The first thing you need to do when starting a business in Malaysia is to study and understand the rules and tax regulations in this country. You will eventually come across Sales and Service Tax (SST) jargon.

Sales and Service Tax (SST) in Malaysia, is also known as Goods and Service Tax (GST) for some other countries. The sales tax is a single tax rate imposed on imported and locally manufactured goods.

Whereas the service tax is levied on taxable person in Malaysia in the course of their business in this country.

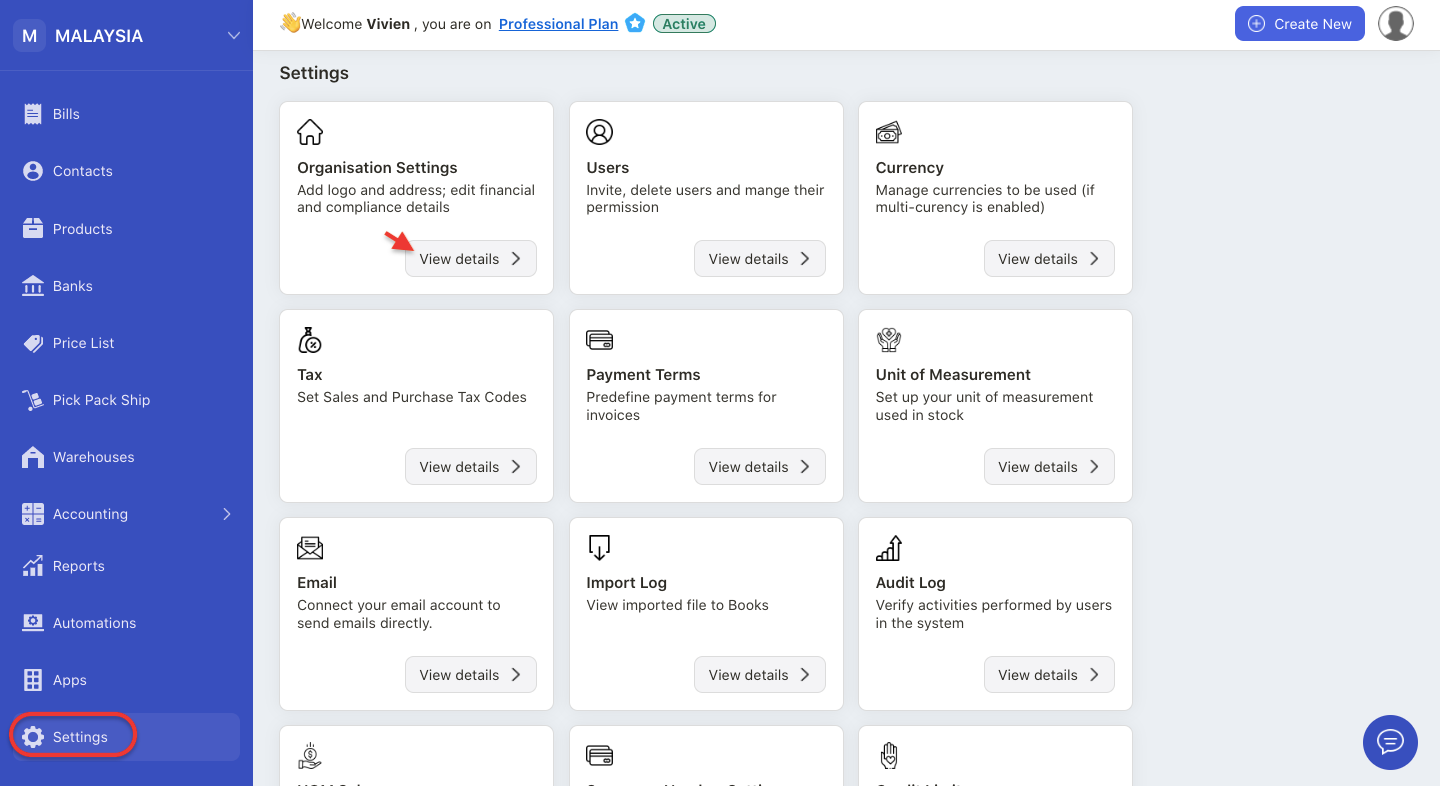

Follow the steps below to set up your Malaysia organization using Deskera Books Plus:

- Login to your Books Plus account.

- Once you are logged-in, you can view Books Plus Dashboard.

- Click on Settings via the sidebar menu.

4. On the setting page, select organization setting tab.

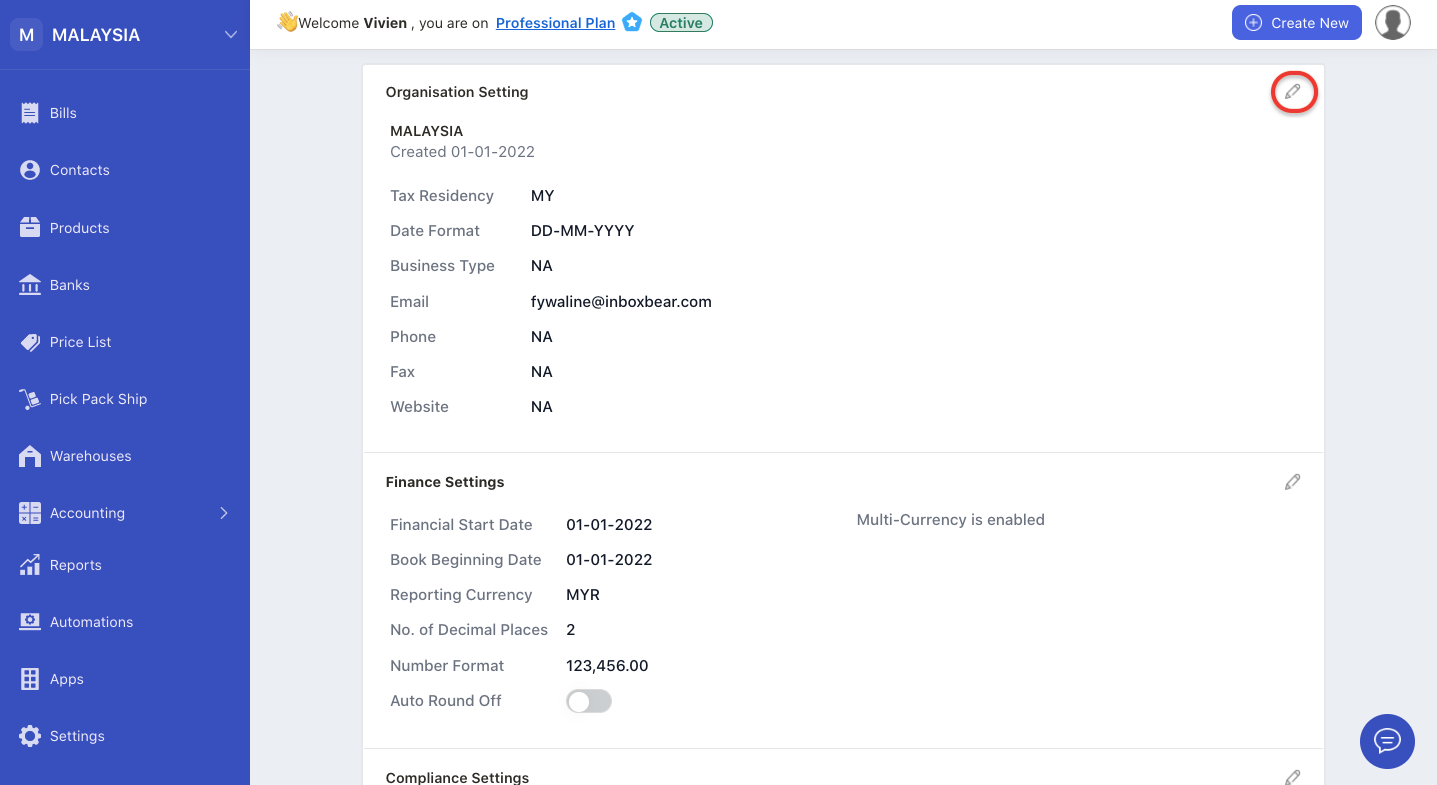

5. Click on the edit icon to edit your organization profile.

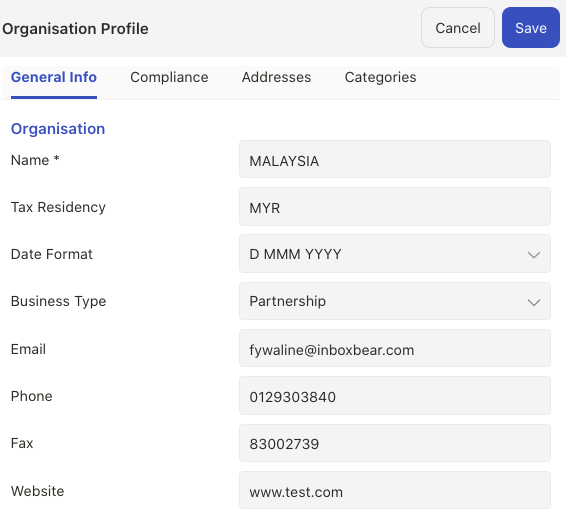

6. You can view five sections on this page. Fill in the fields;

Organization setting

- tax residency; choose your organization's tax residency, which is MYR

- date format; choose the date format that you wish to view in your organization

- business type; choose from sole proprietorship, partnership, LLP, S Corporation, LLC, Corporation, non-profit organization, or charitable organization

- email; enter your company's email

- phone; enter your company's contact number

- fax; enter the company's fax number

- website; enter the company's website

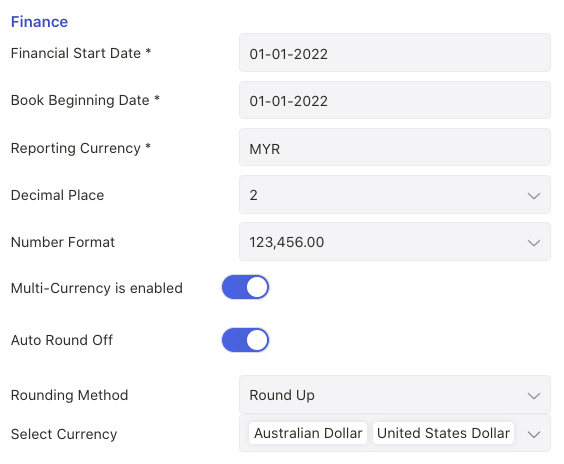

Finance setting

- financial start date; enter your accounting financial start date. You cannot edit this field after you have saved it

- book beginning date; enter the date you start using Deskera Books+. You cannot edit this field after saving it

- reporting currency; this will be your organization base currency, which is MYR

- no of decimal places; enter the number of decimal places to appear in your organization. Choose 2, 3 or 4 decimal places. Once you have saved the decimal places, you cannot edit to lower decimal place anymore

- number format; select the number format that you wish to be reflected in your organization

- multi-currency is enabled; enable the multi-currency toggle. Choose your preferred currency

- auto-round off; enable the auto-round off option. You can choose to round up or round down option. The system will automatically round off the document based on your configuration

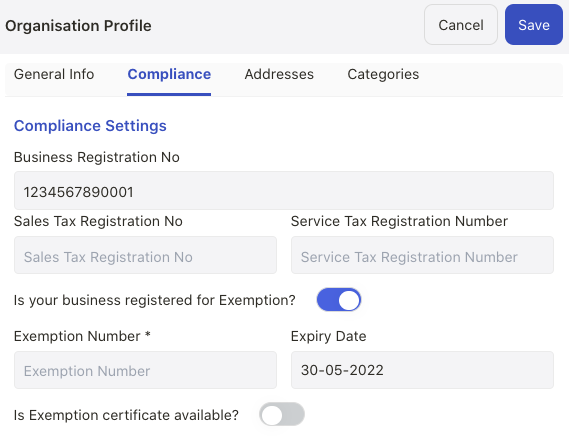

Compliance setting

- business registration number; enter your company registration number. If you have register for a business in Malaysia, you will receive a 12-digit registration number. For old format, your business registration number will start with six digits and end with an alphabet

- sales tax registration number; enter your company's 12 digit service tax registration number

- service tax registration number; enter your company's 9 digit service tax registration number

- exemption; enter the exemption number, expiry date, exemption certificate, and exemption category

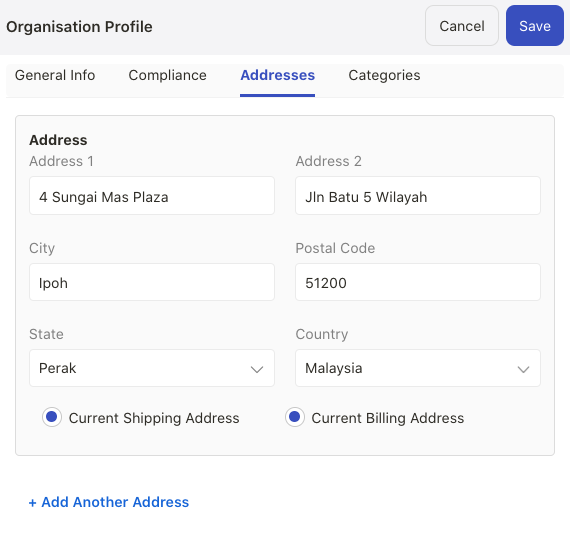

Address setting

- billing address; enter your organization billing address

- shipping address; enter your organization shipping address. Click on the add another address to add multiple addresses

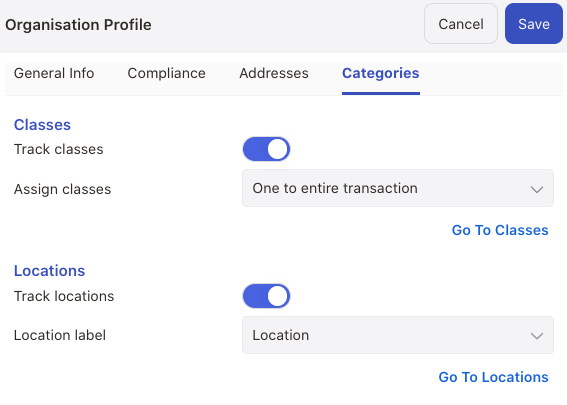

Categories setting

- track classes; enable the toggle if you wish to track classes. You can choose to apply one class to entire transactions or one class to each row in transaction

- track locations; enable the toggle if you wish to track locations. Label the location by business, department, division, location, property, store, or territory

7. After you have completed all the fields above, click on the save button.

8. Your company information will be reflected on this page. You can always edit the fields here except the book beginning date, financial starting date, organization name, tax residency, and reporting currency.