This article will guide you to set up the new payroll earnings and, deductions components for Australia Payroll Compliance.

Earning Components:

Payroll earning component means an additional income from the employees gross pay salary.

With Deskera People you can add the payroll earning component for your employees at any time, before processing the payroll.

Follow the simple few steps to do so,

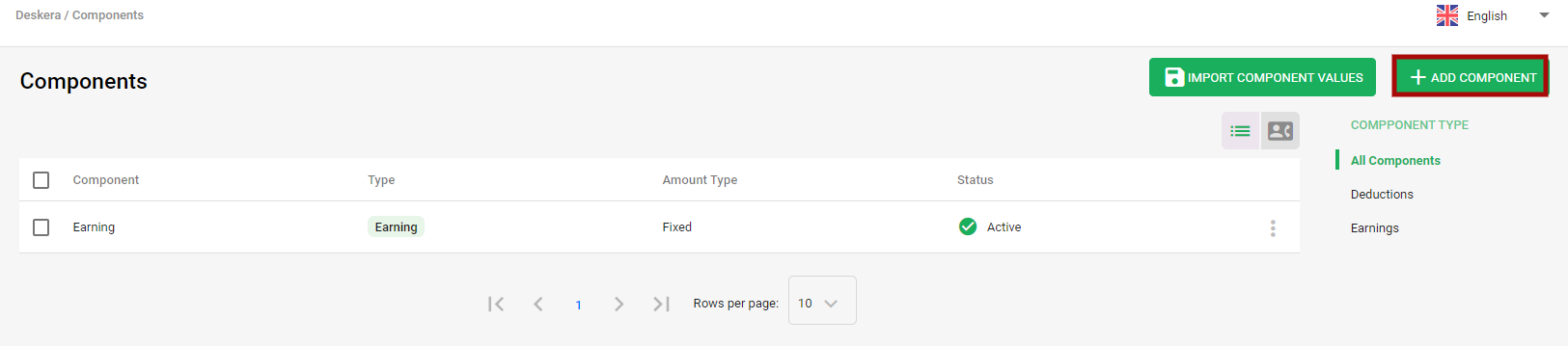

- Click on Component Module, below screen will appear

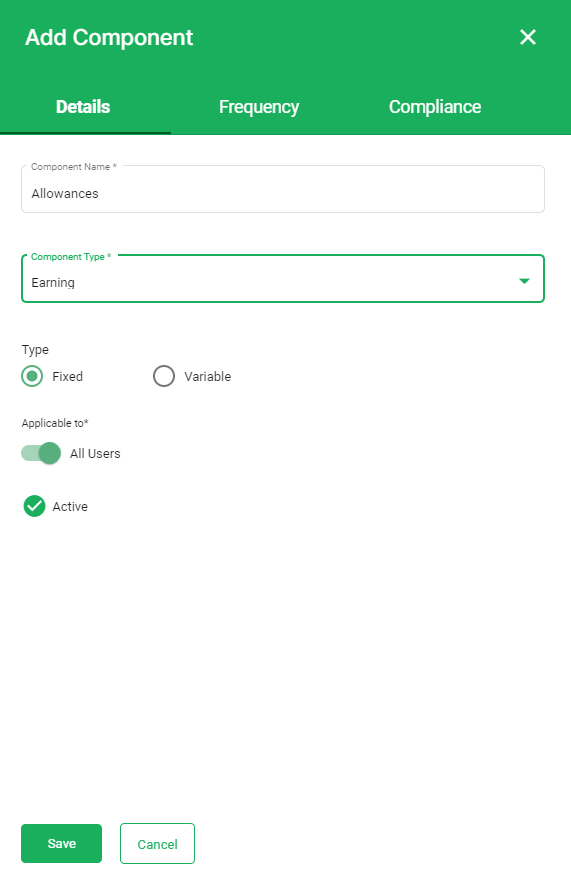

2. To add a new earning component, click on +Add Component button and a window will pop up where you need to fill in the following information,

3. Under Details Tab Section:

- Component Name: Add the component name

- Component Type: Select the component type Earnings from the drop-down menu.

- Type : Select type if, Fixed/Variable

- Applicable to: Under this, the Admin User has an option to select if this new component is applicable to all users or any particular user only.

- Active: Tick if the component is active or inactive

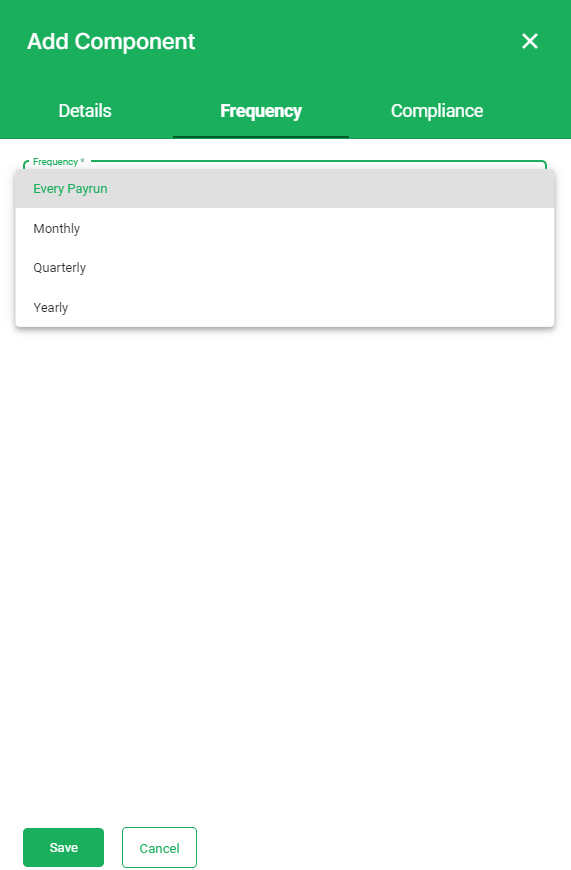

3. Under Frequency Tab you can select, if the component has to be used during each payrun/Monthly/Quarterly/Yearly

- If Frequency is selected as Monthly/ Quarterly you need to fill in below additional information,

- Months - Select the months from drop down list

- When - Select the options (start of month / end of month)

- If frequency is selected as Yearly you need to fill in additional below details,

- When - Select the options (start of month / end of month)

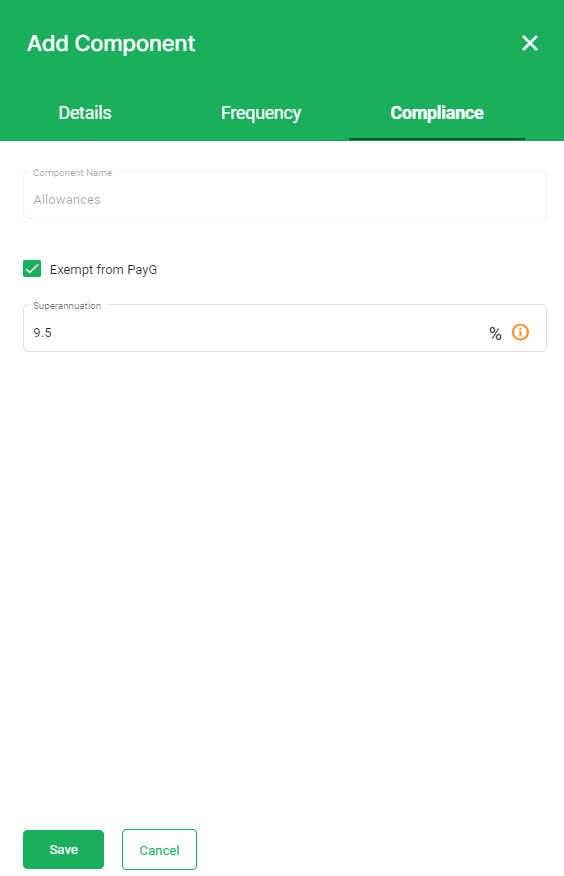

4. Under the compliance tab select below information

- Tick on Exempt from PayG if you want this earning component be exempted from PayG applicability.

- Superannuation : 9.5 % will be default value. Here admin can decide how much percent of superannuation will apply for the employee and therefore while processing the pay run the specific component will have the assigned percentage.

Deduction Components

Similarly, you can also add Payroll deduction component in the system which means that is taken from an employee's pay, whether it be pre or post-tax, other than payroll taxes themselves.

Follow the simple steps mentioned below,

- Click on the Component Module>> a screen will appear

- Click on + Add new component button>> a window will pop up where you need to fill in the following information

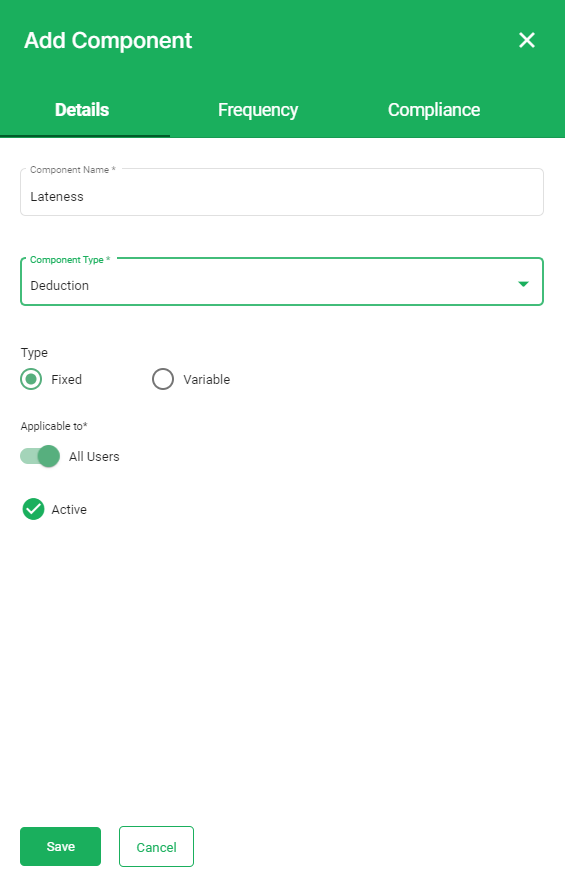

- Under Details tab

- Component Name: Add the component name

- Component Type: Select the component type Deduction from the drop-down menu.

- Type : Select type if, Fixed/Variable

- Applicable to: Under this, the Admin User has an option to select if this new component is applicable to all users or any particular user only.

- Active: Tick if the component is active or inactive

2. Under Frequency Tab you can select, if the component has to be used during each payrun/Monthly/Quarterly/Yearly

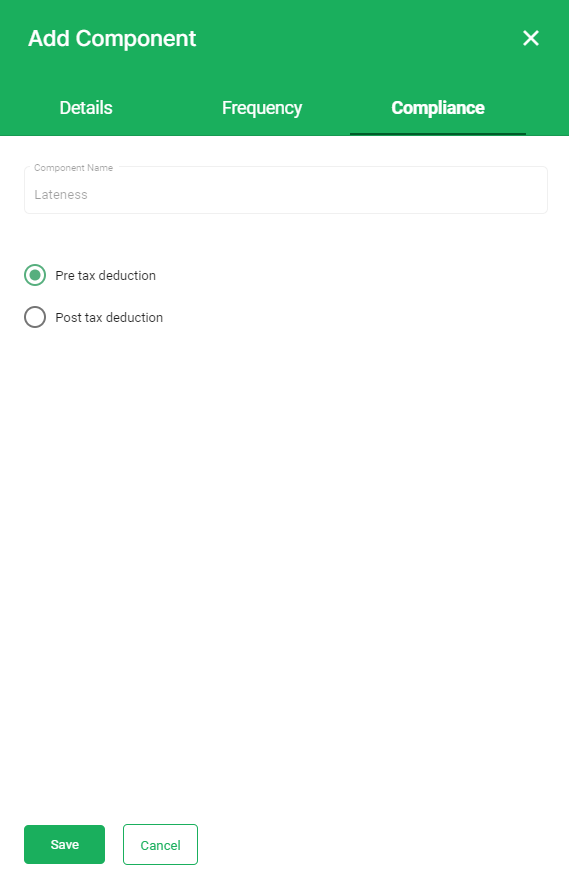

3. Under the compliance tab select below information

- Component Name : Will be auto-populated from the details tab

- Select if Pre Tax Deduction : The deduction is done before the tax is deducted

- Select if Post Tax Deduction : The deduction is done after the tax is deducted