

ABC Enterprise sells mobile phones from Mumbai to Pune. The cost of the mobile phone is ₹10,000. It has a GST rate of 12%.ABC Enterprise will charge a 6% SGST (₹600) and 6% CGST (₹600) since it is a supply of goods within the same state. So the total GST will be ₹1200. The CGST part will go to the Central Government and the SGST part will go to the State Government at the time of paying taxes.

What is the Inter-State Supply (IGST)?

Inter-State Supply refers to the supply of goods and services where the location of the supplier and the place of supply are in different states, two different union territories or in a state and a union territory. Here both the supplier and the recipient are in two different states or union territories. Additionally, any supply in a taxable territory, that is not an Intra-State supply is considered to be an Inter-State supply. Some of the supplies like supplies to or by Special Economic Zones, goods or services imported to India, services or goods exported outside India, the supply of goods and services to international tourists are all treated as Inter-State Supply.

The following tax is applicable in the case of Inter-State Supply is known as IGST. Integrated Goods and Services Tax (IGST) is a tax levied in the case when the supply of goods and services are in two different states or union territories. Paying taxes becomes much easier in case of IGST because when it comes to filing returns, you only need to pay IGST and the amount goes to the central government which keeps one half and sends the other half to the state where the buyer lives.

For Example:

BNA Enterprise is supplying mobile phones from Mumbai to Bangalore. The cost of the mobile phone is ₹10,000.BNA Enterprise will charge IGST 12% (₹1200) since the supply of goods is in two different states. At the time of filing return, the enterprise only needs to report and pay IGST. The Central Government will keep half and send the second half to the buyer in another state.