Credit Notes are used when:

You as a seller

- Received returned/incorrect/faulty goods

- Overcharged your customer

You as a buyer:

- Were undercharged by your supplier

How to create a credit note in Deskera Books?

- Go to the Accounting Tab.

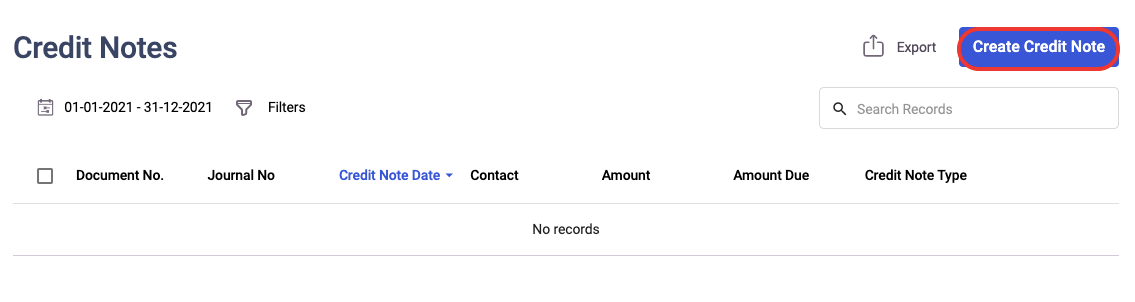

2. Click on Credit Notes and click on Create to go to the Create Credit Note page.

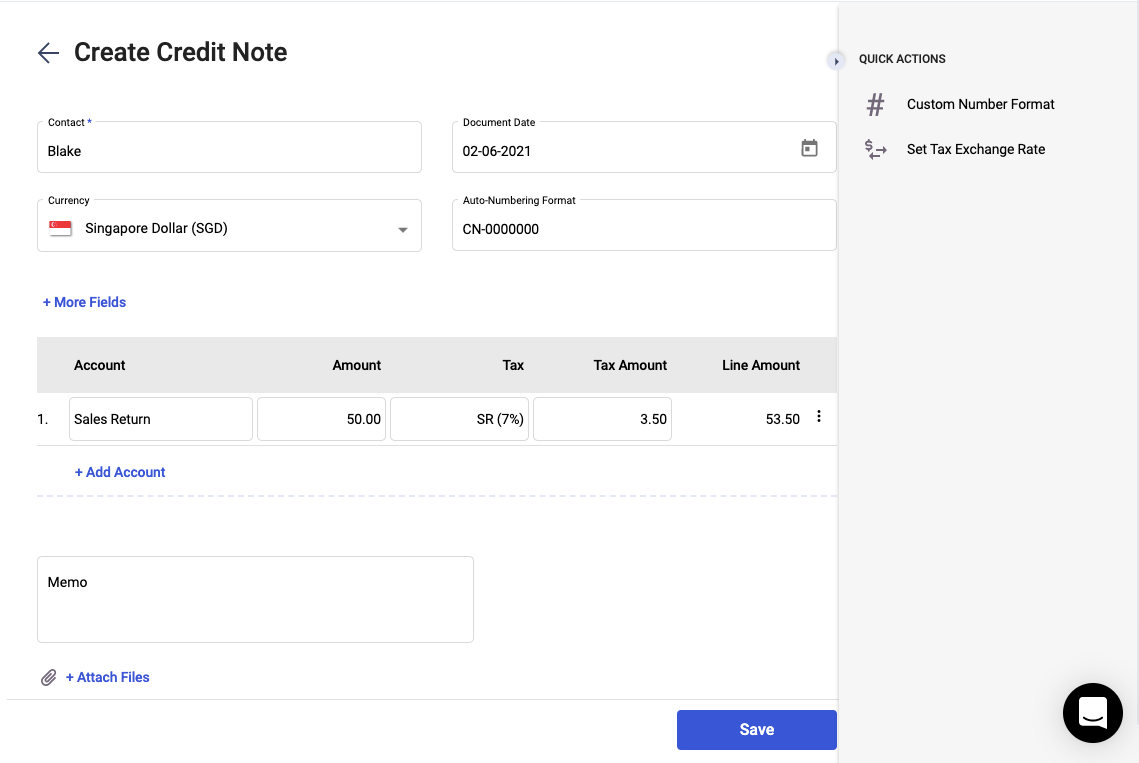

3. Select the Contact that is involved and the Account involved in the transaction.

4. Indicate the amount to be Credited and any applicable taxes.

5. Click the red SAVE button to create your Credit Note.

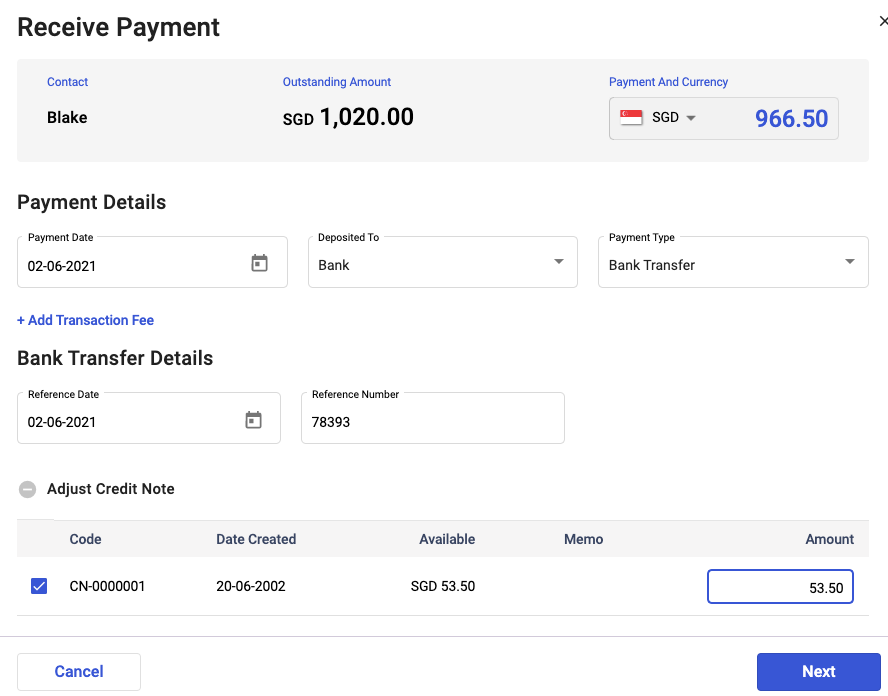

6. To use the Credit Note, go to the invoices under the Sell tab and click on the make payment button.

7. A pop-up will appear and you should be able to apply the credit note against this invoice. Enable the credit note checkbox and enter the amount to be deducted for this invoice document.

8. Once done, click on the Next button.

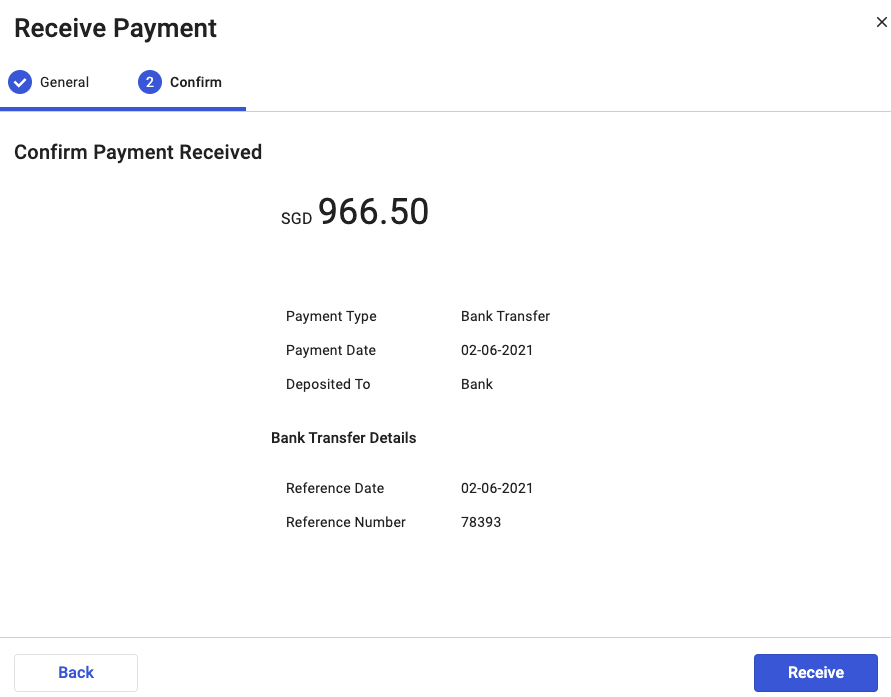

9. In the following screen, you should be able to view the adjusted outstanding amount for this invoice document. Click on receive payment button.

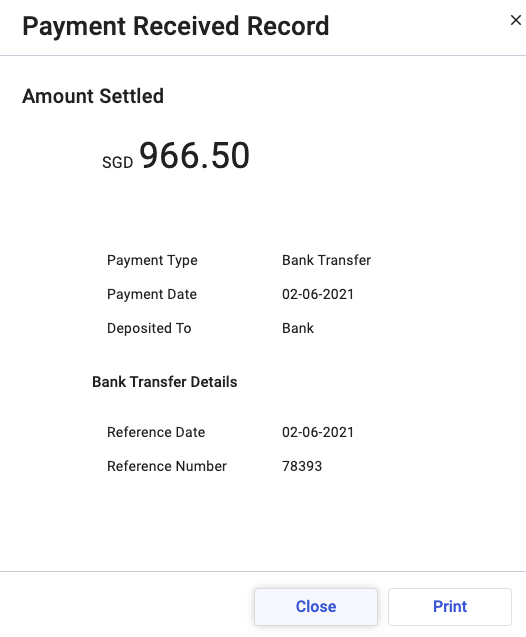

10. Once the payment is fully received, you can either print the payment record, or close the pop-up tab.

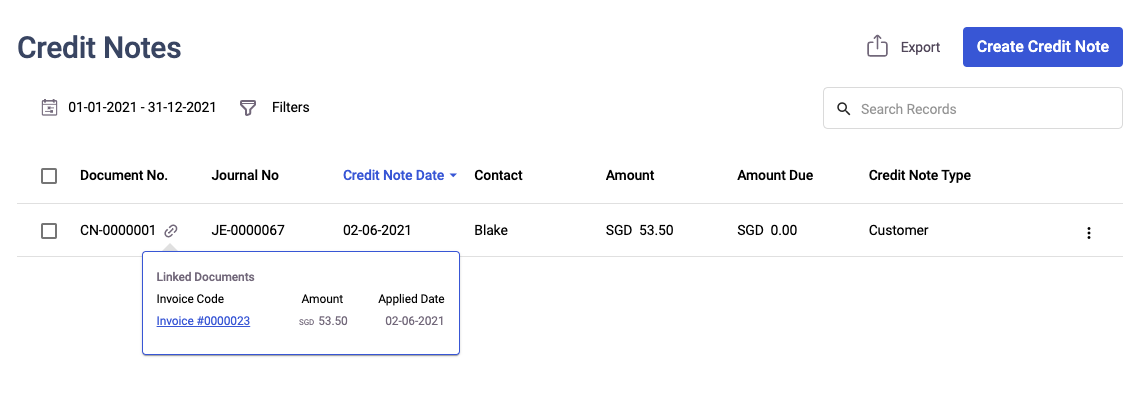

11. In the credit note window, you can click on the link icon next to the credit notes record. You can view the linked documents that you have applied the credit note.

12. If you click on the invoice document, the system will direct you to the respective invoice.

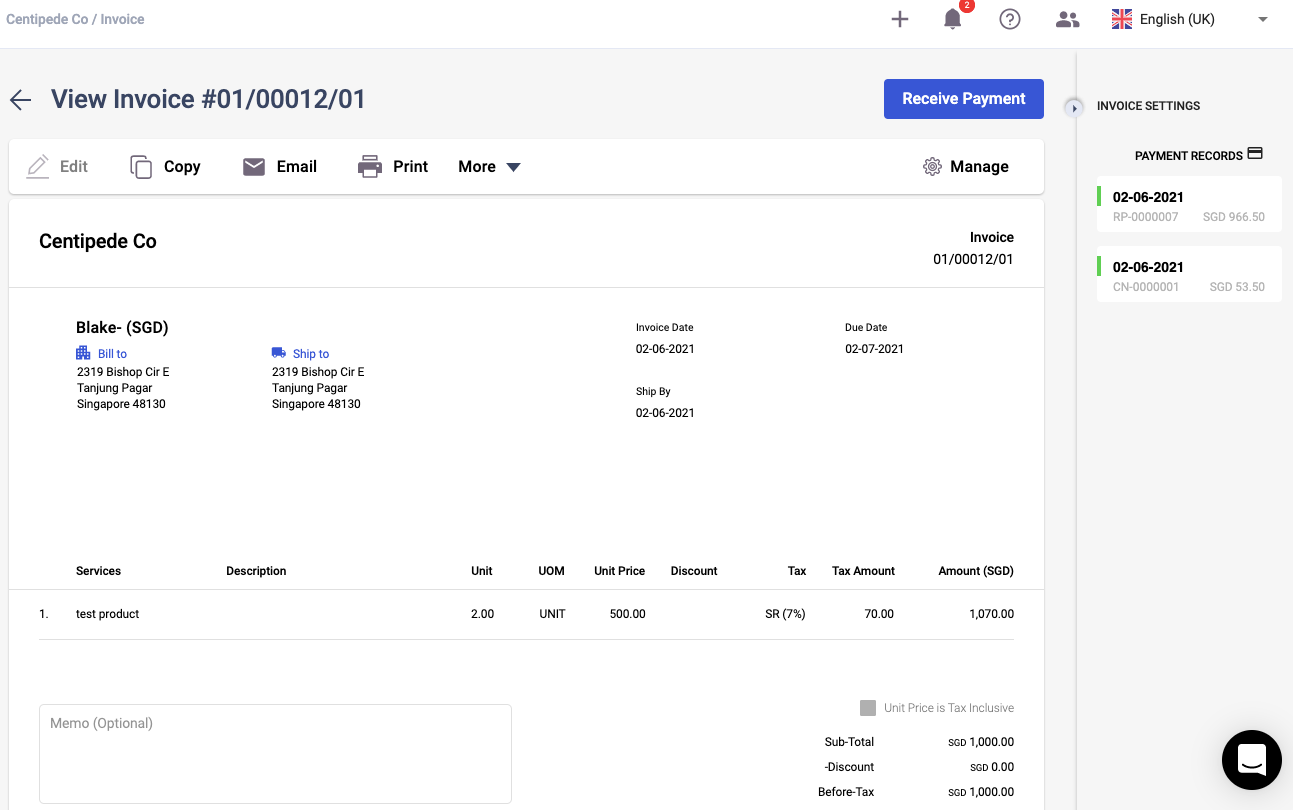

13. You can delete the credit note on your end by hovering your mouse on the payment record shown under the invoice setting.

14. You should be able to view the bin icon. Click on the bin icon to delete the credit note record.

15. Once you deleted the credit note, the linked document in the Credit Note Summary List will be removed as well.

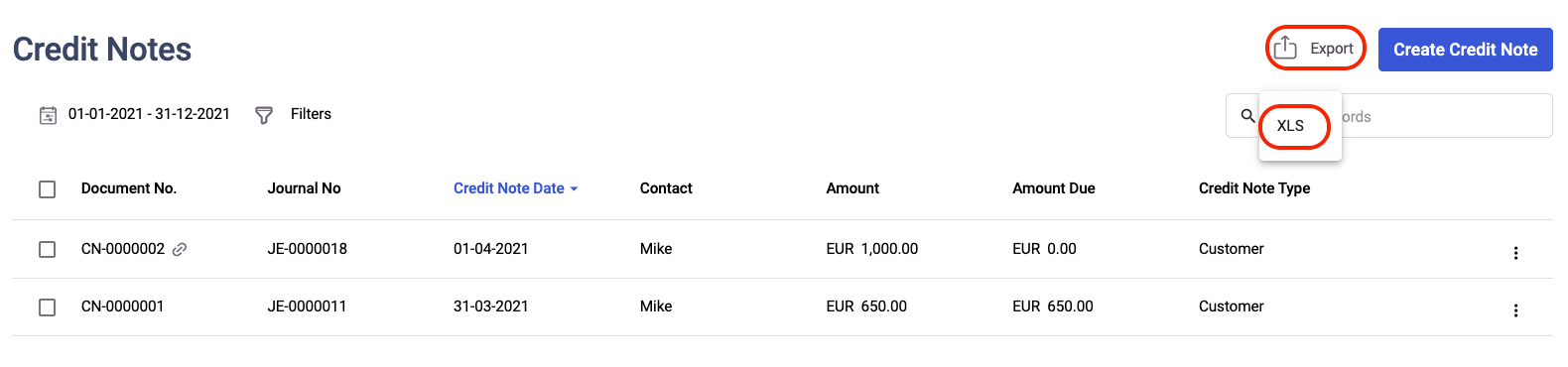

How can I export the Credit Notes Summary List?

- Go to Accounting

- Click on Credit Notes card.

3. On the Credit Note Summary List, click on the export button. You can only export the report in xls. format.

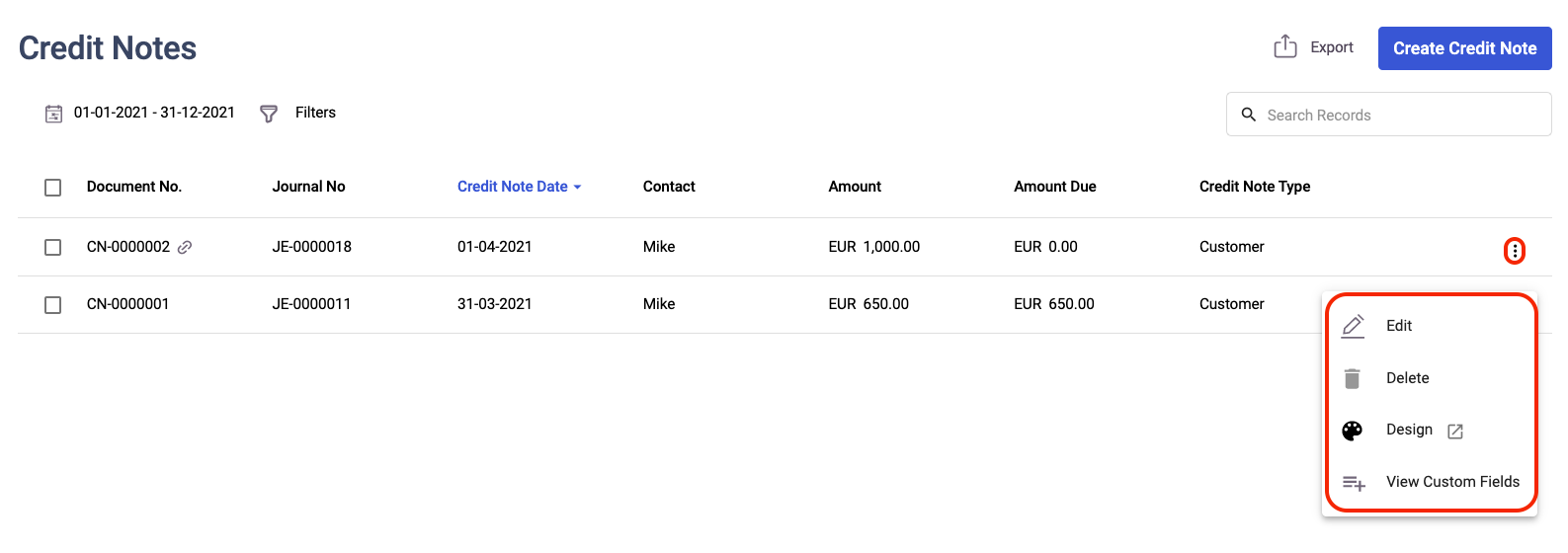

How can I edit, delete and print the credit notes?

- Click on the three dots of the respective credit notes.

2. You can perform the following actions here:

- Edit - To amend the document date, account, amount, and notes. Once you have applied the credit note to your customers, you cannot edit this anymore.

- Delete - To remove the credit note from the system. Once you have used the credit note, you cannot delete this anymore.

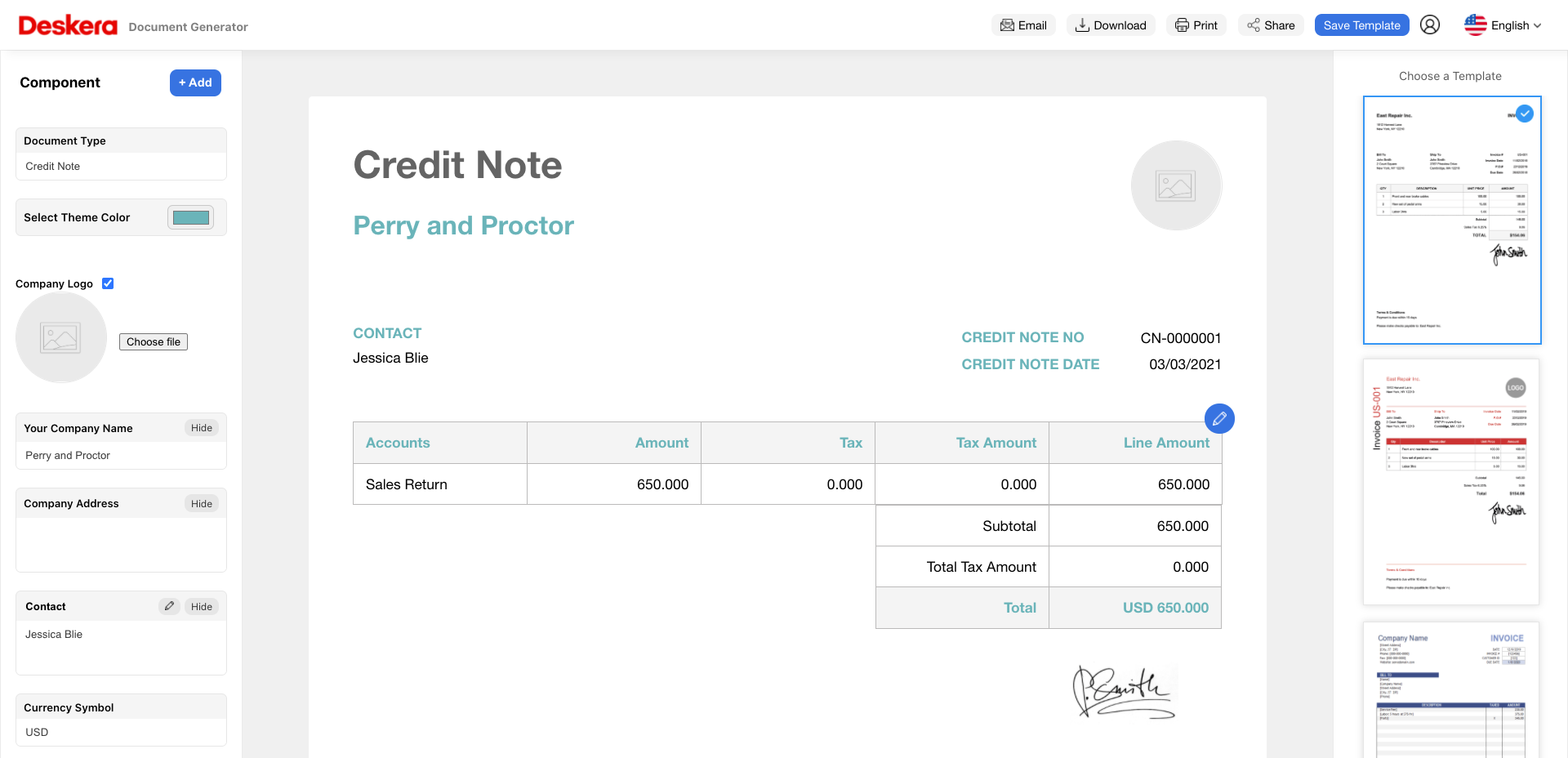

- Design - Clicking on this button will direct you to the document generator. Here you can design the credit note and print out the credit note as well.

- View custom fields - To view your custom fields in the credit note, you can click on this button, without opening the credit note itself.