In every organization, there comes a time when the organization decides to make changes to the company's details and tax details as some companies shift to a new business location due to the end of office leasing or for some other reasons.

Using Deskera People +, the admin of the system can amend or change the company's details and tax details.

How to add company details in Deskera People +?

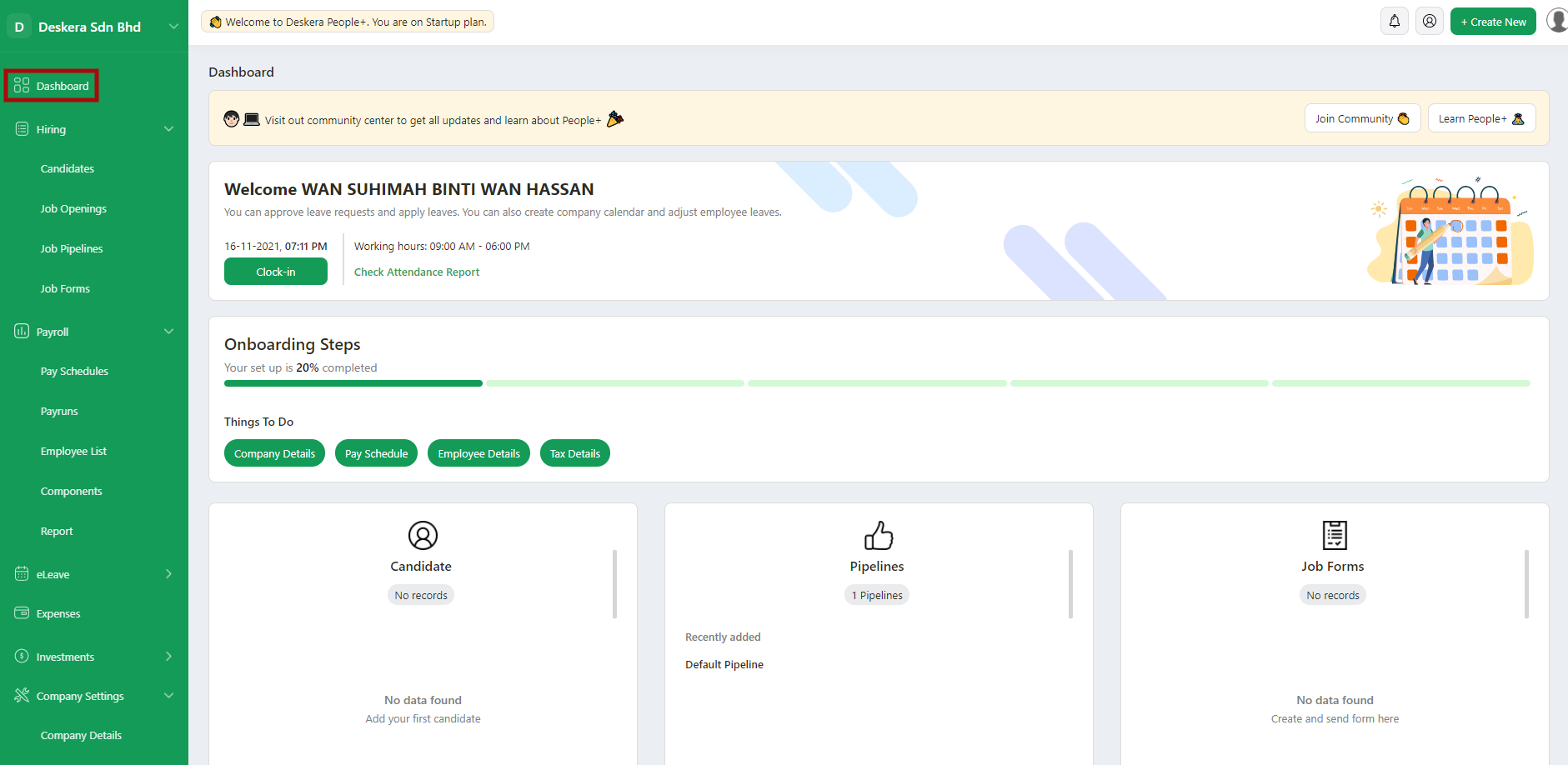

- Login to your Deskera People + Account.

2. After you have logged into your account, you can view Deskera People+ Dashboard. Click on Company Settings module on the sidebar menu. Under this, select the Company Details Module.

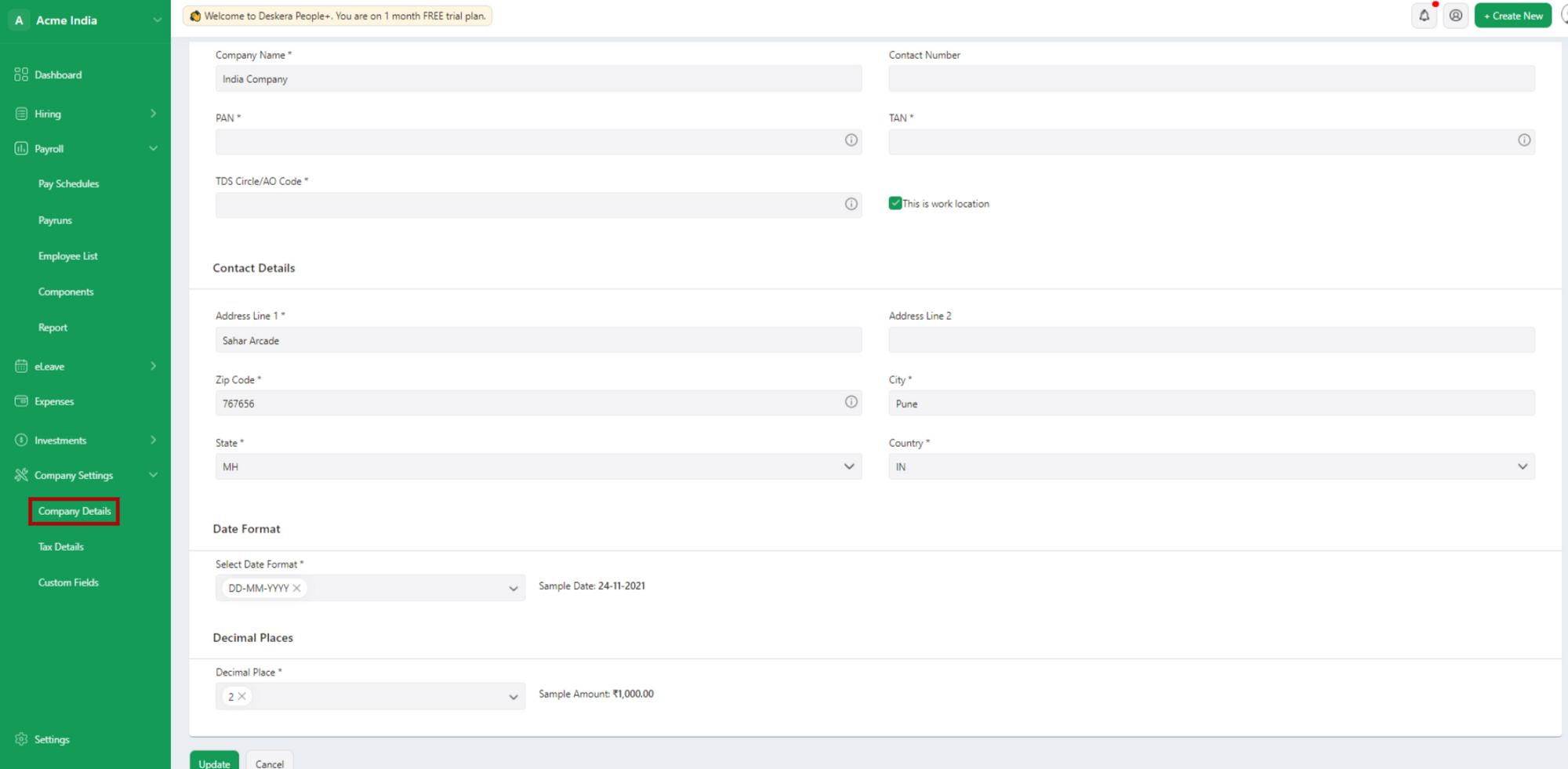

Fill in the following details:

- Company Name

- Contact Number

- PAN Number

- TAN Number

- TDS Circle/AO Code

- Tick on the Checkbox ‘This is work location’ if you want to make these changes address as Work location address.

Date Format

- You can choose the date format from the drop-down list will will further get reflected in the system.

Decimal Points

- From the drop down, select up to which decimal points you need the Amount.

3. Once done filling in the details, click on the update button to get the changes further reflected in the system.

How to add tax details?

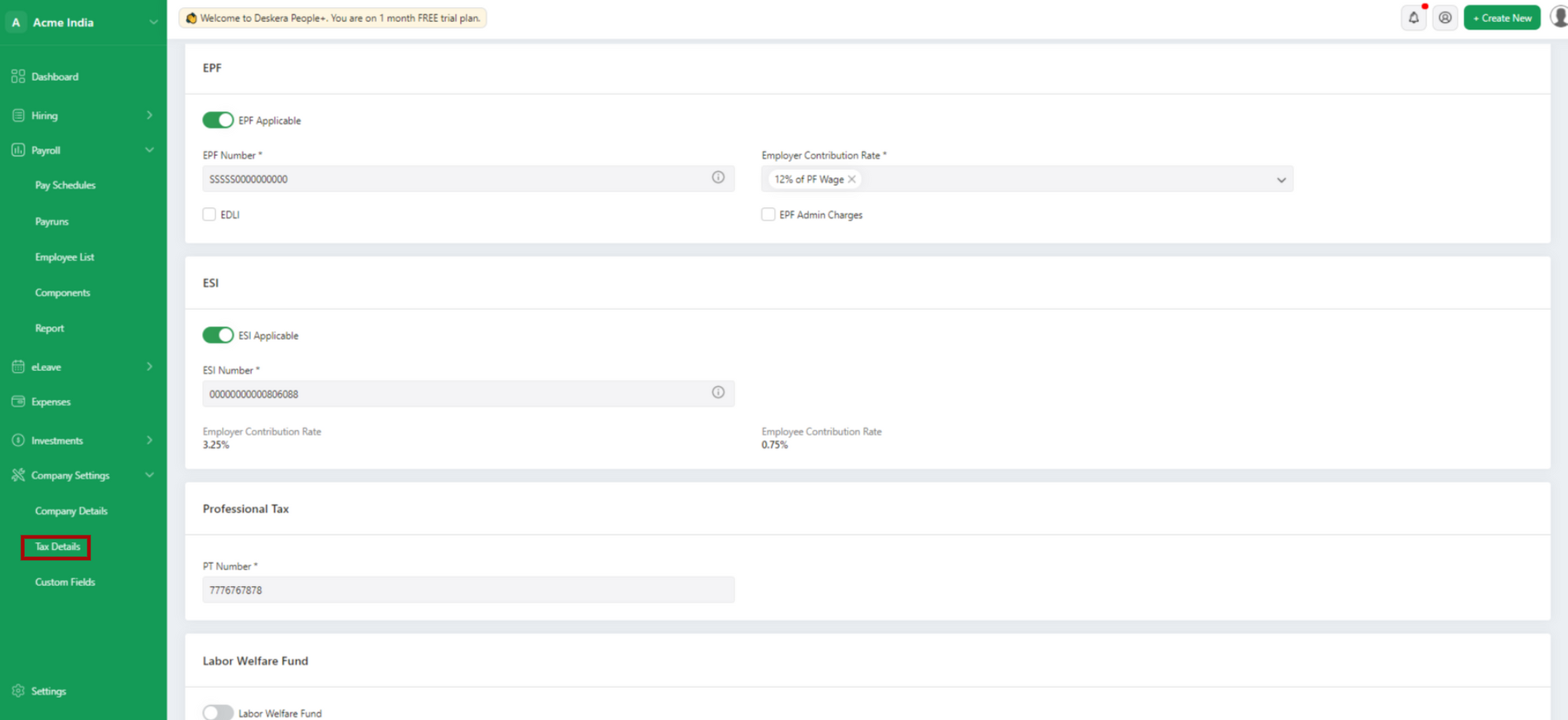

- Click on Company Settings module on the sidebar menu. Under this, select the Tax Details Module.

- Under EPF Section,

- Using EPF toggle button you can enable EPF applicability yes/no

- EPF number : Enter Company EPF number

In every organization, a part of the salary is contributed towards PF, where both the employer and employee contribute toward the employee’s provident fund.

Note: You have the option of disabling the calculation, by using the EPF toggle button, if for the company it is not mandatory amount of employees for calculating. If an admin disables the applicability of EPF then the system will not calculate the PF for any employees in the payroll.(Both employee and employer contribution is not calculated and displayed in the payrun)

- Employer Contribution Rate : Select employer EPF contribution rate from the drop down-list

- Tick on the check-box if EDIL is applicable.

- If there are any changes in EPF Admin, click on check box EPF Admin changes

- Under ESI Section,

- Using ESI toggle button you can enable EIS applicability yes/no

- ESI Number : Enter company ESI number

Employees' State Insurance (ESI) is a self-financing social security and health insurance scheme for Indian workers. The fund is managed by the Employees' State Insurance Corporation (ESIC).

- Employer Contribution Rate : By default ESI employer contribution rate

- Employee Contribution Rate : By default ESI employee contribution rate

Note: You have the option of disabling the calculation, by using the ESI toggle button, if for the company it is not mandatory amount of employees for calculating. If an admin disables the applicability of ESI, then the system will not calculate the ESI for any employees in the payroll.

- Under Professional Tax Section,

- PT Number - Enter company PT number

Professional tax can be defined as a tax that is levied by a state government on all individuals who earn a living through any medium. This must not be confused with the definition of other professionals such as doctors or lawyers. This is a type of tax that needs to be paid by each and every individual earning income. The calculation of this tax and the amount collected differs from one state to another. However, the limit has been set to Rs. 2500 per year. - Labor Welfare Fund

- Using Labor Welfare Fund toggle button you can enable Labor Welfare Fund applicability yes/no.