In the previous article you have read different tax thresholds in Australia for different states.

Now let us see, how to view and record the payroll tax in Deskera People which will display the accurate rates based on the conditions for the particular states.

With Deskera People As an admin you can see the payroll tax that you are liable to pay, with the system Generate Payroll Tax Report further useful to submit the taxts to the state and federal government.

Below mentioned are the steps to view the Australia compliance Payroll Tax Report in Deskera People.

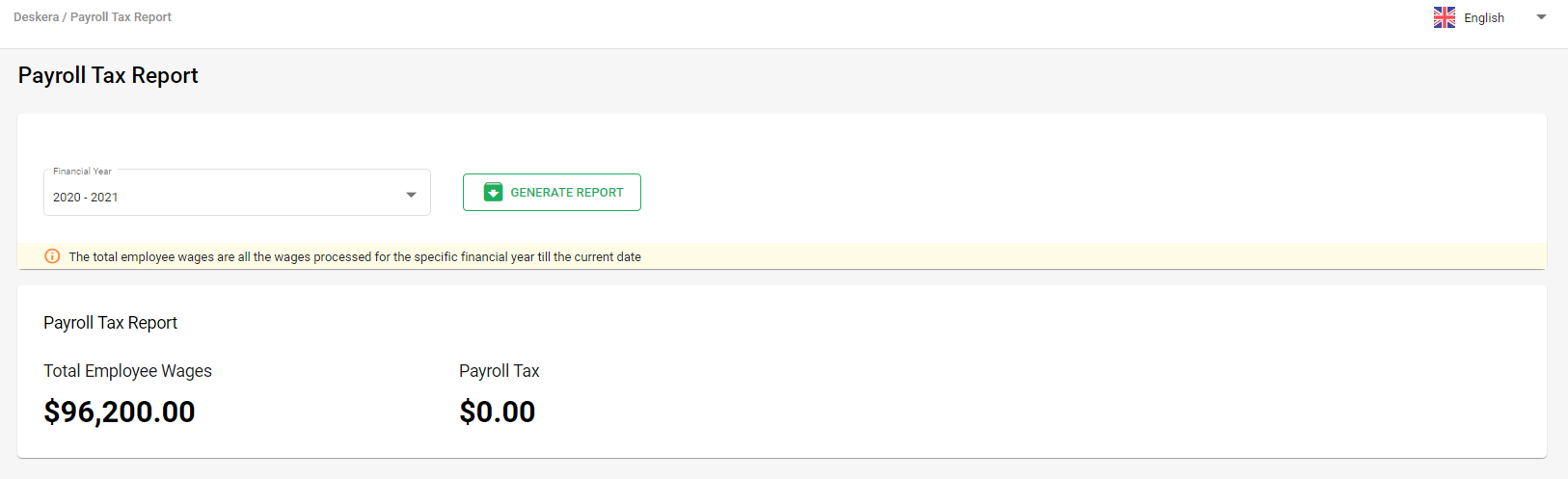

- Go to reports module>>Payroll Reports Section>>click on Payroll Tax, a below screen will appear,

- Select the Financial Year from the drop down list

- Then click on Generate Report, which will generate the below details,

- Total Employee Wages for the year

- Payroll Tax to be paid to the government for that particular financial year

Please note :The calculation for total wages will be as: Total wages = (Basic Salary + Earning components) - Pre tax deductions

Total wages will be amount available for further payroll tax calculation.