When applying to a new office and getting to the contract signing stage, the HR department will definitely ask for a Taxpayer Identification Number (NPWP).

According to the Director General of Taxes (DGT), the NPWP is a number given to taxpayers or taxpayers as a means of tax administration, functioning as the identity of the taxpayer in exercising his rights and obligations.

PWP is given to Taxpayers who have met the requirements stipulated in the Taxation Law and will not change even though the Taxpayer changes domicile.

So far, NPWP has always been used for administrative requirements; opening bank accounts, applying for credit cards, selling land and other necessities. However, NPWP also has an important role in the NPWP calculation process, so make sure you already have a NPWP or make a new one as soon as possible if you don't have one.

What are the consequences for taxpayers who do not have an NPWP? The rate charged for taxable income (PKP) given by the payer will be greater than that of taxpayers who already have an NPWP.

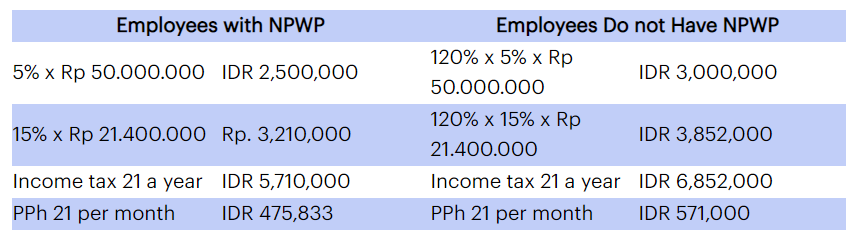

To be clearer, here is an example of calculating PPh 21 questions.

Salary - IDR 11,000,000

Department Fees - 5% x Salary: IDR 550,000

__________________________________________ –

Monthly Net Income - Rp. 10,450,000

Annual Net Income - Rp. 125,400,000 (Rp. 10,450,000 *12)

Calculate Taxable Income (PKP): Net Income for One Year - Non-Taxable Income (PTKP) TK / 0

IDR 125,400,000 - IDR 54,000,000 = IDR 71,400,000

Calculate PPh 21 Payable for a Progressive Tax Year (Because IDR 71,400,000 is more than IDR 50,000,000)

(5% x 50,000,000 = IDR 2,500,000) + (15% x 21,400,000 = IDR 3,210,000) = IDR 5,710,000.

Calculate monthly income tax payable: IDR 5,710,000: 12 = IDR 475,833

Ownership of NPWP is important for all workers, as it helps them from paying much higher taxes. Every worker who does not have a NPWP is subject to a tax of 120%. Here is an example of a comparison.

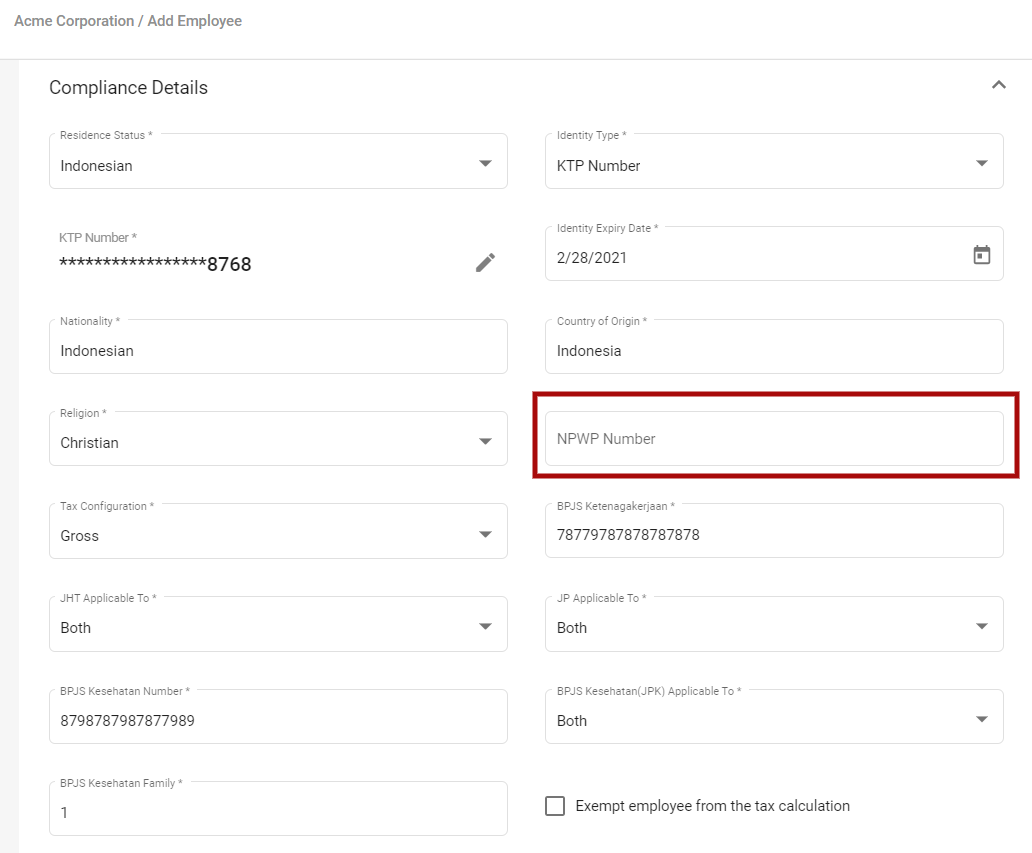

How to calculate PPH 21 without NPWP number in Deskera People?

In Deskera People if you do not enter the NPWP number, your PPH21 calculation will auto-calculated with 20% extra surcharge on your Tax