What is Employee Provident Fund(EPF) and Employee Pension Scheme(EPS) in India?

In order to help individuals save money for their future, the Government of India has launched various investment and saving schemes. Two popular schemes are the Employees’ Provident Fund (EPF) scheme and the Employees’ Pension Scheme (EPS). The main aim of both schemes is to help individuals save money for their retirement. Both schemes are designed for salaried individuals and provide guaranteed returns.

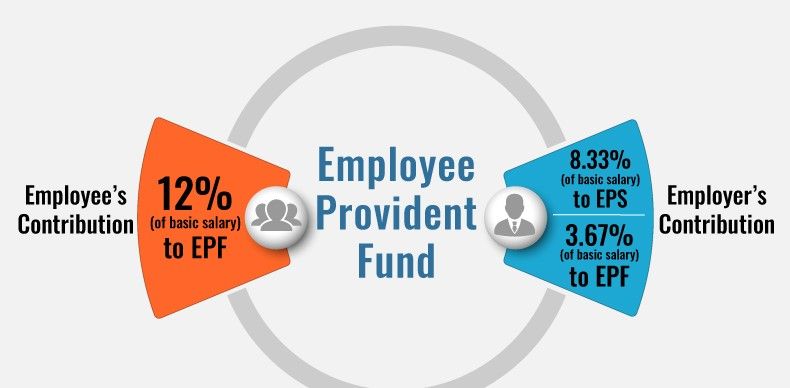

EPF and EPS contribution rates

The employer and employee contributions towards the EPF scheme every month are equal to 12% of basic salary and Dearness Allowance(DA).

Out of the employer contribution, 8.33% is contributed towards the Employee Pension Scheme.

The EPS ( Employee Pension Scheme ) will only be contributed by employer which should consider a maximum of 15000 as PF Wage

Note - PF Wage = Basic Salary + Dearness Allowance * The method of calculation is given below:

Employee | Employer | |

| Total contribution | 12% of Basic + Dearness Allowance (PF Wage ) | 12% of Basic + Dearness Allowance (PF Wage ) |

| Employee Pension Scheme (EPS) | 0 | 8.33% (of the 12%) |

| Employee Provident Fund (EPF) | Full amount | 3.67% (of the 12%) |

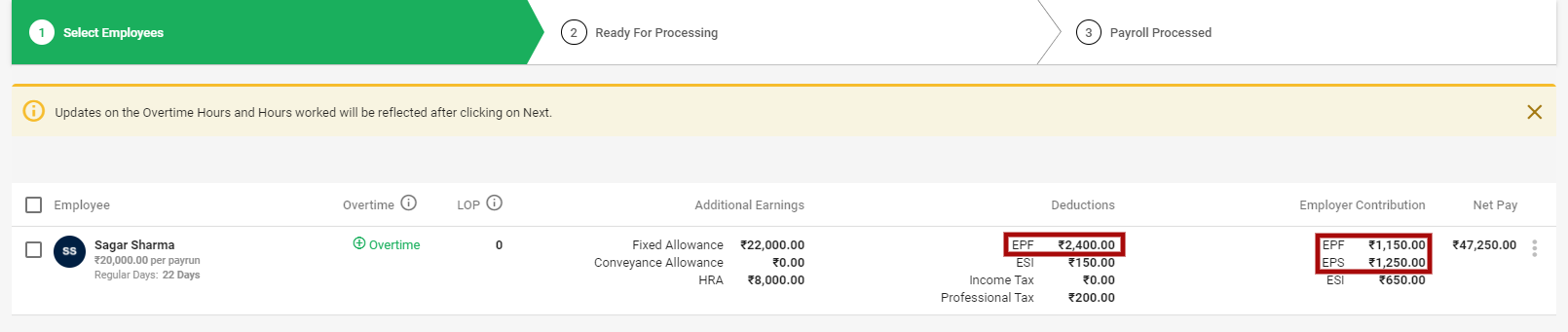

How is EPF and EPS contribution calculated in Deskera People?

With Deskera People, with the below mentioned simple steps you can accurately calculate the EPF and EPS contribution for both employee and employer.

- Under Employees Module>>Select Employee List, a screen will appear

- Then select the Employee and edit the profile/click on +Add Employee button to create a new employee profile

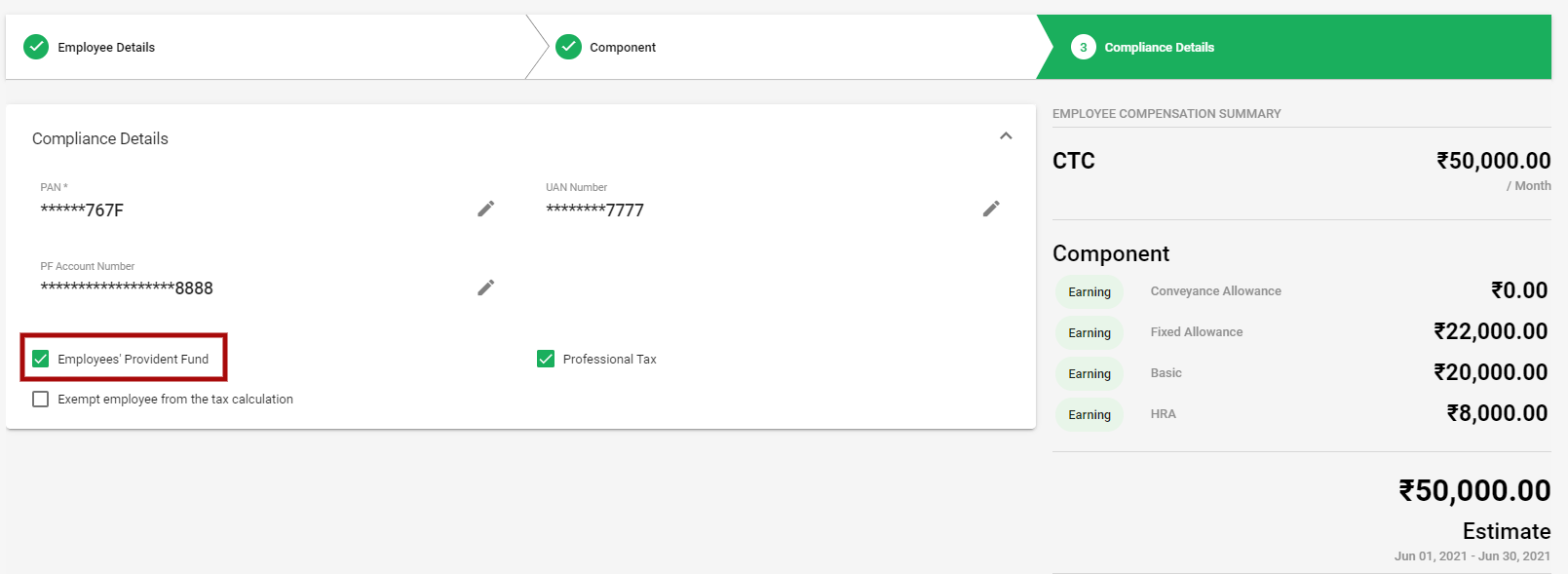

- Next, a screen will appear, go to Compliance Details tab,

4. You can see a Employee Provident Fund checkbox where you can tick the check box and the EPF will be applicability for the employee.

5. Based on the above mentioned EPF and EPS rates, these calculation will be auto-calculate in the system, once the payrun is processed.