SWAT for customer report is about the monthly return of payment received by the customer on the purchase of goods.

What is SWAT?

SAWT is a Summary Alphalist of Withholding Tax at Source serves as a consolidated alphalist of withholding agents from whom income was received and are subjected to withholding agents in the process.

Who needs to file?

This needs to be submitted by the payee-recipient as an attachment to a filed return based on the specific period, and contains a summary of data such as gross sales/receipts. Also, individuals claiming refund or applying creditable tax withheld at source against the tax due with not more than 10 withholding agents-payor of income payment per return.

When to file?

SAWTs need to be submitted along with forms 1700, 1701Q, 1701, 1702Q, 1702, 2550M, 2550Q, 2551M and 2553.

For Withholding – Within ten (10) days following the end of each month

Please take note that your tax forms will be sent electronically to the BIR until 9pm. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day.

Where can Deskera Users retrieve the SAWT for Customer report?

Using Deskera Books, users can now retrieve the Sawt for customer report that is mapped according to the transactions on the Sell tab.

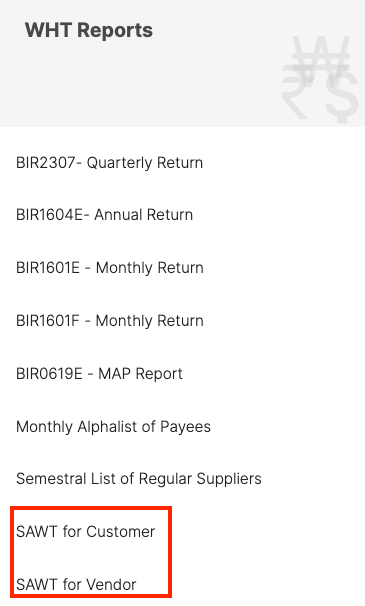

To view the details in the report, users have to click on the Report tab on the sidebar menu. Next, they will have to select the SAWT for customer and vendor Report under the WHT Reports category.

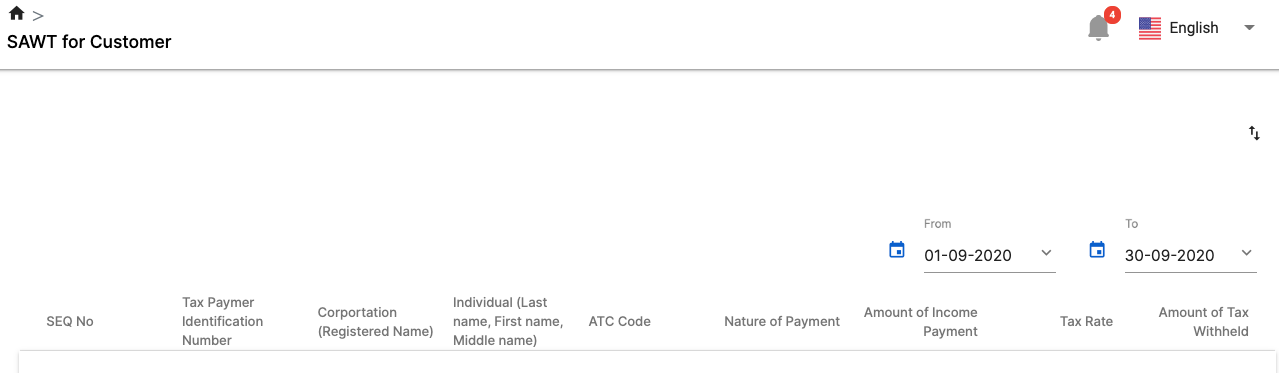

The SAWT for customer Report will reflect the details of the following fields with the tax amount auto-populated based on the transactions in sell Module

- SEQ No

- Taxpayer Identification Number

- Corporation (Registered Name)

- Individual (Last name, First name, Middle name)

- ATC Code

- Nature of Payment

- Amount of Income Payment

- Tax Rate

- Amount of Tax Withheld

SWAT for vendor reports is about the monthly return of payment made by the vendor on the purchase of goods.

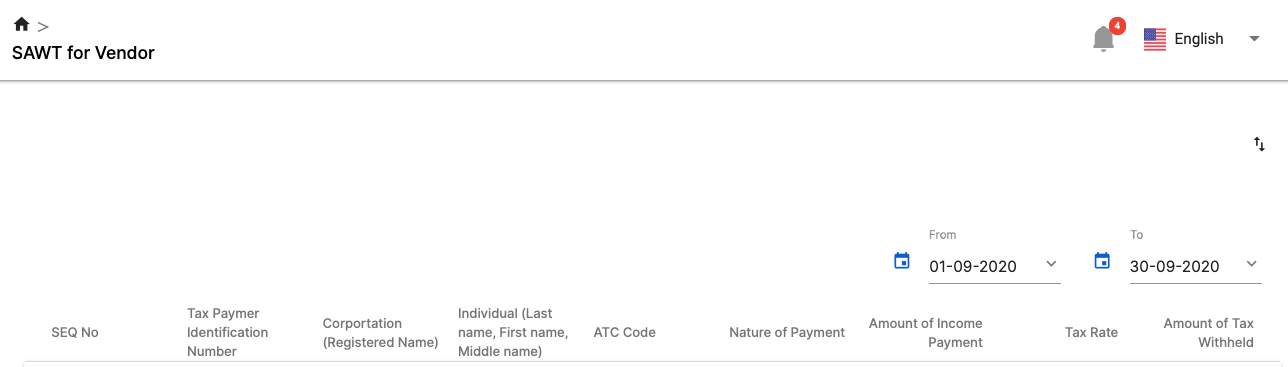

The SAWT for vendor Report will reflect the details of the following fields with the tax amount auto-populated based on the transactions in buy Module

- SEQ No

- Taxpayer Identification Number

- Corporation (Registered Name)

- Individual (Last name, First name, Middle name)

- ATC Code

- Nature of Payment

- Amount of Income Payment

- Tax Rate

- Amount of Tax Withheld

Deskera users can file their SAWT for customer and SAWT for vendor reports via Philippines BIR Portal using the report generated from our system.

You can also generate the report based on the date range you prefer by using the date filter at the top right of the screen,