BIR 2307 is a report about the quarterly return of payment made on the purchase of goods.

Why should you file a BIR 2307 Report?

The BIR Form 2307 is more commonly referred to as the Certificate of Creditable Tax Withheld at Source. This certificate exhibits the income that is subjugated to Expanded Withholding Tax (EWT) that is paid by a withholding agent.

The BIR Form 2307 is also considered as income tax prepayments because it is being deducted from the income tax dues of a taxpayer during the quarterly and the annual income tax return.

Who needs to file a BIR 2307 report?

In most instances, freelancers are the ones who file the form. However, part-time freelancers and employers that hire project-based employees or freelance employees have to file the form as well.

This form should be submitted together with the quarterly and annual Income Tax Return, also known as the BIR Forms 1701/1701Q, for employees or BIR form 1702/1702Q for companies and corporations. Once filed, the amount of withholding tax will be accepted as a tax credit on the taxable quarter or taxable year in which it was earned.

When is the BIR 2307 report filed?

• For EWT: to be filed on or before the 20th day of the month following the taxable quarter.

• For percentage taxes on government money payments: certificate must be attached to 2551 forms and must be issued on or before the 10th day of the following month.

• For VAT Withholding: certificate must be issued on or before the tenth day of the month following the month when withholding was made. To be attached to 2550 forms.

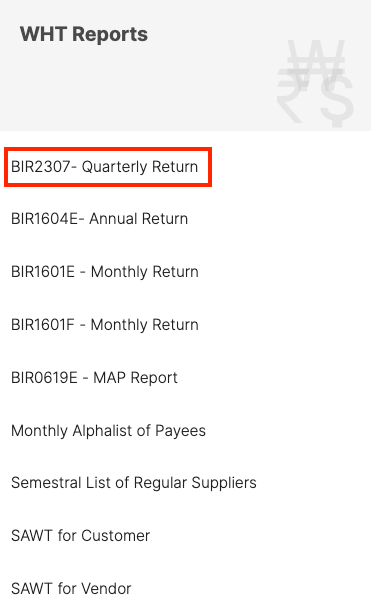

Where can Deskera Users retrieve the BIR 2307- Quarterly Return Report

Using Deskera Books, users can now retrieve the BIR 2307- Quarterly Return Report that is mapped according to the transactions on the buy tab.

To view the details in the report, users have to click on the Report tab on the sidebar menu. Next, they will have to select the BIR 2307 Quarterly Return Report under the WHT Reports category.

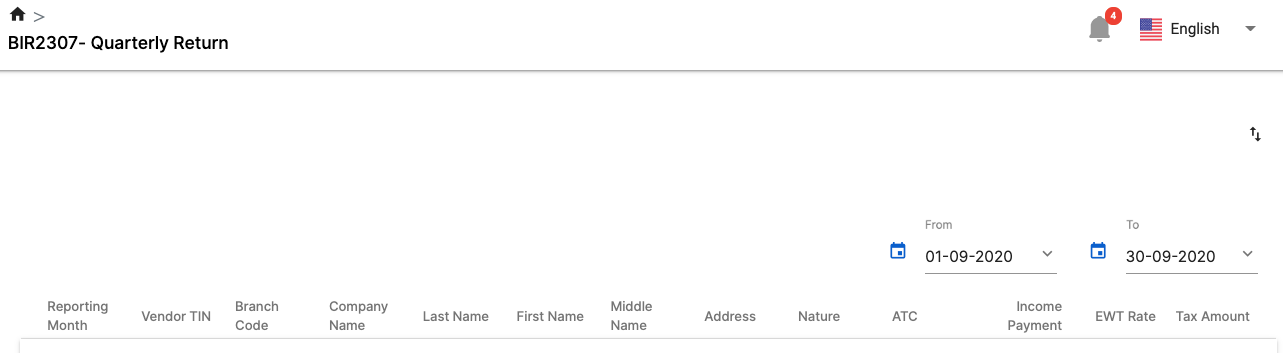

The BIR 2307 Quarterly Return Report. will reflect the details of the following fields with the tax amount auto-populated based on the transactions in Buy Module

- Reporting Month

- Vendor TIN

- Branch Code

- Company Name

- Last Name

- First Name

- Middle Name

- Address

- Nature

- ATC

- Income Payment

- EWT Rate

- Tax Amount

Deskera users can file their BIR 2307 Quarterly return via Philippines BIR Portal using the report generated from our system.

You can also generate the report based on the date range you prefer by using the date filter at the top right of the screen.