Speaking of tax reporting, some of the taxpayers(WP) may have heard the term non-taxable income (PTKP).

PTKP cannot be ruled out because it affects the calculation of Income Tax (PPh) of each individual WP. Every salary or wage received by an employee / employee, there will always be a component of income that is not taxed.

In a way, this is a bonus from the government for each taxpayer for their income that is exempt from taxation.

PTKP is the amount of personal income taxpayers who are exempt from PPh Article 21.

In calculating PPh 21, PTKP functions as a deduction for the taxpayer's net income, to find the amount of income that is subject to tax.

The PTKP can be said to be the basis for calculating PPh 21.This means that if a taxpayer's income does not exceed the PTKP, it is not subject to income tax Article 21. On the other hand, if the taxpayer's income exceeds the PTKP, then the net income after deducting the PTKP will be the basis for calculating the PPh 21.

The basis for calculating taxable income based on the 2021 PTKP

Taxable income is the amount of employee / worker wages who will be subject to PPh 21 after being calculated with allowances, cost of employment, BPJS Ketenagakerjaan, BPJS Kesehatan, and others.

As mentioned above, that in order to find out how much income will be taxed, you must first know the amount of PTKP of the taxpayer concerned.

The amount of this PTKP varies depending on the status of the WP.

Here's how to find out the amount of Taxable Income:

- From gross income => minus costs => then it becomes net income.

- From this net income => deducted by PTKP until finally taxable income is obtained.

After finding the amount of taxable income, the tax will be calculated using the progressive rate of Article 17 paragraph (1) of Income Tax. Article 21 Personal Income Tax is using a progressive rate, which will be multiplied by Taxable Income.

How Much is the PTKP in 2021?

Keep in mind, the size of the PTKP can change every year.

This major change in PTKP depends on government policies that are regulated through a Minister of Finance Regulation (PMK) as an implementing rule of the Income Tax Law.

Then, how much is the 2021 PTKP?

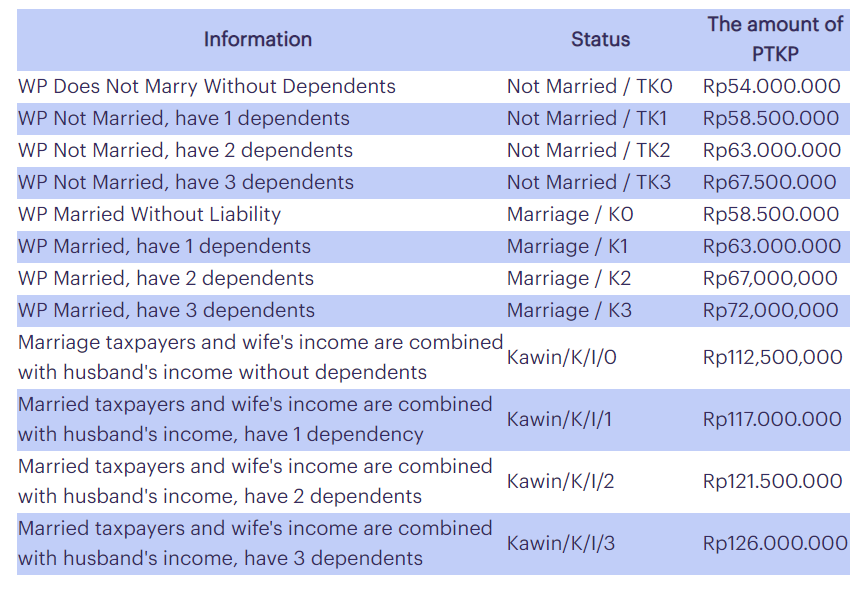

The following is the PTKP rate according to PMK 101/2016 which is still valid until PTKP 2021:

1. For WP OP it will be IDR 54,000,000

2. Taxpayers who are married, get an additional IDR 4,500,000

3. Additional for wives whose income is combined with the husband's income to be Rp. 54,000,000

4. Supplement for each member of the blood family and the relative family in a straight line, including an adopted child of Rp4.500,000, where a maximum of three people in each family.

The biological family referred to in point four is the biological parents, biological siblings and children. While what is meant by semenda family are in-laws, stepchildren, and brother-in-law.

In the following, the complete PTKP 2021 tariff table makes it easier to understand PTKP:

Example of Calculating PTKP in 2021

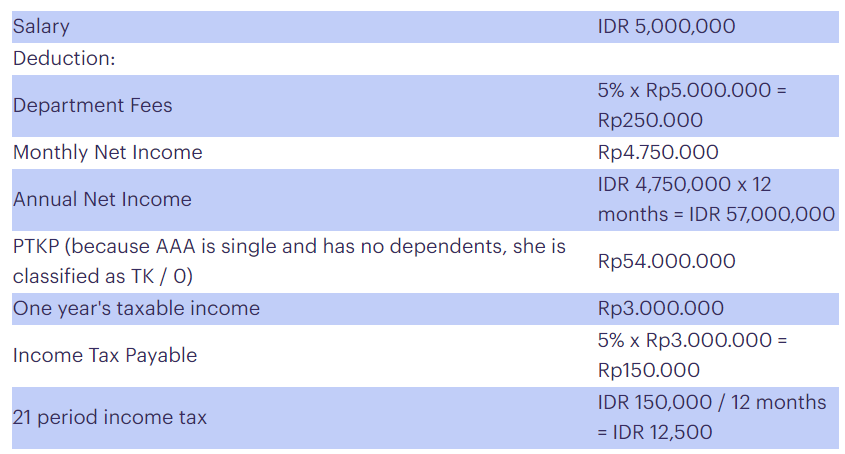

AAA, an employee working at PT BCD, gets a monthly salary of IDR 5,000,000.

He is listed as a fresh graduate who has only worked for one year and is not married.

So the following is the calculation of the PTKP?

With this calculation, AAA must pay PPh 21 of Rp. 12,500 per month or Rp. 300,000 for the total per year.

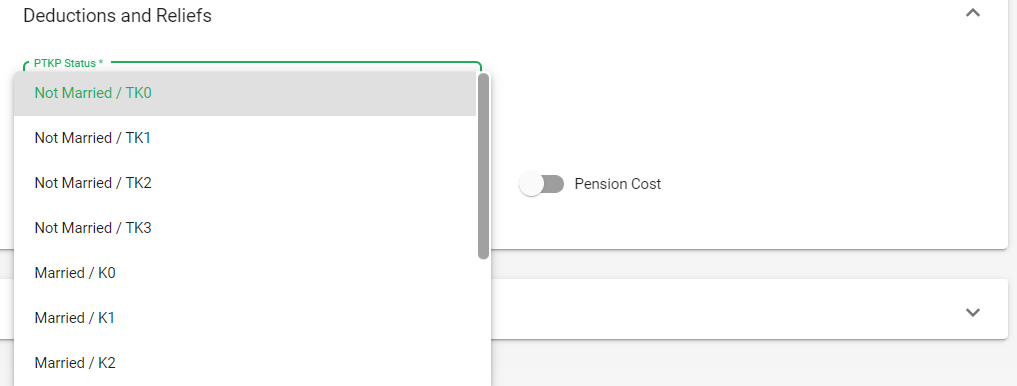

How is PTKP applicable in Deskera People?

With Deskera People, you have an option to select the PTKP status with below simple steps,

- Go to Employees Module>> Employee List, a screen will appear,

- Select the Employee and edit the profile or you can +Add Employee while creating a new employee profile.

- It will take you to the Employee Profile, under the Compliance Details Tab>>Deductions and Reliefs>>,

- Select the PTKP status from drop-down list as per applicability. PTKP amount is a non-taxable amount of personal taxpayer income that is exempt from PPh 21 (Income Tax).