Reverse Change is a process under GST in which the receiver, makes the payment of GST instead of the supplier.

In normal cases, the supplier is the one who pays tax on supplies, but in the case of reverse charge, the role gets reversed.

Here, the buyer pays taxes directly to the government. This happens in the case of import and other notified supplies.

When is Reverse Charge applicable?

The Reverse Charge is applicable in case of:

- Services offered by an E-commerce aggregator/operator

- Here the liability to pay taxes lies on the recipient of the services. If the recipient has no physical presence in the taxable area, the E-commerce operator will be liable to pay the tax

- Supply from an unregistered dealer

- If a dealer is not registered under GST and is supplying goods to a registered buyer, then reverse charge will be applicable

- Supply of specific goods and services decided by the Government

- Some of these goods and services are cashew nuts (not shelved or peeled), tobacco leaves, silk yarn, raw cotton, old and used goods, GTA services, legal services by an advocate, etc

Who is liable to pay for the RCM?

A person or a business required to pay tax under Reverse Charge has to compulsory register under GST.

The threshold limit of 20 lakhs and ten lakhs for special category states does not apply to them.

Any purchases up to Rs.5000 from an unregistered supplier will not come under GST.

Taxpayers have to thoroughly check their daily expenses and analyze P/L accounts to check if any transactions fall under Reverse Change.

How do I set up the RCM in Deskera Books?

- Login to your Deskera account.

- Once logged in, click on the Switch To icon at the bottom left screen.

- Next, select Deskera Books.

- The system will direct you to Deskera Books' Main Dashboard.

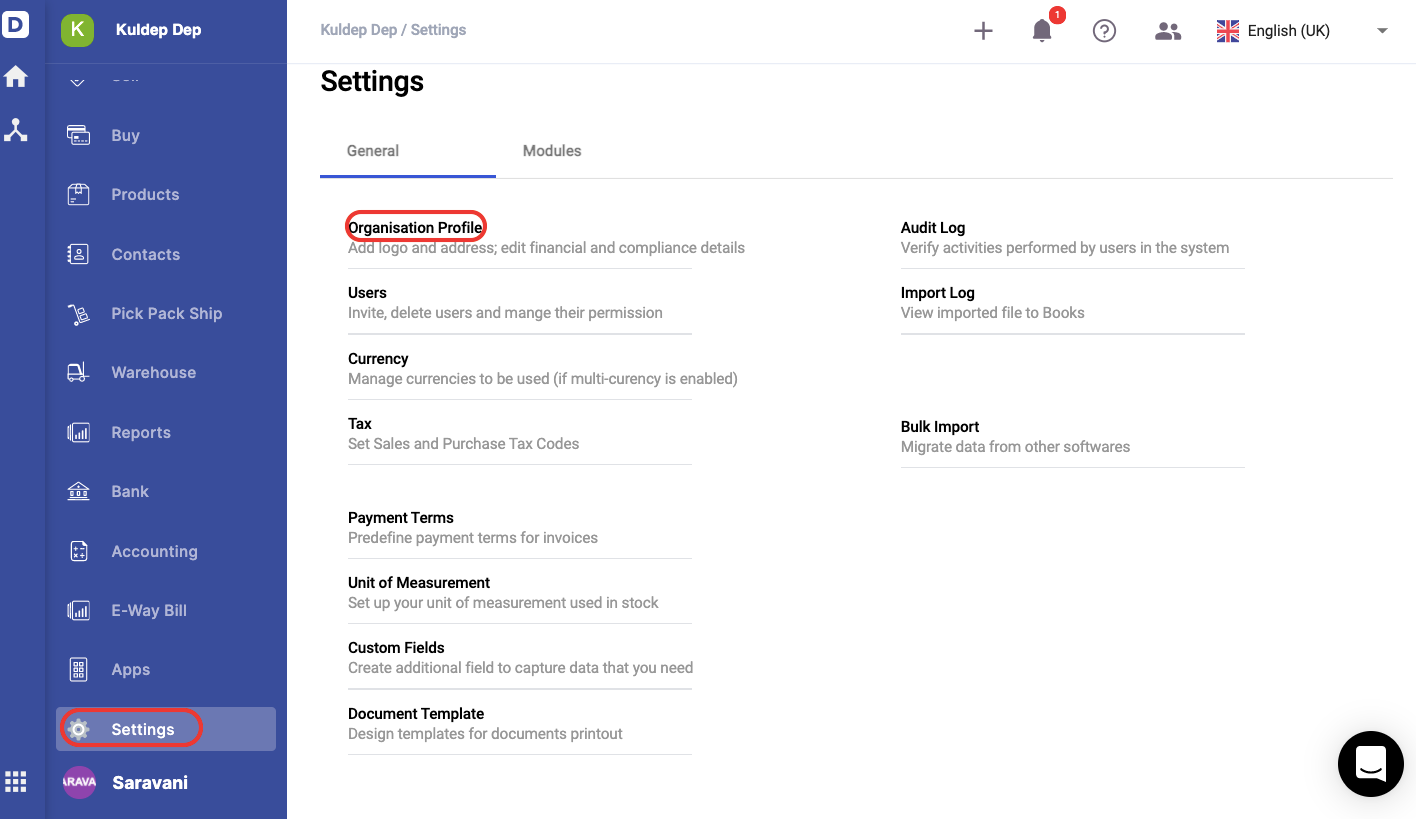

5. Click on Settings via the sidebar menu >> Select Organization Profile.

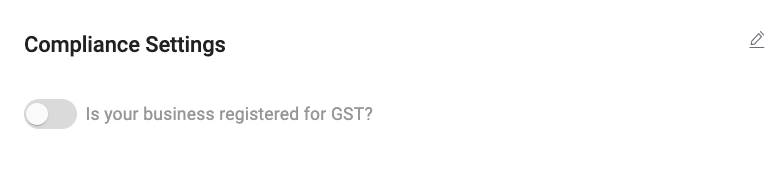

6. Select the edit icon under the compliance setting.

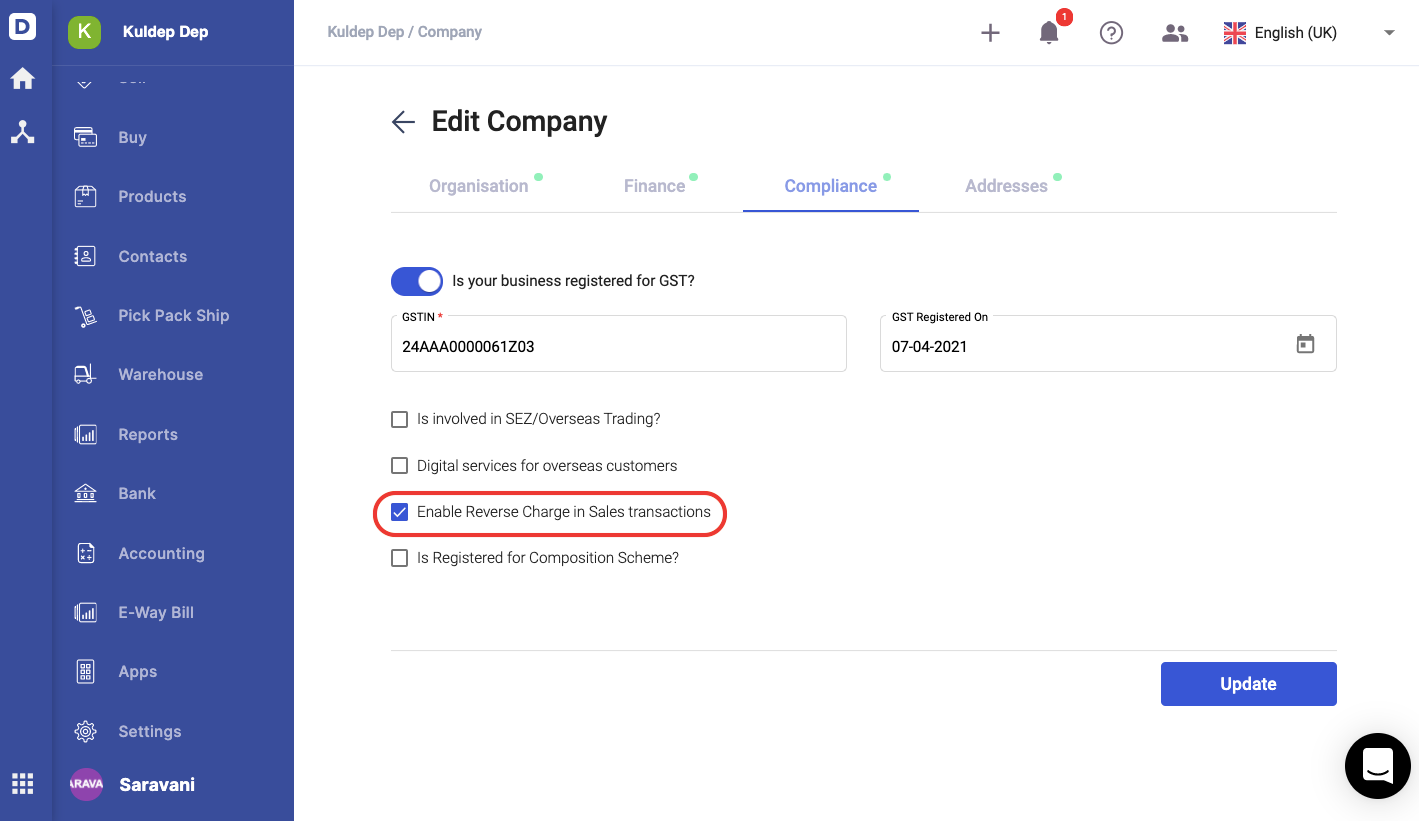

7. On the following screen, you are required to enable the toggle if your business is registered for GST.

8. Once you have enabled this option, you can view the the drop-down options as per the image above. In this case, you will have to enable the reverse charge in sales transactions.

9. Click on the update button.

How do I indicate the products applicable for RCM?

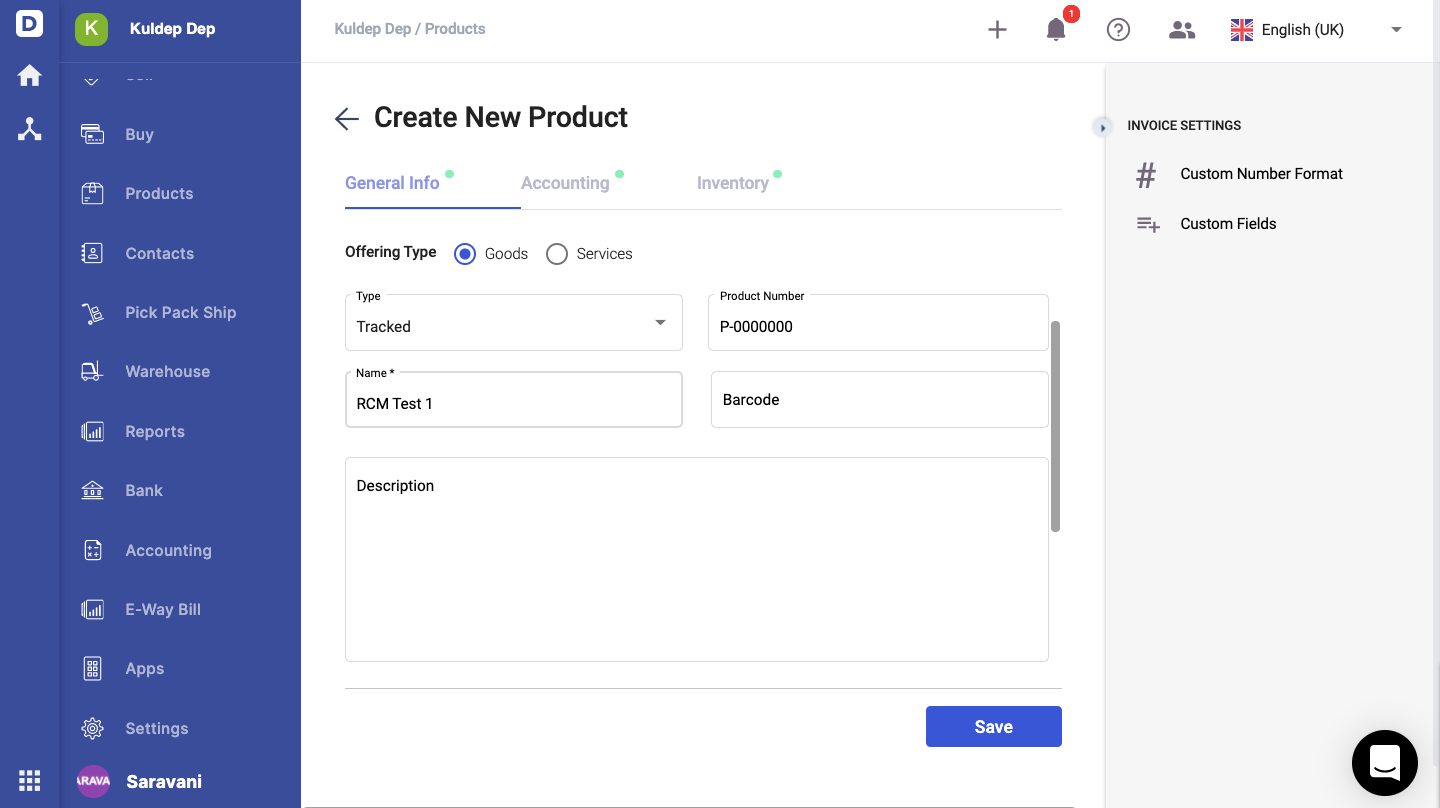

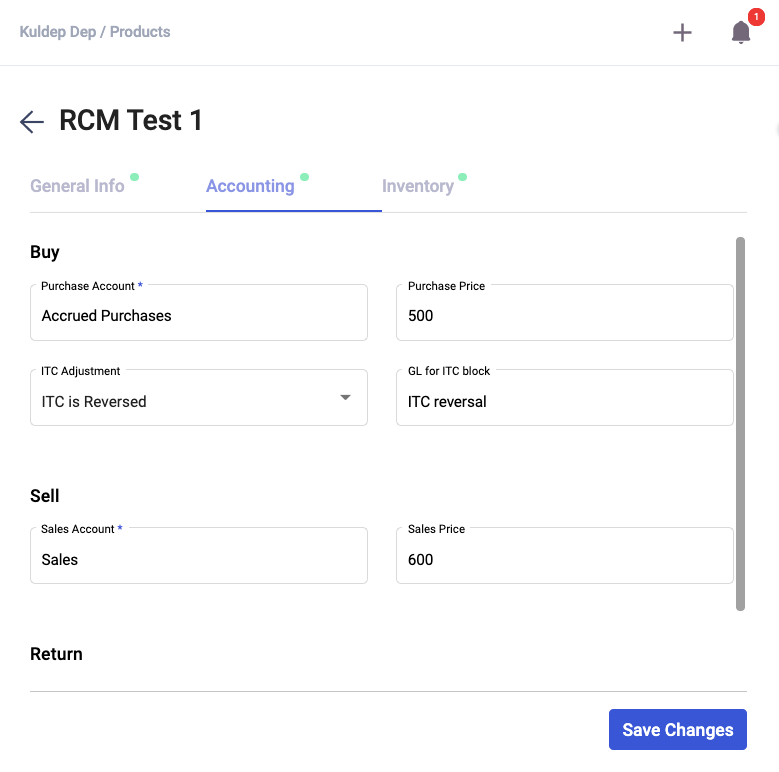

- Go to Product Module via the sidebar menu.

2. Click on the create a new product button; you can create tracked goods or non-tracked goods here. Enter the product's HSN and UQC fields and click Next.

3. Under the Accounting tab, for the ITC Adjustment field you can input ITC is reversed account, whereas the GL for ITC block, you can indicate ITC reversal account.

4. Click on the Save button.

How do I apply the RCM in a Bill document?

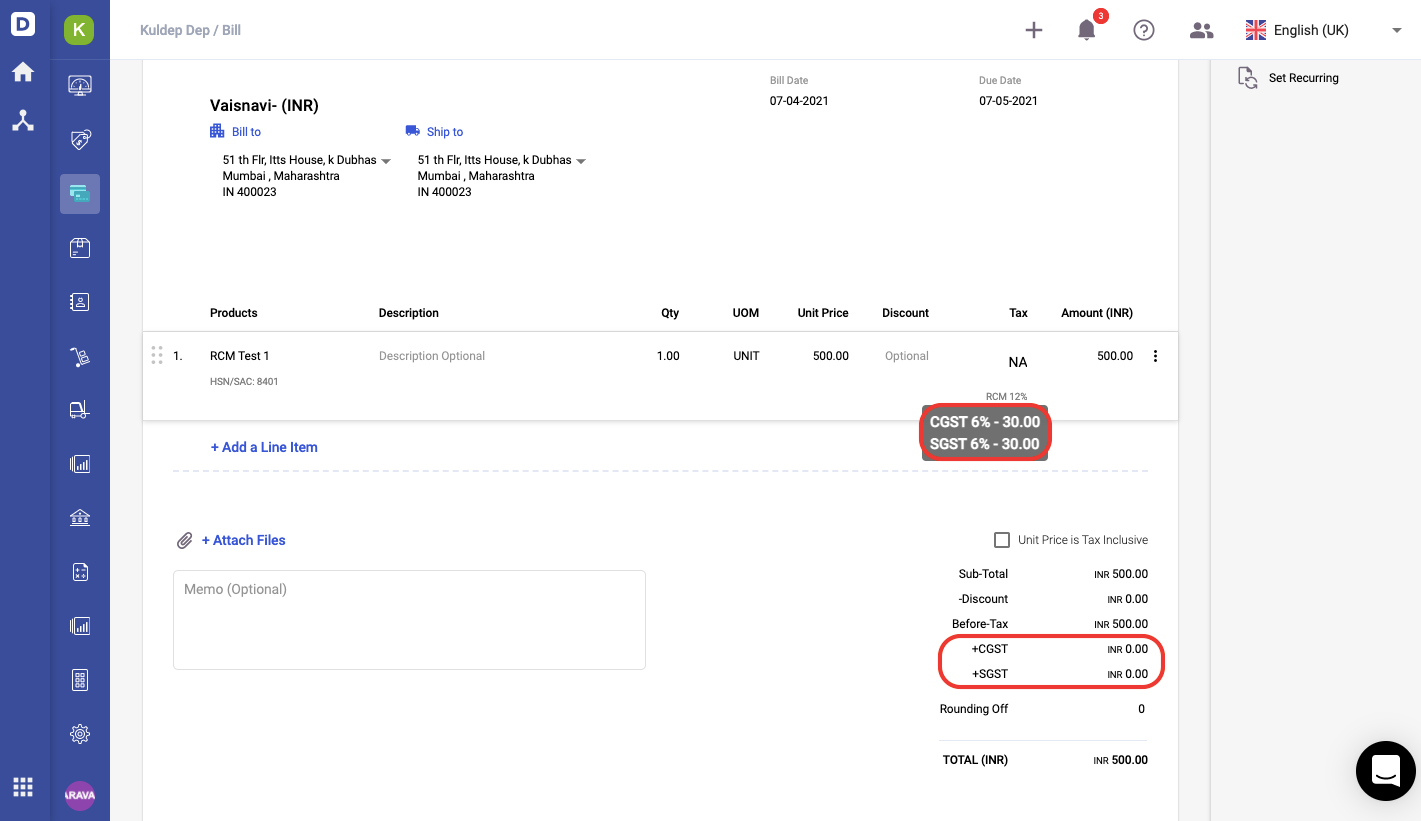

- Go to Buy tab via the sidebar menu.

- Click on the Create A New Bill button.

3. Apply the product with the ITC reversed account in this bill document. You can view the RCM label under the tax column.

4. At the bottom of the bill document, the tax amount will reflect as zero.

5. Click on the Save button.