Indonesia employers must follow a series of monthly procedures when administering payroll for both local and foreign employees to ensure complete compliance with the Indonesian tax authorities.

This includes making tax payments and social security contributions (Jamsostek) which must be withheld by employers each pay cycle.

Tax residence

An individual is regarded as a tax resident if he/she fulfils any of the following conditions:

• He/she resides in Indonesia;

• He/she is present in Indonesia for more than 183 days in any 12-month period;

• He/she is present in Indonesia during a fiscal year and intends to reside in Indonesia.

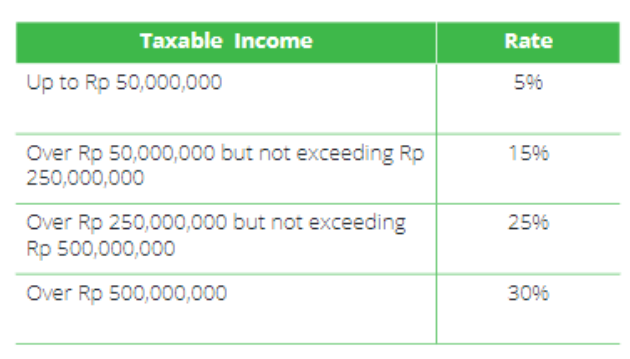

Individual Tax Rates

Non-resident Taxpayer

A single rate of 20% is imposed on gross income, except for income from sale of shares in Indonesian incorporated company and certain assets, which is subject to 5% final tax on the sales proceeds.

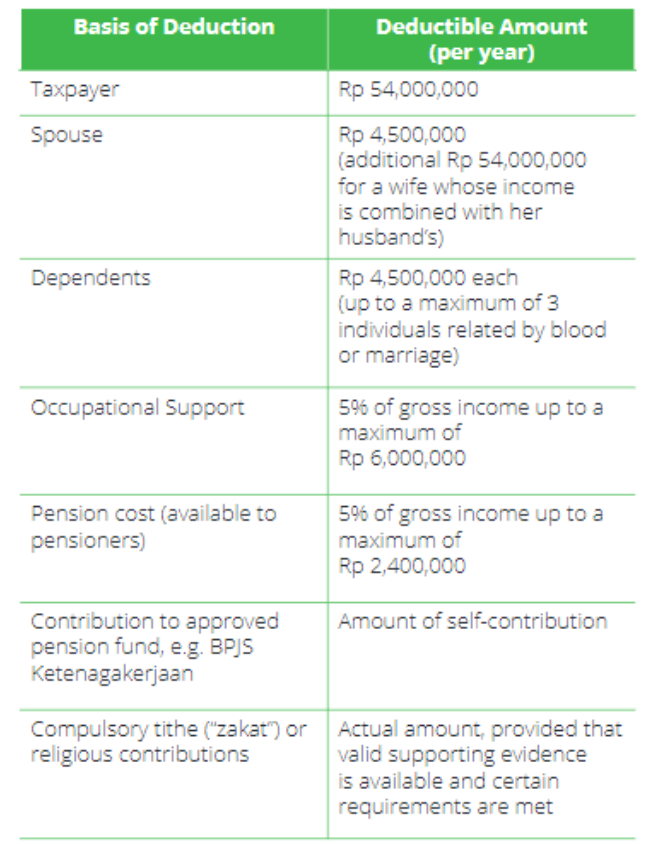

Personal Deductions

The following personal deductions are available for resident individual taxpayers in calcualating their taxable income, depending on the taxpayer’s personal circumstances.

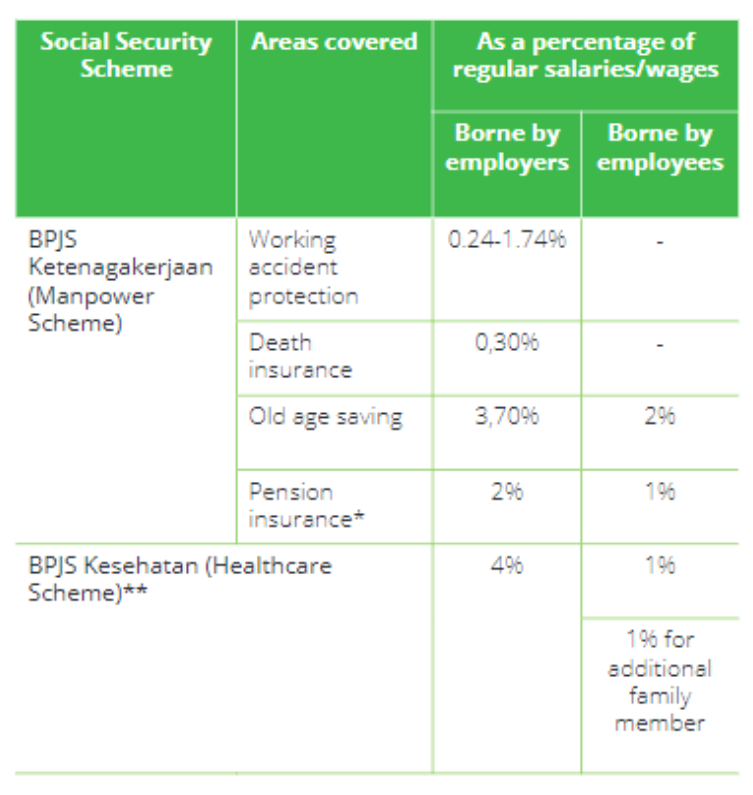

Social Security

The government of Indonesia has introduced new social security schemes, i.e. Manpower Scheme (BPJS Ketenagakerjaan) and Healthcare Scheme (BPJS Kesehatan), which are applicable for Indonesian nationals as well as foreigners who work in Indonesia for at least 6 months.

The contributions for each scheme is as follows:

Employee compliance obligations

The tax year is the calendar year. Indonesia operates a self-assessment system whereby all individuals are required to complete a tax return and compute their tax liability by 31 March in the following tax year. Annual tax payments are due before this deadline.

In order to file a tax return, an individual must register to obtain a tax identification number (NPWP). Employees without an NPWP are subject to a 20 percent tax surcharge.

Individual entrepreneurs/professionals and individuals who have tax payable because of their passive income are required to pay taxes and file monthly returns by the 15th and the 20th of the following month, respectively.

Based on the current tax regulation, taxpayers in Indonesia are now required to submit their Indonesian Tax Return electronically via e-filing (online tax submission). Hence, the taxpayers should also apply for Electronic Filing Identification Number (e-FIN) to activate their electronic filing account at Tax Office website.

Non-residents do not have an obligation to register for an NPWP or file an individual tax return.