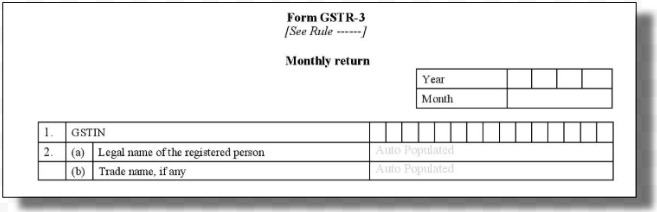

GSTR-3 is a mandatory, self-declaration report that has to be filed by taxpayers even if they have zero returns. The details in the Form that are required to be reported by the taxpayers are:

- Liable Input Tax Credit (ITC)

- Liable Tax

- The total amount paid for tax

- Details of both sales and purchases

The GSTR-3 Form consists of tables, reach requiring specific details. GSTR-3 Report consists of two parts, Part A and Part B.

Section 1 and 2

- GSTIN: Fill in the 15-digits PAN number.

- Name of the registered person and trade name, if any.

Part A

The section in Part A is auto-populated.

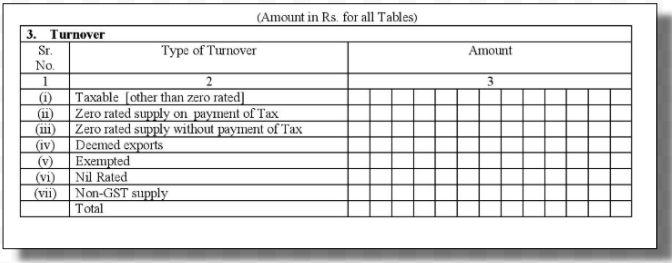

Section 3

Section 3 covers the details of the outward and inward supplies liable to reverse charge. The total taxable value, for both intrastate and interstate, has to be captured along with the total tax (IGST, CGST, SGST/UTGST) as applicable.

Fill in the fields in Section 3 that consists of:

- Non-GST Outward Supplies

- Inward Supplies liable to be paid on the reverse basis

- Outward Supplies towards Nil- Rated and Exempted

- Outward Taxable Supplies (Zero Rated)

- Outward Taxable Supplies other than Zero-Rated, Nil Rated, and Exempted

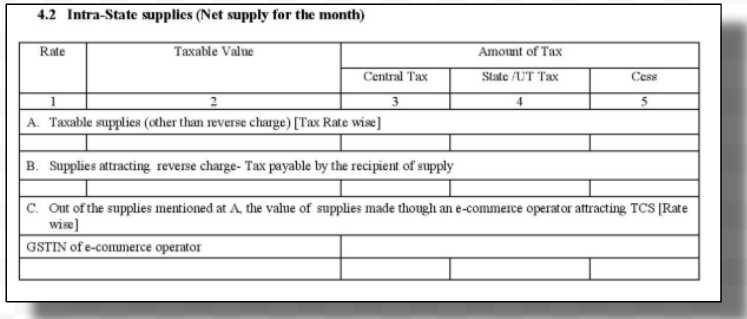

Section 4

In Section 4, fill in the details for all the sales and supplies that you've made to your customers. The data here are auto-populated from the data you have recorded in GSTR-1. There are three subsections in Section 4.

4.1: Consists of all the interstates sales such as taxable supplies, zero-rated supply made with payment of Integrated Tax, supplies attracting reverse charge-tax payable by the recipient of the supply, and the value of supply made through e-commerce operator attracting TCS.

4.2: Consists of all the intrastate sales such as the taxable supplies, supplies attracting reverse charge that is payable by the recipient of the supply, and the value of supply made through e-commerce operators attracting TCS.

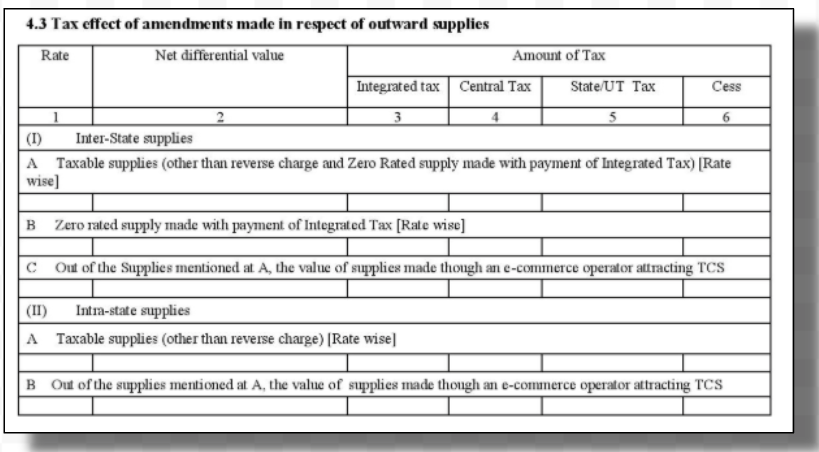

4.3: Consist of the details of changes in tax liabilities, the amount required to pay to the government) and tax credit (the amount that will be refunded back to you) due to the changes made to invoices and other sales documents.

Section 5

Table 5 is the details about the summary of your eligible ITC available and reversals made by you to get the NET ITC amount.

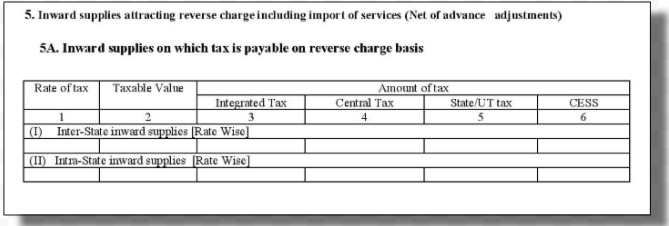

5A: Includes purchases where the reverse charge is applicable. As a buyer yourself, you are required to pay GST. This applies to both interstate and intrastate.

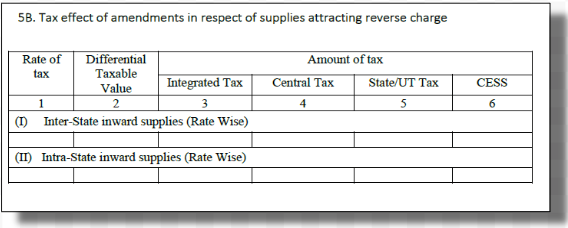

5B: Any amendments you made to your purchases which attract a reverse charge. The amount for ITC will change if the amount here is changed.

Section 6

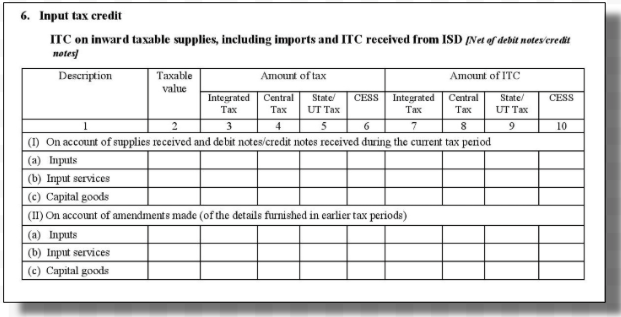

Under Section 6, Input Tax credit records, the amount returned to you as credit by the government for the tax you paid on inward taxable supplies, including imported goods. This credit can be used to reduce/offset the amount of tax you have to pay against the sales you carry out. It captures all the ITC, including those received from Input Service Distributor (ISD). This table also reflects the summary of the net total for all debit notes and credit notes collected during the current tax period.

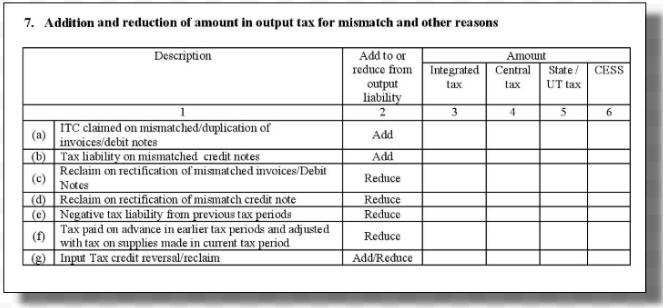

Section 7

Any mismatches in the ITC and tax liability between original returns and any amendments file for them during the current tax period (source from GSTR-1 and GSTR- 2). Fill in the fields stated above:

- ITC claimed on mismatched/duplication of invoices/debit notes

- Tax liability on mismatched credit notes

- Reclaim on rectification of mismatched invoices/Debit notes

- Reclaim on rectification of mismatch credit note

- Negative tax liability from previous tax periods

- Tax paid on advance in earlier tax periods and adjusted with the tax on supplies made in the current tax period

- Input Tax Credit reversal/reclaim

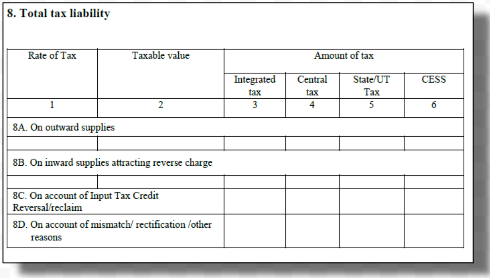

Section 8

The GST Portal will calculate the tax liability under different tax heads such as the CGST, SGST, and IGST. There are four subsections in Section 8 and it includes:

8A: Tax you have to pay to the government on the items and services sold by you

8B: Tax payable on purchases attracting reverse charge.

8C: Data is sourced from Table 11 of GSTR-2.

8D: Data is sourced from Table 12 of GSTR-2.

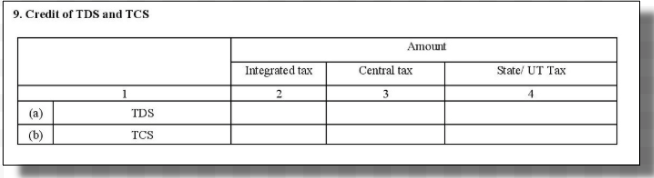

Section 9

Section 9 consists of the details of TDS and TCS paid by you. The sum of TDS/TCS will be deducted from the total liability to arrive at the net tax amount you must pay.

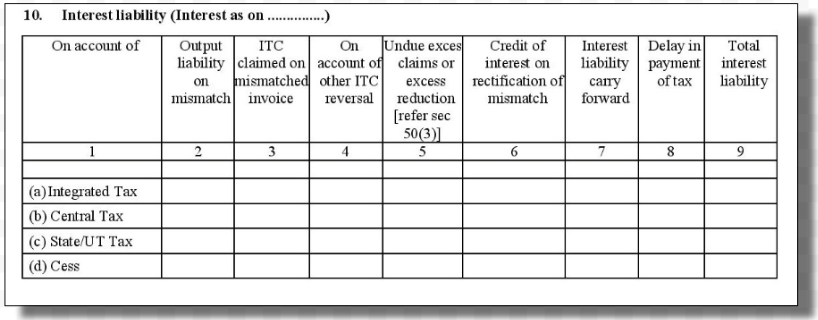

Section 10

Section 10 shows the total interest you owe to the government for various reasons; output liability mismatch, delay in payment of tax, ITC reversal, etc. For any delay in payment, interest will be applicable. The interest is 18% per annum and is calculated based on the total outstanding tax to be paid by the taxpayers.

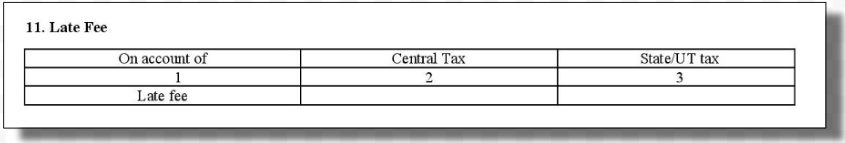

Section 11

Besides interest, taxpayers will have to make a late payment fee if they delayed return filing. Late fee is charged Rs.100 per day and can go up till Rs. 5,000. There is no late fee for IGST.

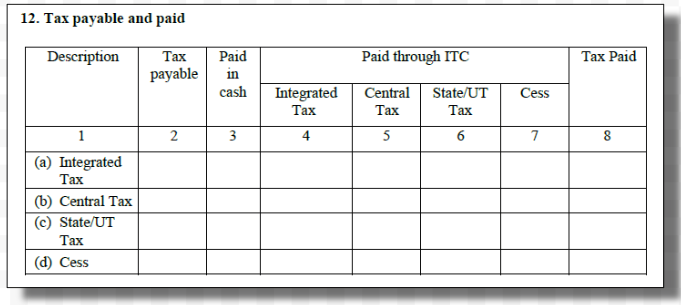

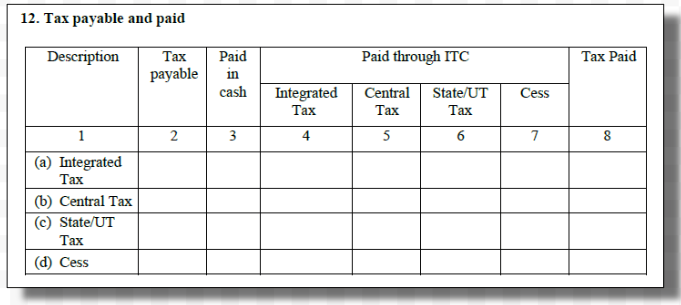

Section 12

Document the taxes that you’ll have to pay under IGST, SGST, UGST, and Cess by referring to your report in GSTR-1 and GSTR-2.

If you make the tax payment via cash, record the amount paid in cash under column 3. Alternatively, you can use the credits that you have under various tax heads against the tax you paid on purchases to offset it (Paid through ITC).

The last column will show the sum of taxes you have paid under various tax heads for the month.

PART B

This section has to be filled manually by taxpayers whereas Part A is shown automatically by the GST Portal.

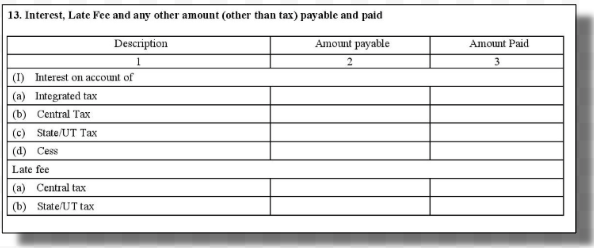

Section 13

Section 13 comprises the penalties levied by the tax authority on taxpayers who failed to comply with the GST law and are separated by type of tax and tax head. If you failed to abide by the GST regulations, you’ll have to pay penalties.

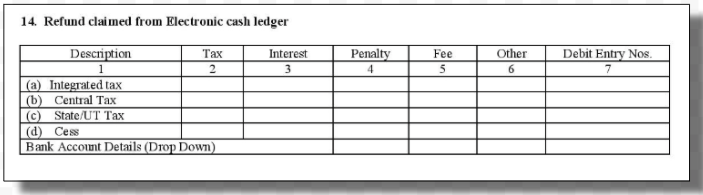

Section 14

In the scenarios where the tax you paid is higher than the original amount, the difference will then be refunded to you. Take note that:

- You can only claim your refund from cash ledger if all returns related to liabilities have been discharged for the particular month.

- Under Table 14, a refund claim will result in a debit entry in an electronic cash ledger on the filing of valid GSTR-3.

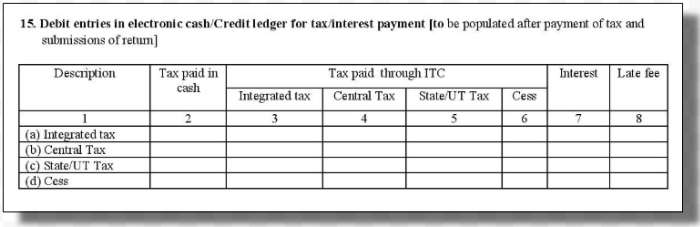

Section 15

Section 15 is auto-generated once you pay your taxes and submit your returns.

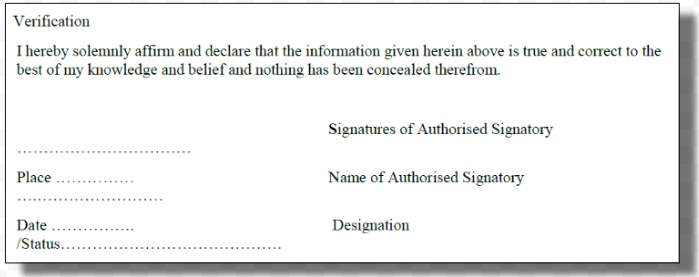

Lastly, fill in the verification form at the end of the report with the authorized signature from your company to confirm that the information is accurate.