Customer acquisition costs can cost up to 7 times more than selling to existing customers. Additionally, the probability of successfully selling to a new customer lies between 5 to 20 percent, whereas the probability of successfully selling to an existing customer lies between 60 to 70 percent.

Yet, the customer acquisition cost is the concern of the majority of businesses. In fact, it is why you are here. You know that having a complete understanding of customer acquisition costs is vital for you to have sustainable business growth, with your expenses due to it not overtaking your revenue from it.

Customer acquisition cost has become a crucial business metric because it helps businesses determine the resources they will need to attract new customers and continue their growth. Customer acquisition cost is hence the amount of money your company spends to acquire a new customer. It also helps in measuring the return on investments on the efforts it took to grow your business’s clientele.

To calculate your customer acquisition cost, you will need to add all the costs associated with converting your sales prospects into customers, such as marketing costs, advertising costs, sales personnel costs, and so on. The sum of these costs is then divided by the number of customers you acquired.

Hence, if you want your business’s customer base to expand and still make net profits, it is essential for you to understand all that there is to know about customer acquisition costs in marketing. This article will be covering the following topics for the same reason:

- What is Customer Acquisition Cost in Marketing?

- Why is CAC Metric Important?

- Types of Costs Included in CAC Formula

- How to Calculate CAC?

- CAC Formula and CAC Examples

- LTV to CAC Ratio (LTV : CAC)

- Common Ways to Segment Your CAC

- How to Improve Your Customer Acquisition Costs?

- How Can Deskera Help Your Business with CAC?

- Key Takeaways

- Related Articles

What is Customer Acquisition Cost in Marketing?

Customer Acquisition Cost or CAC in marketing refers to the total resources and costs incurred for acquiring a new customer. Hence, it includes all the marketing and sales costs incurred over a specific period of time to acquire new customers.

This includes and is not limited to program and marketing spending, salaries, commission, bonuses, and overhead costs. All of these are the costs that are associated with attracting new leads and converting them into customers.

CAC hence has become a key business metric which the businesses try to reduce as much as possible not only to increase their revenue or net profit ratio but also because it is a reflection of the health of your business’s sales, marketing, and customer service programs.

In fact, CAC is not used individually, but rather for more comprehensive insights, it is used alongside Customer Lifetime Value (CLTV)- which measures the value that will be generated by the new customer.

In addition to CLTV, CAC is also measured with Monthly Recurring Revenue which is the measurement of revenue generation in a month. These are the common ways of identifying whether your business is operating efficiently or not and whether, therefore, your operating income is higher than operating expenses or not.

CAC is based on the premise that if, for instance, your inbound marketing program is operating successfully, then you would not have additional expenses in terms of ad spend for generating poor-fit lead. Your inbound marketing might be your own blog which is bringing in high-quality, organic, and qualified leads 24 hours a day.

Similarly, if your sales team is constantly prospecting and nurturing a healthy sales pipeline, you would not have to hire additional salespeople to meet your sales quota each quarter. Lastly, if your customer success team, as led by your customer success manager, is able to cultivate relationships with your customers, then not only would you have increased customer retention and customer loyalty, but you would also have a higher proportion of returning customers.

In fact, the positive customer feedback in terms of testimonials, reviews, and case studies will be even more beneficial to you as it will lead to sales referral as well as increased relationship selling. All of these are ways in which your business can operate with more profitability, lower its CAC and have a stronger customer base.

Today, with the emergence of eCommerce, digital marketing, and web-based advertising companies, CAC as a metric has been growing continuously. In fact, with metrics like CAC, web-based companies can now get engaged with highly targeted marketing campaigns and even be able to track the progress of their customers down the sales cycle until they make the final purchase. In this environment and all that it is a reflection of, the CAC metric is used by the businesses as well as the investors.

Why is CAC Metric Important?

The CAC metric is important to your own company and its employees and to the external investors. Here’s why:

- Investors look into CAC to analyze the scalability as well as the profitability of your business. They can do so by looking into how much money can be extracted from your customers and the costs that would be incurred to extract that money. Investors tend to be more concerned about the present-case scenario here rather than the future. They would be interested in knowing the future promises of improving the metric only if it can be justified.

- Your company’s employees, like marketing managers or anyone having a marketing job role, or operation’s specialists, look into CAC so that they can identify marketing strategies for optimizing your returns on advertising investments. By doing so, they will be able to reduce the costs while simultaneously increasing the profit margin of your business.

Hence, while investors are interested in providing your company with the resources it needs, your company’s partners and employees are interested in ensuring your company’s growth and having higher returns on investment, your company itself is interested in having improved profit margins so that it can pass the value to its customers and secure a greater market position. For achieving all of these objectives, CAC serves as an important guiding metric.

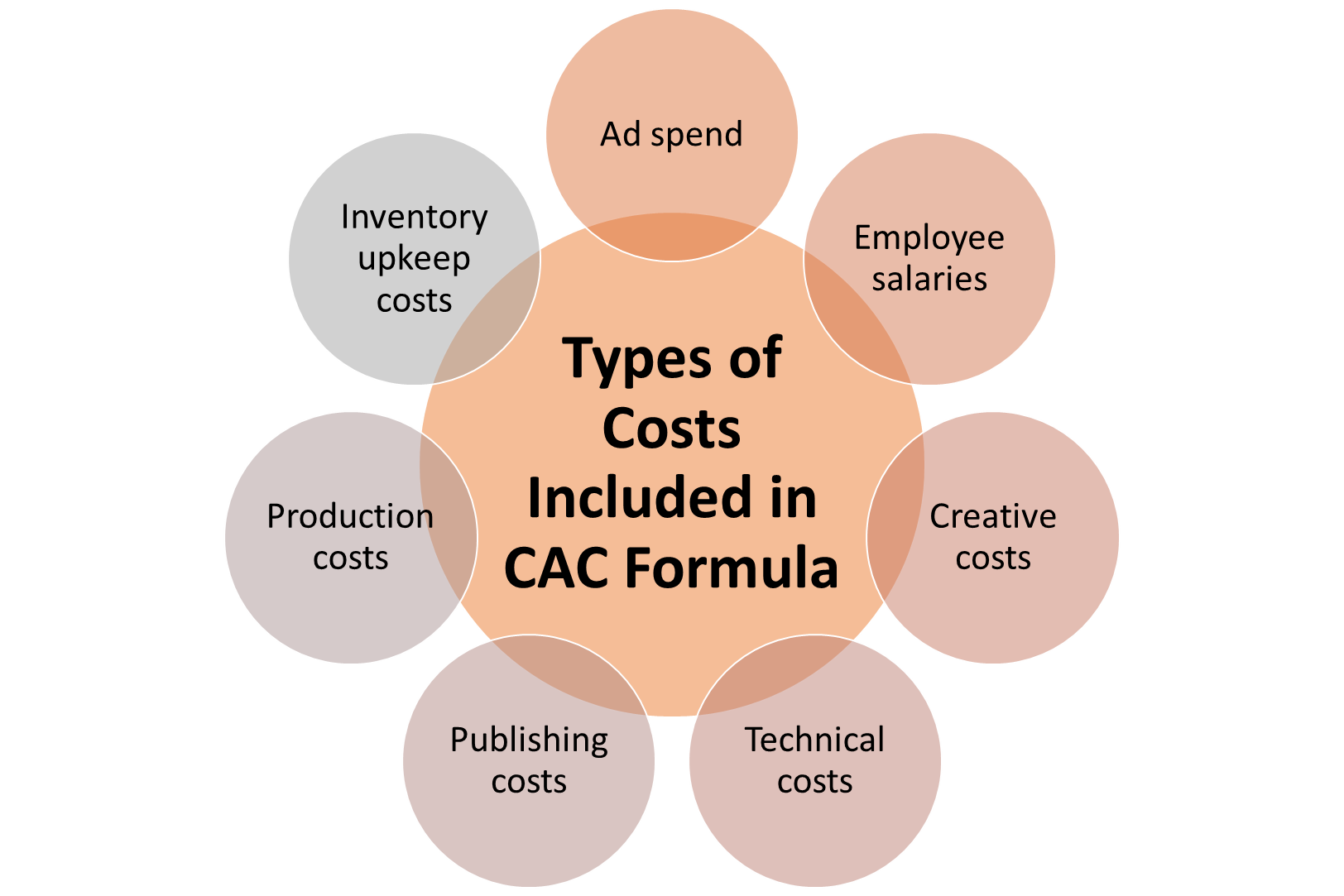

Types of Costs Included in CAC Formula

Customer acquisition costs vary across different industries because of various determining factors like:

- Length of the sales cycle

- Purchase value

- Purchase frequency

- Customer lifespan

- Company maturity

However, their CAC is made up of several types of costs. Thus, the several types of costs that are included in your CAC formula are:

Ad Spend

This refers to the money you are spending on advertisements. Businesses resort to advertisements for various reasons like:

- Acquiring new customers

- Retargeting marketing

- Close deals faster

- Introducing new products or services or features or offers

And so on.

However, in order for your advertisements to work, they should be designed in accordance with the buyer personas of your target audience. In order to know whether your ad spend is profitable or not, you can divide the revenue you earned from ads by the amount you expended on that campaign.

Employee Salaries

Employees are always an asset to your company, and how you approach this cost is hence very important. An employee is great if he or she can manage workplace stress, helps you in achieving all your marketing objectives, and even helps in saving costs while being the reason behind a positive brand image and brand awareness.

Issuing pay cuts or layoffs for such employees would be detrimental to your business and even affect your cash flow negatively. This cost should hence be combated by digitizing customer service, automating email marketing, having a software for tracking your marketing KPIs in real-time, and in many such other ways. These ways will not only help in retaining your employees but also help in increasing your company’s productivity and thereby improve its cash flow and increase its gross profits.

Creative Costs

These are the costs incurred for creating content. Creative costs could thus be the money spent on acquiring talent to promote your company or the cost of lunch during a team meeting. All such factors that are involved in content creation are added under this category of cost.

Technical Costs

This refers to the cost of technology used by your marketing and sales team. For example, if you purchase a tool that helps you create your own sales pipeline and track your customers and deals through it, then this tool would be counted as a technical cost.

Publishing Costs

This is the money spent in order to release your marketing campaign to the public. For example, money spent on TV airtime, paid search engine marketing, performance marketing, money spent for a spot in newspapers or magazines, and so on.

Production Costs

These are the costs associated with physically creating content. For example, if you are making a video, then you will need to buy a camera, create a set, edit the video, etc. All of these would add up to your CAC costs, especially if you are relying on a third party to produce content for you.

Inventory Upkeep Costs

Irrespective of whether you sell physical or non-physical products and services, you will have to spend money on maintaining and optimizing your products. If your business sells physical products, then these costs would be due to utility bills, storage fees at a facility, etc. however, if you are selling a software- a non-physical product, then these costs would be in the form of money spent on updates and patches to improve user experience.

How to Calculate CAC?

The steps to calculating your CAC are:

- Determine the time period you will be evaluating. Is it a monthly CAC, quarterly CAC, or yearly CAC? This will make your results more accurate and help you narrow down the scope of your data.

- Add your marketing and sales expenses incurred to acquire new customers.

- Divide the total you got from the previous step with the total number of new customers that your business acquired during the said period.

- The result value would be your company’s estimated CAC.

Once you have found the value of your business’s CAC, you would be able to compare this value with other key business metrics and get useful insights about your marketing, sales, and customer service campaigns. In fact, you would even be able to identify your marketing attribution, promote your bestsellers further and ensure proactive customer service.

However, if your company has been engaged in investing activities like the early stages of an SEO practice or signing up a digital marketing agency, then it would be expecting to see the benefits from it later on. In such a scenario, CAC should be calculated accordingly in order to keep it as close to reality as possible.

CAC Formula and CAC Examples

The formula that you can use for calculating your customer acquisition cost is:

CAC= (Cost of Sales + Cost of Marketing) / New Customers Acquired

CAC Example 1: A Consumer Goods Company

Suppose a consumer’s goods company spends $7,000 in sales and $3,000 in marketing to attract 1,000 new customers. Then it’s CAC is:

CAC= ($7,000 + $3,000) / (1,000) = $10

Thus, the consumer goods company spends $10 to acquire each new customer.

CAC Example 2: A CRM Company

A CRM company spends $50,000 on marketing its software. After its marketing campaign, it gained 2,000 new customers who have subscribed to its software. Every year, your company is expecting to spend $30,000 on technical and production costs for these customers. Its CAC is:

CAC= ($50,000 + $30,000) / (2,000) = $40

Thus, the CRM company spends $40 to acquire each new customer.

- However, as these examples indicate, CAC by itself does not give much insight. In order to make these values more insightful, they need to be compared with their CLTV as well. Now, I will be taking you through two examples that calculate CAC and compare it with its CLTV.

Example 3: An eCommerce Company

An eCommerce company that sells organic food products spent $10,000 on advertising last month and got 10,000 new orders. This means that its CAC is $10.

However, what CAC does not highlight here is that the average order by its customers is $25, and its products have a markup of 100%.

This hence means that from each sale, the company is generating $12.50, out of which only $2.50 from each customer’s purchase is going towards meeting expenses like employee salaries, office space, web hosting, and other such expenses. Furthermore, each customer is expected to make only one purchase from the company, making their CLTV low and their CAC unreasonably high and unprofitable.

Example 4: A CRM Company

This is a well-established company, who has worked its way up in the search engine and has a brilliant sales team who are working at a minimum wage from their residence in the rural areas.

The cost of distributing the software is also low because it is a cloud-based system, and the customers need only a little support from the company. Additionally, the company also has several strategic partnerships that gives it a steady flow of customers.

Their costs to be included in CAC are:

- Total cost of new customer sales support call center = $1,000,000 / year

- Total cost paid to strategic alliance partners per customer = $1.00

- Total monthly spending on search engine optimization = $20,000 / year

The total number of new customers generated in a year are: 1,020,000

Therefore, CAC = ($1,000,000 + $20,000) / 1,020,000 = $1 + $1 (per customer for strategic alliance)

Hence, CAC per customer is $2.00

Now, the company has calculated $2,000 as its customer’s CLTV. This hence means that this company is able to turn $2 investment into a revenue of $2,000 which is attractive to investors and is also a proof for its marketing team that they have an effective marketing system in place.

LTV to CAC Ratio (LTV : CAC)

LTV to CAC ratio is a quick indicator of a customer’s value relative to how much it costs to earn them. You should thus use the LTV to CAC ratio (LTV: CAC) to guide your business’s spending habits for marketing, sales, and customer service.

In fact, in order to ensure that you are getting the most out of this financial investment and make your financial statements healthier, you should aim to find the right balance for this ratio.

Now, if your business’s LTV to CAC ratio is 1:1, then it means that you are spending just as much money in attaining new customers as your customers are spending on your products or services. It hence is not a profitable ratio. The ideal LTV to CAC ratio is usually 3:1, as this indicates that your customers are spending three times more on your products or services than you are spending on acquiring them.

If your LTV to CAC ratio is higher than 3:1, say, 5:1, then it indicates that your business is not spending enough on its sales and marketing and therefore is letting several opportunities and leads go untapped.

However, depending upon which industry your business is a part of, your ideal, or rather a good CAC, gets determined. To begin to know it, you should start by finding out the average customer acquisition costs in your industry.

Common Ways to Segment Your CAC

One of the disadvantages of looking only at the total CAC is that it hides the specific channels that are most or least effective. Knowing this is important and will help you become more profitable as you would know which channels need to be optimized and which ones need to be held back on.

For example, if you spent $500 on Facebook ads and on Google ads each, but you got double the customers from Facebook ads, then you got from Google ads, in that case, you would want to increase your investment in Facebook ads.

Some of the common ways of segmenting your CAC are:

- Channel

- Ad

- Company size

- Country

- Age

- User persona

And other such relevant demographics.

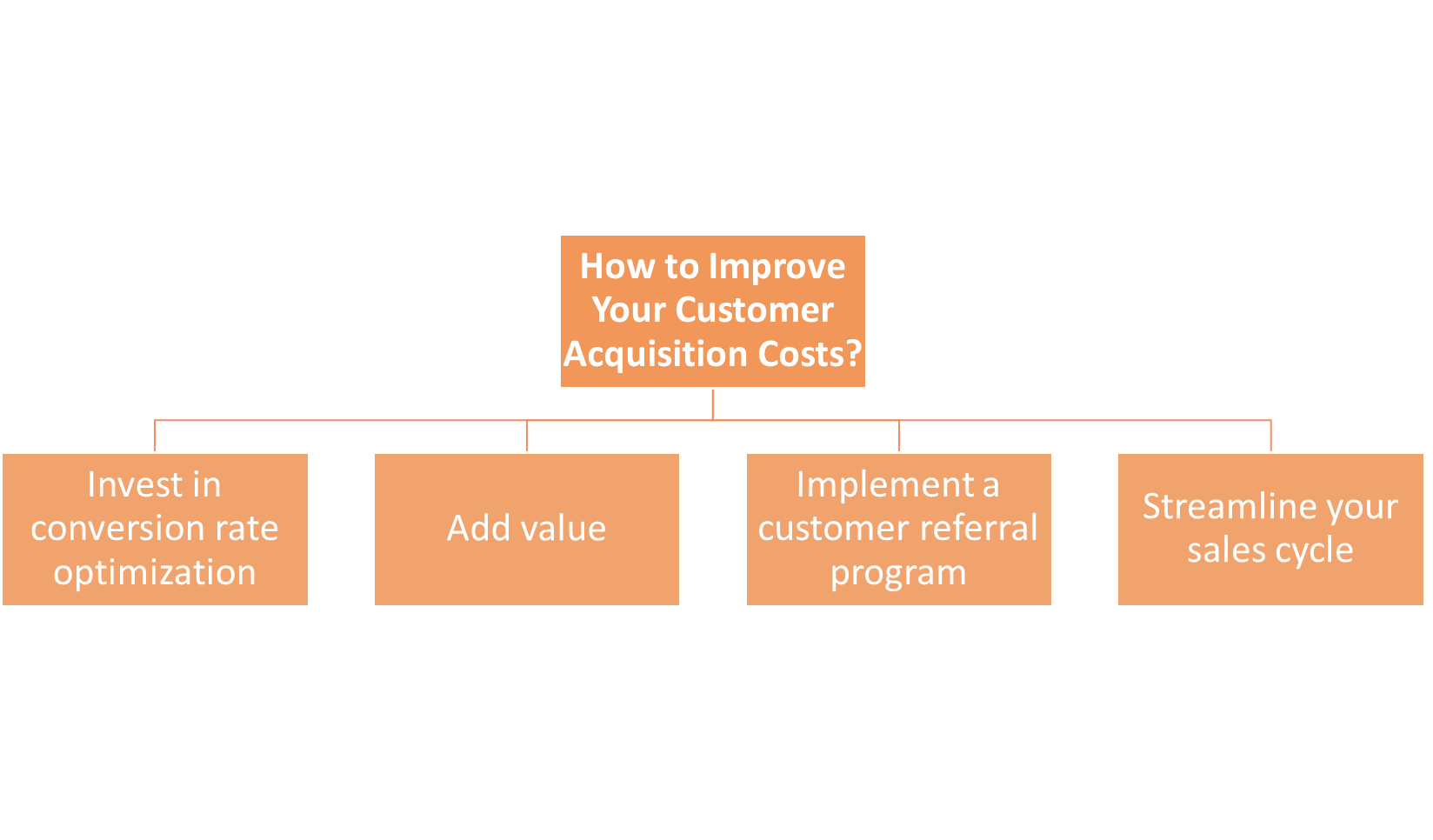

How to Improve Your Customer Acquisition Costs?

Some of the strategies that you can implement in order to bring your LTV: CAC ratio closer to 3:1 are:

Invest in Conversion Rate Optimization

This involves making it easier and straightforward for your visitors to convert into leads and for your leads to convert into customers and make purchases on your website.

Some of the ways of doing that also involve optimizing your website for mobile view, form submission, and shopping. You should also test your website’s copy to ensure that it is clear. You should even make the entire sales process touch-less and simple so that your sales prospect can buy from you 24/7 without having to rely upon any assistance. However, if yours is a business that will require assistance, then you should set up one.

Add Value

Increase value by giving your customers what is valuable to them. To find out what your customer’s pain points are and what they are looking for, you should rely on their feedback. Whether it is a product fix, a new feature, or a complementary product offering, do your best to meet all of your customers' needs, as this will make them stick around longer.

Implement a Customer Referral Program

If your customers refer you to a warm lead who is already interested in buying your product or services, then their CAC will become $0 once the warm lead converts. Such customers who are “free” for your company will reduce your CAC over time. Hence, building a customer referral program and convincing them to buy from you will be beneficial to you in several ways.

Streamline Your Sales Cycle

You should focus on decreasing the length of your average sales cycle so that you can increase your sales over a year. By using CRM and prospecting tools, you would be able to identify leads that are the perfect fit for you and be able to target them with personalized marketing campaigns so that they convert.

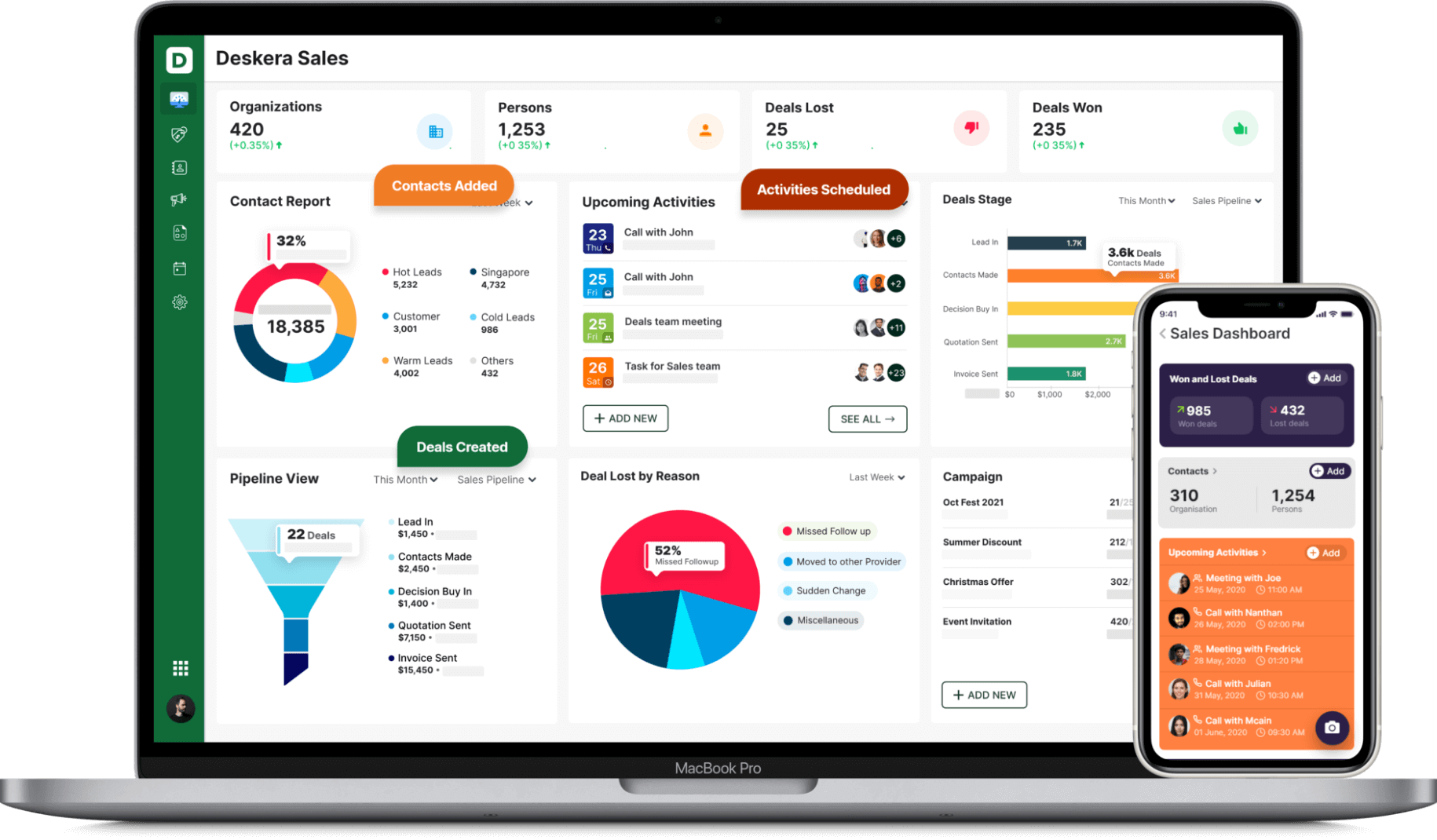

How Can Deskera Help Your Business with CAC?

Deskera’s CRM is a software designed to manage and grow your customer base at ease. It is well-equipped with features that will not only assist you in growing and maintaining your customer base but also help you in keeping your CAC in check while simultaneously increasing your profits.

With Deskera CRM, you would be able to customize your own sales pipeline while also being able to drag and drop your deals through the different stages of your sales pipeline. From the deal value and stage till linked contact, email conversations, and any more such information related to your deal will be updated in real-time here. This will help you in not only knowing how your marketing campaigns are performing in acquiring new customers but also assess their CLTV.

Additionally, you would even be able to create and optimize your landing pages, CTAs, site speed, email marketing template, and any other such marketing materials by using Deskera CRM. In fact, Deskera CRM comes equipped with conversion-optimized templates for the same while also letting you make your campaigns mobile-friendly. All of these will ensure an enhanced site performance and smooth user experience, therefore facilitating faster and more conversions and consequently lower CACs.

Lastly, making business decisions is never easy. But it does become faster, more efficient, and easier by staying up-to-date through insights and analytics gathered on Deskera CRM’s dashboard about the performance of your sales, sales strategy, and marketing plan.

In fact, by updating your marketing planner on Deskera CRM, you would be able to coordinate activities between different teams and save time and unnecessary costs while increasing your performance and effectiveness. This, too, would assist you in decreasing your CAC.

Key Takeaways

CAC in marketing is a very important KPI because it is only when you know how much it costs your business to bring in new customers that you would be able to make informed business decisions, as well as predict how profitable your company would be in the long run. CAC is also an easily trackable KPI, taking into account all the digitization and tools that are now available to assist you.

CAC is hence tracked the most by your internal team or marketing and sales as well as by the investors. The internal team tracks it in order to increase your return on investment and profitability, whereas the investors track it in order to decide whether they should invest in your company or not.

The formula of CAC is inclusive of various types of costs like:

- Ad spend

- Employee salaries

- Creative costs

- Technical costs

- Publishing costs

- Production costs

- Inventory upkeep costs

However, CAC as a standalone metric would not be as insightful as it would be when compared and used with the values of customer lifetime value. In fact, the ideal LTV: CAC ratio that your business should have is 3:1, as only then would your business be profitable and in a position to expand its functions. Lesser than that and your business is not operating sustainably, whereas a ratio higher than that would indicate that your business is missing out on valuable opportunities.

If, however your CAC is high and you need to reduce it, the strategies that you can incorporate are:

- Invest in conversion rate optimization

- Add value

- Implement a customer referral program

- Streamline your sales cycle

By using software like Deskera CRM, you would be able to make more compelling marketing campaigns that are well-designed and optimized and be well aware of your marketing attribution and the buyer persona of your target audience. This will help you in getting more conversions with lower CAC.

Related Articles