What is the W-4 form for employees?

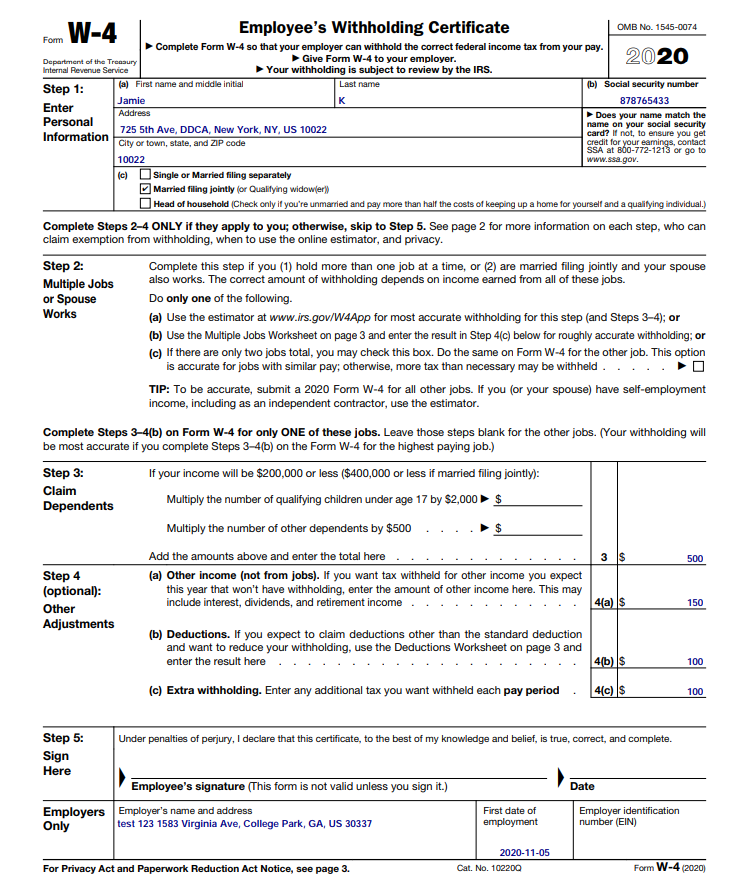

When you get a new job, your employer will ask you to complete is IRS Form W-4: Employee's Withholding Certificate. The way you fill out this form determines how much tax your employer will withhold from your paycheck. Your employer sends the money it withholds from your paycheck to the Internal Revenue Service (IRS), along with your name and Social Security number.

Your withholding counts toward paying the annual income tax bill you calculate when you file your tax return in April. That’s why a W-4 form asks for identifying information, such as your name, address, and Social Security number.

What Is a Form W-4 Used For?

The W-4 form provides information to your employer so that they can determine how much to withhold from your paychecks. This will ensure that the IRS collects federal income tax from you in a timely manner. Not paying enough during the year can result in a tax bill and perhaps a penalty, while withholding too much can create a refund when you file your tax return.

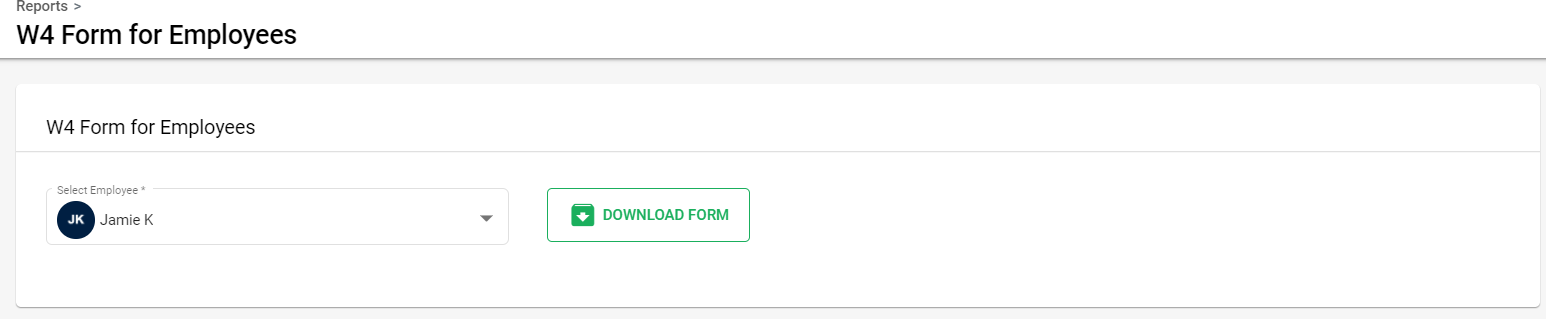

Downloading Employee withholding W-4 Form in Deskera People

Using Deskera People you can Download the W-4 form for employees with the , following steps,

1. Go to the Report Tab>> under Employee withholding section>> click on W-4 form for employees >> Select the name from the dropdown list>> Click on the download the button for downloading this form.

2. Once you have downloaded the W-4 form below details will be auto-populated in the form as entered in the system,