BIR1601F is a report about the monthly return of payment made on the purchase of goods.

Who shall file the BIR1601F Report?

Monthly Remittance Return of Final Income Taxes Withheld. The withholding agent or the employer files this return for the amount of final income withheld and remitted on behalf of the employee.

When to File?

Manual Filing – on or before the 10th day of the following month.

Electronic (EFPS) Filing: varies from 11 to 15 days from the end of the month depending on the grouping set forth in RR No. 26-2002.

What are Penalties for improper filing?

Individuals, who fail to submit this form or who purposely violate any withholding tax provisions, will be imposed with penalties.

Failure to file any form and pay any amount, installment/ due on or before the deadline will receive a surcharge of 25%.

The same penalty is imposed for filing a form with an individual that is not authorized to perform such actions and for failure to remit the deficiency tax within the time prescribed.

A surcharge that amounts to 50% is imposed upon individuals who neglect to file the form or commit tax fraud.

Where can Deskera Users retrieve the BIR1601F Monthly Return Report

Using Deskera Books, users can now retrieve the BIR1601F Monthly Return Report that is mapped according to the transactions on the buy tab.

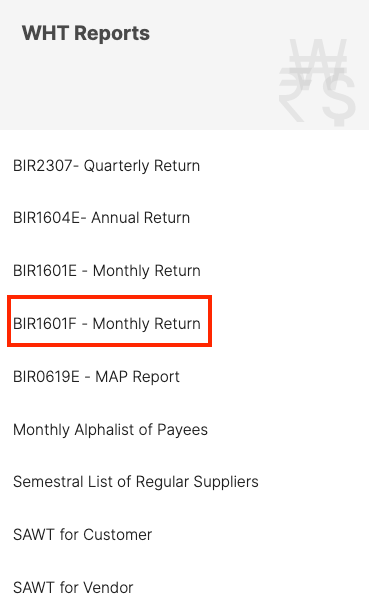

To view the details in the report, users have to click on the Report tab on the sidebar menu. Next, they will have to select the BIR1601F Monthly Return Report under the WHT Reports category.

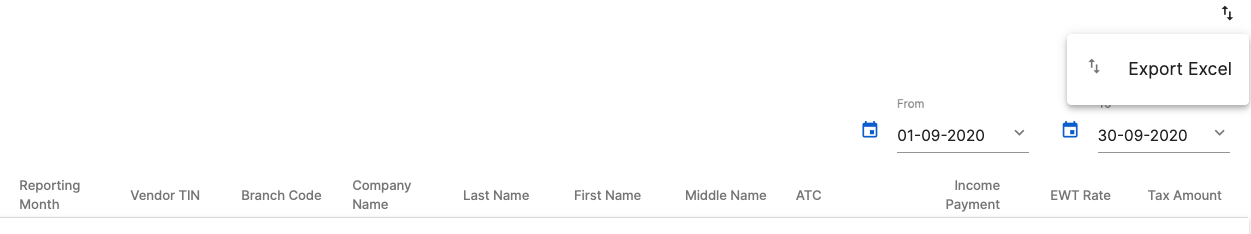

The BIR1601F Monthly Return Report will reflect the details of the following fields with the tax amount auto-populated based on the transactions in Buy Module

- Reporting Month

- Vendor TIN

- Branch Code

- Company Name

- Last Name

- First Name

- Middle Name

- ATC

- Income Payment

- EWT Rate

- Tax Amount

Report Generation

You can also generate the report based on the date range you prefer by using the date filter at the top right of the screen.

Export

You also have an option to export the file in Excel format by clicking on the Export button on the left side corner of the screen.

Deskera users can file their BIR1601F Monthly return report with an Authorised Agent Bank (AAB) of the Revenue District Office (RDO) using the report generated from our system.

If there are no AABs within the area, then the form must be filed with a Revenue Collection Officer (RCO) of the RDO who will issue an Electronic Revenue Official Receipt (eROR).