For businesses in India, managing payroll is a challenging task because of the various statutory compliances.

Many Small businesses in India manage their payroll tasks through spreadsheets, which seem easy to work with. However, this means that every time a new budget announcement is made or a salary revision is processed, someone has to manually change the formulas to ensure that the right deductions will be made and no other dependent inputs will be altered. This is a tedious task especially if you have to do it often.

This is where Deskera People comes to a picture that helps businesses get more efficient. It also ensure accuracy in computations and deductions, and can also adapt easily during any tax laws changes and payroll inputs. This helps you to maintain a neat statutory record at all times.

Deskera People has recently rolled out India Compliance, so lets take a sneak peak as how it works.

How to fill in India Payroll Onboarding details after signing in to Deskera People?

After you have successfully sign up your account with Deskera People, the next step during onboarding is, you need to fill in your company details, Schedule Pay , Add Employees.

How do I set up my company details?

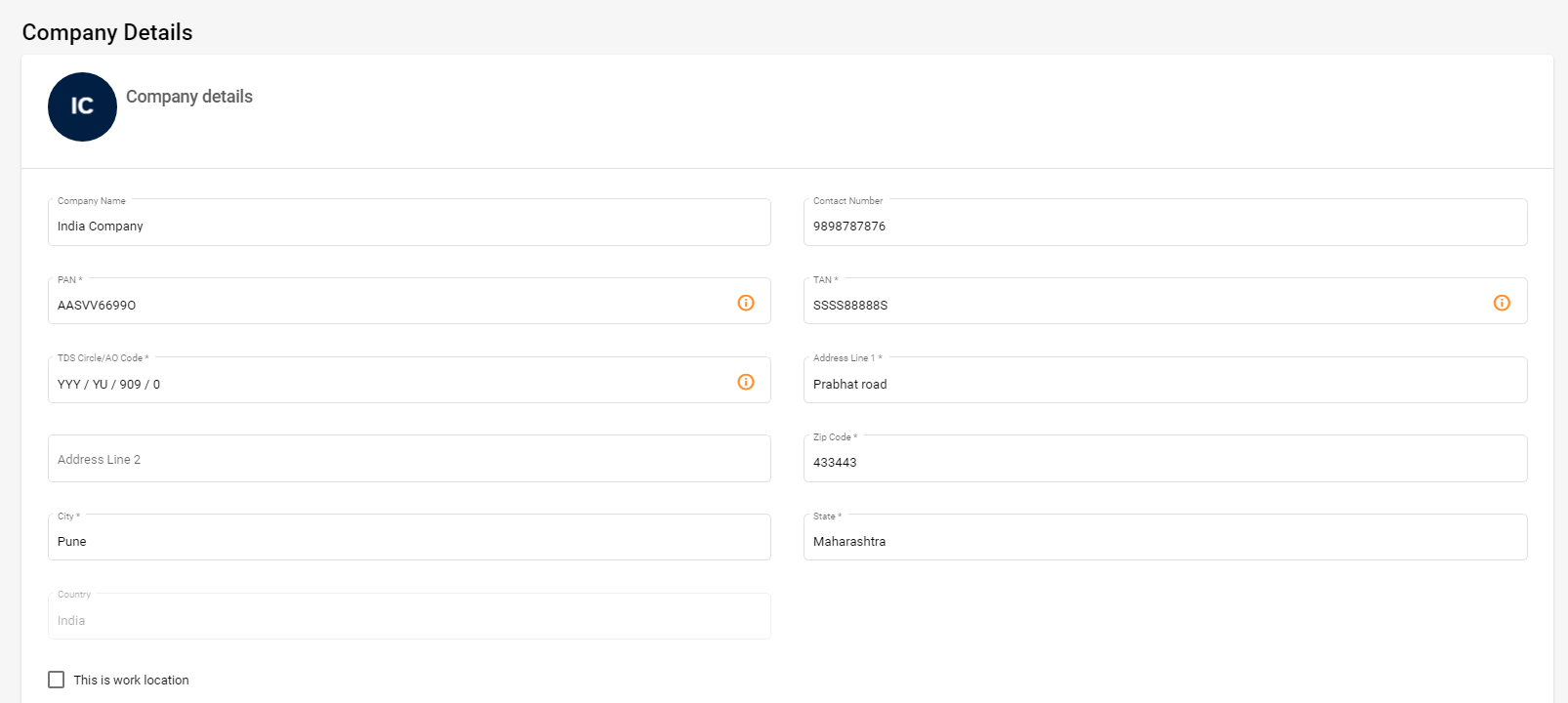

Go to Settings>> Company Settings >> Company Details>>below screen will appear and fill in the required company Details

- Company Name - Add Company Name

- Contact Number - Add company contact number

- PAN Number - Enter Company PAN Number

A Permanent Account Number known as PAN is a vital document for any taxpayer. It is a unique 10-character string of letters and digits. A PAN card is a mandatory requirement for all tax-paying individuals, partnerships, companies, etc. It also serves as an identity proof for a number of purposes. - TAN Number - Enter Company TAN number.

Tax Deduction Account Number or Tax Collection Account Number is a 10 -digit alpha-numeric number issued by the Income-tax Department. TAN is to be obtained by all persons who are responsible for deducting tax at source (TDS) or who are required to collect tax at source (TCS). - TDS Circle/AO Code - Enter company TDS Circle/AO code

TDS stands for tax deducted at source. As per the Income Tax Act, any company or person making a payment is required to deduct tax at source if the payment exceeds certain threshold limits. TDS has to be deducted at the rates prescribed by the tax department.

AO Code is a combination of Area Code, AO Type, Range Code and AO Number. Applicants for PAN are required to provide the AO code in their application. This information can be obtained from the Income Tax Office. Applicants may search their AO Codes on the basis of description wherever provided. - Address/Zip Code/City/State/Country - Add company's address

- If you wish to make this as a work address tick the check box 'This is work location'

Lastly click on Update button to save the details

How do I set company Tax details for India Payroll Compliance?

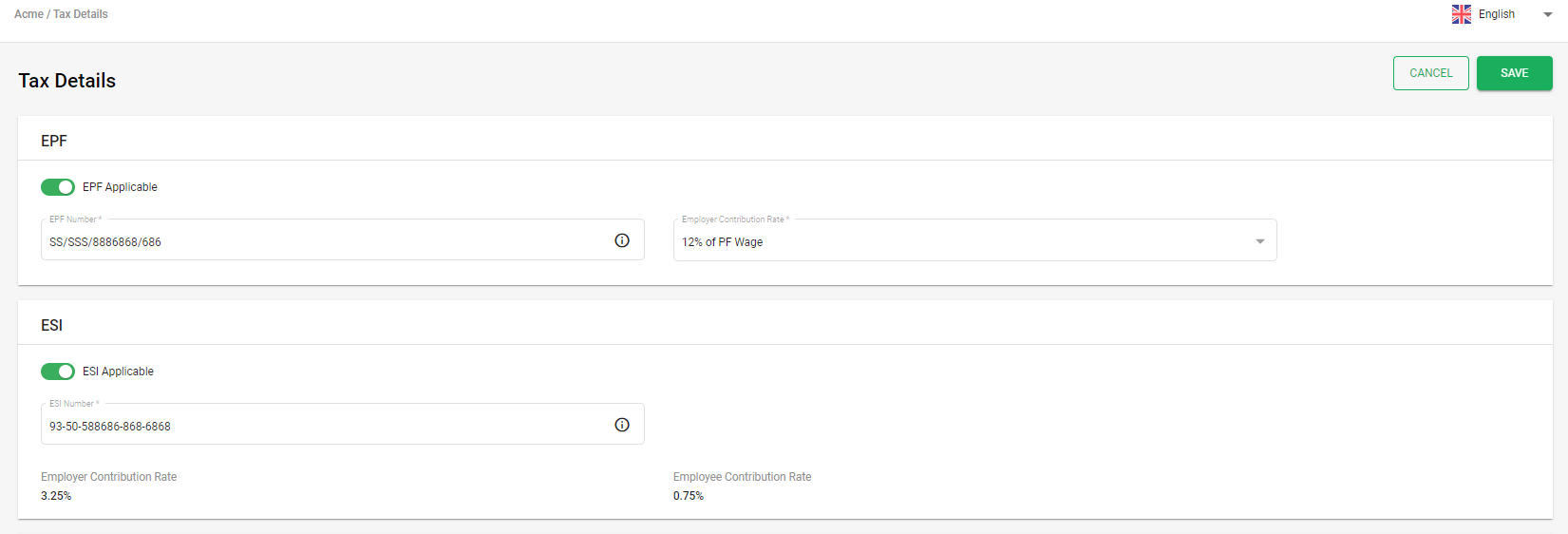

Go to Settings>> Company Settings>> Tax Details >> below screen will appear,

- Under EPF Section,

- EPF number : Enter Company EPF number

In every organization, a part of the salary is contributed towards PF, where both the employer and employee contribute toward the employee’s provident fund.

Note: You have the option of disabling the calculation, by using the EPF toggle button, if for the company it is not mandatory amount of employees for calculating. If an admin disables the applicability of EPF then the system will not calculate the PF for any employees in the payroll.(Both employee and employer contribution is not calculated and displayed in the payrun)

- Employer Contribution Rate : Select employer EPF contribution rate from the drop down-list

- Under ESI Section,

- ESI Number : Enter company ESI number

Employees' State Insurance (ESI) is a self-financing social security and health insurance scheme for Indian workers. The fund is managed by the Employees' State Insurance Corporation (ESIC).

- Employer Contribution Rate : Enter ESI employer contribution rate

- Employee Contribution Rate : Enter ESI employee contribution rate

Note: You have the option of disabling the calculation, by using the ESI toggle button, if for the company it is not mandatory amount of employees for calculating. If an admin disables the applicability of ESI, then the system will not calculate the ESI for any employees in the payroll.

- Under Professional Tax Section,

- PT Number - Enter company PT number

Professional tax can be defined as a tax that is levied by a state government on all individuals who earn a living through any medium. This must not be confused with the definition of other professionals such as doctors or lawyers. This is a type of tax that needs to be paid by each and every individual earning income. The calculation of this tax and the amount collected differs from one state to another. However, the limit has been set to Rs. 2500 per year.

Congratulations! Finally you have successfully set up company details and company Tax details for India Payroll Compliance.